By Inga Fechner & Rico Luman

World trade is literally navigating rough waters

Trading goods was not an easy job in the first half of the year. While component shortages are resolved in most sectors, shipping reliability is once again challenging. Attacks on merchant shipping led to around 60 per cent of all shipping traffic avoiding the Red Sea and the Suez Canal and instead choosing the longer and more expensive route via the South African Cape of Good Hope, which will continue well into the second half of this year.

This has a global impact, particularly in container shipping, where the highest diversion rates are recorded. Politically, there’s more pressure on trade, too, as we see increased rhetoric and other measures, although they’re yet to have any meaningful impact on trade itself.

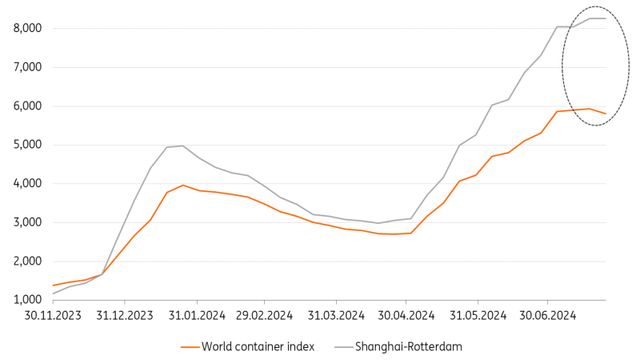

Container prices have risen again

In May, spot rates in the main trade lanes started to rise again as orders were put in early to avoid delays ahead of the holiday season. We’re also seeing a slight recovery in demand following the normalisation of consumer behaviour, some destocking, and new port congestion. The peak season in container shipping is usually in the third quarter of the year, but this combination has brought the peak season forward.

Another element is that supply chain partners are beginning to realise that the crisis in the Red Sea will not end any time soon, as Houthi rebels continue their attacks from a key maritime chokepoint position. These trade tensions might have added to worries about not being able to transport goods in time; Covid-related difficulties are still fresh in many minds.

Lingering congestion and labour friction risks still a major factor

Port congestion intensified across Asia and the Mediterranean in the second quarter due to vessel delays and higher unpredictability due to Cape rerouting and increased demand. Container trade figures show that volumes up to May were 8% above the weak 2023 levels, which is also reflected in major ports such as Shanghai, Rotterdam, and LA-Long Beach.

That coincides with that increase in early orders and spots have reached multiples of 4 to 6 times the long-term average amid the ongoing disruption. In practice, around 50% of freight is shipped under term contracts, which are less affected by the increase. However, given the tense market situation, surcharges are also being levied for at least some of the contracts. We expect the market to calm down in the second half of the year as we approach autumn and leave the peak season behind us.

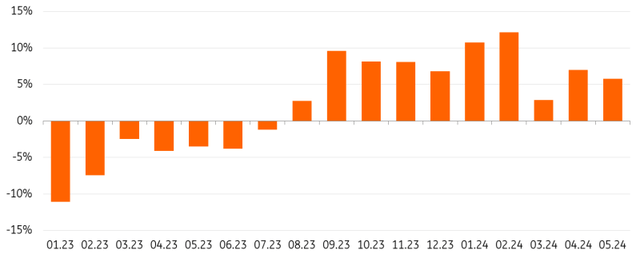

Global container throughput remains positive in 2024 after a year of decline

Global container TEU volume in %YoY

Source: Container Trade Statistics, ING Research

Container spot rates show signs of softening

Spot rates are still hovering around their highest levels since the start of the Red Sea crisis.

World container index (WCI), spot freight rates in $ per FEU (40 ft container)

Source: Drewry

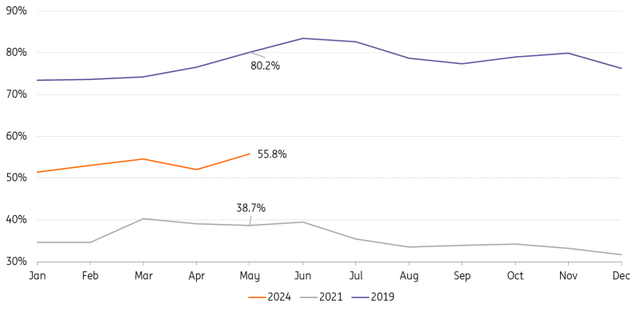

Overall, the global schedule reliability calculated by Sea-Intelligence remains poor and is 11 percentage points below the 2023 level. It stands at 55.8% and although this is the highest value for 2024 to date, it’s far below the usual 70-80%. On the positive side, frictions are currently mainly in (container) shipping and ports and Asia and Europe are more affected rather than the US; the global supply chain pressure index ticked up only slightly in June from -0.5 to -0.03, remaining well below levels seen over the past few years.

Global schedule reliability remains poor

Source: Sea-Intelligence

Strikes, weather and geopolitical threats

Strikes and, indeed, the threat of them are another cause for concern. In Germany, around 11,000 port workers, such as in Hamburg, are affected by the ongoing wage negotiations. In the US, there is a threat of strike action in the East and Gulf Coast ports, as an agreement between the International Longshoremen’s Association (ILA) and the US Maritime Alliance expires on 30 September. It affects around 45,000 port workers.

Extreme weather conditions also caused problems in the first half of the year, not because there was too little water but because there was too much, notably in parts of Europe, the Middle East, and South Asia. Recently, extreme weather around the Cape of Good Hope also caused delays. The World Meteorological Organization estimates that global average temperatures will exceed 1.5 degrees Celsius for at least one year between 2024 and 2028 with an 80% chance of probability, which means we’re likely to get more extreme weather in the future.

At least there is some relief when it comes to the Panama Canal: After almost a year of restrictions due to an extreme drought, shipping traffic is back to operating normally from July. The number of daily transits increased to 34 on 22 July and will increase to 35 in the first week of August.

A positive note

Despite all the geopolitical adversities, the total volume of global goods trade, including oil & gas, all sorts of raw materials and agribulk, increased marginally by 0.1% YoY between January and May (volumes, seasonally adjusted, 2021 fixed base value, USD). As the base year of the CPB World Trade Monitor (WTM) has been brought forward from 2010 to 2021, it’s near impossible to provide accurate comparisons.

Increased demand due to the peak season being brought forward should also be reflected in the summer trade data and drive up the annual growth rate of global goods. In the second half of the year, a low comparative base and current frontloading effects should improve data, and we expect an overall growth rate of 1.9% this year.

The outlook for next year depends very much on political developments, which will clearly continue to drive shifts in trade flows. Structural competitiveness and more severe adverse trade policies pose a risk moving into next year, affecting the pace of goods trading.

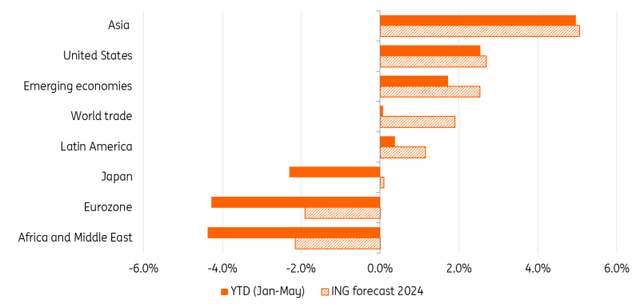

Asia powers ahead

Looking regionally, strength in autos and semiconductor exports has brought China a decent plus in goods trade despite the Chinese economy slowing. Exports to ASEAN countries and Latin America have been particularly strong due to EV exports, but exports to major developed economies have been weak or even negative. Given looming tariffs, some frontloading might further boost exports. Reduced imports due to sluggish demand in the property and agricultural sector should keep the overall rate in the single-digit growth environment, however.

China is followed by the rest of Asia, with machinery and electrical equipment exports, including semiconductors, driving exports. South Korea should particularly benefit from the AI-tech boom as Asia remains the main production hub as Min Joo Kang analyses here.

Japan’s total goods trade by volume in the first half of the year was subdued, partly related to production and shipment disruption at Japanese carmakers early this year due to certification issues, while fuel imports declined. A recent improvement in macro data should limit the negative trend in trade volumes for the year as a whole, with exports of cars and ICT goods remaining robust, while imports of mineral oils continue to be a drag.

Goods trade, volumes

YTD and ING Forecast (%YoY)

Source: CPB World Trade Monitor, ING Asia: Japan, China, Hong Kong, India, Indonesia, Korea, Malaysia, Pakistan, Philippines, Singapore, Taiwan, Thailand, Vietnam; simple average for Asia; Emerging economies: Emerging Asia excl. China, Eastern Europe/CIS, Latin America, Africa and Middle East

In addition to Asia and developing countries, the US has also made a positive contribution to global trade, partly driven by increased intra-NAFTA trade, notably imports from Mexico and Canada. In general, the US economy has proved to be remarkably resilient, with US GDP growth beating expectations in the second quarter. Yet, the economy is facing more challenges in the second half of the year, with consumer spending growth expected to cool further. The share of expenditure on goods in all consumer spending continues its downward trend, and at 33.6%, is only 1 percentage point above the pre-Covid average, which limits the positive contribution of the higher demand for goods instead of services observed in previous years. An increase in the inventories/sales ratios should also put a bit of a dampener on US imports, but for the year as a whole, trade in goods should continue to develop positively.

As for Europe, the first quarter was a positive surprise, but the recovery has recently lost momentum. The inventory cycle has not yet turned – the industrial production volume, tracked by CPB, decreased by 2.9% YoY year-to-date, and the private sector remains weak despite strong wage growth. The trade dispute with China does not help to brighten the outlook, although it’s still more about talk than action in terms of tariffs. Although we still expect a rebound in activity in the second half of this year, overall trade in goods will not be a major growth driver in the eurozone in 2024.

The events in the Red Sea and the conflict in Gaza and Israel severely distorted the movement of goods in Africa and the Middle East, with bordering countries experiencing the largest negative effects. Clearly, this is set to continue.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Original Post

Read the full article here

Leave a Reply