Introduction

Maybe not the best timing for MFA Financial (NYSE:MFA) but it could be ideal for long-term fixed income investors who believe interest rates have peaked. I am referring to the fact that MFA Financial recently issued a second Note that does not mature until 2029. They do have an out if rates drop as both are callable in 2026.

This article gives a brief overview of the issuer, MFA Financials and a deeper review of both the newest Note, the MFA Financial, Inc. CAL NT 29 (NYSE:MFAO), and the first Note, the MFA Financial, Inc. NT 29 (NYSE:MFAN).

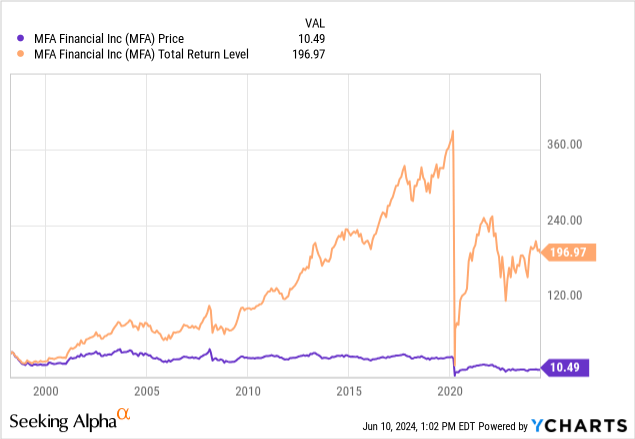

MFA Financial review

Seeking Alpha describes this issuer as:

MFA Financial, Inc., together with its subsidiaries, operates as a real estate investment trust in the United States. It invests in residential mortgage securities, including non-agency mortgage-backed securities, agency MBS, and credit risk transfer securities; residential whole loans, including purchased performing loans, purchased credit deteriorated, and non-performing loans; and mortgage servicing rights related assets. The company was incorporated in 1997 and is based in New York, New York.

Source: seekingalpha.com MFA

The company provides this overview of their business model:

We are a specialty finance company that invests in and finances residential mortgage assets. Our targeted investments include principally the following:

- Residential whole loans, including Purchased Performing Loans, Purchased Credit Deteriorated and Purchased Non-performing Loans. Through certain of our subsidiaries, we also originate and service business purpose loans for real estate investors. We also own residential real estate (or REO), which is typically acquired as a result of the foreclosure or other liquidation of delinquent whole loans in connection with our loan investment activities;

- Residential mortgage securities, including CRT securities; and

- MSR-related assets, which include term notes backed directly or indirectly by MSRs.

Our principal business objective is to deliver shareholder value through the generation of distributable income and through asset performance linked to residential mortgage credit fundamentals. We selectively invest in residential mortgage assets with a focus on credit analysis, projected prepayment rates, interest rate sensitivity, and expected return. We are an internally-managed real estate investment trust (or REIT).

Source: mfafinancial.com/overview

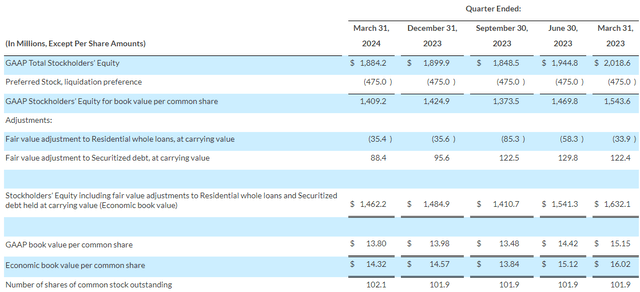

The most recent financial data follows. Of course things can change in five years so keep that in mind when evaluating whether MFA Financial will be able to redeem their new Notes come 2029.

mfafinancial.com Q1 results

While most figures are down from a year ago, they are improvements from last fall. Since the start of the 2024, MFA has executed the following changes in their outstanding Notes.

- Repurchased $40 million of the convertible senior notes due in June, reducing the outstanding balance to less than $170 million. These $1000 face Notes mature on 6/15/24.

- In January, MFA issued $115 million of 8.875% senior unsecured notes due in February 2029.

- In April, MFA issued an additional $75 million of 9.00% senior unsecured notes due in August 2029.

The last quarter ended with over $300m in unrestricted cash. Subtracting the amount needed to redeem the Note in June, that leaves $160m on hand now backing the $190m in new Notes. More important though is the $1422m in stockholder’s equity currently available to redeem these Notes with. That is a better coverage ratio (7x) than most of the banks I have recently reviewed, so currently MFA Financial is well positioned to cover their Notes.

Reviewing the Notes

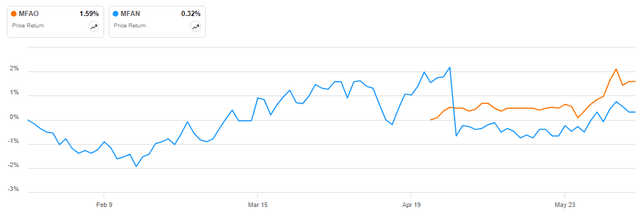

seekingalpha.com charting

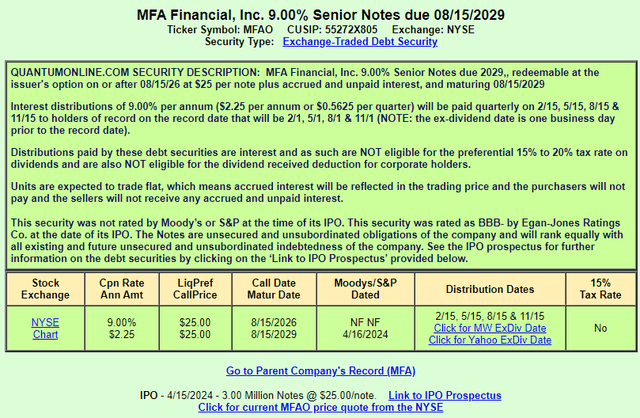

quantumonline.com MFA

This MFA Note offered investors a coupon 12.5bps higher the Note issued just months earlier. One shortcoming is if rates fall, the Call protection is now under two years.

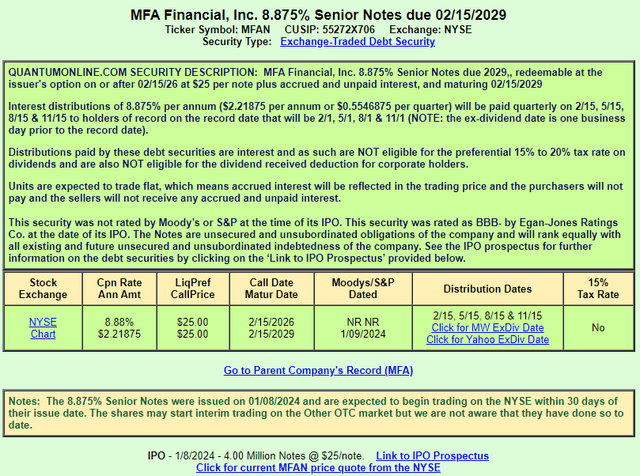

quantumonline.com MFAN

Based on the quarterly report and data shown on QuantumOnline, the Notes were well received and additional $15m were issued. As with the other Note, the Call protection is limited; under two years as of now.

| Factor | MFAO | MFAN |

| Issue date | 4/15/24 | 1/8/24 |

| Issue size | 3.0m | 4.6m |

| Coupon | 9.00% | 8.875% |

| Call date | 8/15/26 | 2/15/26 |

| Maturity date | 8/15/29 | 2/15/29 |

| Price | $25.52 | $25.30 |

| Yield | 8.8% | 8.8% |

| YTM | 7.9% | 8.1% |

At the current values, investors can pick the longer call protection or sacrifice six months of protection for the higher YTM. Keep in mind that will change as the prices of both Notes move and time passes. If there is any concern about MFA redeeming the Notes, the safer choice would be the MFAN since it matures first.

Risk analysis

Of course, anything can happen in five years, it took only months for several large firms to fail during the 2008-09 GFC. Currently, the coverage ratio is strong at over 7X. For traders there is the risk that rates have not peaked or the housing market has issues, causing MFA Financials to become less profitable, which could lead to a credit downgrade on the Notes which in turn would hurt their prices.

Portfolio strategy

If indeed we are near the rate peak of this cycle, locking in today’s YTM values should be explored. Using Notes such as these is one option, though the short Call protection brings that strategy into question. Having a maturity date provides the investor with a known return via the YTM, assuming no payment interruptions, which is a plus over floating-rate and/or perpetual securities. Also, by having a known YTM, an investor can decide if the return above what a similar CD yields justifies the extra risk. Currently, that spread is around 300bps.

Another option is in ETFs that only own bonds that mature in your target year, such as the iShares iBonds 2029 Term High Yield and Income ETF (IBHI).

Final thoughts

Last December, I reviewed two of the preferred stocks available from MFA Financial (article link). MFA Financial and the MFAN Note were also reviewed in this article by another Contributor.

Read the full article here

Leave a Reply