mInvestment thesis for Cadeler

A relatively new publicly traded corporation may attract green investors, thanks to its role in developing wind farms, and its own sustainability efforts.

Cadeler A/S (CDLR) began trading on the New York Stock Exchange last December; it is also listed on the Oslo Stock Exchange. These listings will help it in raising capital to grow its business significantly in the next few years.

This Danish company is rated a Buy, because of its opportunity, and ability, to capitalize on Europe’s huge wind power growth plans.

History and business of Cadeler

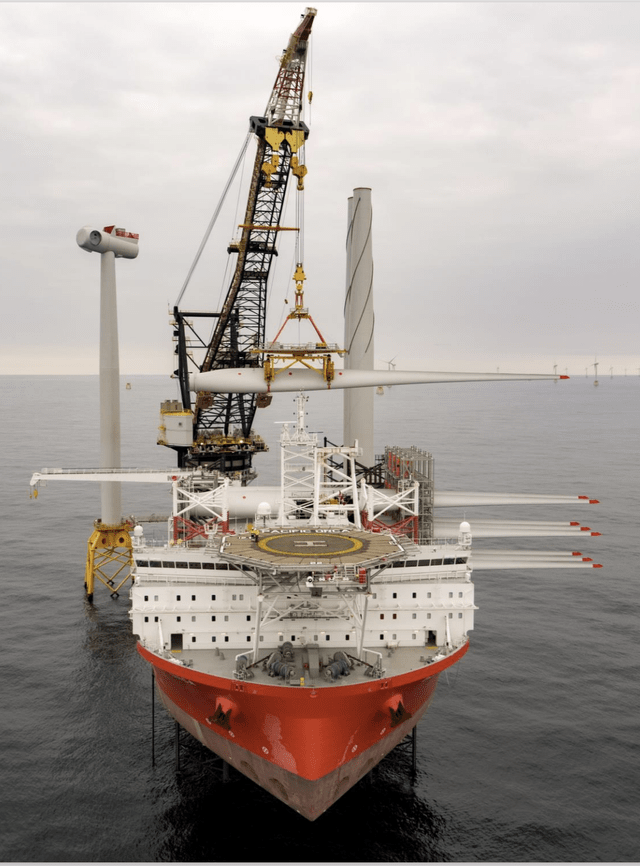

The company calls itself “the industry’s largest fleet of jack-up offshore wind installation vessels, with four vessels in operation and seven new builds on the way” in its first-quarter 2024 earnings release. This photo from the 2023 investor presentation shows an existing vessel:

CLDR – Transportation & Installation ship (2023 investor presentation)

The ship appears to consist mainly of a large crane and tall pilings.

Cadeler was founded in Denmark in 2008, and has operated only in the offshore wind market. As well as installations, its vessels provide operations and maintenance, accommodation, meteorological mast installation and removal, and decommissioning services.

Its shares have been listed on the New York Stock Exchange since December 2023, and in 2020, it had listed on the Oslo Stock Exchange. The company went public in the U.S. after a Business Combination Agreement with the now-defunct Eneti Inc. (NETI).

The most recent earnings release came out on May 28, and covered Q1-2024. Its headline story was that it had delivered financial returns that aligned with expectations, and that it was prepared to meet continuing growth in market demand. The latter referred to its orders for seven new vessels, to go along with its four existing rigs.

Highlights for the quarter included (Q1-2023 results in brackets):

- Revenue: $20.6 million ($20.5 million)

- Cost of revenues: $29.1 million ($13.2 million)

- Selling, General, & Admin expenses: $13.8 million ($5.1 million)

- Total operating expenses: $13.1 million ($5.1 million)

- Net income: minus $22.4 million ($2.1 million)

- EPS: minus $0.06 ($0.01)

- Average shares outstanding: 346.6 million (194.8 million)

Why the slippage from the first quarter of last year? Management explained that three of its four operating vessels underwent scheduled drydock maintenance and crane upgrades during the period.

Expect better returns for the rest of this year, with the firm reporting that its order book for 2024 is “substantially” filled. Presumably that includes the new vessels as they become available for duty.

A note about names and symbols: Before its combination with Eneti, the company was known as Cadeler Group, and that name shows up often in its 2023 annual report/20-F. Regarding tickers, the company also trades on OTC markets as (CADLF).

Comments: Cadeler seems well-positioned to grow. If its order book is almost full for 2024, we should see profits and cash flow to expand even further as new vessels come online.

Competition in the offshore wind market

In its 20-F (the equivalent of a 10-K for non-American companies), Cadeler noted that there has been a “general” increase in the number of firms operating in the wind farm industry. Because of that observation, it warned it may experience increased competition. In turn, that could lead to poorer results on the bottom line.

It named its major competitors in the 20-F: “DEME Offshore, Jan de Nul (both Belgium-headquartered), Fred. Olsen (UK-headquartered) and Van Oord (Netherlands-headquartered). In addition, there are a growing number of players with specialist vessels on order. Seaway7, Dominion Energy (D), Maersk and Havfram, for example, each has a newbuild vessel (or vessels) either on order or currently under construction.”

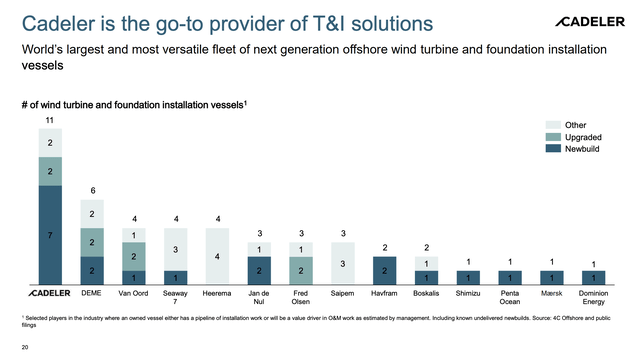

Once it takes delivery of three more vessels, it could have the largest Transport & Installation, or T&I, fleet, as shown in this slide from its first-quarter 2024 investor presentation:

CLDR T&I fleet sizes (Q1-2024 investor presentation)

Competitive advantages: It could have the largest fleet size soon (assuming DEME and others aren’t also planning major expansions). The company points to its combination with Eneti, which provided what it called a “significant step up in the ability to meet the increased demand globally for larger and more complex projects”. The 20-F went on to report that scale is one of the key competitive advantages in the offshore installation market.

Access to public markets is another competitive advantage; aside from Dominion Energy, it is the only one with an American stock listing.

Other benefits coming out of its merger, according to its 2023 investor presentation, include SG&A savings, improved margins on loan facilities, and higher vessel utilization rates.

Comments: Management is building up the company into a strong, if not leading, player with the expansion to its fleet. It also improved its competitiveness by becoming a public company, in both Europe and America, improving its access to capital.

Management and strategy

Chief Executive Officer Mikkel Gleerup joined Cadeler as its Chief Commercial Officer in 2017. Months later, he was named Interim CEO and then became full CEO in 2021.

Chief Financial Officer Peter Brogaard Hansen assumed his position in June 2022, after previously holding a senior position at TORM plc (TRMD), a British shipping company that operates a fleet of product tankers.

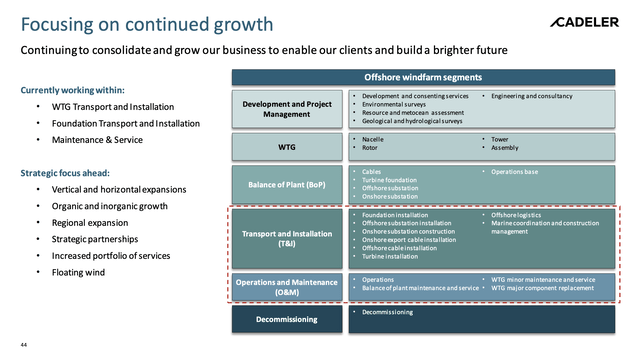

The company’s strategy focuses on growth, through multiple tactics, as explained in this slide from the FY-2023 investor presentation:

CLDR Strategy Overview (FY-2023 investor presentation)

As we saw in another slide above, the appetite for wind power is growing, especially in Europe, making Cadeler’s strategy realistic through at least the rest of this decade.

It should have the funds it needs for its expansion plans. At the end of the first quarter, it had cash of $225.6 million; total current assets amounted to $285.4 million, while long-term assets added up to $1.602 billion.

On the other side of the balance sheet, it had total current liabilities of $80.8 million and long-term liabilities of $317.5 million.

Comments: the company has ambitious plans, but should be able to realize them thanks to the experienced management team and adequate financing.

Cadeler growth tactics

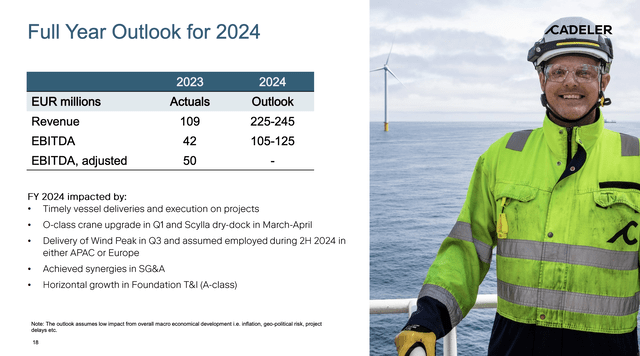

The company has embarked on a major expansion, growing its fleet from four to 11 vessels in just a few years. It is even looking at major gains this year:

CLDR 2024 outlook (Q1-2024 investor presentation)

Observe how much Cadeler expects to grow, more than doubling last year’s results. Both revenue and EBITDA are making gains because of one new vessel coming into service in Q3, as well as crane upgrades on three vessels.

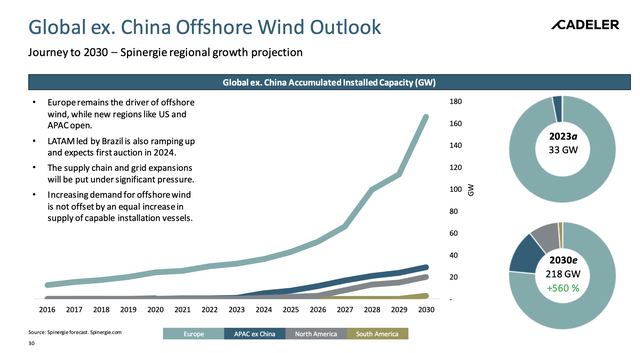

The company’s bullishness is based on industry projections about the growth of offshore wind projects over the rest of this decade:

CLDR Wind Power Outlook (FY-2023 investor presentation)

Why is Europe such a hotspot for wind power? It does not have oil and gas reserves or operations of any significance. Indeed, it had depended heavily on Russian petroleum, before that country invaded Ukraine. The disruptions connected with the invasion made it clear to Europeans that they needed to become more energy self-sufficient.

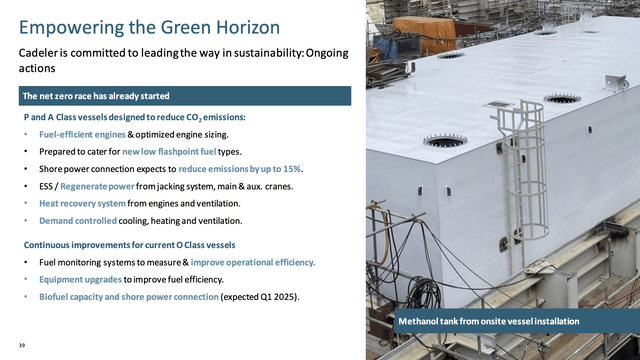

Green energy and sustainability

Cadeler should attract green investors, both individuals and funds, that want to put their capital into a climate-friendly corporation.

To add to its green credentials, the company is reducing its own footprint through various energy-reduction initiatives, as laid out in this slide from its full-year 2023 investor presentation:

CLDR environmental impact (FY-2023 investor presentation)

I am pleased to see the company has adopted a continuous improvement philosophy and practices. Firms that take this route can steadily become more efficient and effective in their operations and financial results. That’s a reason why it may interest not just green investors.

Cadeler valuation

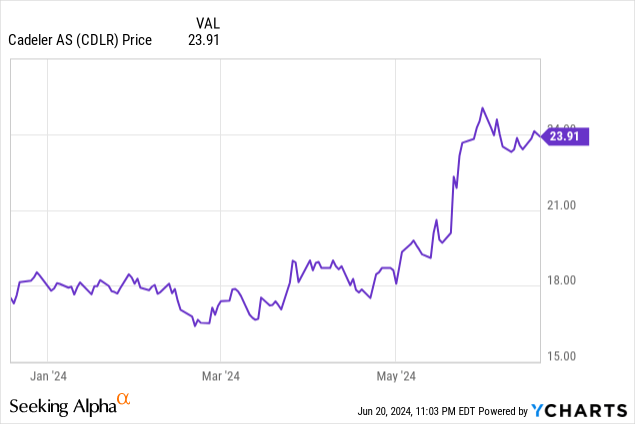

Since its American public markets debut, in December, at $17.50, the price stayed flat for several months, then began climbing in late April. It topped out at $25.04 on May 31, before settling back down to $23.85 at the close of June 20.

Cadeler’s earnings so far have been negative, so conventional valuations such as P/E and PEG are unavailable. However, we can make some educated estimates based on its guidance for 2024.

In the Q1-2024 earnings release, the outlook saw 2024 revenue projected to slightly more than double, from $109 million for 2023 to a range of $225 million – $245 million. EBITDA also is expected to more than double, from $42 million last year to $105-$125 million this year. It does not provide guidance for adjusted EBITDA, net income, or EPS.

Given those forecasts, I believe it is safe to assume that 2023’s net loss of $22.4 million will be cut in half. A more optimistic assessment would suggest that while revenue will grow, costs will not rise as fast, resulting in a net profit rather than a loss.

In any case, investors will probably raise their expectations and push the price higher. A 50% increase in the January 2 closing price of $17.80 would produce a price of $26.70, while a 50% increase on the June 19 close of $24.12 would push it to $36.18.

The halfway point between $26.70 and $36.18 is $31.44, and that’s my target price for the end of this year.

I also rate the company a Buy, based on the overall market size, its aggressive expansion, and the cost containment made possible by continuous improvement. The only other rating available is that of the two Wall Street analysts, who both list it as a Strong Buy.

Cadeler ownership risks

This is a relatively small company, one that is expected to have just five vessels operating at the end of this year. If one of them is knocked out of service, revenue could be pulled down by 20%, and have negative effects on other financial metrics.

The offshore wind sector is subject to “constant technological development” and Cadeler must keep up with it. It noted in the 20-F that some competitors’ vessels have become obsolete in only 10 years, because of growth in the size of turbines.

Cadeler operates a construction business in seas and oceans, making it a relatively risky business. Obviously, there are many hazards, not the least of which would be crew safety, weather, and vessel safety. It reports that it has industry-standard insurance coverage, but that might not be enough for a serious incident.

The interests of individual shareholders may have little influence on board decisions. Three different entities have significant holdings: At the end of 2023, BW Altor Pte. Ltd. had an ownership interest of approximately 19.57%, Scorpio Holdings Limited held an ownership interest of about 12.09% and Swire Pacific Limited had an ownership interest of approximately 8.51%. Collectively, they controlled 40.17% of voting shares.

Cadeler is listed as a foreign private issuer under the U.S. Exchange Act, making it exempt from certain rules. In addition, it is not required to file periodic reports and statements with the SEC as frequently or as promptly as domestic companies.

Conclusion

Cadeler deserves the attention of green investors, and especially green growth investors. With the capital, it raises from its dual listings in New York and Oslo, it should be able to meet the demand for major growth in European wind farms.

It emerged out of a merger with another T&I company, giving it greater scale and cost-saving synergies.

Based on the market opportunity, Cadeler’s ability to grow with it, and its leading position in the industry, I rate it a Buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply