I last covered Microsoft Corporation (NASDAQ:MSFT) in June; then, I put out a Buy rating, and the stock has lost 8% in price since. I believe some of this is due to the fallout from the CrowdStrike Holdings, Inc. (CRWD) crisis, as well as the fact that MSFT was likely slightly overvalued at the time.

Despite this, I think the recent pullback opens up a buying opportunity, and the longest-term competitive advantage MSFT has currently is its development of AGI. I look forward to watching it consolidate a moat in this regard, but I think competition is becoming formidable from Meta Platforms, Inc. (META).

Q4 Earnings & Full-Year 2024 Analysis

First, Microsoft recently had its Q4 earnings released as well as its full-year 2024 results. These can be summarized succinctly as follows:

- 15% YoY revenue increase in Q4.

- 10% YoY net income increase in Q4.

- 16% YoY increase in revenue for the full year 2024.

- 22% increase in net income for the full year 2024.

Most impressive was that Microsoft Cloud increased by 21% YoY in Q4, and Azure and Cloud Services grew by 29% YoY. This is material to this analysis because both of these segments are the largest to benefit from Microsoft’s AI efforts and direction toward developing AGI.

The growth in cloud services and Azure not only boosts its current revenue and evidences the revenue generation capabilities from AI investments, but it also strengthens the firm’s competitive position in the AI arms race. Microsoft’s cloud growth also supports revenue diversification beyond traditional software products. It evidences the broad applicability Microsoft has for its partnership with OpenAI, as well as its proprietary AI models, to drive user engagement and customer acquisition through embedding the new intelligent technology capabilities into its ecosystem. Furthermore, the company beat the EPS estimate by $0.01 on a normalized basis, which reinforces my reason to be bullish given the following content in this analysis.

Escalating AI Costs, Closed-Source AI, Open-Source Threats, And AGI Trajectory

The development of AGI is highly resource-intensive. Training advanced AI models, such as the ones being developed for the ambition of AGI, requires immense computational power and financial backing. As an example, even at this early stage, the cost to train GPT-4 was estimated to exceed $100M. As the models grow in complexity, the costs are expected to rise exponentially, which could become unsustainable; this is why it is so vital that companies begin to develop financial strategies for how AGI will be developed versus its return on investment.

Microsoft and OpenAI present frontier models that are closed-source, which reduces transparency and encourages monopolistic behaviors in big tech. I think it is probable that users begin to trust AI systems less as they become more powerful, but are also closed-source. A closed-source approach also creates an innovation bottleneck; stifling innovation can be one of the longer-term downsides of closed-source, that inhibits the company’s competitive growth. In contrast, open-source or open-weight models, like the frontier models developed by Meta, encourage collaboration and collective problem-solving, which can accelerate technological advancements.

Microsoft and OpenAI envision AGI as a tool to tackle intractable multidisciplinary problems, such as climate change, healthcare, and education, from one unified superintelligence. Microsoft is developing the new Azure AI supercomputing technologies to support AGI development-this will enhance Azure’s capabilities, driving more customers, especially as Microsoft is offering direct access to OpenAI’s models through Azure, too. In my opinion, the widespread benefits of this AGI are likely to be incredibly powerful, with significant margin expansion, automation, and revenue-generating capabilities. However, Microsoft is currently limiting itself due to its closed-source nature and OpenAI’s frontier AI models. OpenAI has to do this in essence because it sells its proprietary model for use at a monthly fee, but Microsoft’s use cases are less direct, and as a result, Microsoft would likely benefit from more frontier-model open-sourcing.

Open-sourcing frontier models would lead to enhanced innovation for MSFT’s AI, as the collaborative community approach can lead to faster developments in the discovery of novel applications and improvements that the company cannot achieve alone. This would also drive ecosystem growth at the frontier level, which is an important distinction because Microsoft has a solid reputation for open-sourcing across its technology ecosystem already, but not at the frontier AI level. Doing so could reduce costs for the company and allow it to iterate AI to compete with OpenAI and other leading AI models such as Gemini and LLaMa.

In many ways, the rivalry between OpenAI and Microsoft, despite them being partners, could see Microsoft take the lead in AGI development if it more widely open-sources its “behind-the-hood” AI models similarly to Meta. As a result, it is not inconceivable that OpenAI is simply used by Microsoft to bolster its AI ecosystem, and I think as time goes on, Microsoft will appear less and less dependent on OpenAI for its AI moat. I think it is conceivable that Microsoft will develop AGI in advance of OpenAI due to its broader operational structure, allowing more freedom in revenue generation as it relates to AI development strategy and open sourcing.

Microsoft can afford to invest in long-term projects like AGI without immediate pressure for returns, and its Azure AI platform is extensive, with arguably higher embedding potential within a much vaster ecosystem than OpenAI. Of course, Microsoft’s significant investment in OpenAI is strong, but it is not the only way it can capitalize on AI over the long term competitively. Microsoft may be able to learn specific model weights and coding requirements to support its models from its partnership with OpenAI. Microsoft has developed the Turing family of AI models and is developing new AI models and technologies through Microsoft Research AI. Furthermore, Microsoft is competing with OpenAI’s voice mode in ChatGPT through its custom neural voice offerings as part of Azure AI.

Growth Potential, Closed-Source Versus Open-Source Costs, And Market Sentiment Analysis

Microsoft has already seen notable growth in its AI-related segments. Its Azure Cloud Services saw a 29% revenue increase in Q4, driven by the integration of AI technologies. Furthermore, Microsoft Cloud delivered a 21% increase in revenue, reflecting the broader adoption of AI-enhanced services across Microsoft’s product lines.

In the Q4 earnings call, CFO Hood mentioned that they are leveraging partnerships with Oracle Corporation (ORCL) and CoreWeave to expand Azure’s capacity. She also mentioned that investments in AI infrastructure are critical to meet demand, and emphasis was placed on the success of Copilot.

However, I think Microsoft is only still at the very nascent stages of the benefits that will accrue when it nears and has fully formed AGI. The race to AGI is still open, and my analysis of OpenAI versus Microsoft versus Meta et al. is informed by current events. There is an indication of who is taking the lead and who may win over the long term, but it is largely speculative to ascertain who will reach AGI first. Part of this context is that I believe Copilot and the current Azure services are very rudimentary, although still impressive. The same can be said for OpenAI’s ChatGPT and Alphabet Inc.’s (GOOGL, GOOG) Gemini. My long-term perspective is that Microsoft and other players will focus much more intently on automation capabilities over the coming decades rather than simpler information-based efficiencies.

Microsoft has massively increased its capex, with a 78% rise to $19B in Q4, primarily for AI and cloud infrastructure. The total spend for the previous year was $56B. Microsoft acknowledges that these heavy investments will take a long time to yield. However, I believe it is indubitable that the benefits are worthwhile eventually, not only to Microsoft as a big tech company but also to Western leadership in AI. Furthermore, utilizing OpenAI’s models through Azure involves ongoing costs for API access, measured by token usage, which can add up significantly during development and testing. This is why I think it is so vital that Microsoft continue to develop its own AGI moat alongside its collaboration with OpenAI.

In contrast, Meta plans to spend $35B to $40B on AI infrastructure in 2024, which is slightly lower than Microsoft. Meta is developing custom silicon, such as the Meta Training and Inference Accelerator, and AI-optimized data centers to support its AI workloads. Additionally, Meta’s Research SuperCluster is one of the fastest AI supercomputers in the world. Of course, Meta also benefits from being able to open-source its frontier models because its revenue is from advertising rather than subscriptions.

| Aspect | Microsoft (Closed-Source Frontier AI) | Meta (Open-Source Frontier AI) |

| Capex | $56B in 2024 | $40B projected for 2024 |

| Infrastructure Development Costs | High: Azure AI supercomputing, global expansion | High: Custom AI hardware, AI-optimized data centers, AI supercomputer |

| Operational Costs | High (API access, maintenance, updates) | Lower due to open-source contributions, flexible scalability, and no licensing fees |

| Customization | Limited (dependent on proprietary updates); likely less accretive over time | High (community-driven improvements and flexibility); likely more accretive over time |

Despite the strength of Meta in my above table, setting up the necessary hardware to run open-source AI models can be costly. It often requires a team of experts to develop and fine-tune open sourcing, especially to ensure that the way it is done is appropriate and not a danger to security. This includes favoring open-weight over providing source code and how this open-weight structure is accessible.

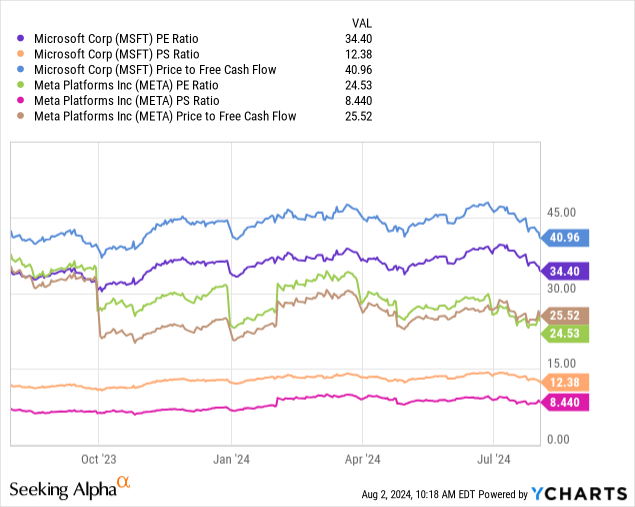

Microsoft is also much more richly valued than Meta, and I believe that this could be a problem as Meta’s capabilities likely scale. I think Meta is currently undervalued, considering how aggressive it is being in the AI arms race. Over time, it is not inconceivable that Meta has a higher earning capacity-I think it will potentially develop an AI development platform, similar to what is provided by Microsoft and AWS. It is still early days for Meta, but its commitment to AI infrastructure and its recent history of efficiency and long history of innovation and iteration bode well for the company to become much more formidable in AI, in my opinion. I think Meta could be one of the biggest threats to Microsoft in the field of AI moving forward.

Based on my analysis, Microsoft is fairly valued right now. Furthermore, its fundamental growth rates look like they will largely be sustained over the coming years, and as a result, I think its current PE ratio of 35 is likely to be sustained over the next 5 years. To further inform my price target from my last analysis, which was a 10Y price target, I am now initiating a 5Y price target of a price CAGR of 15% over the next 5 years. The result of this is a stock price of $817.50 in August 2029.

Conclusion

In my opinion, Microsoft’s path to AGI is multifaceted, and it is still unclear whether the company will be one of the first to achieve this. Primarily, there is a growing sentiment that it could be slower to achieve AGI because of its largely closed-source approach to frontier models. I think Microsoft’s management would need to look at changing this to compete more aggressively with Meta and other open-source frontier AI players.

Despite my concerns with its AI infrastructure spend versus revenue generation in the medium term, the company is likely fairly valued. The long-term accretive benefits of the moat it develops in AI are likely to help it sustain its high-growth rates for many years to come, especially in bottom-line profitability.

Read the full article here

Leave a Reply