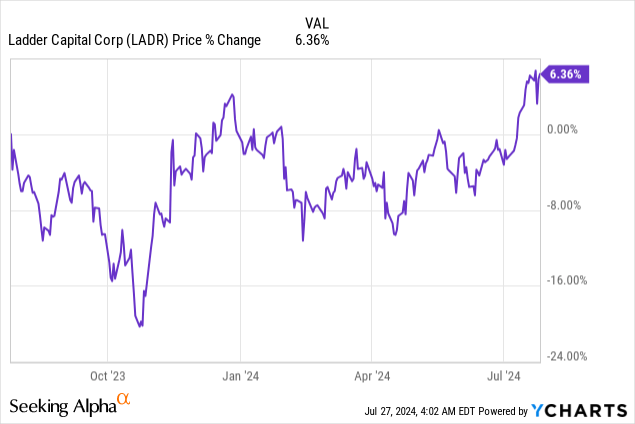

Ladder Capital (NYSE:LADR) delivered solid results for its second quarter last week and maintained healthy dividend coverage. Ladder Capital’s earnings report also stood out because it contrasted with the one submitted by Blackstone Mortgage Trust (BXMT)… a rival CRE REIT that was forced to cut its dividend down by 24% amid continual loan problems in its office segment. While Ladder Capital also had to increase its reserve for loan losses in Q2, the REIT has a high safety margin as far as the dividend goes and shares, given the quality of the REIT’s dividend coverage and distributable earnings performance, are now trading at a premium to book value. I still see some upside here and believe shares remain a buy given that the dividend should be safe in FY 2024!

Previous rating

I rated shares of Ladder Capital a buy in May 2024 after another commercial real estate trust, Starwood Property Trust (STWD), announced redemption limits for one of its non-traded REITs. Fears over redemption restrictions raised fire-sale concerns at the time and caused depressed valuations… which I wrote income investors should take advantage of. The sector, however, has recovered nicely since (with the exception of Blackstone Mortgage) and I continue to see upside revaluation potential for Ladder Capital. The main buy reason for Ladder Capital, however, is the well-supported 8% dividend yield.

Rise in CECL reserve, office loan exposure and dividend coverage profile

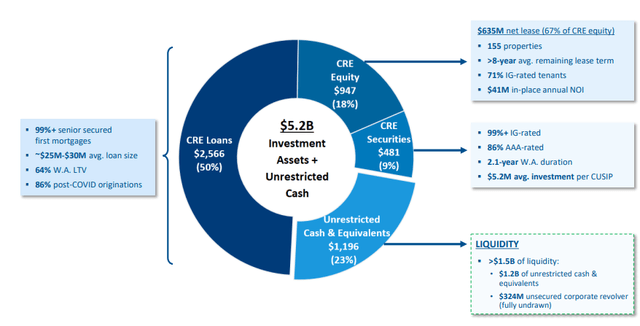

Ladder Capital is a large commercial real estate REIT with considerable investments in CRE loans. The company’s portfolio includes loan investments in offices, multi-family and mixed-use real estate, and it includes investments in real estate securities as well as brick-and-mortar real estate. About 17% of Ladder Capital’s assets relate to office loans, compared to 14% for Starwood Property (as of Q1’24) and 36% for Blackstone Mortgage. Ladder Capital’s portfolio, plus cash, was valued at $5.2B at the end of the June quarter.

Ladder Capital

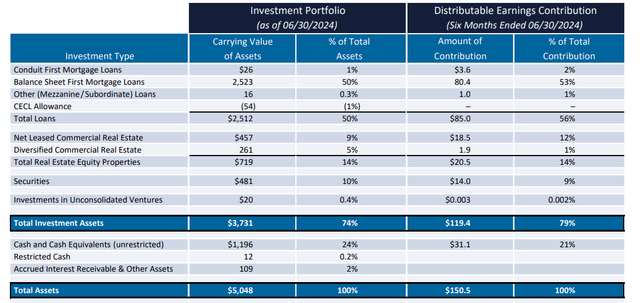

Ladder Capital’s largest segment is the commercial real estate loan business, which included a total of $2.5B in investments at the end of Q2’24. The majority of these investments were balance sheet first mortgage loans — which are loans that Ladder originates and then keeps on its books (instead of selling them into the securitization chain). In the previous quarter, the commercial real estate loan portfolio was valued at $2.8B, but the portfolio is shrinking due to asset divestments.

Ladder Capital

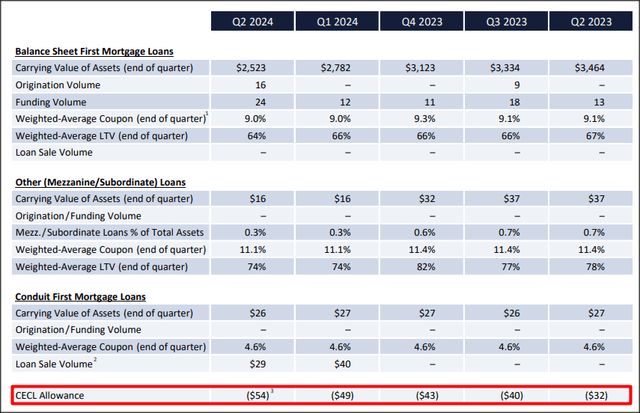

The most important metric is Ladder Capital’s CECL reserve, which has been on an up-trend in the last year. The incremental increases throughout last year were driven mainly by a general degeneration of operating conditions in the office market. CECL stands for current expected credit losses and indicates the amount of losses a CRE REIT might incur if impaired loans have to be written off. U.S. office properties are under pressure from changing work trends after the pandemic, meaning they have seen a decrease in their occupancy rates. Lower occupancy rate mean lower income for office properties, which has led to a rise in impaired loans in the portfolio of commercial real estate companies like Ladder Capital.

In the last year Ladder Capital added an average of $5.5M each quarter to its current expected credit loss reserve and my expectation, especially with the REIT having large investments in office loans, is that this trend of a rising CECL reserve will continue for the foreseeable future. Therefore, I would expect about the same level of distributable earnings as in Q2’24 as well as similar net additions to the CECL going forward, and I don’t expect much in terms of distributable earnings growth.

In the second fiscal quarter, Ladder Capital had a CECL allowance of $54M, meaning the REIT added about $5M to its reserve in the second-quarter (+69% Y/Y). In total, the CECL reserve now represents 2.1% of its total commercial real estate loans, which compares against a CECL/total loan value ratio of just 0.9% in the year-earlier period. The doubling of the ratio indicates that the REIT is experiencing heightened risks of loan write-offs, which in turn may impact Ladder Capital’s financial capacity to pay its dividend. Blackstone Mortgage also reported a significant increase in its CECL reserve, but Ladder Capital still has significantly better dividend coverage.

Ladder Capital

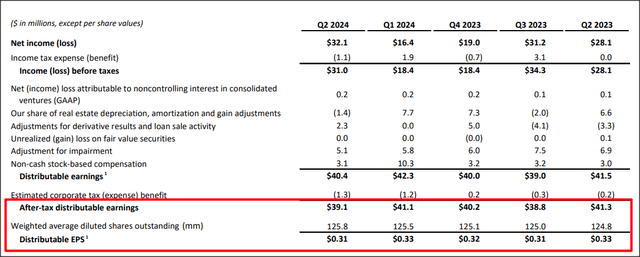

Ladder Capital’s distributable earnings came in at $39.1M in the second-quarter, showing a decline of 5.3% decline year over year, mainly due to asset sales and a shrinking CRE loan portfolio. Despite a slight decline in distributable earnings Y/Y, Ladder Capital maintained a high safety margin when it comes to its dividend: the REIT’s dividend coverage in Q2’24 was 1.35X compared to 1.43X in Q1’24 and 1.38X in the last year. Given these coverage metrics, I believe Ladder Capital’s $0.23 per-share quarterly dividend is sustainable in FY 2024.

Ladder Capital

Ladder Capital’s valuation

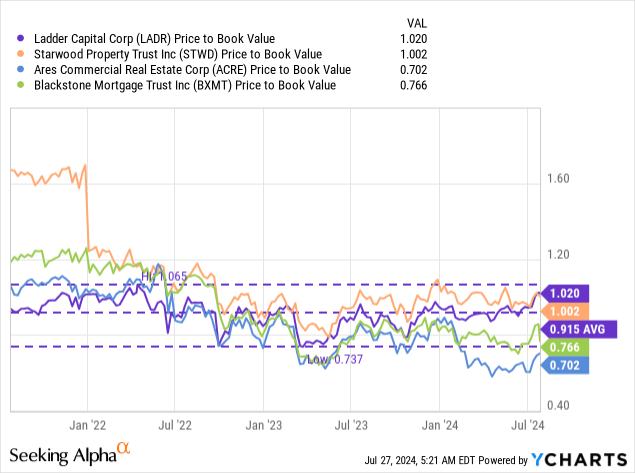

Shares of Ladder Capital are now trading at a 2% premium to book value, and LADR is now the only CRE REIT in the industry group that trades at a premium to book value. Blackstone Mortgage reported its second-quarter earnings last week as well, and announced a 24% dividend cut because of persistent loan problems in the office segment. Ares Commercial Real Estate (ACRE) cut its dividend earlier this year as well, also by 24%, due to higher credit losses.

While Ladder is now trading at 1.02X book value, I see more upside potential for the REIT as it has succeeded, so far, to position itself as a stronger CRE investment option for dividend investors. With a dividend coverage ratio of 1.35X investors need not be worried about an impending dividend cut unless the company’s loan quality experiences a steep and rapid decline, which I consider to be unlikely. I can see Ladder Capital’s shares trade at a 1.10X price-to-book value ratio given the quality of the 8% yield which gives the commercial real estate REIT a fair value of $13.16 per-share, under the condition that the REIT’s loan quality doesn’t deteriorate.

Risks with Ladder Capital

A red flag would clearly be a significant increase in the CECL reserve going forward, which would indicate growing loan problems in Ladder Capital’s portfolio. However, Ladder Capital is not at risk, at least not now, of having to reduce its dividend, in my opinion. As opposed to Blackstone Mortgage, Ladder Capital doesn’t have as much exposure to the office market and the dividend is still well-covered by distributable earnings. Investors buying Ladder Capital for income, however, should keep an eye on both the REIT’s CECL as well as dividend coverage trends.

Final thoughts

Ladder Capital is still one of the best CRE plays in the market given its strong dividend coverage of 1.35X as well as fairly stable distributable earnings trajectory in a challenging market. While Ladder Capital has seen a growing CECL reserve and a shrinking loan portfolio, the dividend has sufficient excess dividend coverage that indicates that it is sustainable at this point. I would change my mind about Ladder Capital going forward if the REIT were to see a degeneration of its dividend coverage ratio and had to deal with higher credit losses!

Read the full article here

Leave a Reply