Investment Thesis

Making a bold bet on the future of clean energy, NET Power (NYSE:NPWR) is making steady progress on their vision to transform natural gas into clean energy. What NET Power is doing is both unique and effective, a bold bet on making energy both clean and affordable, in my view. Investors who believe in this story are looking long-term as NET Power currently does not generate significant sales or profits. However, I believe the upside potential is impressive and view the historically lowly-priced shares as a good buying opportunity.

Company Overview

Perhaps one of the more unusual companies out there, NET Power “is a clean energy technology company with a mission to globally deliver the Energy Trifecta: clean, reliable, and low-cost energy” according to its website. They do so by making technology that combines natural gas with oxygen, and mixes the two with CO2 to produce energy, and then recapturing the remaining the CO2. This is my simple way of putting what is a pretty innovative process in the global energy market, in my view.

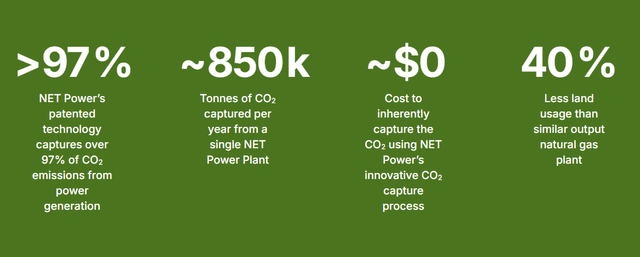

The process is environmentally friendly because “97% of Net Power’s patented technology captures over 97% of CO2 emissions from power generation” according to their website. Given natural gas is so plentiful and cheap nowadays, I think the potential of this technology is quite valuable and will prove a net positive for all stakeholders.

Net Power Website

I think the long-term potential, although hard to quantify, is potentially very impactful and positive for shareholders. And every quarter, progress marches on steadily which signals management effectiveness in execution. In just a few years, revenues may start rolling in as the first utility scale project is expected to be operational in 2027-2028. The business also has strong intellectual property protection to guard their competitive position, making a decent moat for investors.

In conclusion, the company has proven to be innovative and is making steady progress on achieving its goal of making energy both clean and affordable for the general public. While some may say it’s a long-shot, each quarter demonstrates good progress in testing, project development, and prospecting and site evaluation to further this clean energy story. With the stock price at historical lows around $8, it may be a good time to buy.

Recent Updates Show Good Progress

Equipment validation continues to go at a nice clip, with management saying in their press release,

The Company continues to prepare its La Porte facility in advance of upcoming equipment validation campaigns with Baker Hughes. The La Porte site work includes enhancements to piping and instrumentation, relocation of CO2 compression equipment and updates to the distributed control system.

The partnership with Baker Hughes seems to be working well without any delay. They plan on validating and de-risking the “Baker Hughes utility-scale turbo expander and optimizing its operation within our cycle” according to the earnings call transcript. Overall, the plan seems well thought out with careful metrics to monitor success. It has clear hurdles they must pass to test both the safety and effectiveness of their technology. Investors should view the updates about the work with Baker Hughes as a signal that things are going well.

Further progress is shown, as Net Power “signed Limited Notice to Proceed with Baker Hughes to release all long-lead materials required to meet the schedule for the first utility-scale turboexpander” according to the press release. All the puzzle pieces are starting to come together, and the cash burn doesn’t seem to be excessive. For the second quarter, cash flow used in operations was only $8 million, compared to the current cash balance of $609 million. The projects seem well-funded at this point with significant progress, and I view these updates positively and expect the market to price them in with a higher stock price.

Overall, I think progress is going smoothly with very few interruptions from state and local regulators, as what Net Power is doing is actually quite environmentally beneficial. Partnerships with experienced engineering teams make NET Power’s solution potentially better than any other competing source, so I view recent progress as a positive. It’s clear that management is taking great care to execute properly by doing a rigorous step by step process to ensure no mistakes accumulate to jeopardize their project, and I expect progress to continue at a similar pace in the future.

Natural Gas Is A Cheap Fuel Source

Since NET Power uses natural gas as a fuel source, in my view it is worth assessing the long-term cheapness of natural gas to assess the unit economics of NET Power. In my opinion, I expect natural gas to continue to be very cheap due to its excess supply and plentiful reserves in the world. Therefore, the unit economics of NET Power should be very profitable as it the inputs may continue to be cheap.

I believe natural gas will continue to be cheap due to technological developments made in horizontal fracking. Basically, now that all the wells are being drilled horizontally, this new method has increased the potential for extracting natural gas which increases its supply, making it very cheap going forward. According to Natural Gas Solution,

Advancements in natural gas extraction methods have resulted in an abundant supply of natural gas. Technology has increased production efficiency through both hydraulic fracturing (also commonly referred to as fracking) and directional/horizontal drilling. Improved production methods reduce costs, allowing producers to produce more natural gas and oil.

When oil producers go fracking for oil, they happen to come across a lot of natural gas in the process. And while oil prices continue to be high, over $70 a barrel at the time of this writing, natural gas prices continue to hover around $2/MMBtu.

Trading Economics

I believe that the main pressure keeping natural gas very cheap is the excessive amount of oversupply oil producers get when going fracking. People end up inevitably unlocking new supplies of natural gas, which keeps the price low and defies the typical pork cycle we see in most commodities, in my opinion. Therefore, I predict going forward natural gas will continue to be cheap as advancements in fracking make natural gas easily accessible, keeping the price low for NET Power to use as a cheap fuel source.

A Potential Multi-Billion Dollar Valuation

It’s very hard for me to put a price target as evaluating the intrinsic value of a stock like this is very difficult. Given no sales and profits today, there is no history to rely on so I’m going in uncharted territory. According to the investor presentation, management believes the TAM for North America is “800-1000 NPWR Plants between 2028-2040”.

Assume we get to 5% of the TAM for now, as we are still in the early stages. That means I can expect 40 NPWR plants by 2030, as a rough guess. I will assume each power plant generates an average of 876,000 MWh according to this EIA report. So, total MWh is 40 x 876,000 = 35 million MWh of annual generation capacity by 2030.

Assuming each MWh is worth $60, I think total sales may be $2 billion by 2030, based on these speculative assumptions (35 million x $60 = $2 billion). Management confirms this $60 price in their transcript, “Today, average U.S. power prices are approaching $60 per megawatt hour with unprecedented load growth coming down the pipe”.

These numbers are subject to a wide margin of error so investors may have their own opinion about the true value of NET Power. Regardless, I think my valuation analysis suggests there is large potential upside in the long-term future, and NET Power could approach sales in the multi-billion dollar range within the next decade.

With only 5% of management’s projected TAM achieved, I can expect $2 billion in sales. Assuming management can continue building more power plants, I think sales can reach $5-10 billion dollars, and if we apply a sector median forward P/S ratio of 1.45x means I can potentially expect a market cap of $7.25-14.5 billion from beyond 2030. So the exact upside I’m talking about is potentially a 3-5x in the stock price over the course of the next 5-10 years, in my opinion.

Investors who buy into this story are likely set on holding this for the next 5-10 years. Nonetheless, NET Power has the potential to be worth several billions of dollars if they execute property and get to commercialization. At the current stock price, markets are valuing the story at a historical low which makes me believe we are seeing a good buying opportunity. My back of the envelope valuation suggests that NET Power is being mispriced as positive developments have followed a declining stock price.

Risks

There is a significant downside if execution fails or regulators stop the projects from happening. A future Harris presidency may make natural gas more expensive as she may put a stop to fracking. Future cash outflows may require management to dilute or borrow, which would increase the risk to shareholders. A rise in interest rates can make this story more daunting as the cost of borrowing increases. Also, investors could have to wait a long time due to future delays or obstacles that prevent progress from being made.

Other competing energy sources like nuclear, solar, and wind may improve in technology as well and create competition for NET Power. Nuclear has had an interesting past, and I think will see continuous investment into technology that also make it a viable source of energy for the world. We are dealing with a very uncertain future and NET Power’s vision may fail due to competing sources of energy.

A loss of management may cause projects to slow and morale to dim, as this bet puts significant faith into the people that work there. Some may say this is a long-shot, and investors who are looking for more stability or reliability may not find NET Power attractive for their investment goals. This is a sort of high-risk, high-reward situation that can be classified as too speculative for some investors.

Buy NET Power

The stock trades at historical lows yet I see continuous positive progress being made to commercialize power production at NET Power. I have never seen a company like this one before, and my curiosity led me to discover a new technology that could potential revolutionize energy for the world. It’s rather speculative, but if the company succeeds we could see a valuation in the multi-billions. If they fail, it would be a potential total loss. Therefore, I recommend a speculative buy rating but caution patience will be necessary.

Read the full article here

Leave a Reply