Investment Thesis

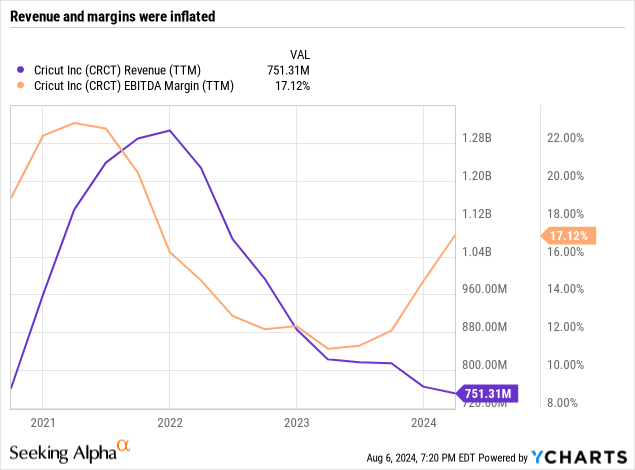

Cricut (NASDAQ:CRCT) is a stock that has been hit hard since its IPO in 2021. This due to a sharp decrease in revenue and falling margins, but it’s now trading at a P/FCF of 5.5 times, and there are some signs that suggest a possible turnaround.

It still seems too early to say that this is the case, so I consider it a hold, but it is worth following this story closely, and the next two quarters could be key, since it’s the peak season for its sales.

A COVID-19 Fad

The company is dedicated to manufacturing cutting machines that are used to make crafts, such as customizing clothing, making handmade cards, among other crafts. These machines allow you to cut different materials, such as paper, vinyl, fabric or cardboard, which makes them very versatile and made it a very popular product between 2020 and 2021.

In addition to the cutting machines, the company also sells the materials necessary to make the products (but these can also be purchased from third parties) and a software subscription to have access to images, fonts and design projects that users usually use for their creations, so they don’t need to design something from scratch.

Cricut Maker 3 – Cutting Plotter (Cricut)

As I mentioned, these machines were very popular on TikTok during the pandemic since, in that complicated time, many people used it as an additional source of income (me included). You could personalize mugs, t-shirts, birthday letters, you name it, and sell it.

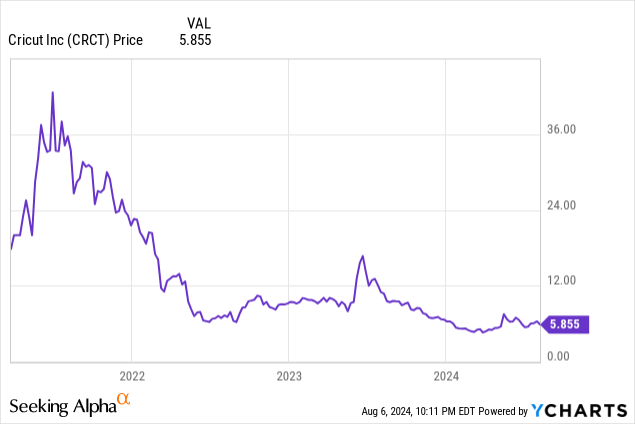

That’s why during 2020, the company reported revenue growth of 97% year-over-year and 36% in 2021 and at the same time, that they made their IPO in March 2021, followed by a performance of 133% in the first 3 months of being a public company.

However, when the economy reopened, and we returned to our jobs, this source of income stopped being relevant (at least in my case) and I stopped buying machines, accessories, materials, and subscriptions that were no longer useful to me. In any case, whether the reason is this or not, Cricut’s revenue decreased 32% in 2022, another 14% in 2023 and during Q2 2024 it continued to decrease 6% year-over-year, so it doesn’t seem like things are getting better.

That’s why shares have fallen 85% from their all-time highs reached in 2021 and have not recovered since. The important thing in the thesis is to find out if there’s a possibility of a turnaround story now that investors have lost faith in the company.

Subscriptions: The Way to Recovery

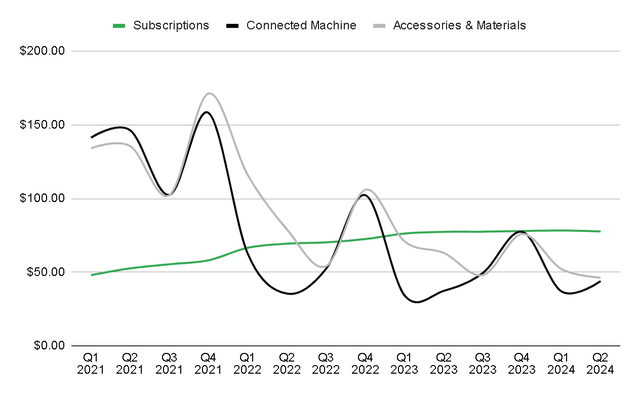

A key to the company, and something that has kept it afloat in recent years, is the subscription mentioned above. Unlike machines and materials, the revenue of this segment is very predictable and stable, in addition to having gross margins of 90%, like any good software business.

However, you cannot depend solely on this software, since in order to have new customers, you must necessarily sell new machines, otherwise its usefulness is null. For this reason, I’ve been following the company for a couple of years, waiting for signs that the machines are being sold again, since this would greatly improve the outlook and would give hope of a turnaround.

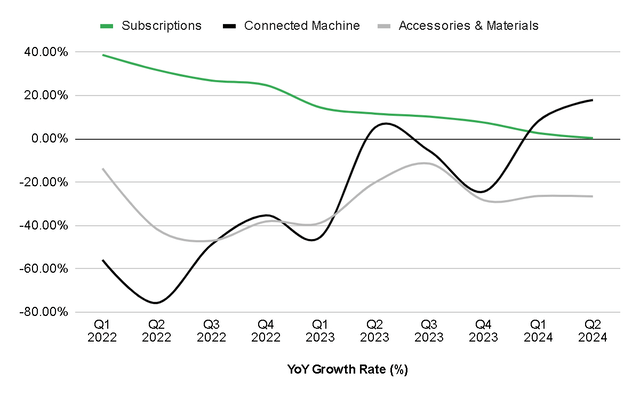

Revenue by segment (Author’s compilation)

In that regard, in the last two quarters, the company has reported machine growth again. In fact, during Q1 2024 this was 8% YoY and Q2 2024 confirmed this positive trend, reporting revenue growth of 18% YoY. This is extremely good, since the company is quite cyclical quarter-on-quarter and normally Q1 and Q2 tend to be the weakest, while during Q3 and Q4 machine sales are reactivated a little due to Black Friday, Christmas and some other festivities of the style.

So, reporting solid growth in the first two quarters could give encouragement to think that the rest of the year will be good, in terms of machine sales, and during the next year the sale of subscriptions can also be reactivated, which have had an extreme deterioration in growth and during this Q2 2024 has already stopped growing (0.34% YoY growth).

Revenue growth rate (Author’s compilation)

Cash Machine

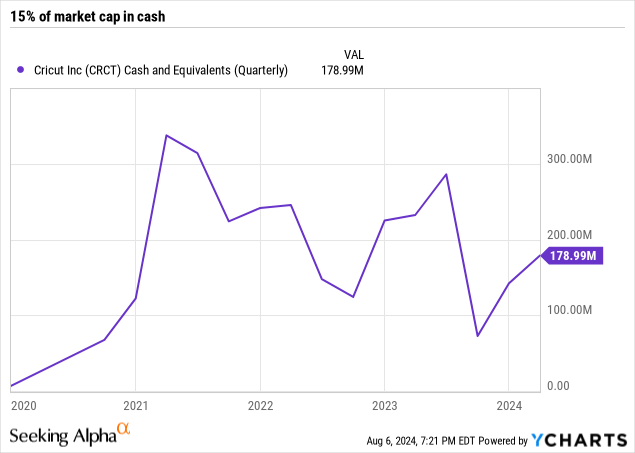

Something notable about Cricut, is that it’s an absolute cash-generating machine. After the Q2 2024 report, it already accumulated almost $300 million in cash and marketable securities, that is, 25% of the market cap.

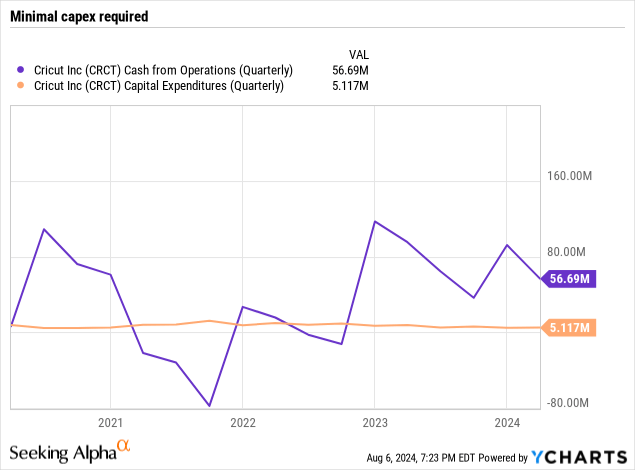

In part, it’s because a good part of the net income reaches cash from operations and from there the capex is minimal, since the majority of expenses are in opex such as R&D. Therefore, the free cash flow margin is high, with a margin of 34% during FY2023 (28% ex-SBC) and 48% in Q2 2024 (35% ex-SBC).

Between low capital expenditures and having no debt, the company can accumulate the majority of the cash generated.

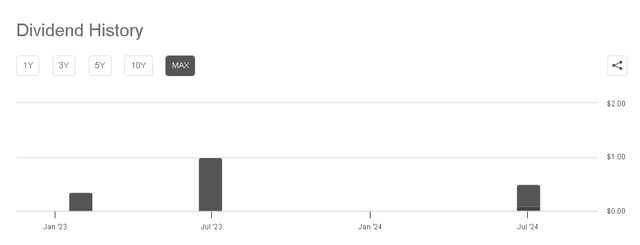

The question now is, what do they do with all this cash? On some occasions, special dividends have been distributed with a fairly high yield.

For example, in December 2022 a special dividend of $0.35 per share was announced, representing a yield of 3.5% at the time of the announcement. But in May 2023, $1 per share dividend was declared, representing a yield of 15% since at that time the stock was trading at $7 USD. Also, this May, a special dividend of $0.40 (7% yield) and a semi-annual payment of $0.10 cents were announced.

An excellent way to remunerate the shareholder, although it also sends the message that they do not see investment opportunities in new products or services. Some share buybacks have also been carried out, but they haven’t been as significant, and during FY2023, it only reduced outstanding shares by 0.4%.

Seeking Alpha

Valuation

According to management, the outlook for the remainder of the year is to continue decreasing.

We expect continued sales pressure on our product segment … and accordingly, total company revenue may be down Q3 year-over-year. Given ongoing retailer conservatism … it is too soon to call an inflection point; hence, we may even see a decline for full year company revenue.

Kimball Shill, CFO. Q2 2024 Earnings Call

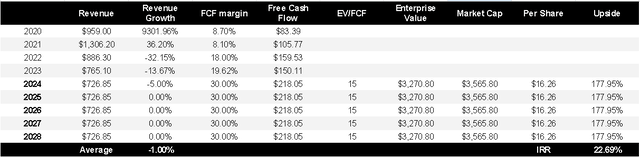

So for my estimate I am going to assume a 5% decrease in FY2024, slightly better than what was reported in Q2, assuming that Q4 is good. Furthermore, I estimate that free cash flow margins can be maintained at 30%.

Valuation model (Author’s compilation)

And here comes the interesting part. If in the remaining years the company doesn’t grow, but maintains margins and is valued at 15 times EV/FCF, then it could easily be worth double or almost triple what it is trading today. This considering the $295M of net cash and the 219M of outstanding shares.

Even if revenue decreased 5% each year and was valued at 10 times EV/FCF, I estimate that an IRR of 10% would be obtained, as long as FCF margins are maintained, which seems reasonable given what was discussed above.

The Bottom Line

The stock is currently trading at a LTM P/FCF of 5.5 times and an EV/EBITDA of 8 times. Of course, this type of valuation is what I would expect from a revenue-declining business, which has all the earmarks of being a fad and is just getting started to give signs of life.

The risk is high, but so is the possible benefit. Currently, I’m still skeptical about the possible turnaround, but if the positive trend of selling more machines continues and subscription growth reaccelerates, then it would seem like a good sign to buy. For now, I consider it a hold, but a story to watch closely.

Read the full article here

Leave a Reply