Capital Product Partners L.P. Overview

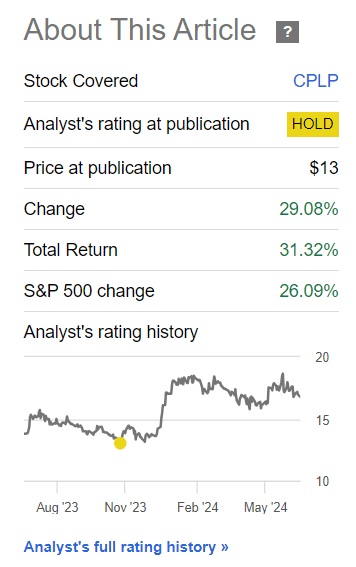

Capital Product Partners L.P. (NASDAQ:CPLP) (formerly known as Capital Product Partners) is a Greek marine transportation company, which I covered in the last year with a cautious article titled “Capital Product Partners: It’s Cheap But Maybe For A Good Reason.” Since then, the company’s stock has outperformed, resulting in total returns of 31% for investors, beating the S&P 500’s (SP500) strong performance of 26%. This perhaps proves that my caution was overdone and not totally warranted.

Stock Performance Since Last Coverage (Seeking Alpha)

Since my last coverage of this company, a few developments have happened. First, the company acquired assets of Capital Maritime, including 11 liquefied natural gas carriers that were newly built, and announced that it would start offloading some of its non-core container vessels. In fact, it already sold 4 container ships for a total of $81 million in March and sold another 3 vessels in April. The company also converted into a corporation and its units converted into shares after this acquisition, which cost the company $3.1 billion.

The company also benefited from higher tanker rates after Houthi attacks emerging in Yemen disrupted shipment routes in the Red Sea. The company also had to spend more on fuel because oil prices also happened to rise in the same fashion, so the benefits of higher prices benefited the company only partially.

When the company reported earnings in February, it posted 20% revenue growth year over year, but net income was down by close to 40% year over year from $1.03 to 61 cents, which also happened to be slightly lower than analyst estimates of 65 cents. Most of the revenue growth came from the 3 new vessels added to the company’s fleet in the last year. In April, the company issued another quarterly earnings report where its net income came at 32 cents per share, which was down about 36% year over year despite having revenues rise by 29% during the same period.

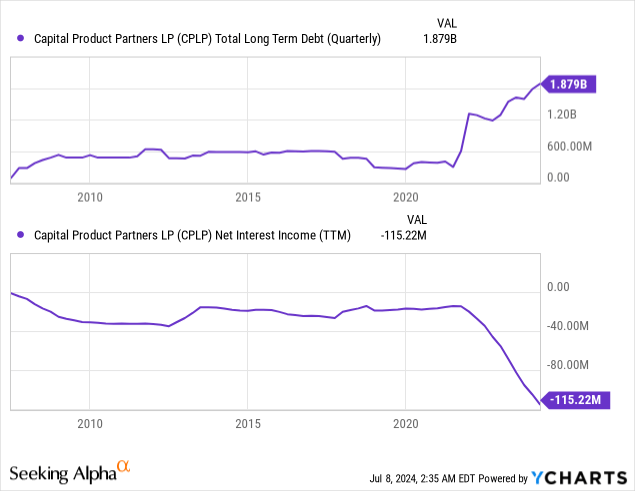

In my last article covering the company, one of the concerns I had about this company was its high debt levels. Back then, the company had $1.289 billion in total long-term debt, which translated into $82.56 million for annual debt servicing costs. Since then, these two metrics both got significantly worse. Now the company’s long-term debt jumped to $1.88 billion and its debt servicing costs rose to $115.22 million, which is a significant jump, but a big portion of this is related to the company’s latest acquisition and only time will tell whether this will pay off for the company or not. It is very possible that the company generates enough cash flow from its new acquisitions to cover all this debt and then some more, but it is also possible that this may not happen, especially if the state of the global economy worsens.

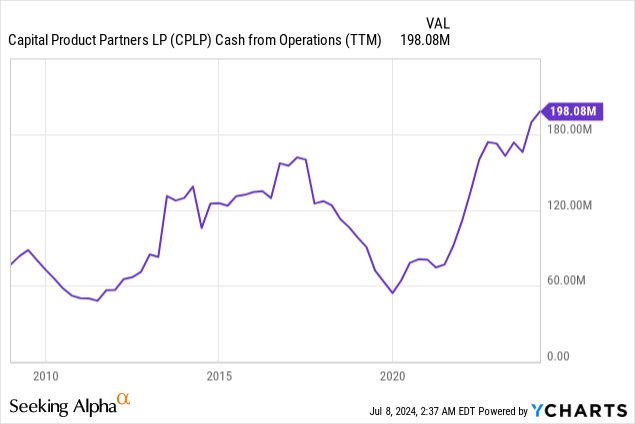

Speaking of cash flows, the company’s operating cash flow improved since last year. The last time I covered this company, they were generating $173 million of cash from their operations, and now this number is just $2 million short of $200 million. This was certainly helped by the company’s newly acquired vessels and more favorable pricing due to Red Sea disruptions. Then again, the company’s operating cash flow grew by about $25 million while its interest payments grew by $32 million, which means the company is actually down $7 million in terms of how much cash it generates from its operations in relation to its debt servicing.

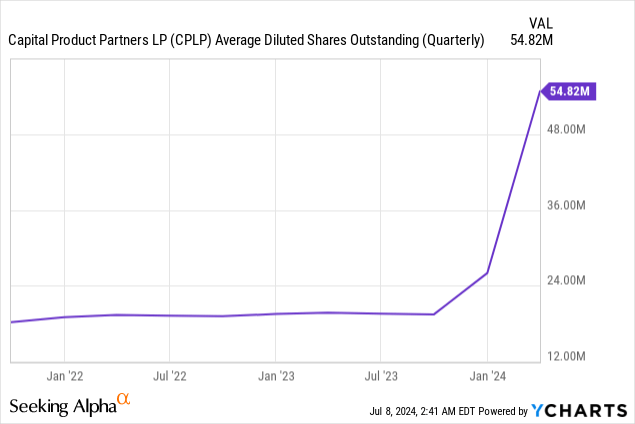

Earlier, one concern I had regarding this company was its dilution of its shareholders, which seems to have gotten worse in the last year, mostly thanks to its new acquisition, which was pretty costly. This also explains why the company’s EPS dropped significantly while its revenues were up almost 30% from last year and its operating cash flow is higher because there are far more diluted shares out there now than there has ever been. The company’s current quarterly dividend of 15 cents is still supported by its current income, but this could quickly change if this rate of dilution continues.

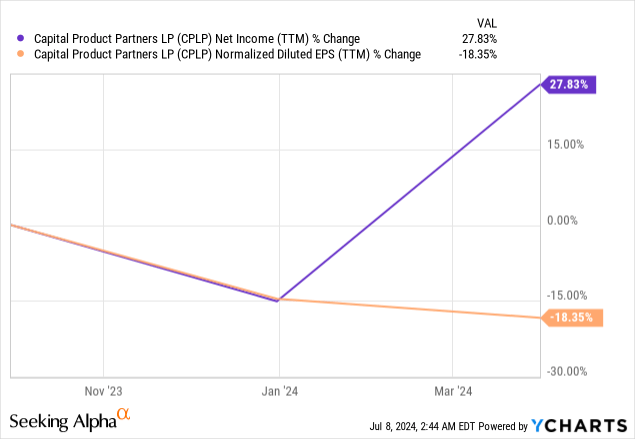

To put things into more perspective, in the last 12 months the company’s net income was up 28%, while its EPS (earnings per share) was down -18% during the same period. This is where dilution becomes highly problematic. In the future, this might be less of an issue though, because the company is now a corporation (as opposed to a partnership), which means it doesn’t have to distribute virtually all its income any longer, which means it can use some of its profits to fund further growth instead of doing endless amount of dilution. When the company was a partnership, it had no choice but to do dilutions, but now it has more options to fund its growth, so we will see if this dilution picture changes in the future in light of this new development.

CPLP Stock Valuation

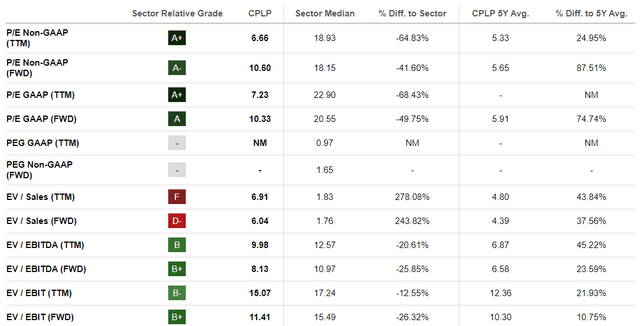

After the recent rally, the company’s valuation looks slightly higher than before but still well below its peers. The last time I covered this company it had P/E values ranging from 2 to 4, depending on whether you are looking at GAAP or non-GAAP figures, but not the range, is 6 to 10 depending on whether we are looking at GAAP and non-GAAP as well as whether we are looking at trailing or forward P/Es. The company’s current valuation is a bit higher than its 5-year average of around ~5 but significantly below the sector median, which is in the high teens. The company is still fundamentally “cheap” but it is certainly less cheap than it was last year.

CPLP Valuations (Seeking Alpha)

Conclusion

Can the stock keep outperforming? It certainly can if tanker rates remain high, but we are also seeing signs of a global slowdown after 2 years of fiscal tightening by central banks around the world. Marine transportation tends to be one of the most cyclical industries, and the sector’s performance heavily relies on a strong economy. If the economy were to suffer a significant slowdown, we may have a slowdown in this company’s income, even though I must also add that it has a pretty large backlog as it is, and the backlog is unlikely to go away anytime soon. Still, the price and profitability of those contracts might fluctuate along with the economy.

Another thing to watch is where LNG shipments are going. Currently, European countries are getting their LNG from alternative resources after having depended on Russia for many years. If the war in Ukraine were to reach a conclusion and Europeans started buying natural gas from Russia again, some LNG routes might get affected by weaker demand. This is unlikely in the short to medium term, but still possible.

CPLP stock is cheap, but I am still cautious about it in terms of dilutions, heavy debt and other factors such as the state of the economy. If you must absolutely buy and hold this stock, I’d keep my position size fairly small.

Read the full article here

Leave a Reply