SOFI Stock Has Underperformed Significantly

SoFi Technologies, Inc. (NASDAQ:SOFI) investors have faced the worst decline in recent times after SOFI stock peaked in December 2023. Accordingly, SOFI’s selling momentum has intensified, revisiting levels last seen in November 2023. As a result, SOFI has dropped into a deep bear market, down 40% through this week’s lows. With SOFI’s YTD gains lost, there’s little doubt that bearish pessimism has built up. In contrast, the S&P 500 (SPX) (SPY) has continued to break into new highs, heaping more pain for bullish SOFI investors.

I had anticipated SOFI’s bearish sentiments to peak in my bullish SOFI article in March 2024. However, selling momentum in SOFI has continued, as buyers failed to return with conviction. As a result, SOFI has underperformed the market significantly.

SoFi Draws Scrutiny On Potential Loan Losses

SoFi’s Q1 earnings release in April 2024 presented a mixed report. While the digital finance company surpassed Wall Street’s estimates in the first quarter, SoFi’s Q2 guidance disappointed analysts. Even though SoFi raised its full-year guidance, the market is likely concerned about higher execution risks in the second half.

Moreover, SoFi sold $62.5M in late-stage delinquent personal loans, which likely attracted scrutiny from investors. Despite that, SoFi maintained its confidence in reaching a “long-term life-of-loan loss outlook of 7% to 8%.” In addition, SoFi’s decision to sell off the delinquent loans helped improve its personal loans charge-off rate to 3.45% in Q1. SoFi believes the company benefits from selling off these loans at a late-stage “rather than after charge-off.”

However, Wall Street is justifiably concerned as SoFi’s estimated “charge-off rate could have been higher, possibly exceeding 5%.” As a result, I assess that the market has turned increasingly cautious about SOFI’s growth premium. The market is right to reflect the adverse impact of potentially worse macroeconomic risks in the second half. Recent weaker consumer spending dynamics and the likelihood of a peak Fed (potentially lowering net interest income) have heightened uncertainties in SoFi’s upgraded full-year guidance.

SoFi: Market Worries About Meeting Its Full-Year Guidance

SoFi has committed to reaching GAAP net income profitability for 2024, helping to assure investors about its profitability growth inflection. Accordingly, SoFi anticipates full-year GAAP net income between $165M and $175M. It represents an adjusted EPS of between $0.08 and $0.09. In addition, SoFi also expects to continue diversifying its reliance on its lending segment.

While lending revenue performance has remained tepid, SoFi sees increased opportunities in the cross-selling momentum through its financial services products. In addition, the gains in its enterprise technology segment have also opened another pivotal growth lever. As a result, I assess SoFi’s diversification has reaped substantial benefits, helping to mitigate the anticipated growth normalization in its lending segments.

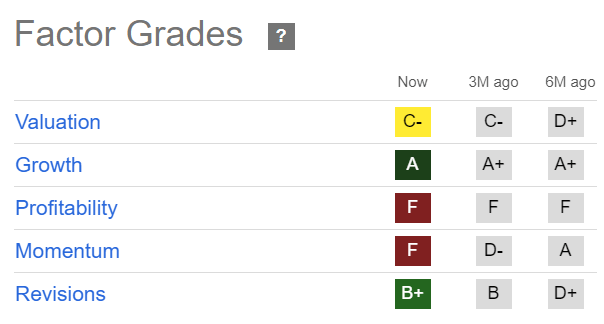

SOFI Stock Has A Very Poor “F” Momentum Grade

SOFI Quant Grades (Seeking Alpha)

The market’s concerns aren’t overstated, as SOFI is still assessed as a growth pick within the financial sector. However, SOFI has yet to convince the market that it can sustain its profitability inflection, resulting in an “F” profitability grade. SOFI’s “F” momentum grade highlights the significant reversal in investor sentiments over the past six months (from an “A” momentum grade).

Therefore, it’s clear that growth investors likely reallocated out of SOFI as they have become increasingly concerned about its profitability pivot. SoFi needs to convince the market that it can continue to maintain a relatively low net-charge off rates in the second half, as the US consumer sentiments could weaken further. With a potential peak in net interest income, SoFi faces higher execution risks through its technology and financial services to justify its “A” growth grade.

With SOFI not assessed to be undervalued (“C-” valuation grade), have we observed a bullish reversal in SOFI yet?

Is SOFI Stock A Buy, Sell, Or Hold?

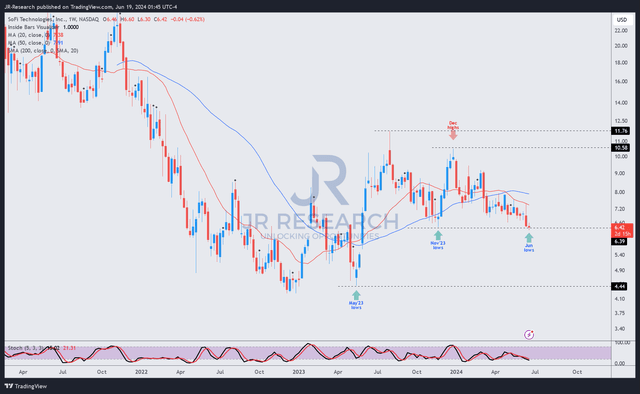

SOFI price chart (weekly, medium-term) (TradingView)

SOFI’s price action is increasingly bearish. It’s testing a key support zone at the $6.4 level. However, it’s important to consider that SOFI’s uptrend bias has reversed into a downtrend, suggesting the pain might not be over.

As a result, a decisive breakdown below SOFI’s November 2023 support level could invite a potentially steeper selloff. SOFI “diamond-hands” investors could flee in droves, anticipating further downside.

Hence, I assess that the risk/reward has turned much less attractive, even though a bearish rating at the current levels seems too aggressive. I urge investors to wait it out and assess SOFI’s consolidation at the current level before deciding whether to add more exposure.

Rating: Downgrade to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here

Leave a Reply