By James Knightley

Subdued inflation throughout

The June consumer price inflation report is surprisingly soft and should go some way to boosting the confidence of individual FOMC members that inflation is on the path to the Federal Reserve’s 2% target. Headline CPI fell 0.1% month-on-month rather than rising 0.1% as predicted, while core CPI came in at +0.1% MoM versus the +0.2% consensus forecast. Separately, initial jobless claims dipped 17k to 222k and continuing claims held stable, but it is the low CPI print that is dominating the market moves, with the 10Y Treasury yield dropping below 4.20% for the first time since late March.

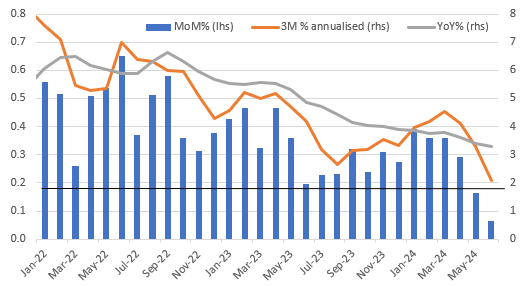

Core inflation: MoM%, 3M annualised & YoY%

Source: Macrobond, ING

Housing is finally cooling

The core CPI number is the key figure, and it is a “good” 0.1% in that it is rounded up from 0.065% to three decimal places and the 3M annualised rate is now down to just 2.1%, even though the annual rate dipped only modestly to 3.3%. We were forecasting a 0.2% MoM print, but we had thought the balance of risks were skewed to the upside due to a likely rebound in auto insurance. That component did increase 0.9% MoM, although it was less than we feared. Everywhere else there was softness. We are finally seeing housing inflation slow, with shelter coming in at 0.2% MoM rather than the 0.4% rate it has been trending at. Owners’ equivalent rent and primary rent were 0.3% MoM, the lowest for 3 years, while hotel prices fell sharply. Medical care has also cooled to 0.2% MoM after posting a series of 0.4 and 0.5% readings. Used car and new car prices are falling while airline fares dropped 5% MoM.

3 rate cuts remains our call for 2024

This report clearly supports the argument that the Fed can start to loosen monetary policy a little from restrictive territory to “slightly less restrictive” territory at upcoming meetings. 0.17% MoM is the key number. If we get twelve of those in a row, that brings us to the 2% year-on-year target. We have now had two in a row that are below that threshold with the chart above, a sharp slowing in momentum. A July rate cut remains highly unlikely, but 23bp of a 25bp cut is now priced for September. Between now and then, we expect to see more evidence of a cooling jobs market and decelerating consumer spending growth. With the Fed keen to avoid a recession and achieve the targeted “soft landing” we think the Jackson Hole Conference at the end of August will be the venue for the Fed to signal more explicitly that interest rate cuts are coming. We continue to see three rate cuts this year versus the market pricing of two.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Original Post

Read the full article here

Leave a Reply