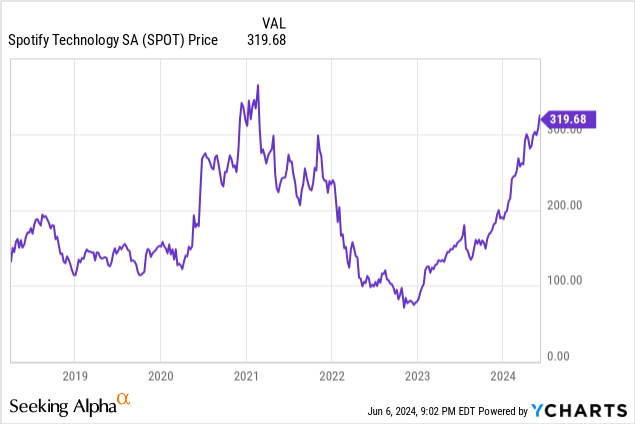

Spotify (NYSE:SPOT) has had a banner year this year. The leading streaming company has seen its share price surge 70%, and the stock is now well on its way to reclaiming its pandemic-era highs.

The backbone behind this rally, of course, is the company’s price increases. Spotify has taken advantage of the ultra-inflationary environment and banking on the fact that its subscriber base is loyal to boost prices several times across markets. This has driven revenue growth well in excess of Premium subscriber/MAU growth, pulling its share price up with it. But the question for investors now is: how much steam is there in this rally?

I had been bullish on Spotify until earlier this year, when I downgraded Spotify to neutral in February. While I acknowledge that my call may have been a bit early, I certainly think there is more downside than upside after the massive YTD rally. I’m reiterating my neutral call and am encouraging investors to take caution here, locking in any YTD gains that you have.

Broadly, I’m concerned about two major risks:

- Spotify’s latest pricing moves may alienate its user base, especially as it is now slightly more expensive than its competition

- Slower user growth. The company has relied more and more on promotional windows (like Q4’s “Wrapped” campaign to bring in the bulk of its new subscribers, whereas non-promotional periods have seen quieter trends. Will these types of subscribers stay on when promotional rates and discounts expire?

Maintain caution here and move to the sidelines on Spotify.

New U.S. Price Increases kicking off in June

Earlier this month on June 3, Spotify announced yet another round of price increases in the U.S.

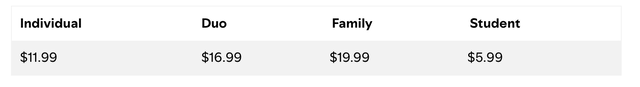

Spotify prices (Spotify.com)

The price of the individual plan is going up by $1/month to $11.99, from $10.99. Recall that Spotify had just increased prices last July from $9.99 to $10.99. Meanwhile, Duo, the company’s two-person plan, is increasing by $2 to $16.99, while Family is seeing the largest nominal and percentage increase of $3 to $19.99 (an 18% jump).

Note that this puts Spotify in the unique position of finally being more expensive than Apple Music, its primary competitor, for all plan types except for Student. Apple (AAPL) Music costs $10.99 for an individual plan, and $16.99 for a Family plan – the same as Spotify’s prices pre-increase. Note as well that Apple subscribers have the option of bundling Music alongside Apple One plans.

And while a distant third competitor, we also can’t ignore the fact that Amazon (AMZN) offers its Amazon Prime Music subscription at an even lower $9.99/month for existing Prime subscribers.

Spotify often touts that its users are locked into their existing libraries and playlists, and that migration to a different streamer is a difficult feat. While this may be the case, amid more and more consumers watching their budgets in a tight macro environment, Spotify’s decision to boost prices above peers may be the tipping point that starts to drive elevated churn rates.

Spotify’s sharp share price jump only gives the company credit for the potential upside for the price increase, but we have to maintain caution and recognize that the competitive dynamics may drive downside as well.

Slower user adoption

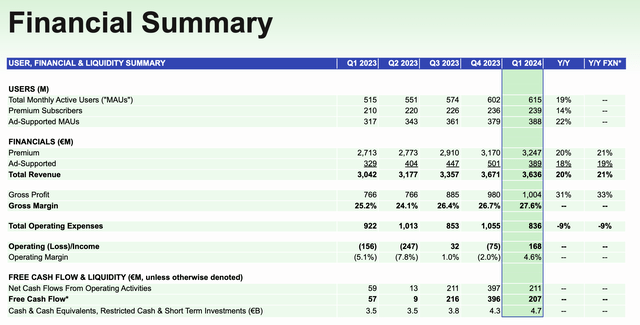

From a revenue perspective, Spotify’s y/y price increases have been able to still produce ~20% revenue growth in spite of slowing user adds. But ultimately, user additions are going to be the core driver of the business. We note as well that pricing will face a more difficult compare in the back half of FY24, as this year’s price increases from a percentage standpoint are lower than last year’s July price increases.

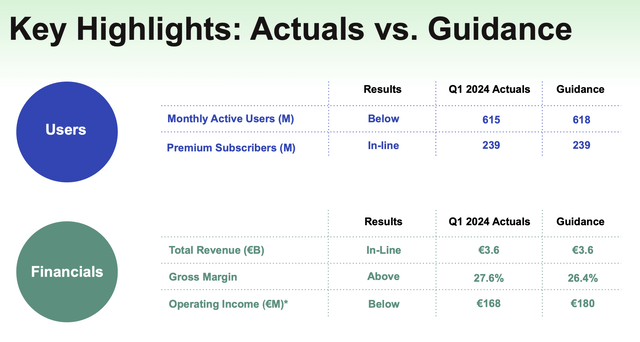

Spotify Q1 results vs. guidance (Spotify Q1 earnings deck)

In Q1, as shown in the chart above, Premium subscriber adds were only 3 million, in line with expectations as the company finished off a very strong Q4 promotional window with 10 million net adds. But we note that on overall MAUs, which include ad-supported listeners, MAU adds were only 13 million – which came in 3 million MAUs lower than initial expectations.

Furthermore, guidance for Q2 showcases potentially another weak quarter versus prior-year compares:

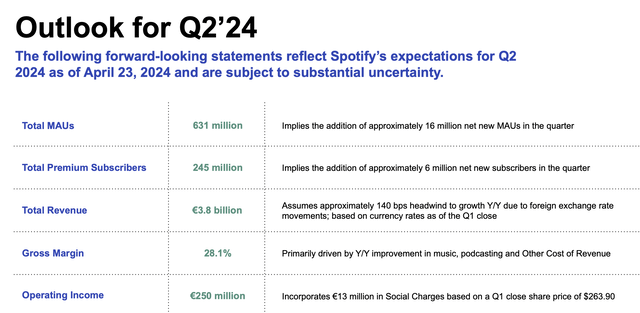

Spotify Q2 outlook (Spotify Q1 earnings deck)

As shown in the guidance note above, the company is expecting 16 million total MAUs added in Q2 and 6 million Premium subscribers.

We can see in the trended chart below, meanwhile, that in Q2 of last year, the company added 36 million total MAUs and 10 million Premium subscribers.

Spotify trended results (Spotify Q1 earnings deck)

It’s not difficult to draw the conclusion that Spotify is at a saturation point and that the company’s price increases are designed to still produce revenue growth in the wake of slower user growth. With a crowded market and competitors now priced lower, it’s tough to imagine Spotify re-accelerating the pace of its new user adds.

The one positive offset for Spotify financially is its boosted operating margins. In Q1, the company’s operating margin jumped to 4.6%, a nearly ten-point improvement y/y. It’s also guiding to an even better 6.6% margin (a 14-point y/y improvement) in Q2. The company has been diligent at managing opex and controlling headcount.

We shouldn’t ignore the fact, however, that continued profitability expansion relies on economies of scale and a wider user base. And so far on this front, we see more risks than opportunities.

Key takeaways

In my view, the market has put the cart before the horse for Spotify, sending the stock up ~70% this year without considering the potential downside ramifications of the latest round of price increases, which may compound on already-slowing MAU growth and Premium adoption rates.

If you’re sitting on any gains on Spotify, I’d recommend cashing in now while the stock is still trading strongly. As prior-year price increases and stronger user adds start to show up in Spotify’s y/y comps in Q2, the narrative may shift quickly.

Read the full article here

Leave a Reply