Coupang, Inc. (NYSE:CPNG), South Korea’s leading domestic e-commerce player, has consistently commanded a premium valuation since its 2021 IPO. Coupang is growing fast, and its market capitalization reflects that reality. The company attained profitability in 2023, but its profits are experiencing a significant contraction this year amid substantial ongoing investments and the absorption of the loss-making luxury retail marketplace Farfetch.

Peter Lynch once observed that the “very best way” to make money in the stock market is “in a small growth company that has been profitable for a couple of years and simply goes on growing.” Coupang doesn’t exactly fit that bill, as its ~$36B valuation places it squarely in large-cap territory. In my view, however, Coupang remains a small company relative to its potential. With a profitability track record going back less than 2 years and growth-oriented investments muddying visibility into future profits, Coupang is facing some market uncertainty as to its fair value. That said, there is a strong probability that Coupang will “simply go on growing” its customer base, sales, and profits. Accordingly, while the valuation does appear stretched relative to current earnings, I believe there is a high likelihood that the company will grow into its valuation in the quarters and years ahead – and go on growing from there.

Coupang is a profitable growth company selling at a justifiably elevated price. While it’s difficult to nail down the precise value (or estimate the future profits) of a growth company still in the early stages of its life cycle, all that we must conclude is that Coupang is undervalued relative to its long-term prospects. I believe that Coupang not only meets this criterion, but also offers a margin of safety based on the profit potential it already demonstrates coupled with the high growth rates it is likely to continue exhibiting.

Operations

Coupang is a leading Korean e-commerce company commonly referred to as the “Amazon of South Korea.” The company primarily focuses on online retail and logistics in South Korea, but has branched out into other adjacent industries and geographies in recent years. Coupang has become a leading provider of on-demand food delivery services in Korea and expanded its core retail platform’s reach to Taiwan. The company has also established a presence in Western markets through its acquisition of the assets of luxury goods digital retailer Farfetch. Additionally, Coupang is developing fast-growing, nascent operations in video streaming and fintech services.

In Q1 2024, Coupang’s Product Commerce segment – that is, its core Korean e-commerce and logistics business – accounted for ~91% of net revenues. The remainder of the company’s revenue was derived from its Developing Offerings segment, which includes Farfetch, Taiwan e-commerce, Coupang Eats, streaming, and fintech.

While Korean e-commerce accounts for all but a negligible share of total sales, the Developing Offerings segment grew by triple digits YoY in Q1 (even excluding the impact of the Farfetch acquisition) vs. 20% (currency-neutral) growth for Product Commerce. All units of the company are growing at a healthy clip, and over time the smaller segments are clearly on track to have an intensifying impact on the company’s overall results.

Valuation

As profitable companies go, Coupang is quite challenging from a valuation standpoint. The company’s price multiples are increasingly unhelpful, as the Farfetch acquisition and escalating investments in the Developing Offerings segment artificially deflate the net earnings and FCF of the core business. This effect was extremely evident in Q1, when Developing Offerings’ EBITDA losses totaled nearly $200 million, consuming approximately two-thirds of the Product Commerce unit’s profits. This drag is not expected to abate over the remainder of the year, with a full-year consensus EPS estimate of just $0.09 – a collapse of 64.24% as compared to normalized diluted EPS in 2023. Coupang thus sports a 2024 P/E ratio in the 200s.

Per-share earnings are forecast to spike to $0.58 in 2025 and further rise to $0.86 in 2026. Revenue is expected to reach $30B in 2024, $35B in 2025, and $40B in 2026. Of course, the future is never guaranteed, and analyst forecasts should generally be regarded with skepticism. That said, these estimates seem extremely reasonable based on the company’s growth track record and aggressive investments for future growth. I am especially optimistic that the company will meet or surpass revenue estimates in the coming years; Coupang’s future profits are much harder to predict. Based on 2026 estimates, Coupang features a P/S ratio of 0.9 and a P/E of 23.6 at current prices. Due to the high likelihood that Coupang will meet these estimates and continue growing from there, I believe that Coupang’s present valuation will look unjustifiably cheap in the long run.

It’s also worth noting that if we were to simply zero out the Developing Offerings businesses and disregard their financial results, Coupang would sell today at a P/S ratio of 1.53 based on 2023 Product Commerce revenue. Moreover, the 2023 adjusted EBITDA in the Product Commerce segment was $1.5B, representing a backward-looking P/EBITDA of 24 for the segment. Considering the core segment’s continued double-digit growth, a back-of-the-envelope analysis would indicate that Coupang is likely undervalued without even considering its fast-growing Developing Offerings businesses.

Margin Profile

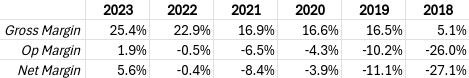

When evaluating growth companies with little history of profitability, margin trends are often the best indicator of both business model viability and earnings potential. Notably, Coupang’s margins have been steadily on the march in the right direction:

Analyst’s Calculations Based On Company Financials

As the above chart makes evident, Coupang’s margin profile has improved across the board every year except for 2021. In Q1 2024, the company posted a gross margin of 27.1%, or 26.5% excluding Farfetch – translating to a 200bp YoY improvement on a comparable basis. That said, net margins have taken a significant short-term hit due to the higher pace of investment in Developing Offerings as well as losses resulting from the Farfetch acquisition.

Throughout 2024, the rapidly growing Developing Offerings segment will continue to be a drag on the bottom line with escalating losses. However, as long as Coupang’s gross profit margin continues on its current trajectory, net profits can be expected to follow suit judging by the company’s impressive track record. To that point, management expects that Farfetch “will reach close to positive adjusted EBITDA run-rate by the end of the calendar year.”

Coupang’s management is taking advantage of its cash cow e-commerce business to drive runaway growth in its loss-making developing units, which will limit profits in the near term but should help the company achieve far greater profits in the long run. In 2023, we already got a peek at how much net income and FCF Coupang’s core business is capable of generating, even at this early stage. Provided that management reinvests these earnings wisely, Coupang is on track for explosive and profitable growth for many years to come.

Strong Balance Sheet

Coupang is in a comfortable financial position, as its profitability comes on top of a healthy balance sheet. The company carries little debt and mostly short-term liabilities, which are more than offset by current assets. Tangible book value is $3.73 billion, comprising >10% of the company’s market cap. This is quite favorable financial footing for a growth company that posted its first net profit in 2023.

Growth Opportunities

On Coupang’s Q1 earnings call, one of the first points mentioned by Founder & CEO Bom Kim in his prepared remarks was that Coupang still has a “single-digit share of a massive retail opportunity in Korea and an even smaller share of Taiwan’s.” This point underscores the remaining runway for organic growth within the company’s core Product Commerce operations. Coupang’s Product Commerce division continues to post healthy double-digit sales growth, handily outpacing the South Korean e-commerce industry’s single-digit CAGR. This indicates that Coupang’s core segment is not only riding on the back of a secular growth trend, but rapidly gaining market share within a growing industry. This dynamic embodies the best of both worlds for Coupang shareholders.

Aside from the strong growth of e-commerce sales, Coupang has no shortage of other avenues to supercharge its growth moving forward. The Farfetch acquisition (and attempted turnaround) is certainly one such avenue, but it’s far from the only one. The company’s Fresh grocery delivery segment grew 70% YoY in Q1, fulfillment and logistics recorded 130% growth, and Coupang Eats “recorded the largest year-over-year increase in customers and orders in its history.”

The company’s streaming operations and nascent Taiwan e-commerce unit – which is hopefully just the first step on Coupang’s international expansion journey – are further opportunities to accelerate growth moving forward. Coupang Play, the company’s OTT subscription-based streaming service, was launched in December 2020. Its content includes live sports, scripted TV shows, and SNL Korea. As mentioned, the company’s Developing Offerings revenues more than doubled YoY even excluding the impact of the Farfetch acquisition.

Logistics

Like many of the world’s leading e-commerce companies, Coupang has invested heavily in logistics infrastructure within its domestic market. Coupang operates more than 100 fulfillment centers across 30 Korean cities, boasting a fulfillment center within 7 miles of 70% of Koreans. In addition to warehouse personnel, the company also hires its own drivers, including for the expensive and logistically challenging last-mile delivery step. Coupang’s impressive logistics infrastructure network facilitates the company’s one-day delivery service Rocket Delivery and allows for enhanced quality control and cost efficiency. Earlier this year, it was reported that Coupang is investing $2.2 billion into additional logistics centers with the intention of extending Rocket Delivery “throughout almost the entire country” (to include “rural” and “remote” areas) by the end of 2026.

Risks

Recession

The most significant medium-term risk to Coupang’s operational performance is the likelihood of a sustained economic downturn. Much of the world seems overdue for a recession, and elevated interest rates alongside inverted yield curves seem to raise the odds of economic contraction. Needless to say, a recessionary period in South Korea would be detrimental to Coupang’s business and could adversely affect the company’s ability to meet or exceed growth estimates. In the long term, it is inevitable that the next recession will both (a) occur and (b) prove temporary. Investors need not concern themselves with predicting macro cycles, and I am certainly not doing so. All of that said, a recession would likely disrupt Coupang’s growth trajectory alongside the upward trajectories of many other businesses.

Developing Offerings Segment Losses

Coupang’s Developing Offerings segment need not factor into the long thesis, but it nonetheless bears heavily on the company’s future performance. The segment is on track to lose ~$750 million on an EBITDA basis this year alone, which is 100% of the company’s reported EBITDA in 2023. Since management is reinvesting much of the Product Commerce segment’s earnings into the developing segments, significant value destruction could result if these segments fail to live up to expectations.

Clearly, management is betting that the developing units’ future profits will more than offset their heavy near-term losses. When investing in Coupang on the basis of its cash cow business, shareholders are betting that management knows what it’s doing in the Developing Offerings segment. The future is always uncertain, however, and the business models of some of Coupang’s developing offerings (such as food delivery and streaming) have proven challenging for other operators in terms of achieving sustained profitability.

The good news is that even if the long-term net value of the developing businesses turns out to be zero, Coupang is still a buy. The only way these segments could meaningfully hamper long-term shareholder returns is if they turn into money pits in which shareholder value is permanently destroyed. Based on Coupang’s reliable track record of strong operational performance, I do not believe this will be the case.

Competition

South Korea’s e-commerce industry is highly fragmented, with numerous foreign and domestic players vying for market share. As mentioned, Coupang’s management reports having a single-digit market share despite being one of the top dogs in the industry. While competition is fierce and will remain a primary risk in the future, the company’s leading market position and continued market share gains indicate that it occupies a uniquely strong position within the Korean e-commerce landscape. If anything, the likelihood of industry consolidation may play to Coupang’s benefit in the long run.

Korean Demographic Collapse

South Korea features one of the least favorable population pyramids in the world. The country’s median age is approximately 45, one of the world’s highest. Its birth rate is abysmally low and continues to plunge, with a 2023 fertility rate of 0.72 births per woman, the lowest in the world. The country’s fertility rate is projected to drop further to 0.68 in 2024. As a result of these trends, the South Korean population is expected to halve by 2100. This reality will inevitably have an extremely detrimental impact on the South Korean economy over the remainder of the century, but its long-term nature should not cause it to be dismissed.

Fortunately, Coupang has ample time to adjust to its domestic market’s bleak demographic outlook. That said, the company’s ability to sustain strong growth over the course of decades rather than years will largely depend on the success of its nascent international expansion efforts – particularly its ability to successfully expand into other Asian countries with some of the healthiest population pyramids in the world.

Taiwan Risk

Taiwanese e-commerce currently accounts for a negligible share of Coupang’s business. Nonetheless, the potential for a Chinese invasion of the island represents a significant risk due to the company’s increasing investments in establishing and developing its operations there. It’s a bit difficult to predict how this risk would play out in the worst-case scenario, but what’s clear is that it could present a serious impediment (if not a total loss) for Coupang’s Taiwanese operations. For one thing, the economic and social fallout resulting from an invasion would likely be severe. Moreover, due to South Korea’s alliance with Western powers, it is possible that in the future Coupang could be forced to cease or limit its Taiwanese operations for geopolitical reasons. That said, even in the event of a total write-off of Coupang’s investments in Taiwan, the company could weather such a scenario with relative ease.

Conclusion

Coupang looks expensive relative to its net earnings, but its valuation does not do justice to the strong profitability and growth of its core Product Commerce segment. Massive losses within the company’s fast-growing developing units mask this underlying profitability, so I suggest simply disregarding them when valuing the company. In my view, Coupang is undervalued on the basis of the net earnings and growth of its core e-commerce operations alone.

The investment’s margin of safety is not based on rock-bottom earnings multiples or substantial book value relative to market cap, but rather on the company’s growth trajectory providing a clear path to more than justifying its present market value. Both sales and profits can be reasonably expected to balloon in the years ahead, and the company’s current valuation should look very cheap in a few years as its growth story continues to play out.

In the short run, any stock can go anywhere. This is especially true for growth companies, as the market struggles to accurately price their future growth and earnings expectations. In the next year or two, Coupang could just as easily lose half its value as double. Over the long run, however, I am quite bullish that it will comfortably exceed its current market value and post market-beating returns on the back of powerful operating performance and strong financial results.

Considering the substantial uncertainty and volatility potential around this name, I currently maintain more of a tracking position in Coupang rather than a strong bet on the stock. However, if the stock price dips substantially from here, in my view it will present an extremely attractive opportunity to load up on a premier profitable growth company with an extraordinary long-term outlook.

Read the full article here

Leave a Reply