Building a passive income snowball is a great way to fund retirement because it generates consistent cash flow from your investment portfolio that can fund your living expenses. This makes you relatively agnostic to the short-term performance of your portfolio on a market price basis because if you generate enough dividend income from your holdings, you never have to sell a single share. As long as the dividends keep rolling in, you will be able to meet your monthly living expenses, and your lifestyle will not be affected by market volatility.

One of the drawbacks of focusing on high-yielding stocks to build a passive income portfolio, however, is that such portfolios typically have very low exposure to the technology sector. This is because tech stocks generally pay little to no dividends as they often retain their cash flow and reinvest it in research and development projects to maintain their competitive advantage and fuel strong growth, given that they operate in a sector that typically enjoys high growth rates.

To bridge this disconnect, several ETFs have been launched in recent years that concentrate heavily on leading technology stocks, including several with large exposure to leading AI powerhouses, and implement a covered call strategy. This generates cash flow from options premiums each month, which they then distribute to shareholders, thereby enabling high-yield investors to round out their passive income streams with exposure to leading technology stocks while still generating attractive dividend yields, giving them a better-diversified portfolio without sacrificing their income yield.

In this article, we will discuss the REX FANG & Innovation Equity Premium Income ETF (NASDAQ:FEPI) and then compare it to two other popular AI-heavy covered call ETFs: the JPMorgan Nasdaq Equity Premium Income ETF (JEPQ) and the Global X NASDAQ 100 Covered Call ETF (QYLD). We will share our thoughts on which one would best round out a passive income snowball portfolio.

Fund Comparison

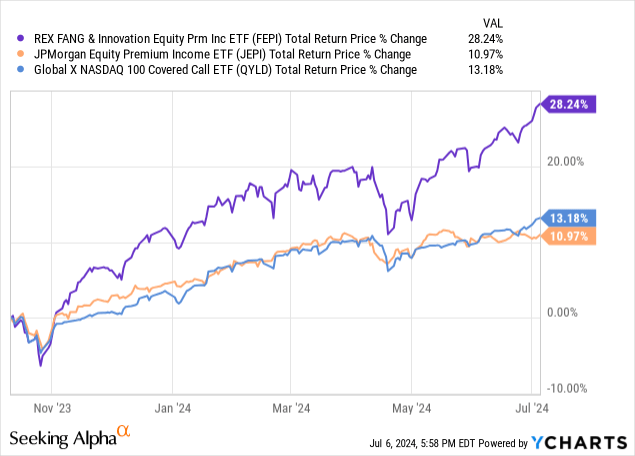

FEPI has not traded for very long, but over the short course of its existence, it has massively outperformed both JEPQ and QYLD. In fact, it has been active for less than a year and yet has already returned 28.24%.

On top of that, its annualized yield is much higher than JEPQ’s and QYLD’s. JEPQ’s trailing 12-month yield is about 8.8%, QYLD’s is 11.49%, and FEPI’s is about 25%. While all three funds seem to implement slightly different options writing strategies-with JEPQ allowing for the most upside potential, QYLD allowing for a bit more, and FEPI allowing for the least-the exact details of their options writing schemes are somewhat ambiguous as they do not lay them out clearly. The only thing that is clear is that both QYLD and JEPQ implement a covered call strategy on the Nasdaq 100, whereas FEPI writes covered calls on its underlying holdings.

FEPI’s portfolio consists of the FANG & Innovation Index, which is equally weighted and includes five highly liquid tech stocks. It is rebalanced monthly and reconstituted quarterly. QYLD and JEPQ, on the other hand, target the Nasdaq 100 in their portfolios. FEPI also adds additional holdings to create better diversification. However, it is not as well-diversified as QYLD and JEPQ. JEPQ has 98 holdings, QYLD has 104, and FEPI has 78. Additionally, FEPI has 70.37% of its portfolio invested in its top 10 holdings, whereas JEPQ has 44.36% and QYLD has 52.94%. This means that from a portfolio perspective, FEPI has a higher risk profile than QYLD and JEPQ. This perhaps explains why its options writing is much more aggressive, generating more options premiums to reduce volatility in total return performance and offset some of the risk incurred from being more concentrated.

Since its launch, FEPI has focused on the leading Magnificent 7 stocks and a few other top technology stocks that have had very strong total return performance over that period, fueling the fund’s extremely strong overall total returns. However, since it is less diversified than JEPQ and QYLD, it has significantly outperformed them. One other item to note is that JEPQ has a much lower expense ratio than both FEPI and QYLD. JEPQ has a 0.35% expense ratio, QYLD has a 0.61% expense ratio, and FEPI has a 0.65% expense ratio, making it the most expensive of them.

Investor Takeaway

The comparison boils down to this: If you want to maximize your concentration in the leading technology stocks and are fine with the NAV being pretty stagnant and possibly even declining over time, depending on the degree of volatility in the Magnificent 7 and other leading tech stocks, FEPI is likely a better pick because it gives you greater concentration and a higher yield. However, if your goal is to maximize risk-adjusted total returns over the long term while still having some fairly concentrated exposure to tech along with a nice yield, JEPQ is the best pick in my view because it has a much lower expense ratio, greater diversification, and manages its covered call strategy in a way that does not over-generate options premiums at the expense of NAV sustainability and appreciation over time.

If it were me, I would pick JEPQ just because I don’t like paying high fees and I don’t need a 25% yield from my tech allocation. The roughly 9% trailing 12-month yield that JEPQ offers is plenty high, and I like the idea of still being able to get significant upside potential in the price, as it has appreciated about 16.2% over the past year. In contrast, FEPI has only appreciated by about 10% since it launched a year ago, and that’s only because of the extremely strong underlying performance of its holdings over that period. That level of performance will not continue indefinitely, so FEPI’s NAV is likely to decline over time unless it relaxes its options strategy and generates a significantly lower yield.

However, I can totally see why some would want FEPI in their portfolio due to the ability to dramatically juice the yield and provide greater concentration to leading tech stocks. The one I do not think is desirable is QYLD, as I think it offers the worst of both worlds in that it does not have the concentrated exposure and high yield offered by FEPI, but still has a very high expense ratio. For that reason, I don’t see any real reason to hold QYLD over JEPQ.

Read the full article here

Leave a Reply