Investment overview

I give a buy rating for ExlService Holdings (NASDAQ:EXLS), as I am very positive about the ongoing AI tailwind that EXLS is well positioned to benefit from after years of investments. Given the large addressable market, I believe EXLS has a long growth runaway ahead that can easily support low-to-mid-teens EPS growth. While valuation is trading at a depressed level today (at the minus 1 standard deviation of the EXLS historical PE bend), I expect multiples to trade up when EPS growth accelerates back to the mid-teens.

Business description

EXLS is in the business of offering offshore business processing outsourcing [BPO] and analytics solutions to customers, mainly in the insurance (42% of net revenue) and healthcare (22% of net revenue) verticals. The business also offers data analytics solutions to help drive insights for customers better decision-making. The primary business units (segments) are BPO and analytics.

1Q24 earnings (announced on 2nd May)

EXLS reported 1Q24 revenue of $436.5 million, beating consensus estimate of $425.7 million. On a reported basis, revenue grew 5.4% vs. 4Q23 and 9% vs. 1Q23, but grew 8.8% on a constant currency basis vs. 1Q23. While revenue grew, adj. EBIT margins fell by 50bps to 18.9% as EXLS stepped up in its SG&A investments. Nonetheless, EXLS beat consensus EPS estimates by a huge margin, coming in at $0.38 vs. $0.02. Exiting the quarter, EXLS has $299 million in cash and $280 million in gross debt, which translates to a net cash position of ~$19 million and $194 million if including short-term investments.

Business to benefits from AI tailwinds

EXLS

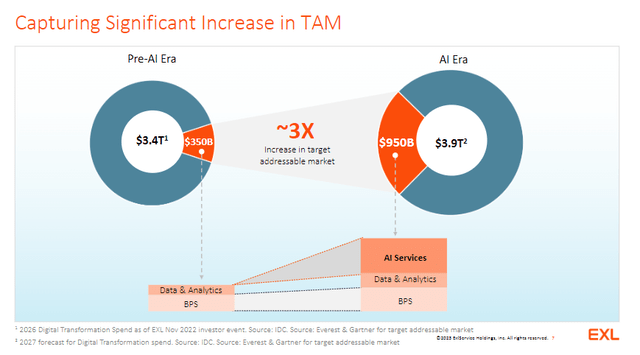

EXLS has evolved from a traditional BPO business into a data- and analytics-driven organization that aims to help clients grow their businesses and optimize costs. After years of investments and strategic pivots, I believe EXLS is now well positioned to ride the ongoing AI wave that has dramatically improved the total addressable market for EXLS. I don’t think anyone can argue that AI is going to significantly enhance the productivity and effectiveness of businesses, and that businesses (who by nature constantly seek to improve on both aspects) will eventually leverage more AI solutions. According to research by Gartner, by 2026, more than 80% of enterprises will have adopted GenAI or related models, up from less than 3% in 2023, and this rate of adoption really gives a hint of how much latent demand there is for other AI-related solutions.

EXLS

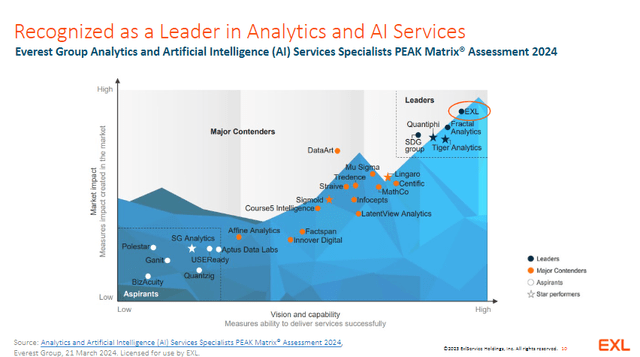

This strongly benefits EXLS, given their leading position as the best analytics and AI service provider in the industry. The business has already made strong strides on this front, where they have more than $2 billion worth of pipeline that consists of Data & AI-led and Gen AI & industry solutions, according to the May investor day. To give a sense of the magnitude of this pipeline, 1Q24 run-rate revenue is around $1.75 billion, which means the pipeline can cover more than 1 year worth of revenue, giving high visibility. Of the >$2 billion pipeline, EXLS has already signed more than 30 agreements, and this shows that pipeline deals are being converted to actual revenue.

Strong execution and transition to a Data & AI-led business can be seen clearly in EXLS financials, where revenue exposure has increased from 38% of revenue in 2020 to 51% of revenue in 2023 (32% CAGR). I take this as solid evidence that EXLS products are being well accepted by businesses. One concern that investors may have is the slowdown in marketing analytics that drove a growth slowdown for the analytics segment in 1Q24 (from 22% in 1Q23 to 4.9% in 1Q24). I think the worst may be over already, as EXLS saw a sequential acceleration in new client additions (10 in 1Q24 vs. 8 in 4Q23), suggesting a turnaround in the cycle. More importantly, this headwind from the marketing analytics sub-segment is largely macro-driven, not that the EXLS product is lacking. According to the call, the reduction in demand mainly stems from insurance clients cutting back on marketing spend, which, I think, is a natural thing given the soft macro environment. Once the economy turns (i.e., rates get cut), I expect a pickup in marketing spend, which will be a tailwind for EXLS.

EXLS

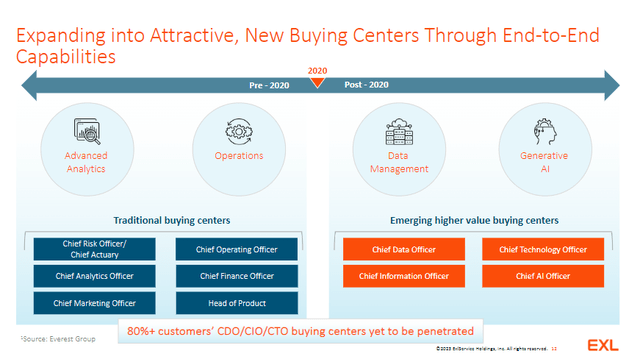

One interesting growth catalyst for EXLS ahead is its ability to expand into new higher-value buying centers such as the CDO, CTO, CIO, and CAIO. This is a massive shift from the traditional buying centers like the CFO, COO, and CMO. The reason I note this as interesting is because I believe the new buying centers would be easier for EXLS to convince because they have more technical knowledge. The bigger implication is that it opens up more possibilities for EXLS to cross-sell other products now that they are dealing with a prospect with technical knowledge. As of investor day, only 80% of EXLS customers are using EXLS’s data management capabilities; hence, I believe there is a large greenfield opportunity ahead.

Valuation / Guidance

EXLS May Investing Ideas

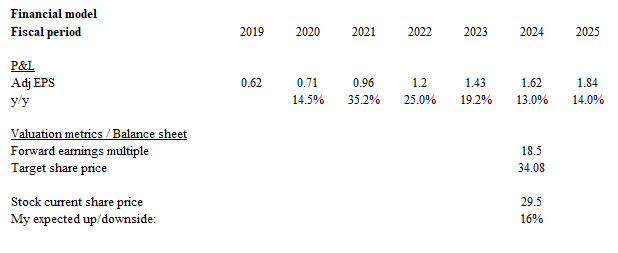

Based on my research and analysis, my expected target price for EXLS is ~$34.

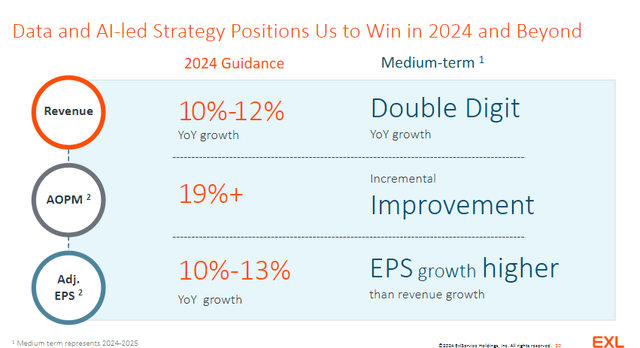

- Using the management EPS growth guide, I modeled EPS to grow 13% in FY24 (the high end of the guide), followed by 14% in FY25 (assuming that EXLS benefits from the recovery in the marketing analytics subsegment and AI tailwinds). Management’s guidance has reliability considering that they have always met their adj EPS guidance (beat midpoint by 2% on average) over the past 10 years.

- It is unlikely for EXLS to trade back to >20x earnings in the near term, as EPS growth is evidently slower than the past few years. But as earnings growth accelerates back to mid-teens, I do think that multiples will rerate upwards. In my model, I assumed EXLS to trade at 18.5x FY25 EPS.

Risk

Although there is a lot of interest in AI, adoption may be slower than expected as there are several risks that relate to data privacy, security risks, and a lack of transparency. Businesses that are inclined to adopt AI may continue to delay full deployment until there is more clarity on how they can deal with these risks.

Conclusion

I give a buy rating for EXLS. Years of investment have transformed EXLS from a traditional BPO provider to a data-driven leader in analytics and AI solutions. This makes it well positioned to benefit from the ongoing AI tailwinds. The shift towards selling to higher-value buying centers also opens up significant cross-selling opportunities. While valuation is currently depressed, I expect a rerating as EPS growth reaccelerates.

Read the full article here

Leave a Reply