I had a ‘Strong Buy’ rating for Veeva Systems (NYSE:VEEV) in my previous coverage published in March 2024, highlighting its strong clinical platform solutions. The company released its Q1 FY25 result on May 31, lowering its full-year revenue guidance by $30 million. While the guidance cut is disappointing, I favor the company’s long-term growth prospects in the data cloud and clinical platform. I reiterate ‘Strong Buy’ rating with a one-year target price of $220 per share.

Guidance Cut Amid Tough Macro Environments

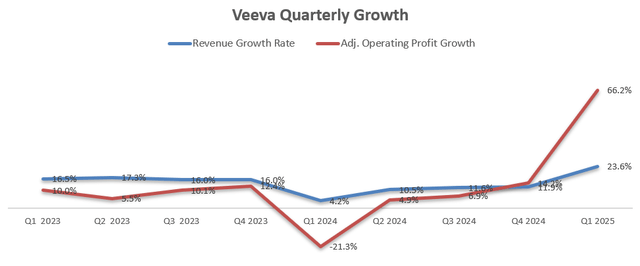

In Q1 FY25, the company delivered 23.6% growth in revenue and 66.2% growth in operating profits, indicating a strong margin expansion, as depicted in the chart below.

Veeva Quarterly Earnings

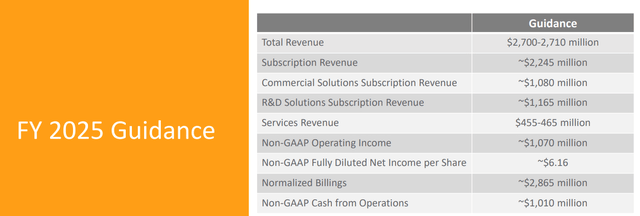

However, the company cut its full-year revenue guidance by $30 million, which disappointed the market. The guidance cut is primarily caused by the lower-than-expected service growth, as large pharma customers are prioritizing IT investments in AI areas, as explained by the management over the earnings call.

Veeva Investor Presentation

Here is what I am thinking about their guidance cut:

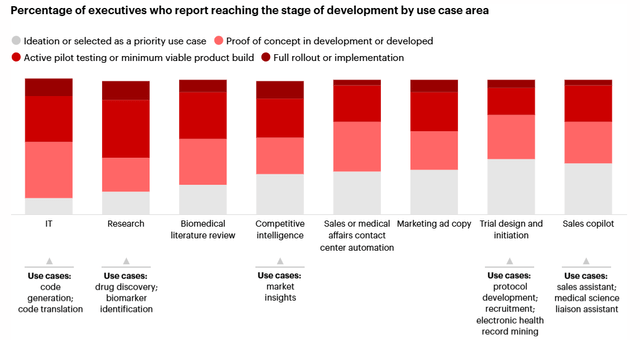

- According to a survey conducted by Bain & Company, 40% of pharma companies are baking expected savings from AI into 2024 budget, and pharma companies are applying AI across various departments, particularly in IT and research areas, as illustrated in the chart below.

Bain & Company Report

It is evident that global pharma companies are prioritizing AI investments in 2024, which could defer their investments in other IT software solutions.

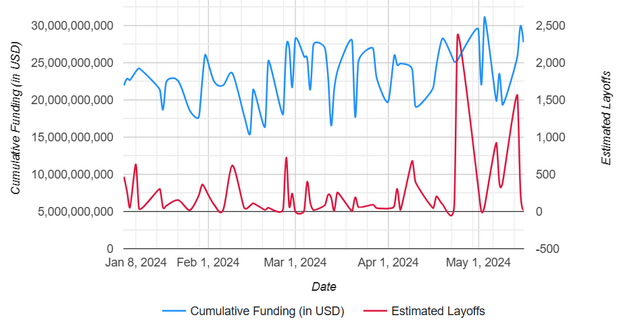

- As pointed out in my previous coverage, amid the high-interest rate environment, small-sized pharma companies have been experiencing tight capital funding. As a result, these small pharma companies have to control their budgets, layoff some staff and navigate a challenging environment. As reported by Drug Discovery & Development, layoffs among pharma industry continued in H1 2024, affecting more than 20,600 workers. In April 2024 alone, there were approximately 3,548 layoffs in the biotech and pharma industries, as shown in the chart below.

Drug Discovery & Development

As such, I think Veeva’s guidance cut is caused by the weak macro, IT budget towards AI, and layoffs among biotech and pharma companies. However, these issues are short-term in nature, and when the Fed begins to cut interest rates, these situations are likely to improve. In addition, I am optimistic about the long-term growth prospects in the biotech industry driven by innovative gene therapy, stem cells and mRNA technologies.

Near-Term Outlook

I anticipate Veeva can grow their revenue by 14% in the near future. Key reasons are:

- Veeva’s normalized billings are expected to grow by 10% in FY25, which is lower than its historic average of 15%. The temporary weakness of billing growth is caused by the tightening budgets of pharma customers and delays of some large deals, especially in the service segment. When the capital funding conditions improve in the future, I anticipate Veeva’s billings will recover to mid-teens growth.

- The growth of Veeva’s CRM platform is tied to the headcount growth in sales team within the pharma industry. The growth would be pressured by the industry-wide layoffs; however, I am optimistic that the pharma and biotech industry will continue their growth journey when the economy normalizes.

- As indicated over the earning call, existing Veeva CRM customers will begin moving to Vault CRM in 2025, which could contribute to higher profits margin for Veeva. Veeva has been developing the migration tools to simply the platform transitions.

As such, I anticipate Veeva will deliver 14% revenue growth in the near term assuming 15% growth in subscription services including CRM, Development Cloud and Commercial Cloud, as well as 10% growth in professional services.

Valuation Update

Veeva experienced a huge expansion in operating margin in Q1 FY25 due to its disciplined expense control and focused hiring initiatives. Over the long term, I anticipate Veeva will generate margin expansion from its gross profits and sale/marketing expenses.

When Veeva begins moving its existing CRM customers to its own platform, Veeva could potentially generate much better margin. Additionally, I anticipate Veeva continues to control its sales and marketing expenses during the challenging macro environment. I estimate that Veeva’s total operating expenses will grow by 12% annually, resulting in a 50bps margin expansion driven by 20bps from gross margin and 30bps from sales and marketing leverage.

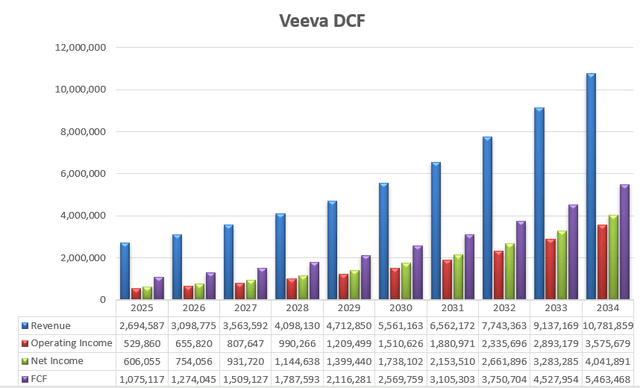

Veeva DCF -Author’s Calculation

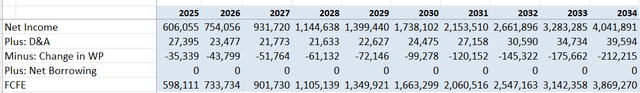

The future free cash flow from equity is calculated as follows:

Veeva FCFE-Author’s Calculation

The cost of equity is calculated to be 13.5% assuming: risk-free rate 4.22% (US 10Y Treasury Yield); beta 1.33 (Seeking Alpha); equity risk premium 7%.

Discount all the future FCFE, the one-year price target is estimated to be $220 per share, as per my calculations.

Key Risks

In 2023, Veeva decided to move its existing Salesforce (CRM) platform to its internally developed Vault CRM system. In April 2024, Salesforce announced an expanded partnership with IQVIA (IQV), Veeva’s competitor. IQVIA will license its Orchestrated Customer Engagement (OCE) platform to Salesforce to accelerate development of Life Sciences Cloud. During the earnings call, Veeva’s management indicated that OCE product has been in the market for 6-7 years but hasn’t gained much traction from pharma and biotech companies.

It is too early to tell if Salesforce can leverage the OCE platform to build up its next generation of CRM for pharma/biotech industry. I encourage investors to pay attention to the progress in the near future.

Conclusion

I admire Veeva’s leading technology in the CRM, Development Cloud and Commercial Cloud among global pharma and biotech markets. I view the challenges they are facing today are macro-driven and temporary in nature. I reiterate ‘Strong Buy’ rating with a one-year target price of $220 per share.

Read the full article here

Leave a Reply