Q2 earnings season is now in full swing, and in spite of the potential tailwind from coming rate cuts, there have been more high-profile disappointments than wins, as investors seem to be looking for reasons to be bearish.

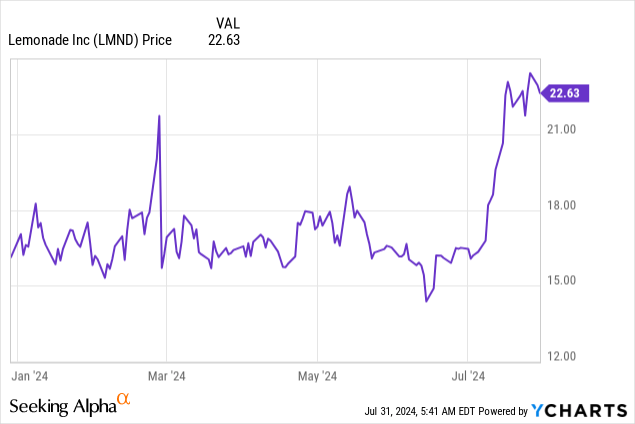

Among the major losers this quarter is Lemonade (NYSE:LMND), the digital insurance broker that started with a simple home insurance product and is now expanding to become an insurance monolith spanning many different types of coverage. Despite a Q2 earnings beach, the market reacted negatively to the company’s Q3 guidance, sending the stock skidding down more than 10%. At the stock’s post-earnings share prices just below $20, Lemonade is still up more than 25% year to date, beating the S&P 500 – and I think now is a great time for investors who missed the first rally to get in on the action.

I last covered Lemonade in May, giving the stock a buy rating when it was trading at $18 per share. Now, after the company’s Q2 earnings print and despite the slight boost in Lemonade’s valuation since my last update, I’m reiterating my buy rating on this stock. I continue to view Lemonade as a long-term, structural winner. Young customers especially, are gravitating toward Lemonade’s easy, modern insurance quote process and the ability to bundle and save across many core insurance categories. And as Lemonade’s scale grows, so is the profitability of its underwriting book.

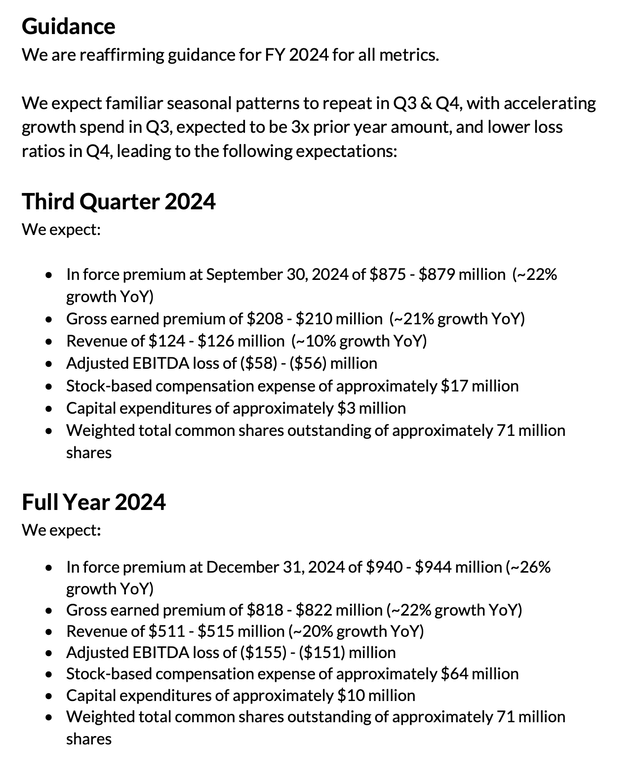

We’ll touch on the elephant in the room: Lemonade’s guidance. For Q3, the company guided to $124-$126 million in revenue, or a growth range of 8-10% y/y (vs. 17% growth in Q2), and materially lower than the $134.9 million (+18% y/y) that Wall Street was holding out hope for. Obviously, this is a disappointment, but I find two offsetting factors to help blunt the worry. First: Lemonade has a track record of beating its conservative guidance, with Q2 actuals of $122 million coming in even higher than the high end of the company’s initial guidance range of $118-$120 million for the quarter. All else equal, I’d expect Lemonade to continue this trend and come in higher next quarter as well. We note that Lemonade also held on to its full year FY24 outlook.

Lemonade outlook (Lemonade Q2 shareholder letter)

Second, and perhaps more importantly, revenue is more of a secondary top-line metric for insurance carriers like Lemonade, which is influenced by reinsurance contracts and ratios. The company can, at any time, increase its reinsurance percentage to reduce risk (as well as revenue), or lower its resonance to boost revenue as well as exposure. The more meaningful measure of the company’s growth and traction with customers is in force premium, which is the sum premium total of all the contracted policies that Lemonade has issued. Lemonade’s IFP guidance for Q3 of $875-$879 million, meanwhile, represents 22% y/y growth – exactly in line with Q2 growth rates, and representing $38 million in sequential IFP growth (vs. $45 million this quarter, and $32 million in the year-ago Q3). To me, there’s no major cause for concern here.

For investors who are newer to Lemonade, here’s a rundown of my core long-term bull case for this stock:

- Growth at scale as Lemonade continues to take share from legacy insurers. Lemonade continues to grow IFP at a +20% y/y clip. And though the current market is very nonchalant about these impressive growth rates, to me, this shows a business that is still very much in its nascence and able to scale to much greater heights.

- Healthy product diversification and cross-selling product flywheel. When it started out, Lemonade just offered home and renters insurance. Now, the company is also offering bundles with pet insurance and car insurance as well (the latter through its acquisition of Metromile). Perhaps in no other industry is diversification more vital than in insurance, so Lemonade’s ability to continue growing into other insurance streams will be critical to its success.

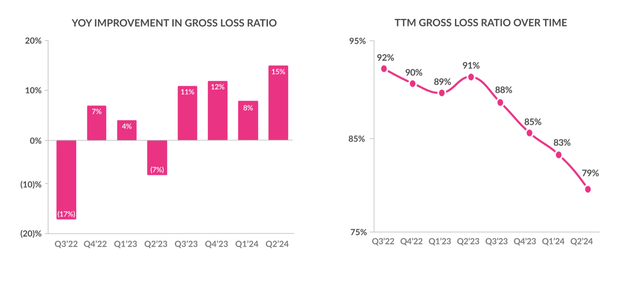

- Loss ratios are set to improve. Lemonade is already on a positive trajectory for loss ratios, driven by both increased scale, as well as, efficiency of its AI bot for paying off small, legitimate claims. Progress toward regulatory approval for rate changes will help to accelerate the trajectory of loss ratio improvements as well. In addition, lower exposure to home insurance as a percentage of its total portfolio will help improve loss ratios as well.

- Leveraging AI to reduce cost. On top of improvements in underwriting profitability, the company is deploying its years of investment in AI and automation to accelerate claims processing jobs and reduce overhead, a further catalyst for the company’s profitability.

Stay long here and use the dip as a buying opportunity.

Q2 download

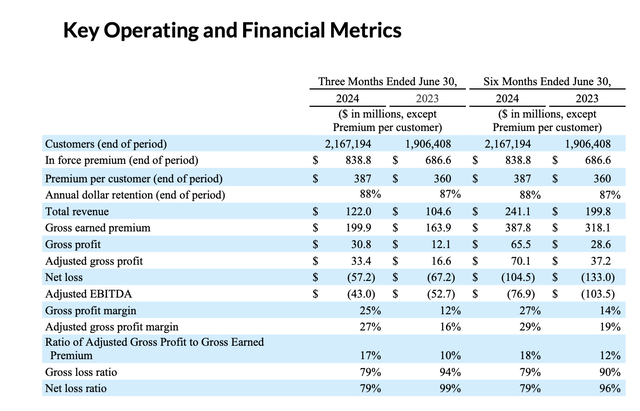

Let’s now go through Lemonade’s latest Q2 results in greater detail. The Q2 earnings summary is shown below:

Lemonade Q2 highlights (Lemonade Q2 shareholder letter)

There are a number of items worth calling out here. First, in force premium grew 22% y/y to $838.8 million, adding ~$45 million sequentially in the quarter. The company’s insurance flywheel continues to be a success, with more customers attaching and bundling different coverage plans. The company also grew customers by 14% y/y to 2.17 million, adding 72k customers within the quarter. And revenue grew 17% y/y to $122.0 million, ahead of the Street’s $121.3 million (16% y/y) expectations.

Second: Lemonade has continued to see astounding progress in improving its underwriting metrics and boosting the profitability of its insurance book. The right-hand side of the chart below shows that the company’s trailing twelve month loss ratios have been on a consistent decline (improvement) since Q2’23, with TTM loss ratio of 79% in Q2 improving four points sequentially.

Lemonade loss ratio trends (Lemonade Q2 shareholder letter)

The left-hand side of the chart above, meanwhile, shows that Lemonade achieved 15 points of y/y improvement in discrete loss ratios in Q2: higher than every quarter in the preceding two-year period. Furthermore, according to Lemonade, it’s beating the industry, which suffered several catastrophic claims events in Q2.

Management noted that it has been able to lower and stabilize its loss ratios, even during more volatile periods for the industry, by its combination of growing lower-risk contracts (per and renters insurance), growing its geographical diversity by adding more policies in Europe, and leveraging its AI tools to help more selective in underwriting new policies and not renewing other ones (as a personal anecdote: within the past year, I was automatically served a non-renewal of my Lemonade home insurance policy).

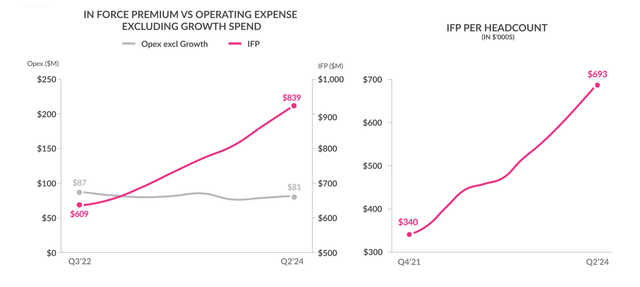

And on top of underwriting improvements, the company has also been more efficient from an opex standpoint. The chart below shows that Lemonade’s IFP per headcount has grown to a record of $693 and is consistently expanding, with opex levels stable as IFP is growing.

Lemonade opex efficiency (Lemonade Q2 shareholder letter)

As a result, Lemonade’s adjusted EBITDA in Q2 was -$43.0 million, which was an 18% improvement in loss year over year (in line with revenue growth).

Key takeaways

In my view, Lemonade continues to be doing a lot of things right as it continues to fill a large greenfield market for multi-product insurance policies, underwritten and serviced more efficiently with AI and automation tools as compared to traditional insurance brokers.

Consistently improving in force premiums and lower loss ratios are much better long-term indicators for this company, in my view, than a single quarter’s disappointing revenue guidance. Stay long here and buy the dip.

Read the full article here

Leave a Reply