Intro

Sonida Senior Living, Inc. (NYSE:SNDA) came across our desk as a US-based senior living player (Primarily focused on independent living, memory care & assisted living) which continues to acquire assets at an accelerated clip. After the company’s recent Q1 earnings report, Sonida Senior Living owned 61 communities while managing a further 10 in the US. Furthermore, there seems to be no letup here concerning forward-looking investment trends. To this point, the company announced on its recent Q1 earnings call (announced on the 10th of May) that significant amounts of equity capital continue to be raised demonstrating the company’s clear intent to grow both organically & inorganically in this space.

Many senior-living outfits in the US continue struggling with high debt payments and here is where SNDA is looking to take advantage by swooping in (with third-party investors if needs be) & buying depressed loans for pennies on the dollar. This ‘in-house’ setup (Sonida operating, owning & investing in its Senior Living assets) model is pretty rare in this industry and should bring synergies to the company’s operations due to the lack of multiple interests potentially competing against each other.

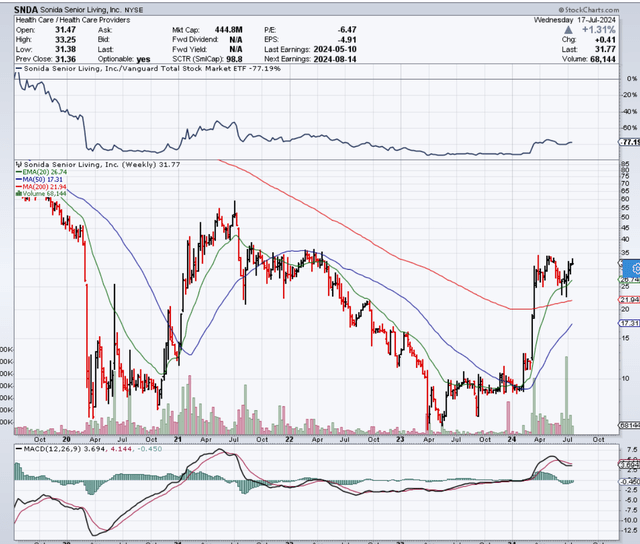

Then, over time, if Sonida’s assets can begin to pay for themselves through sustained positive cash-flow generation, the market should begin to mark the stock up as long as it sees a credible move to positive profitability. This has happened this year as we see from the technical chart below. Shares are up well over 200% year to date and are currently trading around the $32 level.

SNDA Technical Chart (StockCharts.com)

Q1 Trends

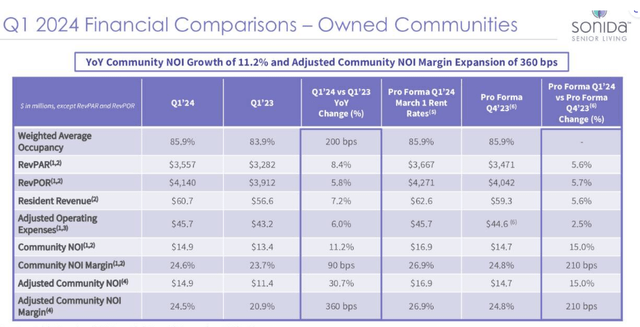

Despite the continued negative GAAP profitability trend over a trailing 12-month average, we witnessed net EBIT growth of 11%+ & net EBIT margin expansion of 360bps. Residential rent rates increased by 10% over a 12-month rolling quarter basis helping revenue growth to continue to outpace Sonida’s labor costs (45.1% of revenues in Q1). Non-labor costs did jump sequentially in Q1 this year but importantly remained below the same quarter of 12 months prior. Quarterly occupancy (86.9% in Q1) growth continues to march towards that key 90% level. In the chart below, we see how RevPAR rose in Q1 in Sonida’s owned communities so it will be interesting to see if growth in rate capture can accelerate from what we are seeing at present.

Sonida Q1 Financial Metrics Owned Communities (Seeking Alpha)

Market Conditions Have To Stack Up

Although Sonida may have no debt maturities pending for the remainder of 2024 & only $31+ million maturing in 2025, investors should note that $220+ million of debt is scheduled to mature in 2026. At the end of Q1, annual interest expense came in at approximately $36 million on long-term debt of $571 million. Sonida’s debt is 72% fixed & has a weighted average interest rate of just under 5%. Furthermore, the variable percentage of Sonida’s debt is 100% hedged which again protects against any potential interest rate spikes in the years ahead. Slowly but surely, management has been deleveraging the balance sheet but we would state the following concerning the importance of market conditions going forward.

Elevated & growing occupancy levels coupled with consistent resident rent rate growth are essential to any prospective rollover of debt & Sonida being continuously funded by its creditors. Management believes the spike in ‘Senior Living demand as well as the significant number of underperforming loans in this space will enable Sonida to continue to add assets at scale to its balance sheet over time. While this may be correct over the near term, the efficient management of these assets remains critical from a creditor’s point of view.

To this point, although positive operating cash flow was generated over the past 12 months ($3.3 million generated), Sonida’s $18+ million capex spend means fresh debt or equity raises will most likely be par for the course here for some time. We have seen in recent years how spiraling labor costs have wreaked havoc in this space, particularly since the pandemic. Licensed carers are always going to seek out the best conditions for themselves which is why the ‘organic’ performance of Sonida’s assets will be a key area creditors will continue to study. Case in Point: Large debt (no matter how well it is managed) always becomes more burdensome when market conditions change and herein lies the risk in SNDA as it continues to grow its asset base.

Valuation

Given shareholder equity & GAAP earnings currently come in negative over a trailing 12-month average & cash-flow as alluded to earlier is minuscule compared to the market-cap ($436 million) of the company, Sonida’s sales are the only metric from which we can gauge the company’s inherent value. As we see below, although Sonida’s trailing sales multiple comes in well below the sector median at present, the company’s trailing EV / Sales multiple (which takes the company’s leverage into account) currently comes in higher. High EV / Sales multiples point to above-average forward-looking growth but, as mentioned, market conditions will play a big part in ascertaining whether this valuation is overly optimistic or not.

Furthermore, with the number of shares outstanding now approaching 14 million, significant dilution has materialized in Sonida in recent times, adversely affecting existing investments. Furthermore, as mentioned, the longer cash-flow generation remains under pressure, more external funding will be needed for the company over time, diluting existing positions even more.

| Valuation Multiple | SNDA Trailing | Sector Median |

| Price-To-Sales | 0.99 | 3.77 |

| EV/Sales | 4.24 | 3.78 |

Conclusion

To sum up, although Sonida’s revenue, occupancy & RevPAR metrics continue to grow, the company’s high leverage means market conditions have to stack up for the company so organic & inorganic growth can continue to be realized. Let’s see what the second quarter numbers & trends bring. We look forward to continued coverage.

Read the full article here

Leave a Reply