MELI’s Investment Thesis Remains Robust – With Raised Double Digit Growth Prospects

We previously covered MercadoLibre, Inc. (NASDAQ:MELI) in April 2024, discussing how our recommended entry point had materialized then, with the stock charting the predictable trading pattern since the June 2022 bottom as the management consistently delivered on its profitable growth initiatives.

Combined with the double-digit growth recorded in the advertising segment, we believe that it might remain a long-term winner with an excellent upside potential over the next few years.

Since then, MELI has already rallied by +14.8%, well outperforming the wider market at +8.6%. Even so, we are reiterating our Buy rating, due to the double beat FQ1’24 earnings call, growing market share in Latam, and robust performance metrics.

We will also be highlighting a few metrics to look out for in the upcoming earnings call on August 02, 2024, with it underscoring the health of MELI’s businesses along with near-term prospects.

1. Competition From Shopee & Amazon

Based on Statista, MELI reports 15.4% in e-commerce market share in Mexico in 2023 (inline YoY), with the other competitor being Amazon.com, Inc. (AMZN) at 11.2% (-2 points YoY).

The same market leadership has also been observed in Brazil, with MELI leading at 28.9% (+4.5 points YoY) and AMZN placing second at 23.2% (+5.6 points YoY).

These two regions are important indeed since MELI reports 22.4% of its revenues from Mexico (+3.3 points YoY) and 59.3% from Brazil in FQ1’24 (+8.1 points YoY).

At the same time, the company has had to contend with a new competitor, Sea Limited’s (SE) Shopee, which has been aggressively expanding their investments and e-commerce/ fintech offerings in the Latam region.

This naturally explains why Shopee’s market share in Brazil has also expanded to 9.2% by 2023 (+0.5 points YoY), building upon the immense growth observed since late 2019.

As of May 2024, Shopee at 201M visits in Brazil (+10.8% MoM) has also beaten Amazon at 195M visits (+3.4% MoM). While MELI remains the undisputed market leader at 363M visits (+6.6% MoM), SE’s double-digit growths can not be ignored indeed.

Therefore, while market analysts still expect Latam’s e-commerce GMV to grow tremendously from $182.7B in 2023 to $269.8B in 2028 at a CAGR of +8.1%, with the market big enough to accommodate multiple players, the intensifying market competition may potentially trigger the deceleration of MELI’s profitable growth trend.

Readers may want to pay attention to MELI’s execution and the management’s commentary in the upcoming earnings call indeed, despite the robust QoQ/ YoY growth in its performance metrics in FQ1’24.

2. Argentina Devaluation & Expanding Credit Risks

For reference, Argentina continues to face eye-watering inflation of 276.4% in May 2024, compared to the US at 3.37% and the global average of 5.9%.

With the government still printing money and Pesos losing value, it is unsurprising that the ongoing issue in the country has triggered headwinds to MELI’s operations since the country comprises 14.1% of the company’s revenues in FQ1’24 (-9.6 points YoY).

The YoY decline is not surprising as well, as the Argentine Pesos lost much of its value over the past few years – leading to a much weaker macro environment and consumer spending trends.

Even so, readers must note that the hyperinflation in Argentina has been somewhat easing from the 292.2% reported in April 2024, with things likely to further improve moving forward if the new government’s devaluation process continues as expected.

While MELI continues to report mixed performance in the e-commerce segment in Argentina, the management has already doubled down on its fintech expansion. This has led to the robust growth observed in the active user base and assets under management, well-balancing the e-commerce headwinds.

The same optimism has already been guided from FQ2’24 onwards, with the FX headwinds normalizing relative to other Latam countries.

On the other hand, readers may want to monitor MELI’s non-performing loans in Argentina along with Brazil and Mexico, since the management’s fintech efforts have also led to the growth in its loan originations to $4.44B (+7.2% QoQ/ +71.2% YoY) and early delinquencies < 90 days at 9.3% (+1.1 points QoQ/ +1.5 YoY) in FQ1’24.

While the management has highlighted that the credit risks remain within limits, it is uncertain what the long-term impact may be, despite the still expanding Net Interest Margin of 31.5% (-8.3 points QoQ/ +0.9 YoY).

With the Latam inflation still generally higher than pre-pandemic levels, we believe that readers may want to pay attention to MELI’s intermediate-term fintech execution since the segment comprises 42.2% of its overall FQ1’24 revenues (-5.2 points YoY).

3. MELI Remains Extremely Cheap For Its Accelerated Growth Prospects

The Consensus Forward Estimates

Seeking Alpha

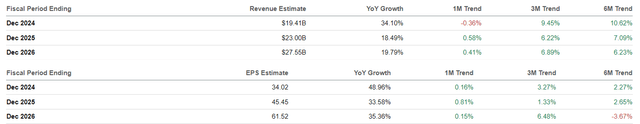

For now, given the robust FQ1’24 performance and the management’s hiring blitz in 2024, it is unsurprising that the consensus is increasingly optimistic about MELI’s prospects, as observed in the accelerated top/ bottom-line growth projections at a CAGR of +23.9%/ +39.1% through FY2026.

This is compared to the previous estimates of +18.8%/ +26% and historical growth at +50.1%/ +31.7% between FY2016 and FY2023, respectively, implying its ability to consistently generate high double-digit growth.

MELI Valuations

Seeking Alpha

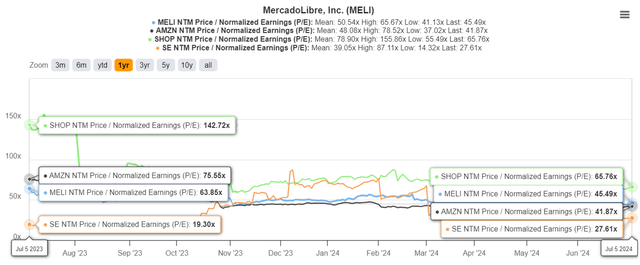

As a result of the accelerated growth prospects, we believe that MELI appears to be very cheap at FWD P/E valuations of 45.49x, compared to its 1Y mean of 50.54x and 3Y P/E mean of 115.18x.

This is because the stock continues to trade near to its well-diversified e-commerce/fintech/logistics peers, such as AMZN at FWD P/E valuations of 41.87x, Shopify Inc. (SHOP) at 65.76x, and SE at 27.61x.

This is especially true after comparing MELI’s top/ bottom-line growth prospects through FY2026, to AMZN at +11.1%/ +37.3%, SHOP at +21.1%/ +32.4%, and SE at +14.1%/ +93.2%, respectively, implying that the former is trading at relatively cheap valuations given the accelerated profitable growth prospects, aside from SE of course.

So, Is MELI Stock A Buy, Sell, or Hold?

MELI 5Y Stock Price

TradingView

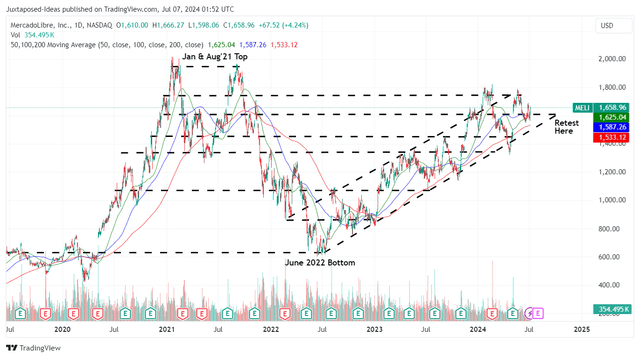

For now, MELI’s trading pattern has materialized as expected, with the stock’s uptrend still well supported since the June 2022 bottom and our recommended entry point of $1.45K in December 2023.

At the same time, with the consensus recently upgrading their FY2026 adj EPS estimates from $58.41 to $61.52, we will also be updating our long-term price target from $2.62K to $2.76K – based on the stable FWD P/E of ~45x, with it offering an excellent upside potential of +66% from current levels.

With the Argentina devaluation already behind us and things normalizing from Q2 onwards, we believe that MELI may easily beat the consensus FQ2’24 estimates, significantly aided by the management’s intensified fintech expansion in Brazil and Mexico as more consumers adopt its vertically integrated offerings.

Combined with the robust growth in its advertising segment and its growing market share across the e-commerce/ logistics segment, we are reiterating our Buy rating.

Interested investors may consider monitoring MELI’s stock movement for a little longer, before adding according to their dollar cost averages and risk appetite, preferably at $1.52K based on the established trading pattern, with those levels naturally triggering an improved margin of safety.

Read the full article here

Leave a Reply