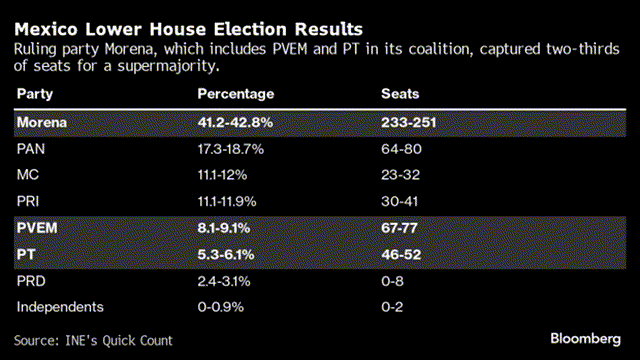

Mexico’s latest election result, headlined by a resounding win for governing Morena-PT-PVEM coalition candidate Claudia Sheinbaum, has injected new uncertainty into the Mexico investment case. The key issue is that the incoming Sheinbaum administration will have a large enough majority that market-unfriendly changes to the Constitution, among other major reforms outlined by the AMLO administration earlier this year, may now be on the table.

Bloomberg

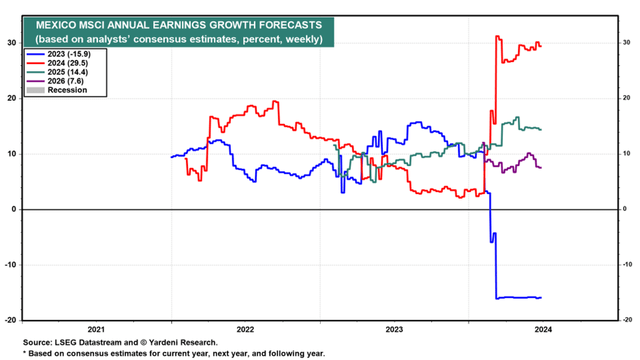

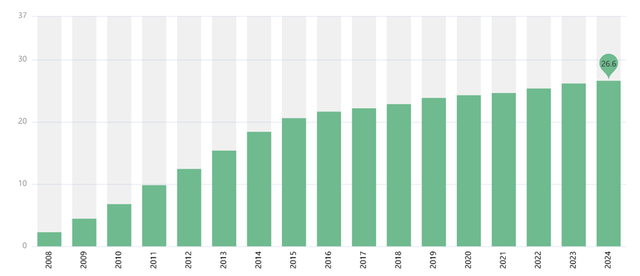

The silver lining, however, is that Mexican equities have also de-rated to such a large extent that they are now among the cheapest in the world relative to underlying fundamentals. For context, Mexican large-caps are currently priced at an undemanding 11x forward P/E against ~30% forecast earnings growth this year (+14%/+7% in 2025/2026). In essence, the market has priced in heightened domestic political risks and perhaps also US election uncertainties in the coming months.

Yardeni

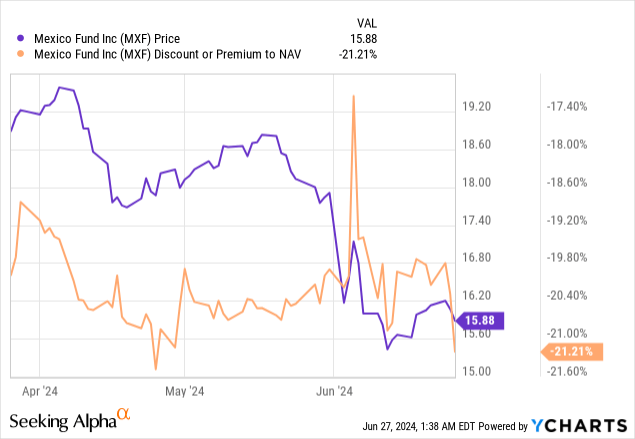

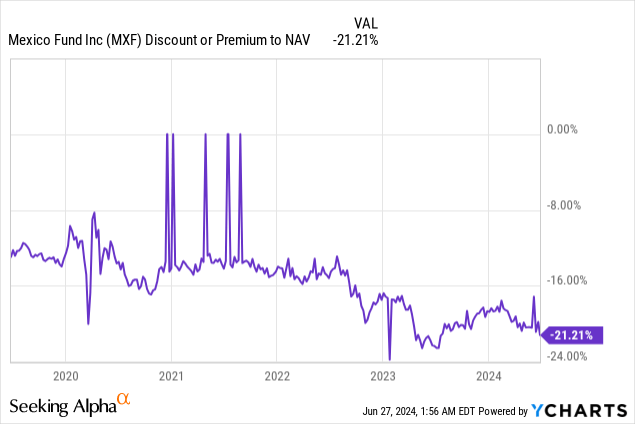

The closed-end Mexico Fund (NYSE:MXF), with its portfolio of Mexico’s largest cap names, wasn’t spared either. Nor was the NAV discount, which has yet again widened beyond 20%. To some extent, this isn’t unwarranted. After all, the manager has made little to no effort to narrow the discount in recent months. Yet, the quality of MXF’s holdings and diversification throughout the rest of Latin America make the fund an interesting play on a relief rally. Plus, MXF is light on regulated sectors like railroads and airports, lending it a fair bit of insulation from the worst of a near-term political fallout. Having been cautious about MXF pre-election (see MXF: Caution Still Warranted Despite The Wide Mexico Fund Discount), the fund makes sense as a tactical play here.

MXF Overview – Mind the Fees and Illiquidity

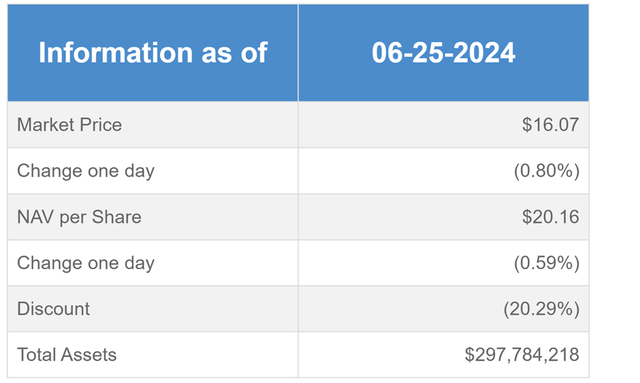

Fundamentally, the actively managed Mexico Fund, benchmarked against the MSCI Mexico Index, hasn’t changed too much. Total assets under management are slightly up from when I last covered the fund, though the current $298m remains well below pre-election highs.

Mexico Fund

A lower asset base also means the expense ratio is now higher than the 1.35% quoted in its last monthly factsheet. The silver lining is that the fund also has an “expense limitation” in place, effectively keeping the expense ratio below a 1.4% ceiling. That said, in a world where passively managed options like iShares’ MSCI Mexico ETF (EWW) and Franklin Templeton’s FTSE Mexico ETF (FLMX) charge 0.5% and 0.2%, respectively, MXF still isn’t very competitive on cost. Shares don’t trade anywhere near as much as the ETFs either, so liquidity, especially for those moving larger volumes, is an additional issue.

|

Fund |

Expense Ratio (%) |

|

Mexico Fund (per May Factsheet) |

1.35 |

|

iShares MSCI Mexico ETF |

0.50 |

|

Franklin FTSE Mexico ETF |

0.19 |

Source: iShares, Franklin Templeton, Mexico Fund

MXF Portfolio – As Concentrated as Ever on Mexico’s Largest Cap Names

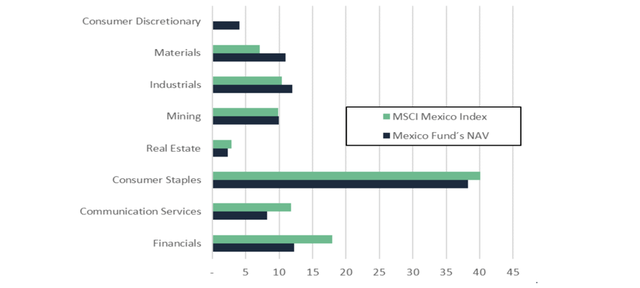

Sector-wise, MXF’s latest annual report revealed that its relative overweights on Consumer Discretionary, Materials (ex-Mining), and Industrials remain intact. Conversely, the fund is significantly underweight Financials and Communication Services relative to its MSCI Mexico benchmark. Given the low portfolio turnover, MXF’s sector breakdown shouldn’t deviate too far from these weights going forward.

Mexico Fund

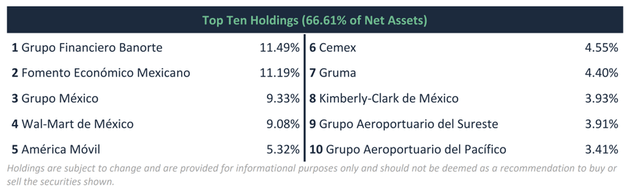

As for the single stock profile, there has been some reshuffling at the top, with Grupo Financiero Banorte (OTCQX:GBOOF) now the largest holding at 11.5%, followed closely by beverage and retail conglomerate Fomento Económico Mexicano (FMX) at 11.2%. Telco América Móvil (AMX) (5.3%) has ceded further portfolio share in recent quarters, in line with its relative underperformance vs conglomerate Grupo México (OTCPK:GMBXF) (9.3%) and Wal-Mart de México (OTCQX:WMMVY) (9.1%).

Mexico Fund

In total, the top ten holdings, comprising Mexico’s highest-quality franchises, continue to make up an outsized 66.6% of net assets. So even though MXF doesn’t deviate too far from MSCI Mexico composition-wise, it is much more of a concentrated bet on Mexico’s largest companies.

MXF Performance – Post-Election Blues and a Near Record NAV Discount

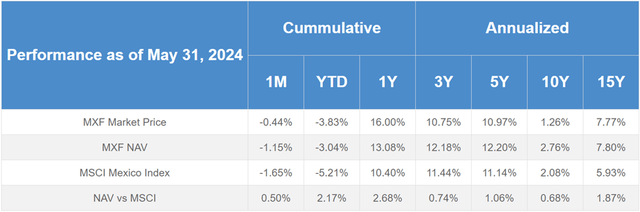

As of end-May, the fund’s year-to-date decline of -3.0% (in NAV terms) means it has outperformed its benchmark MSCI Mexico Index (-5.2%); on a one-year basis, the NAV outperformance widens to nearly three percentage points. Over longer five and ten-year timelines, the fund’s NAV growth is similarly ahead of its benchmark, albeit by a smaller margin.

Mexico Fund

Where investors have lost out, though, is via the persistent discount to NAV priced into the shares. After accounting for this delta, in market price terms, MXF investors have actually underperformed MSCI Mexico over the last decade. Post-election, this gap has only widened, and as a result, MXF is now priced at a near-record +20% discount to its underlying NAV.

On the one hand, the manager has done its part in keeping a steady pace of distribution growth via its “managed distribution plan” – currently yielding in the high-single-digits per this year’s run-rate (capital gains + income). Yet, the rate of buybacks (1.6% of outstanding shares in fiscal 2023, none in Q2 to date) has been largely symbolic. Nor has the manager shown any willingness to address its uncompetitive fee structure. Until we see intent by the manager, for instance, by reducing the expense ratio, accelerating distributions or buybacks, there’s a good chance the NAV discount stays wide.

Mexico Fund

Tactical Play on a Mexico Relief Rally

While somewhat warranted, the extent of the post-election move in Mexican equities seems overdone. Even in a worst-case scenario where we do see some of AMLO’s controversial reforms implemented, large-cap equity valuations, now at ~11x forward earnings, seem overly discounted relative to underlying fundamentals. For all its flaws, MXF’s high-quality portfolio and relative insulation from political risk make it an attractive option to capture some near-term upside.

Read the full article here

Leave a Reply