The regulatory environment for automobile safety has changed; the NHTSA published a final ruling mandating that all light vehicles sold in the US must have automatic braking systems from 2028 onwards at speeds above 10 mph.

The ruling delivers a significantly expanded TAM for Arbe and sets a deadline for OEMs to start deploying Arbe’s technology. Likely, most car manufacturers (perhaps excluding the luxury premium priced manufacturers) will have a choice of two systems. Arbe Robotics (NASDAQ:ARBE) or Mobileye (MBLY).

With a massively improved TAM, an enforced deadline for decision-making, the existence of only one competitor, and Arbe’s recent commercial technological validation, I am upgrading them to a strong buy.

Arbe is guiding to success with 4 of the top ten auto manufacturers in the world, implying a 2029 revenue of over $600 million, up from $1.5 million today. It is likely to be a high margin product with the potential to deliver enormous returns.

Arbe The Story

This is my fourth article on Arbe, I was the first analyst to cover them on the Seeking Alpha platform in January 2022 just after they completed their SPAC merger. Since I have tracked their performance reporting on several delays to the commercialization timeline, commercial operations were initially forecast for 2023 and have still not started. In the latest earnings call (Q1 2024) Arbe announced the first confirmed design win for their radar chipset through the Chinese Tier 1 HiRain and that GlobalFoundries have begun production of the commercial intent chips. The CEO Kobi Marenko said he expects Arbe to deliver large numbers of product next year.

The first confirmed OEM order, which provides commercial validation of their technology, and the start of mass production have moved Arbe forward as a company, they are exiting the story stage and beginning the production phase.

Before writing this article, I interviewed Kobi Marenko (Arbe CEO) and some of the information in this article comes from that interview. I will pin a comment with a link to the Zoom interview in the comments section of the article for people to watch.

Arbe is riding a wave higher

Arbe is a typical example of the Gartner Hype Cycle, the cycle has 4 parts beginning with an “innovation trigger” that leads to “irrational exuberance” as the market buys into this new technology only to become disappointed when progress is slow, the share price falls into the “trough of disillusionment” as the market looks elsewhere for the new best thing and a quick return. Many small companies fail at this point; the innovation never develops into a commercial product, but for some, the idea becomes a reality and the technology ascends the “slope of enlightenment” as the market realizes that this thing might actually work. The fourth and final stage is when production and commercial operations begin in the “plateau of productivity”.

With the confirmed design win from HiRain and the move to commercial intent production from GlobalFoundries, I think the market will soon realize that the Arbe story is becoming a real business, and the share price will begin to increase sooner rather than later.

Regulatory Changes to Drive Acceptance of Radar

Arbe manufactures a “4D radar on a chip” system, the 4D is the usual 3D space plus speed. At launch in 2022, they imagined the use case to be autonomous and semi-autonomous vehicles with 4 small corner radar devices, named “Lynx” and two high precision radars at the front and back called “Phoenix”.

The introduction of these autonomous vehicles still looks a long way off in most parts of the world. However, a recent change in safety regulations in the US means that every new car sold in the US from 2028 will probably need a high precision radar system. This change brings the likely mass adoption of 4D radar onto the immediate horizon for auto manufacturers, even if they are not yet ready to move toward autonomous vehicles. This regulation alone is enough to upgrade my rating for Arbe.

Regulatory Changes that Benefit Arbe

The NHTSA final rule on automatic braking systems allows vehicle manufacturers 3 years from the date of publication to meet new rules, one exception is the low-speed Pedestrian Automatic Emergency Breaking Rule (PAEB) performance requirements (Page 11). Which will have an extra 12 months before becoming mandatory.

The rule means new cars must have Automatic Emergency Breaking systems by Sept 1st, 2028.

The NHTSA and I believe that the rule can only be delivered by the implementation of radar.

Page 13 of the ruling says

the incremental cost associated with this rule now includes the cost of a software upgrade and the cost to equip a second sensor (radar).

Environmental Conditions (p66)

The NHTSA requires the systems to continue to function in all environments, not just the track testing environment. Involving additional vehicles, pedestrians, bicyclists, buildings and other objects within the view of the sensor and should not negatively affect their operation.

The final rule has changed the wording here, the advisory panel decided that there will be combinations of environmental factors that make AEB impractical but said they could not enumerate these conditions, as a result the wording has become.

all manufacturers to ensure that the system is robust and functions in as many real world environments as possible.

The ruling says that the AEB system must work to speeds of 70mph as a minimum.

The ruling means that every new car sold from 2028 onwards will have at least one front-facing high-precision radar system.

That represents about 14 million cars a year in the US, as this is a safety issue and the ruling from the NHTSA contains significant data about how many lives will be saved and injuries avoided I think it is probable that the rest of the world will follow 77 million cars in total. It leads to a 2029 TAM for Arbe of $6.9 billion.

Arbe Competitive Strategy

Arbe has two areas that could deliver competitors, other technologies that compete with its radar and other radar companies.

Technological Competition

Radar can do many things, it can detect small objects at long distances, see through certain materials and with good software correctly identify what it is looking at. However, it has limitations, it can see a road sign but can’t read it, and radar can see a traffic light but not tell if it is red or green. As a result, it must be integrated with a camera to provide the complete set of information that a central compute system will need to make driving decisions. That is its weak point, allowing competitive technologies into the market.

LiDAR

LiDAR was expected to be the lead technology for autonomous cars, I covered the main competitors in this field in 2022 in this review article. Auto manufacturers are using/exploring LiDAR in upcoming premium brand releases. BMW (OTCPK:BMWYY) has launched its seven series vehicles equipped with LiDAR sensors and more launches are planned for next year; however, LiDAR will likely be restricted to premium models only.

Radar has one enormous advantage over LiDAR, its cost per unit and per car. I expect Arbe Radar systems to sell for $90 (information from interview), whereas a LiDAR system is still in the range $500-$1000. It is a significant difference when cars will probably need front and back sensors. With EV prices headed ever lower, possibly down to $20,000, is it realistic for them to carry $2,000 worth of sensors? I do not think so, and I believe from a cost and performance standpoint, the likely most competitive scenario is a camera/radar mix giving the best of all worlds.

Camera Only

One car company Tesla (TSLA) believes in a camera only system, Tesla removed radar from its cars in 2022 and recently announced that they will remove ultrasonic sensors leaving a camera only system in place called Tesla Vision.

The investment Tesla has made in AI is staggering and it may well reap enormous rewards when full self-driving cars begin to arrive on our streets. The AI capabilities of Tesla, as described by the CEO of NVIDIA, are “revolutionary end to end generative AI”.

There is a disconnect between the stated camera only position of Tesla, the NHTSA wording that cars will need radar and the accepted view in the industry.

Kobi Marenko said when I interviewed him that he believes that camera only systems will not be safe, despite Tesla’s huge advantage in data collected from the millions of cars it has on the roads. Kobi said that every one of Tesla’s reported crashes to date could have been avoided using Arbe radar. He said that Arbe had looked at and evaluated the conditions leading to each crash and could have eliminated them all. Integrating radar would add complexity to Tesla’s vision system, requiring more processing power and increased cost at a time Tesla is trying to cut prices.

It remains to be seen if Tesla can deliver a camera only system that meets the new NHTSA braking guidance and full self-driving regulations when they arrive. Kobi said they face just one problem “it cannot be done.”

The NHTSA regulation requires breaking in all environments at 70 mph, if you are driving at 70mph in thick fog and something is in front of you the camera will not see it in time, and you will crash. Tesla would blame the driver (that appears to be the modus operandi) as they should not have been driving at 90mph in fog, but if they had a high precision radar fitted the crash would have been avoided and the NHTSA requirements met.

Radar combined with Cameras appears to have a significant price/performance advantage over the other two technologies putting Arbe in an excellent strategic position.

Radar competitors

I have been following the progress of automotive radar from Uhnder (Austin, Texas), bitsensing (South Korea), which has teamed up with Uhnder, Aptiv PLC (APTV), NXP Semiconductors (NXPI), Texas Instruments (TXN) , and Mobileye.

There are several criteria on which radar systems are judged, the two crucial ones are range and precision. Mercedes was the first to define precisely what precision they need for the next level of autonomous driving, a minimum resolution of 1,500 pixels (Arbe Q1 earnings 2024). Pixels are defined in radar as the number of transmitters x the number of receivers Arbes 48×48 solution has over 2,000 pixels as does the solution from Mobileye. No other competitors can meet this threshold. The systems from Uhnder, NXP and TI are an order of magnitude lower at less than 200 pixels. The APTV radar solution falls short on range, its latest offering the FLR7, detects motorbikes at 290m to a resolution of 20cm once again an order of magnitude lower than Arbe and Mobileye.

In Radar Arbe has Mobileye as its only competitor in its targeted market. Kobi Marenko has said this many times in Earnings calls.

The lower resolution radars target different use cases but still have markets in the tens of billions of dollars.

Tier 1 Competitors and Customers

The automotive industry is a well-established business. Car manufacturers are called OEMs and buy systems from Tier 1 suppliers to integrate into their vehicles. Tier 1 companies buy components from Tier 2 suppliers to build into systems. Arbe is a Tier 2 supplier. They sell radar on a chip to Tier 1 companies that use it as part of a complete sensing package to sell to auto manufacturers.

The Tier 1s

There has been some movement on Arbes Tier 1s since my last article.

Veoneer was bought by Magna, the relationship with Veoneer has moved to Magna and Kobi said in the interview that things were going very well. Magna has a relationship with Uhnder, as previously discussed a radar targeting a different use case which should not affect the Arbe relationship. Magna will target Europe and the US on behalf of Arbe.

Valeo did sign with Arbe and sent representatives to early Arbe earnings calls; however, they have recently made the strategic decision to move to Mobileye. Mobileye needed a tier 1 for its radar and Valeo was already selling Mobileye’s camera-based solution, Arbe has been cut completely by Valeo.

Continental are selling a radar system based on chips from NXP and TI, which I have already discussed. They are also selling LiDAR and camera solutions.

HiRain and Weifu are the two Tier 1’s Arbe is working with in China, the relationships here are going extremely well. Both companies have announced large pre-orders totaling $60 million per annum and HiRain announced Arbe’s first OEM confirmed order for mass production in Q1.

Sensrad is Arbe’s non-automotive OEM and continues to make progress they have announced several provisional orders, but none have yet been confirmed.

Central Compute Systems

Arbes radar system provides information that needs to be plugged into a central compute system where it is combined with camera information. The central compute system will make the decisions about automatic braking.

Some automakers are making their own central compute system as are some tier 1s, but four major computer players are designing and offering complete systems. Nvidia (NVDA), Mobileye, Qamcom and Horizon. The system from Mobileye will be closed to Arbe, and we cannot expect any progress there; however, the other three seem to favor Arbe.

Nvidia has selected Arbe as its only radar supplier to be integrated with its Omniverse ecosystem, it is a big vote of confidence from the world’s leading AI supplier. Horizon has integrated Weifu’s 4D radar system (based on Arbe chips) into its partner ecosystem and Qamcom has been an Arbe partner since the very beginning.

Being the chosen supplier to Nvidia, Horizon and Qamcom puts Arbe in a potentially market leading position for these central compute systems. Some care is needed here, because a company is currently working with Arbe does not guarantee its final products will be based on Arbe’s radar, the world just is not like that. The situation is promising but has not yet led to any orders.

The Auto Manufacturers

Arbe has consistently guided to being in discussion with 10 or 11 of the world’s largest auto manufacturers, in a recent convertible debt agreement they gave a list of 10 OEMS one of whom they must sign a deal with to receive the funds from the convertible debt deal. When I interviewed the CEO, he told me Arbe’s actual list of 11 was confidential and the one in the debt deal came from Wikipedia, he did say some of the companies were in his list of 11 but some were not, he declined to give me the actual list. As a result, we still do not know who the 11 companies are that Arbe is negotiating with; however, Kobi confirmed that Arbe is still on track to sign 4 major OEM deals this year for production beginning next, this is in addition to the HiRain robotaxi deal announced in the recent earnings report.

We have information about the potential size of the deals from Q1 earnings.

HiRain have placed a provisional order for +300,000 chipsets with a total value of $52 million.

Weifu have a provisional order placed for $11 million, both orders are waiting for final sign off from the Auto Manufacturer.

In my interview, Kobi said that deals would range from 100,000 units to 400,000 units in the initial stages and rise to 1 million to 1.5 million by the end of the decade. Using this information, I have started to build a mathematical model of Arbe. It is early days so the model is full of assumptions and guesswork. It will be subject to change over the coming months.

In the Q1 2024 Q and A Kobi did say

So we already stated that HiRain and Weifu gave us preliminary order for 2025. HiRain is $30 million, Weifu is $10 million. And we are now engaged with a few programs to make sure that the customers will get radars based on our chipset in this volume in 2025.

Does he mean by this that he expects to sell $40 million in 2025? It could be the case, if so, the forecast I have presented here would need to be moved forward by 1 year. I have assumed volume shipments will begin in 2025 but perhaps only half of the total $40 million will be invoiced in that year.

There are more unknowns than usual in this model as ARBE has not yet started commercial production. One of the biggest unknowns is gross margin. For this first version of the model, I have used 67% taken from Arbes’ main competitor Mobileye (Mobileye Q1 2024). I am not going to present a DCF as the model has too many uncertainties and assumptions, but it is indicative of what we can expect and will be useful as a measure of future performance.

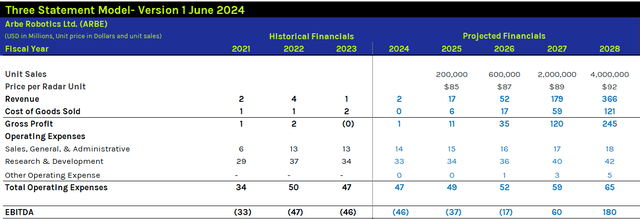

Mathematical Model (Author)

It is worth pointing out that the CFO guided to 2024 Adjusted EBITDA of -$36 million, $10 million better than my unadjusted figure. Positive EBITDA for 2026 would require a sales volume of 725,000 units at $87 each (Kobi quoted $85-$90 so I started 2025 at $85 and increased by 2.5% for inflation each year) and the assumed 67% margin. It is not an unreasonable volume for Arbe to hit, later in the year when Arbe announces the size and schedule for the 4 OEM deals they have guided to, I will adjust the volumes.

At the moment, breakeven looks like H2 2026 and full year 2027 being the first year of positive cash generation for the firm.

Arbe Balance Sheet

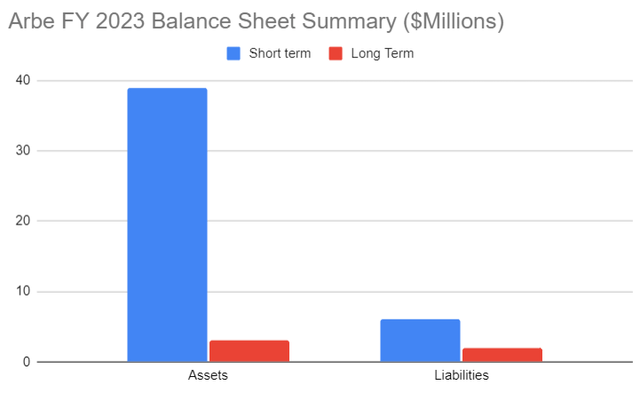

At the end of 2023, Arbe reported a strong balance sheet position.

Balance sheet summary (Author Database)

By the end of Q1 short-term assets had fallen slightly to $36 million, which gives Arbe a cash runway of approximately 1 year, not enough to reach profitability. Arbe currently has no debt but on June 7th published details of a $30 million convertible debenture that will be used to fund the company through its upcoming production ramp up. The instrument has an interesting clause, it will be issued in Israel and the money will be released to Arbe if it meets the three following conditions:

- Being selected as the sole supplier of radar chips by one of the top ten automobile manufacturers.

- Maintaining an average closing price of at least $3.10 per share on Nasdaq for 30 consecutive days with a trading volume greater than 300,000 shares per day.

- Shares close above $3.10 on the day the company provides evidence of meeting conditions 1 and 2.

It implies that Arbe, and Mishmeret Trust company (the trustee) believe that winning the first top 10 OEM deal is going to push Arbe shares over $3.10, which is a 70% increase from today’s $1.82, as Arbe has consistently guided to four wins this year the probability of getting one of them and seeing a 70% rise in share price is very high.

Mobileye is the big risk to Arbe

I have said several times that Arbe has only one competitor. The problem is that its competitor is Mobileye, a huge established company backed, and majority owned by Intel Corporation (INTC).

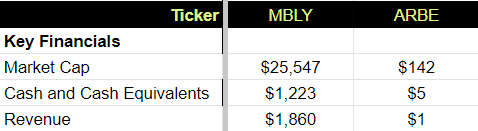

It is a David and Goliath situation, there is a risk that Mobileye will win so much of the business that Arbe never makes it to profitability. The table shows some key financials that and the relative financial strength of the two competitors.

Mobileye v Arbe Financials (Author)

In its Q1 2024 earnings call, Mobileye gave guidance of unit sales equal to 7.4 million chips for Q2, a Q-on-Q increase of 100% and gave full year guidance of 32 million chips. They also reported Q1 design wins totaling 26 million units. Mobileye’s supervision product is a complete driver assist system (still requires a driver’s full attention). It currently has 11 cameras and one optional radar with 100,000 cars already running the system, it has gained significant traction. Mobileye Chauffeur is the more advanced system including an 11-camera system, 1 high precision radar plus 4 low-definition radars and 1 front facing LiDAR.

Mobileye said in Q1 it is in discussion with 14 OEMs against Arbe’s 11 for high precision radar, that Volkswagen are aligning with Mobileye, and this has improved traction with other OEMs. Mobileye also believes that their full stack solution offers advantages over the products being put together by Tier 1 companies based on the Arbe chipset. They also believe that Tesla’s decision to double down on a camera only solution is adding to the interest they are receiving for their competing solution.

In this Arbe v Mobileye battle, we should expect Mobileye to take the lion’s share of the business. Arbe has consistently said they hope to acquire 4 of 11 major OEM deals, so approximately 36%, leaving Mobileye with the remaining 74% that would seem to fit with the competitive advantages Mobileye has.

I said earlier that the TAM for this market would be $6.9 billion by 2029, the model presented showed revenue of only $660 million around 10%. I expect Mobileye to take the lion’s share and LiDAR companies to pick up the rest.

Conclusion

Arbe is in a two-way fight with a dominant incumbent in Mobileye for the high perception radar sensor business in the Automotive market. A sector that has seen its TAM increase dramatically with new safety rules issued by the US authorities. It seems likely that a radar/camera fusion will deliver the most cost-effective product to meet the new automatic breaking rules and the upcoming transition to autonomous driving cars.

Arbe continues to guide to securing 4 major OEM deals this year, a new debt deal suggests they believe getting one deal will increase their share price by 70%, and they may well have already secured this deal with the $52 million HiRain provisional order placed last year. We do not know who the auto manufacturer is for that deal, and at 300,000 chips per year it could very well be a top ten OEM.

Arbe has a solid balance sheet, has arranged additional capital for production and, with a low cost-base, should hit profitability toward the end of 2026.

I am upgrading Arbe to a strong buy and will continue to hold my current position, if they announce a top ten deal an immediate 70% price jump is likely and as further orders arrive it could drive the price of Arbe higher for the next few years.

Read the full article here

Leave a Reply