Dear fellow investors and friends,

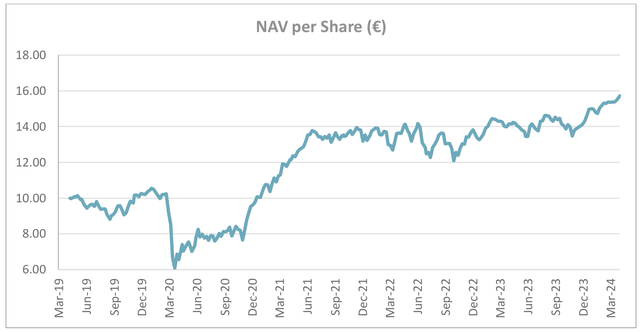

During the first quarter the fund gained 4.6% gross of fees[1]. We do not have a stated benchmark in our Key Investor Information Document (‘KIID’) and therefore cannot comment on relative performance. We leave it up to you to decide. We note the above number appears lower than European and global benchmarks. Inception to quarter end return was 57.3% or 9.5% compounded annual return. Our last reported NAV at quarter end was 15.73 (28/03/2024), +4.9% from the closest reported NAV at the fourth quarter end of 15.00 (28/12/2024). We are extremely optimistic about our portfolio’s prospects and believe we will reach our compound return aspiration over time. Our fund’s composition is unlike any index, and we are unlikely to perform in a similar manner.

Before we comment on the first quarter, we would like to note the five-year anniversary of the fund launch. While technically in the second quarter, we reached this milestone on the 4th of April 2024.

In the first quarter the market focused on interest rates and inflation, just as it did for the past couple of years. Flip-flopping frequently between, ‘higher for longer’ and, ‘inflation is tame so lower sooner’. It was amusing to see stronger than anticipated economic results pushing out long hoped for rate cuts becoming a consensus expectation during the first quarter – thus spurring the rally onwards, only for the hope of renewed rate cuts arising recently to spur the rally further. We think the lesson here is that markets just like to go up and greed generally wins over fear – right up until it doesn’t. Large caps continued to push higher, and small caps generally did well but not keeping pace with AI fueled index ETF inflows pushing the mega caps. It is an election year and traditionally markets do well (up >11% on average since 1928) and they generally do very well if a Republican wins (+15%). Of course, it’s worth noting that the S&P500 is already up 12% year to date and 29% in the last 52 weeks.

We purchased a Greek port concessionaire during the quarter. Piraeus Port Authority operates the main port of Greece and is the first major European port after crossing the Suez Canal. It is highly cash generative, with a cash-rich balance sheet and the management is concluding a large capacity expansion program. Although, challenges in the region hide the true earnings power, we believe that the investment offers a significant upside potential once trade routes normalize. We sold two positions noted below.

At quarter-end our portfolio had more than 101% upside to our estimated NAV and was trading at a weighted average P/E of 8.9x, FCF/EV yield of 17% and a return on tangible capital of 28%.

|

Contributors |

Detractors |

||

|

Ocean Wilsons Holding |

97 bps |

IGT |

-74 bps |

|

Nippon Television Holdings (OTCPK:NPTVF) |

93 bps |

[Undisclosed] |

-50 bps |

|

Senshu Electric |

91 bps |

[Undisclosed] |

-34 bps |

|

Compagnie Industriali Riunite |

68 bps |

H&T Group |

-24 bps |

|

The Italian Sea Group |

68 bps |

Syensqo (OTC:SHBBF) |

-22 bps |

The top contributor during the quarter was Ocean Wilson (+19% +97 bps), the Bermuda based investment company with port and tugboat operations in Brazil, which we introduced in our third quarter 2023 letter. Wilson Sons, the listed port, and tugboat operator is the lion’s share of the market value, and they continued to perform well, with sales, margins, and cash generation at all-time highs. This boosted the share price to new highs near the quarter end. We continue to highlight that Ocean Wilson’s stake in Wilson Sons is worth roughly 145% of Ocean Wilsons’ quarter-end market value. Ocean’s Wilson equity portfolio, which is worth 50% of the total market capitalization, increased slightly compared to the third quarter. The strategic review remains ongoing hence we are patiently waiting for a plan to release the underlying value. In the meantime, the management increased the dividend by roughly 21% (from $0.70 to $0.85 per share) on the back of strong operating performance.

The second largest contributor was Nippon Television Holdings (+45.3% +93 bps), the Japanese media conglomerate and balance sheet hoarder (+52.5% on market, -4.72% FX). The company continued to perform well, posting satisfactory year-on-year performance. However, the main driver of the share price re-rating was a change in dividend policy, making it more favorable for foreign investors, plus a ¥7 billion share buyback announcement. This followed the government’s pressure on companies to improve balance sheet efficiency. Nippon Television belongs to that infamous group of companies with a mismanaged balance sheet, consisting of a massive equity portfolio and cash position that makes return on equity terrible and leads to the stock trading below book value – the big no no’s of the Japanese stock exchange. The management reacted positively to the external pressure, by increasing the dividend and trimming the equity portfolio. Cash and equity investments combined were worth more than the market capitalization at quarter end, implying no value for the operating businesses.

The third significant contributor was Senshu Electric (+46.6% +91 bps), the Japanese cable distributor (53.9% on market. -4.7% FX). When we initially invested, the cash was almost half of the market cap. This made little sense to us, since the company has a very good operating history. We believe the company has an opportunity to improve its balance sheet efficiency to help unlock the discount at which the shares trade. The company’s sales are correlated with the copper price, the major input into wiring products. However, copper is a pass-through for sales but mechanically helps the margin. Since copper increased almost 12% in local currency (up 4% in USD) over the course of the quarter, Senshu Electric’s share price followed suit. Cash remains high at approximately 28% of the market cap at quarter end and we predict further upside.

The fourth largest contributor was Compagnie Industriali Riunite (+24.5% +68 bps), the Italian holding company with a stake in the publicly listed car parts maker Sogefi and the nursing home operator KOS, which we introduced in our fourth quarter 2019 letter.

Over the quarter, Sogefi sold its filtration business, 35% of sales and what the market perceived as the least attractive of the three segments, to private equity for an Enterprise Value of €374 million. Just before the deal announcement, Sogefi’s market capitalization was roughly €235 million and its Enterprise Value €500 million. It goes without saying that selling the more internal combustion-heavy part of the business for 75% of company’s EV caught the market by surprise and Sogefi’s share price spiked more than 65% in a week. As a reminder, CIR owns 56.5% of Sogefi. Moreover, KOS continued its post-COVID and inflation recovery and at least reassured the market the worst is behind us. The share price of the holding company reacted positively on the news, however, remains significantly undervalued in our view. We believe that the management will continue to unlock value through corporate actions, including the ongoing share buyback program.

The fifth contributor was The Italian Sea Group (+22.3%, +68 bps), the Italian luxury yacht builder. The company continued to perform well, with sales and margins increasing year-on-year while the backlog remains at a healthy level. Margin improvement was attributed to operational efficiencies, product mix, price increases and economies of scale. The management highlighted that this level of profitability is sustainable as they continue to see structural growth ahead. The broader luxury yacht industry continues to perform well in contrast to lower-end peers who are suffering from a post-COVID hangover. Through this lens, we continue to believe that the company’s shares remain inexpensive relative to its cash flows. At quarter end the majority shareholder placed 8.7% of the shares at a 10% discount to the share price increasing the free float from 78,7% to just below 70% to meet the requirements for the company’s stock inclusion in the STAR segment of Euronext Milan market.

The top detractor was International Games Technology (-14.9%, -74 bps), the Italian American lottery and gaming machine technology provider, which we introduced in our first quarter 2020 letter. Please see our update later in this letter for further details.

The second and third largest detractors were small undisclosed positions that cost us a combined 84 basis points (-84 bps) during the quarter. Ironically, they were very small positions yet cost us a significant amount of portfolio performance, relative to their size. Both performed very poorly with operational difficulties that appear to have been self-made in nature. Both also had controlling shareholders that we thought could fix the issues. We should have exited the positions sooner but had “hoped” that they would get a grip on their problems. Instead, like cockroaches, more issues came to the surface. Hope is not an investment strategy, and we will be more ruthless cutting disappointers in the future. Many lessons have been learned and will be remembered.

The fourth significant detractor was H&T Group (-12.7% -24 bps) the UK high street pawnbroker, which we introduced in the third quarter 2022 letter. The pledge book and sales continued their upward trajectory, however, inflationary pressure, particularly in salaries, which increased 20% year-on-year, mitigated most of these benefits. Cost control remains high on the management’s agenda but nevertheless the market did not like their weaker margins and punished the stock. During the quarter, H&T acquired Maxcroft, a profitable pawnbroker in Essex which focuses on providing working capital to small businesses. This looked a bit odd compared to H&T’s profile. Management claimed that the acquisition improves the quality of the pledge book and opens opportunities to add more business clients. We believe they will in time recover the margin and we appreciate how H&T plays a countercyclical role in the portfolio.

The fifth largest detractor was Syensqo (-6.9%, -22 bps), the Belgian specialty polymers and composite materials group, which was recently spun-off from Solvay in December 2023. After a bumper 2021 and 2022 for the chemicals industry, sales decreased 13.2% (10% organically) and EBITDA by 13.1% for the full year, driven by an 11% decline in volumes. This was prompted by a more challenging macro environment and customer destocking. The stock likely fell as guidance for 2024 slightly missed analyst expectations. Management believes volumes bottomed out in the fourth quarter and called the end of customer destocking, which has stabilized the demand outlook. In the mid-term, growth industries such as aerospace, electric vehicles. batteries, green solutions, and semiconductors are expected to support the 2028 targets. For a highquality chemical company that is exposed to growing end markets Syensqo remains attractive.

International Games Technology (IGT)

We have been shareholders of International Game Technology since December of 2019 and we first wrote about it in our first quarter 2020 letter, in the depths of the COVID panic when we were adding to the position. We initially invested under the thesis that the lottery business was a high quality, recession resistant, recurring business and that the market was punishing the stock due to high leverage. The leverage was due to the previous merger bringing GTECH and IGT together as well as to the nature of the business where typically a large upfront fee and/or capital expenditure is required to win a multi-year concession from a government. The company was paying too high a dividend to support the controlling family and we thought they would eventually adjust this to pay off the debt to prepare for future tenders. COVID then occurred and showed how even the recession resistant lottery business could be put on its knees for a short period of time.

The company wisely pivoted to debt reduction. They cut their dividend, divested their Italian B2C business Lottomatica for €1.1 billion in December 2020 and their Italian commercial payments business in February 2022 for €700 million. Due to these transactions and significant free cash flow generation the company went from peak net debt / EBITDA of 7.0x at year end 2020 to 2.9x at the end of 2023. This is the lowest in company history. Despite this, the shares have languished and continue to trade around 6x EV/EBITDA, which was roughly similar to where it traded in 2019, despite the massive step change in leverage.

The board became annoyed that despite their efforts the stock traded at a significant discount to listed peers and recent transactions. The most comparable business to the lottery segment was Scientific Games’ lottery business, which was sold to Brookfield Business Partners L.P. for an implied trailing EV/EBITDA of approximately 13x[2]. Neogames, a tough competitor in the iLottery business was purchased in May 2023 for an 15x EV/EBITDA by top competitor Aristocrat (ALL AS) of Australia[3]. We believe other listed peers are less relevant but note other companies in the sector like Pollard Banknote (PBL CN), OPAP (OPAP GA) and the French lottery provider La Française des Jeux (FDJ FP) are all trading at 10x forward EV/EBITDA. Meanwhile gaming segment peers such as Light & Wonder (the renamed non-lottery part of former Scientific Games) and Aristocrat traded at 9x and 12x EV/EBITDA respectively.

So it’s not a huge surprise that on June 8, 2023, the company announced the Board would begin evaluating potential strategic alternatives for the Global Gaming and Play Digital businesses, with the goal of unlocking the full value. The company has three divisions with lottery consisting of roughly 60% of sales and 70% of EBITDA whilst Gaming (slot machines) and PlayDigital (iGaming, PlaySports) are the remaining 40% of sales and 30% of EBITDA. The shares traded up on the announcement to eventually reach the low $30s culminating with the rumour in September 2023 that Apollo[4] was interested in the business in the $4-5 billion range which was roughly our assessment of the fair value of the business.

By the fourth quarter, however, given no news of the sale, the shares drifted lower (making it our worst performing position in the fourth quarter of 2023) and the market turned its attention to the 2025 Italian Gioco del Lotto renewal. The concession is roughly 12% of reported sales and more in EBITDA terms according to our estimates, but given IGT’s 61.5% ownership, it is less than the headline might indicate (although still significant).

Then on 29th February 2024 the company announced that the Global Gaming and PlayDigital divisions would be spun-off and then merged with publicly listed peer Everi (EVRI US). Post transaction, IGT shareholders will hold 54% interest in the combined company (GamingCo) with existing Everi shareholders owning the balance. The newly merged company would then pay $2.6 billion in cash to the lottery company. This would leave the GamingCo with 3.2-3.4x net debt / EBITDA based on $2.7 billion pro forma 2024 sales and $1 billion PF 2024 EBITDA. Whilst the highly cash generative LottoCo would be 2.5x levered.

At first the market reacted positively to the deal but then as the details were digested the shares declined to the high teens. We agree that a sale at full value to private equity would have been the quick and preferable path. We think many speculative shareholders were likely positioned for this, anticipating a rapid rerating of the lottery business. We believe part of the sell-off was due to the perception that the “catalyst” wasn’t due until 2025, while many had assumed a deal in 2024. However, we must admit the bears have concerns which may or may not be likely outcomes, but certainly increases risk.

First, Everi is split into two segments fintech (financial technology products for gaming operators) and gaming machines (slots). The gaming segment is riskier as it is undergoing a portfolio refresh and appears to be losing market share, which may or may not reverse. Previous mergers in the gaming space (WMS Industries, Bally Technologies, GTECH) are perceived as having not added value. There is also some risk that purchasing managers decide to wait before purchasing new cabinets from them, until it is known which products will be supported by the newly merged company. However, the companies say that there is very little overlap in products and synergies are not coming from a reduction in the product portfolio. Hence, they claim all products will be supported going forward. The two companies are indeed focused on different VLT classes with no overlap in the fintech business. Therefore, there is some evidence to support the case of a complimentary merger. We will have to wait and see how their sales develop over the course of the year but in any case, this would be at most a timing issue, if an issue at all.

Second, the Italian (Gioco) lottery would go from optically 12% of reported group sales to 20% of LottoCo sales, therefore magnifying the risk of losing the concession. However, it is less a concern in earnings terms, as there is significant minority leakage. Whilst they have had this contract since 1998 and retention rates are generally >90% for incumbents, there is always a risk of loss. Since the last tender the competitive landscape has changed. Sisal was previously owned by private equity and likely levered, but is now owned by Flutter, a company with a very strong balance sheet. Likewise, Allwyn (previously SAZKA Group) is also in a significantly better leverage position. Note that Allwyn recently challenged the UK incumbent Camelot and won the UK contract. In fact, during the previous tender, IGT was also quite levered and had to invite financial investors to aid in the bidding. The final JV is owned 61.5% by IGT and 32.5% by Allwyn (the remainder 4% tobacconists’ industry body and 2% Novomatic). In the latest release, it appears that Allwyn has signed an MOU with IGT to keep the current structure for the next tender, removing one obvious threat. Flutter, most consider a lower threat as they are focusing on US sports betting and iGaming expansion.

Third, the transaction is structured as a tax-able spin-off, whereas most are structured as tax-free. At face value this seems odd, as does management’s explanation that it provides the most flexibility for both LottoCo and for GamingCo to pursue other strategic alternatives as stand-alone entities. We believe the tax is mostly focused on US investors and it is unlikely that the major controlling shareholder, who is an Italian tax resident, purposefully signed up for a large US tax bill. The company is in fact UK domiciled and while not offering tax advice, it seems foreign investors may not necessarily have the same problem. However, it does seem odd to anger your core US taxable investor. If anyone understands the tax ramifications better please let us know.

In summary, we see some incremental risks to our buy case, but we think the risk reward remains massively skewed towards the upside with the businesses continuing to perform well. Our fundamental value is still north of $45 if the two new entities trade at a closer discount to peers. In fact, we think none is likely warranted. Fortunately, we are long-term investors and with this kind of upside we can be patient and wait to realize the value.

As stated in our previous letters, we are currently not charging a management fee until the fund reaches a larger size. The founder’s class management fee will then be only 1% of assets. We do not charge entry or exit commissions despite our KIID saying it is theoretically possible.

Our focus is and remains on the portfolio, but we do need to grow our assets to a sustainable level. Please feel free to share this letter with any potential investors.

We now have a commercial agreement with Cobas Asset Management to distribute our fund in Spain. You can now open an account and place orders with them. For more information, please contact them via phone or email. In the future, we hope it will be possible via their website. You can reach the Cobas team at +34 91 755 68 00 or [email protected]

Our fund can be invested through both European international central securities depositories: Euroclear and its FundSettle clearing platform and Clearstream through the Vestima fund clearing platform. Our fund is registered for distribution in the UK, Spain and Luxembourg including for retail distribution.

Currently the following financial institutions in Spain are distributors: Renta 4, Ironia, Lombard Odier, Creand as well as many other institutions working through the main platforms in which the fund is available upon request: Allfunds Bank and Inversis.

In the UK we are offered on the AJ Bell low-cost platform ajbell.co.ukand can be part of an ISA or pension.

Our fund is also available on Swiss Quote where almost any nationality (ex-USA) can open an account without local Swiss taxes being an issue.

If you have any issues finding our fund or wish to get more information about us and our process, please contact us at [email protected]

Our fund is being offered as part of a Spanish pension value-orientated fund of funds. Please follow this linkto find out more.

We thank you for your ongoing support. We continue to believe this is a great time to be a value investor and are very excited about the medium-term prospects for the current portfolio.

Yours faithfully,

Palm Harbour Capital

|

Footnotes [1]Our NAV is calculated weekly by FundPartner Solutions, a subsidiary of Pictet & Cie and does not align with monthly or quarterly reporting. The gross return stated is net of taxes and fees but before fund expenses, which are currently running at approximately 15 bps per quarter at current AUM. We project this to decline significantly as AUM grows. Please see our comment on management fees. [2]Scientific Games / Brookfield deal [3]Neogames / Aristocrat deal [4]Reuters This information is being communicated by Palm Harbour Capital LLP which is authorized and regulated by the Financial Conduct Authority. This material is for information only and does not constitute an offer or recommendation to buy or sell any investment or subscribe to any investment management or advisory service. In relation to the United Kingdom, this information is only directed at, and may only be distributed to, persons who are “investment professionals” (being persons having professional experience in matters relating to investments) defined under Articles 19 & 49 of Financial Services and Markets Act 2000 (Financial Promotion) Order 2001 & Articles 14 & 22 of the Financial Services and Markets Act 2000 (Promotion of Collective Investment Schemes) (Exemption) Order 2001 and/or such other persons as are permitted to receive this document under The Financial Services and Markets Act 2000. Any investment, and investment activity or controlled activity, to which this information relates is available only to such persons and will be engaged in only with such persons. Persons that do not have professional experience should not rely or act upon this information unless they are persons to whom any of paragraphs (2)(a) to (d) of article 49 apply to whom distribution of this information may otherwise lawfully be made. With investment, your capital is at risk and the value of an investment and the income from it can go up as well as down, it may be affected by exchange rate variations, and you may not get back the amount invested. Past performance is not necessarily a guide to future performance and where past performance is quoted gross then investment management charges as well as transaction charges should be taken into consideration, as these will affect your returns. Any tax allowances or thresholds mentioned are based on personal circumstances and current legislation, which is subject to change. We do not represent that this information, including any third-party information, is accurate or complete and it should not be relied upon as such. Opinions expressed herein reflect the opinion of Palm Harbour Capital LLP and are subject to change without notice. No part of this document may be reproduced in any manner without the written permission of Palm Harbour Capital LLP; however recipients may pass on this document but only to others falling within this category. This information should be read in conjunction with the relevant fund documentation which may include the fund’s prospectus, simplified prospectus or supplement documentation and if you are unsure if any of the products and portfolios featured are the right choice for you, please seek independent financial advice provided by regulated third parties. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply