Welcome back to another edition of upcoming dividend increases. This week, we are back with a large list of seventeen more increases, including two dividend kings. The kings this week are PPG Industries and American States Water Company. PPG has a 4.6% increase, extending its 53-year history. AWR, on the other hand, has an 8.3% increase, extending its streak to 70 years! This is the longest growth streak, making AWR the king of kings! The overall group features an average increase of 9.0% and a median of 8.3%.

My investment strategy involves buying, holding, and adding to companies that meet two criteria: consistently increasing their dividends and beating an equivalent benchmark. The information in this article is generated for my investing needs, and I’m happy to share my findings with my Seeking Alpha audience. This list can help you make wise investment choices and create a successful long-term portfolio.

How I Created The Lists

The following information is a result of merging two sources of data: the “U.S. Dividend Champions” spreadsheet from a particular website and upcoming dividend data from NASDAQ. This process combines data on companies with a consistent dividend growth history with future dividend payments. It’s important to understand that all companies included in this list have consistently grown their dividends for at least five years.

Companies must have higher total yearly dividends to be included in this list. Therefore, a company may not increase its dividend every calendar year, but the total annual dividend can still grow.

What Is The Ex-Dividend Date?

The ex-dividend date is when you must own shares to qualify for an upcoming dividend or distribution. To be eligible, you must have bought the shares by the end of the preceding business day. For instance, if the ex-dividend date is Tuesday, you must have acquired the shares by the market close on Monday. If the ex-dividend date falls on a Monday (or a Tuesday following a holiday on Monday), you must have purchased the shares by the previous Friday.

Dividend Streak Categories

Here are the definitions of the streak categories, as I’ll use them throughout the piece.

- King: 50+ years.

- Champion/Aristocrat: 25+ years.

- Contender: 10–24 years.

- Challenger: 5+ years.

| Category | Count |

| King | 2 |

| Champion | 4 |

| Contender | 9 |

| Challenger | 2 |

The Dividend Increases List

The data is sorted by the ex-dividend date (ascending) and then by the streak (descending):

| Name | Ticker | Streak | Forward Yield | Ex-Div Date | Increase Percent | Streak Category |

| PPG Industries, Inc. | (PPG) | 53 | 2.29 | 12-Aug-24 | 4.62% | King |

| Essential Utilities, Inc. | (WTRG) | 33 | 3.31 | 12-Aug-24 | 5.99% | Champion |

| Chemed Corp | (CHE) | 16 | 0.35 | 12-Aug-24 | 25.00% | Contender |

| Reinsurance Group of America, Incorporated | (RGA) | 15 | 1.79 | 13-Aug-24 | 4.71% | Contender |

| Clorox Company (The) | (CLX) | 47 | 3.37 | 14-Aug-24 | 1.67% | Champion |

| Home BancShares, Inc. | (HOMB) | 14 | 3.1 | 14-Aug-24 | 8.33% | Contender |

| Cintas Corporation | (CTAS) | 40 | 0.84 | 15-Aug-24 | 15.56% | Champion |

| Kroger Company (The) | (KR) | 18 | 2.36 | 15-Aug-24 | 10.34% | Contender |

| ResMed Inc. | (RMD) | 12 | 1 | 15-Aug-24 | 10.42% | Contender |

| Greene County Bancorp, Inc. | (GCBC) | 11 | 1.16 | 15-Aug-24 | 12.50% | Contender |

| American States Water Company | (AWR) | 70 | 2.28 | 16-Aug-24 | 8.26% | King |

| The J.M. Smucker Company | (SJM) | 27 | 3.6 | 16-Aug-24 | 1.89% | Champion |

| Lindsay Corporation | (LNN) | 22 | 1.22 | 16-Aug-24 | 2.86% | Contender |

| Duke Energy Corporation (Holding Company) | (DUK) | 20 | 3.71 | 16-Aug-24 | 1.95% | Contender |

| Hawkins, Inc. | (HWKN) | 20 | 0.61 | 16-Aug-24 | 12.50% | Contender |

| First Mid Bancshares, Inc. | (FMBH) | 14 | 2.57 | 16-Aug-24 | 4.35% | Contender |

| Wingstop Inc. | (WING) | 7 | 0.3 | 16-Aug-24 | 22.73% | Challenger |

Field Definitions

Streak: Years of dividend growth history are sourced from the U.S. Dividend Champions spreadsheet.

Forward Yield: The payout rate is calculated by dividing the new payout rate by the current share price.

Ex-Dividend Date: This is the date you need to own the stock.

Increase Percent: The percent increase.

Streak Category: This is the company’s overall dividend history classification.

Show Me The Money

Here is a table that shows the new and old rates and the percentage increase. The table is sorted by ex-dividend day in ascending order and dividend streak in descending order.

| Ticker | Old Rate | New Rate | Increase Percent |

| PPG | 0.65 | 0.68 | 4.62% |

| WTRG | 0.31 | 0.33 | 5.99% |

| CHE | 0.4 | 0.5 | 25.00% |

| RGA | 0.85 | 0.89 | 4.71% |

| CLX | 1.2 | 1.22 | 1.67% |

| HOMB | 0.18 | 0.2 | 8.33% |

| CTAS | 1.35 | 1.56 | 15.56% |

| KR | 0.29 | 0.32 | 10.34% |

| RMD | 0.48 | 0.53 | 10.42% |

| GCBC | 0.08 | 0.09 | 12.50% |

| AWR | 0.43 | 0.47 | 8.26% |

| SJM | 1.06 | 1.08 | 1.89% |

| LNN | 0.35 | 0.36 | 2.86% |

| DUK | 1.03 | 1.05 | 1.95% |

| HWKN | 0.16 | 0.18 | 12.50% |

| FMBH | 0.23 | 0.24 | 4.35% |

| WING | 0.22 | 0.27 | 22.73% |

Additional Metrics

Some different metrics related to these companies include yearly pricing action and the P/E ratio. The table is sorted the same way as the table above.

| Ticker | Current Price | 52-Week Low | 52-Week High | PE Ratio | % Off Low | % Off High |

| PPG | 118.75 | 118.59 | 149.73 | 31.96 | 0% Off Low | 21% Off High |

| WTRG | 39.91 | 31.26 | 41.78 | 47.71 | 27% Off Low | 5% Off High |

| CHE | 570.15 | 491.81 | 654.14 | 29.22 | 16% Off Low | 13% Off High |

| RGA | 198.67 | 133.11 | 227.87 | 15.19 | 49% Off Low | 13% Off High |

| CLX | 144.77 | 112.78 | 159.92 | 22.28 | 29% Off Low | 9% Off High |

| HOMB | 25.79 | 19.16 | 28.99 | 15.73 | 34% Off Low | 11% Off High |

| CTAS | 744.54 | 471.57 | 773.95 | 41.26 | 58% Off Low | 4% Off High |

| KR | 54.2 | 41.61 | 58.03 | 8.18 | 30% Off Low | 7% Off High |

| RMD | 212.05 | 131.19 | 225.68 | 44.87 | 62% Off Low | 6% Off High |

| GCBC | 31.06 | 22.14 | 37.25 | 11.59 | 40% Off Low | 17% Off High |

| AWR | 82.62 | 65.67 | 87.76 | 33.24 | 26% Off Low | 6% Off High |

| SJM | 119.96 | 104.44 | 144.36 | 15.17 | 15% Off Low | 17% Off High |

| LNN | 117.63 | 105.56 | 136.15 | 33.49 | 11% Off Low | 14% Off High |

| DUK | 113.33 | 80.38 | 116.67 | 33.6 | 41% Off Low | 3% Off High |

| HWKN | 117.91 | 49.7 | 123.83 | 16.9 | 138% Off Low | 5% Off High |

| FMBH | 37.36 | 25.17 | 40.24 | 12.48 | 49% Off Low | 7% Off High |

| WING | 360.67 | 149.76 | 431.03 | 112.38 | 143% Off Low | 16% Off High |

Tickers By Yield And Growth Rates

I’ve arranged the table in descending order for investors to prioritize the current yield. As a bonus, the table also features some historical dividend growth rates. Moreover, I have incorporated the “Chowder Rule,” which is the sum of the current yield and the five-year dividend growth rate.

| Ticker | Yield | 1 Yr DG | 3 Yr DG | 5 Yr DG | 10 Yr DG | Chowder Rule |

| DUK | 3.71 | 2 | 2 | 2 | 2.8 | 5.7 |

| SJM | 3.6 | 3.9 | 5.6 | 4.5 | 6.2 | 8.1 |

| CLX | 3.37 | 1.7 | 2.6 | 4.6 | 5.4 | 8 |

| WTRG | 3.31 | 7 | 7 | 7 | 7.3 | 10.4 |

| HOMB | 3.1 | 4.4 | 9.4 | 8 | 17 | 11.1 |

| FMBH | 2.57 | 0 | 3.9 | 5 | 6.1 | 7.6 |

| KR | 2.36 | 11.5 | 17.2 | 15.7 | 13.7 | 18.1 |

| PPG | 2.29 | 4.8 | 6.4 | 6.3 | 7.6 | 8.6 |

| AWR | 2.28 | 8.2 | 8.7 | 9.4 | 7.8 | 11.7 |

| RGA | 1.79 | 6.3 | 6.7 | 7.2 | 11 | 9 |

| LNN | 1.22 | 3 | 2.8 | 2.5 | 6 | 3.7 |

| GCBC | 1.16 | 14.3 | 10.1 | 9.9 | 6.2 | 11 |

| RMD | 1 | 9.1 | 7.2 | 5.4 | 6.8 | 6.4 |

| CTAS | 0.84 | 17.4 | 2.5 | 21.4 | 21.5 | 22.2 |

| HWKN | 0.61 | 10.4 | 10.3 | 7.1 | 5.9 | 7.7 |

| CHE | 0.35 | 5.3 | 5.6 | 5.9 | 7.2 | 6.3 |

| WING | 0.3 | 15.8 | 16.3 | 19.6 | 19.9 |

Historical Returns

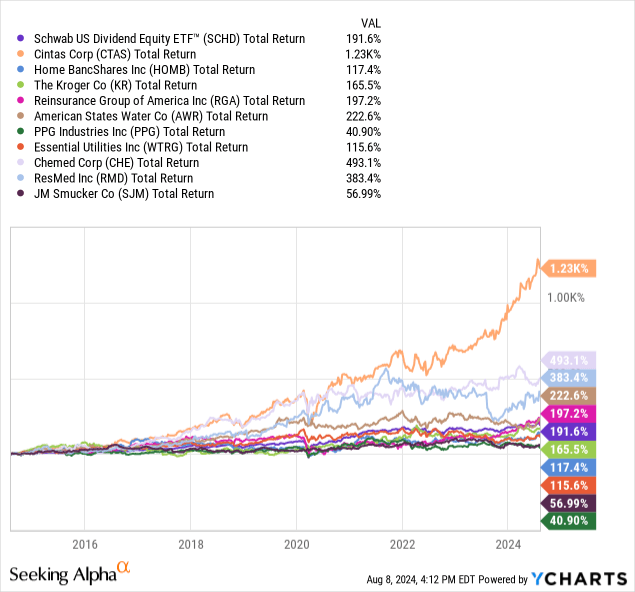

My investment approach involves identifying stocks that consistently outperform the market while increasing dividend payouts. I use the Schwab U.S. Dividend Equity ETF (SCHD) as a benchmark to gauge performance. I use the “Cohen & Steers REIT & Preferred Income Fund” (RNP) for REITs. SCHD has a strong track record of exceptional performance, offers a higher yield than the S&P 500, and has consistently grown dividends. I prefer to invest in the ETF if a stock cannot outperform its benchmark. I have selected several companies for my investment portfolio using this analysis. Additionally, I rely on this analysis to make well-timed additional purchases for my portfolio.

The ten-year dividend growth rate is one of the four main factors in the index behind SCHD. It’s also a proxy for success, although it’s not a perfect predictor. Share prices follow strong dividend growth over long periods, and longer trends will drown out short-term movements. With a large list this week, I have to limit it to the ones with the highest 10-year growth rate. These are total return figures, which include reinvested dividends.

Because of the 10-year growth rate floor I’ve set, there are some other companies on this list you will need to research for yourself. WING is one; they have a 19.6% 5-year CAGR, so they may be worthy of taking a closer look.

The benchmark, SCHD, returned 192% over the past decade, good for an 11.3% CAGR. The outperforming group consists of CTAS, CHE, RMD, AWR, and RGA. CTAS boasts a 1230% total return and a 29.5% annual return—just crazy! I also wish I could boast of owning it for a decade, but alas, I have not. This research series is what led me to become a shareholder a few years ago.

CHE features a 493% total return (19.5% CAGR) and RMD a 383% (17.1% CAGR).

After SCHD, we have the list of underperformers: KR (166%), HOMB (117%), WTRG (116%), SJM (57%), and PPG (41%).

Again, this analysis doesn’t include the companies that were excluded for comparison because they had either too low or no 10-year dividend growth rate.

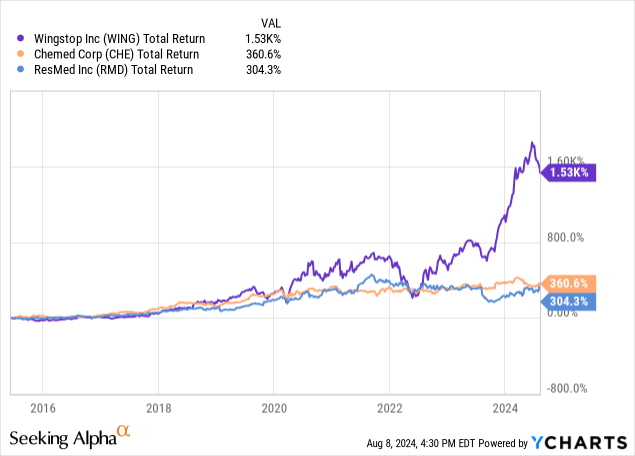

Next Steps

As I already own CTAS, the only other three companies I’m interested in reviewing further are CHE, RMD, and WING. I included WING in this section because of its extremely strong dividend growth rate.

To be fair, I only created this chart of total returns after identifying their strong dividend growth performance on my charts. I can’t say I’m surprised their total return has strongly followed that same growth. However, I will note that their outperformance was “relatively” muted even as recently as late last year.

Let me know what you think of my strategy, and feel free to add yours in the comments below! As always, please do your due diligence before making any investment decision.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply