Thesis

DoubleVerify Holdings (NYSE:DV), is in my opinion going to maintain the growth in the digital advertising market. The company’s recent strategic moves, such as the implementation of the AI-powered Universal Content Intelligence tool, and the recent expedition into the qualitative measurement of social media platforms such as TikTok and Meta, have notably boosted the gains and effectiveness of the operations. In the face of the adversities posed by competitors like Integral Ad Science and Comscore, the strong foundation of DoubleVerify in digital marketing is through their unique solutions and strategic partnerships. Nevertheless, I have no strong stand towards DoubleVerify’s current high P/S and EPS ratios as I am of the opinion that the best thing to do is holding and reassessing after a price drop to ensure a more attractive valuation, as much of the future potential appears to be already priced in.

Business Profile

DoubleVerify Holdings, is a digital media measurement and analytics company. It provides tools to verify the quality and performance of digital ads across different platforms. Founded in 2008, DoubleVerify places the emphasis on making sure that ads are viewable, fraud-free, and are mostly brand-safe. The lineups of its products are composed of ad activation solutions, measurement of media audio and supply-side platforms of it.

DoubleVerify operates internationally, offering services across social media, Connected TV (“CTV”), retail media networks, and the open web. The company works with clients such as Philip Morris, Bacardi, and Anheuser-Busch in various regions. It leverages the use of tools such as the AI-powered Universal Content Intelligence and the Scibids AI platform to offer their services.

Latest Projects and Their Potential Issues

Recently, DoubleVerify has made use of two key programs as its strategic objectives, which include the utilization of its AI-based video classification solution, called Universal Content Intelligence, and the expansion of its social media measuring capacities, particularly, over sites like TikTok and Meta. The new release of the Content Intelligence tool, which was done in 2024 in the early months, now comes with more advanced AI algorithms that help with video content categorization. This tool helped different social media platforms to be more successful in handling the video content which they exhibited.

Implication of this change has enabled DoubleVerify to grow its gross margin to 83% in Q2 2024 from 81.09% in Q1 2024, as it diminishes cost of sales through technological efficiencies. The direct impact of the use of the tool for the reduction of the cost reached $0.52 million in the second quarter alone. One another major strategic move is the company’s initiative of launching the DoubleVerify social media measurement services. The social measurement revenue of the company jumped by 44% on the year-to-year comparison in Q2 2024, driven primarily by growth in short-form video on TikTok, Meta reels, and YouTube shorts

DoubleVerify has now secured more than 30 new advertisers who have not previously used its services on Meta, including larger brands such as Best Buy, AB InBev, and J&J. These developments underline the company’s efforts to adapt to the increasing prevalence of short-form video content, which now make up 60% of worldwide digital ad spend ex-search, according to Magna Global. Also, The expansion includes movements to build relationships with platforms like Pinterest and Reddit, where DoubleVerify has launched brand-safety and suitability metrics solutions.

I see that one of the drawbacks to these advancements is that, while the AI tool performs its job, it still relies heavily on the precision of its algorithms. Moreover, it is bound to AI for providing Digital Intelligence, which could lead to pending issues if the algorithms do not adapt to digital content or faulty activities. By doing so, the software must regularly update to detect new threats and new content formats. Similar to this, the malfunction or inefficiency in the AI system can create faulty classifications, which will have a negative impact on the company’s name and the client’s trust in it. This risk is heightened by the increasing complexity of digital content and the potential for sophisticated ad fraud schemes. Moreover, the sets of social media measurement services for social media measurement might present a new challenge, which is overexerting operational resources and introducing compliance risks due to the nuances in international regulations and data privacy laws. For instance, Didomi shows that GDPR is enforced in Europe while the CCPA has been issued in California. The company must meet strict data privacy requirements for both regulations that it must comply with.

Performance Analysis

|

Jun 2023 |

Sep 2023 |

Dec 2023 |

Mar 2024 |

Jun 2024 |

|

|

Revenues |

133.74 |

143.97 |

172.23 |

140.78 |

155.89 |

|

Cost Of Revenues |

26.19 |

26.47 |

30.02 |

26.62 |

26.1 |

|

Gross Profit |

107.55 |

117.51 |

142.21 |

114.16 |

129.79 |

|

Selling General & Admin Expenses |

51.29 |

56.25 |

59.22 |

59.95 |

67.93 |

|

Net Income |

12.84 |

13.35 |

33.1 |

7.16 |

7.47 |

|

Gross Margin |

80.42% |

81.62% |

82.57% |

81.09% |

83.26% |

|

Net Margin |

9.6% |

9.27% |

19.22% |

5.08% |

4.79% |

Source: Seeking Alpha. Retrieved on 08-02-2024. Financials in millions USD.

The fiscal performance of DoubleVerify signifies two main developments in the Q2 2024 earnings call: the consistent rise of revenues and the changes in the company’s net income. Revenue was up from $133.74 million in June 2023 to $155.89 million in June 2024 as a result of its entry into social media measurement and the Universal Content Intelligence tool introduction. Take, for example, in Q2 2024, the social measurement revenue grew by 44% year-over-year due to an increase in activity on platforms like TikTok, Meta reels, and YouTube shorts. Such a focused approach to the areas of digital advertising with high demand significantly boosted overall incomes.

On the other hand, the net income has been changing all the time, and it has slumped from $33.10 million in December 2023 to $7.47 million in June 2024. The decrease has resulted from the rise in selling, general, and administrative (SG&A) expenses from $51.29 million in June 2023 to $67.93 million in June 2024. These costs are related to AI technology investments as well as going into new market fields. Besides these expenses, the company managed to increase its gross margin to 83.26% in June 2024 compared to 80.42% in June 2023, thereby demonstrating good cost management. On the other hand, the net margin also dropped from 9.6% to 4.79% during the same period, indicating that the increased operational costs initially led to a short-term decrease in profitability.

Peers

DoubleVerify is a company performing in a very competitive digital advertising market which involves several strong players such as Integral Ad Science (IAS), Comscore, and Moat by Oracle. One instance of that is the business models between Integral Ad Science and DoubleVerify in their solutions for ad verification, fraud detection, and viewability, both of which are very similar products. IAS’s product “Total Visibility,” which provides deep insights for media quality and performance, directly competes with DoubleVerify’s solutions. Comscore, which is another top player, is better suited in digital audience measurement and it has a prominent position in cross-platform measurement; they advertise analytics and audience insights that rival DoubleVerify’s measurement capabilities.

Oracle’s Moat has been one of the main players in the field of ad verification, but according to Yahoo it still has pulled the plugs on certain activities recently, this has led to both an opportunity and a challenge for DoubleVerify. Moat has been engaged with big advertisers and platforms to its customer base and they might hunt for a way out, in turn, offering DoubleVerify the chance to get the new customers. However, this also gives chances to other competitors to fill the space left by Moat and enter into the market. DoubleVerify’s main advantages are its AI-powered Universal Content Intelligence tool as well as its strong social media measurement instruments. These advanced products combined with the partnerships with platforms like TikTok, Meta, and YouTube put DoubleVerify in a good position to benefit from the soaring need for reliable ad verification and measurement in the digital advertising industry.

Outlook for the Year Ahead

In my opinion, DoubleVerify is expected to experience strong financial performance over the next year. This is primarily due to its expansion into social media measurement services on platforms like TikTok and Meta, and the implementation of tools such as Universal Content Intelligence. I foresee a revenue growth rate of 20-25% and a profit growth rate of 15-20%, driven by increased digital advertising verification and strategic alliances with major advertisers. Over the past year, Revenue Growth has risen steadily at an annual rate of 22.03%, while Profit Growth has been 9.13%. The prospective revenue growth rate is expected by me to align with the company trends, balancing positive outlooks with rising operational and competitive expenses. Nonetheless, I anticipate profit growth to be higher due to cost-saving technologies and the impactful expansion of product offerings. Combining demand-driven revenue with the sale of complementary products or premium versions, profit growth is projected by me to be greater in the upcoming year, still referencing the YoY trends.

Valuation

Seeking Alpha

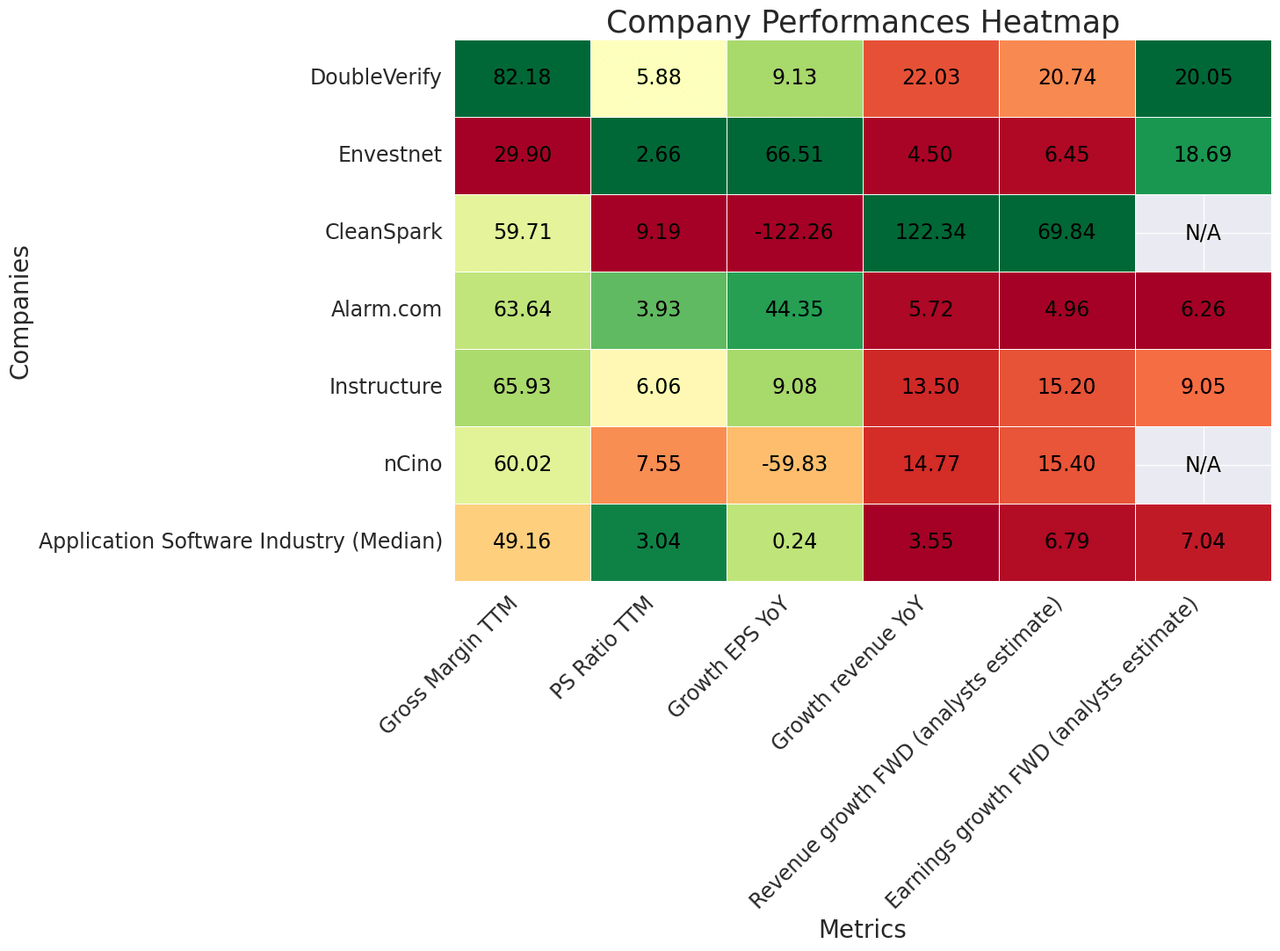

DoubleVerify’s robust gross margin of 82.18% is far higher than the median of 49.16% for the application software industry. This points to a high level of operational efficiency and cost management. The company’s P/S ratio of 5.88 also exceeds the industry median of 3.04, indicating the market’s confidence in its revenue-generating capacity. My estimates are consistent with the forward earnings projections of analysts which are planned as a 20.74% revenue growth and 20.05% earnings growth.

Due to these alignments, I estimate the company’s earning per share will most likely remain within the 9 – 10 range. As far as P/S ratio is concerned, it should remain somewhere in the range of 6.0 to 7.0 as well because of the solid market position of the company and the high demand for the revolutionary verification solutions it offers. I see that this reflects a slight premium over the current P/S ratio due to expected continued growth and market expansion. The competitive landscape remains challenging, with companies like Integral Ad Science and Comscore offering robust alternatives, yet DoubleVerify’s advanced AI tools and expanding global reach position it well for sustaining its valuation. Since we do align with its current positive predictions and value, we advise it as a ‘’hold’.

Final Remarks

The impression I got from DoubleVerify was positive. With its earnings increasing continuously, showing the power of its services in the market and high-level efficiency the company has, DoubleVerify has truly shown a strong financial performance. At the same time, the current high P/S and EPS ratios and the fact that my growth expectations aligns with the analysts’ forecasts, imply that much of the future potential may already be priced in. While the technological solutions developed by DoubleVerify are impressive and the company’s strategy developments are promising, the share does not seem to be cheap right now. I would suggest waiting for a price drop to re-evaluate whether or not the evaluation becomes more attractive.

Read the full article here

Leave a Reply