Berkshire Stock Underperformed Recently

Berkshire Hathaway Inc. (NYSE:BRK.A) (NYSE:BRK.B) investors are likely contemplating the relative underperformance of Berkshire stock over the past three months since my update. In my Berkshire article in March 2024, I highlighted my concerns that it could get increasingly more challenging for CEO Warren Buffett to beat the market. BRK.B has underperformed the S&P 500 (SPX) (SPY) since my article, but not significantly. Therefore, it has demonstrated the confidence and resilience of the investors, who trust the capital allocation prowess of Warren Buffett.

Berkshire: Investors Are Confident in Its Succession Planning

However, Berkshire is a company in transition. Shareholders who regularly attend Berkshire’s annual shareholders meeting likely missed the highlights and witty commentary from the late Charlie Munger. Buffett reminded investors that his successor, Greg Abel, “understands businesses extremely well, is designated to take over capital allocation.” Given that Berkshire stock has already broken into a new high in February 2024, investors are likely confident about Berkshire’s succession planning. Buffett has made it clear during the conference that while he felt well, Buffett also “knows a little about actuarial tables.” Therefore, investors must be prepared for the inevitable, but one that Berkshire Hathaway seems well prepared to manage for its shareholders.

Berkshire’s Cash Pile Continues To Grow

Berkshire’s cash pile is expected to hit $200B by the end of June, up from the $189B reported at the end of Q1. Therefore, the higher-for-longer posture adopted by the Fed has benefited Berkshire significantly. However, concerns about whether Berkshire Hathaway can deploy it effectively to generate accretive returns are justified. Furthermore, the Fed is expected to cut interest rates by the end of 2024. The question has shifted to the frequency of the cuts, but less about whether the Fed would cut. As a result, the comps in 2025 could get increasingly challenging for Berkshire as they lap peak rates in 2024.

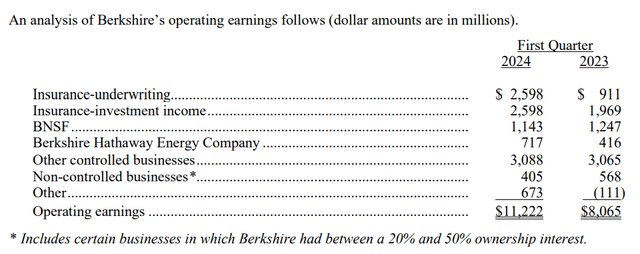

Berkshire operating earnings (Berkshire Hathaway filings)

Insurance’s performance is critical to Berkshire’s earnings profile. Accordingly, it accounted for over 45% of Berkshire’s operating earnings in Q1, well above the 36% last year. As a result, insurance-related earnings are inherently volatile.

Despite that, Berkshire has a well-diversified portfolio that can help mitigate the cyclicality and volatility in its insurance businesses. Moreover, as long as Berkshire can continue generating significant cash flows, it can still mitigate the impact attributed to the peak in short-term interest rates. Therefore, insurance-related investment income is expected to maintain the resilience in Berkshire’s operating earnings profile.

The recent disclosure of Berkshire’s investment in Chubb Limited (CB) has been well received. Berkshire invested a 6.4% stake in Chubb, leading to a surge in CB stock in mid-May 2024. While the recent optimism cooled down somewhat as CB pulled back, it’s a critical development for Berkshire.

Chubb is growing its ex-US business, as “about half of Chubb’s premiums come from outside the US.” In addition, the insurance contribution gap from Asia is expected to narrow, helping to support the growth in Chubb’s earnings profile. Therefore, Berkshire could explore opportunities with other US companies that have increased exposure outside of the US to capitalize on potentially higher growth. Buffett also highlighted the “potential for unexplored opportunities in India,” presenting possibilities for future Berkshire management to enter. As a result, I could have been too cautious in thinking that Berkshire could not evolve quickly enough to outperform the market potentially.

Berkshire Stock Is Not Expensive

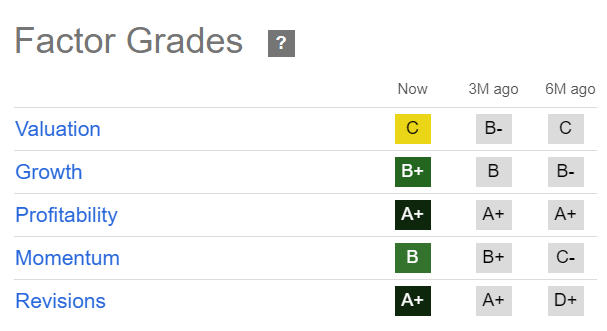

BRK.A Quant Grades (Seeking Alpha)

BRK.A is still rated favorably for valuation and assigned a “C” grade by Seeking Alpha Quant. Berkshire’s fundamentally strong business model (“A+” profitability grade) will remain a key anchor in bolstering investor sentiments.

Notwithstanding the recent relative underperformance in Berkshire stock, BRK.A’s “B” momentum grade suggests its buying sentiments have remained resilient. Therefore, investors have not moved away from buying a wonderful business (like Berkshire) at a fair valuation. Should investors consider investing now with the current consolidation phase observed in Berkshire stock?

Is BRK.B Stock A Buy, Sell, Or Hold?

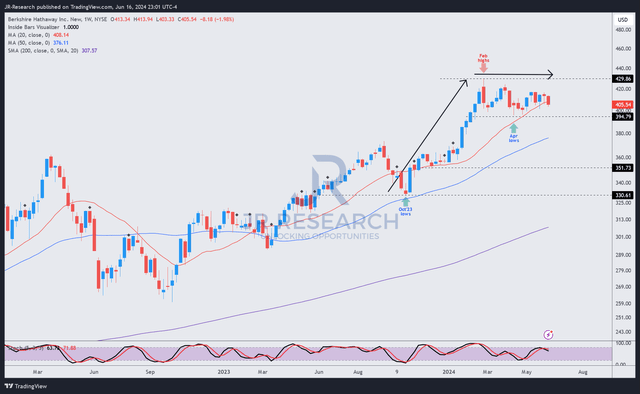

BRK.B price chart (weekly, medium-term) (TradingView)

As seen above, Berkshire stock has been consolidating since it topped in February 2024. However, there seems to be robust buying support above BRK.B’s April 2024 lows ($395 level).

Given its solid operating earnings profile, I have not assessed the need to turn highly cautious on Berkshire stock. Berkshire’s ability to continue building on its massive cash horde is expected to bolster its ability to make earnings accretive investments. US companies focusing on ex-US growth could increasingly be within Berkshire’s crosshairs as Buffett and his team look to deploy funds. With Berkshire’s book value per share expected to increase by 7.6% in 2024 and 5.7% in 2025, Wall Street is confident in Berkshire’s forward performance.

Therefore, Berkshire stock’s buying momentum has been stellar and more resilient than I had previously anticipated. With Berkshire stock likely in an accumulation phase above the $395 level, I have assessed a buying opportunity for investors to consider adding.

Rating: Upgrade to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here

Leave a Reply