It’s been a while since we last covered Cava (NYSE:CAVA), the leading Mediterranean fast casual restaurant chain.

In our first article last September, we compared the company with Chipotle (CMG), and ultimately argued that CAVA was likely the better option for growth-oriented investors. With a mostly undemanding valuation, leaning long at the time was a relatively easy decision.

Then, earlier this year, we covered the stock again, recommending a slightly more conservative approach going into the Q1 report. While the stock was somewhat volatile following earnings as anticipated, the stock has broadly continued its march higher, reaching, today (at the time of writing), all-time highs at nearly $100 per share.

Overall, our bullish stance on CAVA has been one of our better calls since becoming a Seeking Alpha Analyst, with our initial buy coming in at $31 in the fall of last year:

Seeking Alpha

While the run-up the stock has enjoyed so far has been fruitful for investors, in this article, we wanted to spend some time getting ready for Q2 earnings next week, figuring out what the analyst community is focused on.

Do analysts want to see same store sales growth? Progress on operating margins? New store openings?

Today, we’ll dive into all of CAVA’s key metrics and give you a preview of where we think things stand going into earnings.

Plus, we’ll also cover whether or not we think shares stand a good chance of heading higher or lower after the report.

Sound good?

Let’s dive in.

Cava’s Financials

Before taking a look at the upcoming report, it’s worth spending a little bit of time giving you a lay of the land about where things stand at present.

Right now, CAVA is a nominally profitable fast casual restaurant chain focused on premium rice bowls, Gyros, and other Mediterranean fare.

Positioned in mostly major metro areas, the company focuses on high income consumer lunches and dinners. Consumer satisfaction – both anecdotally and from consumer data – is very high, and CAVA enjoys strong brand affinity as a result.

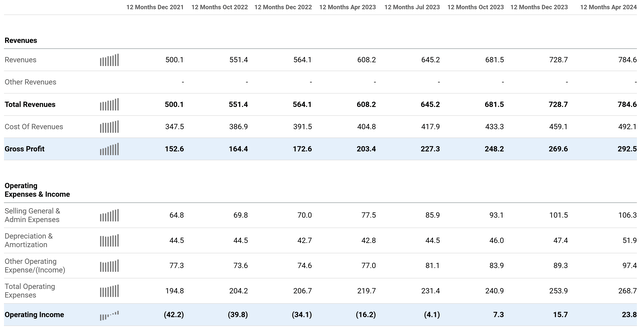

The company has grown revenues over the last year at about 30% YoY each quarter(!), and operating margins have just inflected higher and into the black on a TTM basis:

Seeking Alpha

A setup like this, with high revenue growth, a beloved product, and net profit inflection usually lends itself to strong stock returns, which is what we’ve seen up to this point.

On the liquidity front, the company’s balance sheet is clean as a whistle, with no long-term debt and substantial cash to fund operations and cover liabilities.

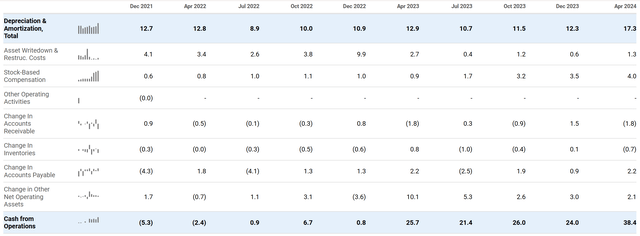

While net income has swung into the black only recently, CAVA is also highly cash generative, growing CFO from -$8 million to +$38 million over the last 9 quarters:

Seeking Alpha

Restaurant-level margins for CAVA stand around 25%, which is quite strong, and offers the company a high level of ROI when it comes to opening new stores.

But how much does this package cost?

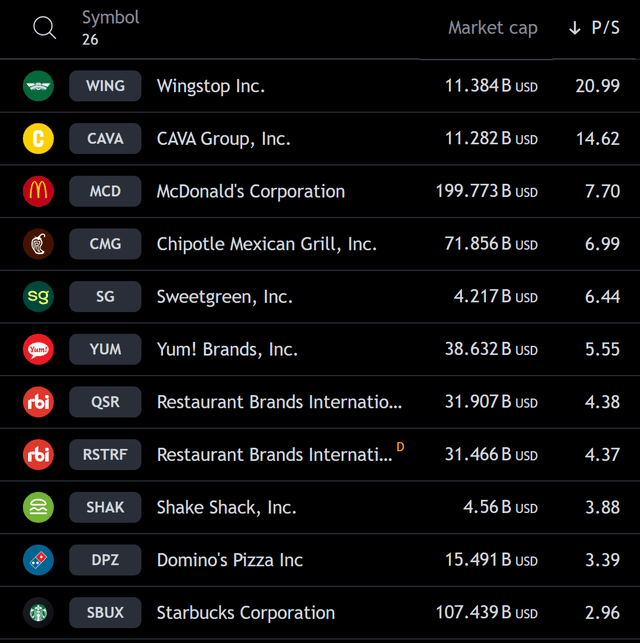

Right now, CAVA shares are a bit pricey, trading at 14x sales, which is well above the restaurant industry average, and second only to highflier Wingstop (WING):

TradingView

CAVA also trades at a premium to Chipotle (CMG) and McDonald’s (MCD), which is likely due to the company’s aforementioned growth, streamlined capital structure, and margin expansion.

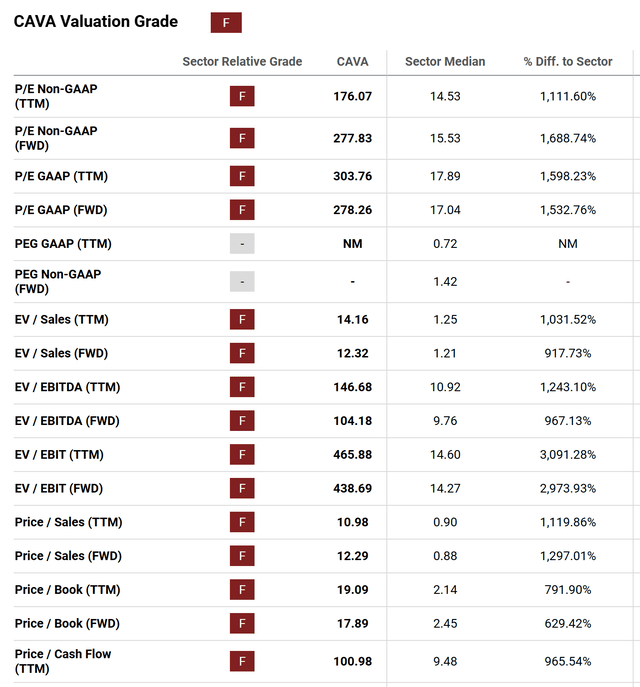

Seeking Alpha puts CAVA’s valuation at an ‘F’, which we think is a bit harsh, but to some degree, there’s no getting around it, CAVA is a premium stock that comes with premium performance:

Seeking Alpha

Thus, going into Q2’s report, we find CAVA to be a very well run, highly premium restaurant brand that has a significant amount of future expectation baked into the price.

We think the multiple could probably go higher, but it wouldn’t be unfair to say that CAVA is priced near perfection.

Cava’s Upcoming Q2 Report

So, what are the things to look out for in the Q2 report?

First off, CAVA is a growth story, which means that growth metrics like Sales growth, New store growth, and EBITDA growth will matter a lot from an analyst point of view.

CAVA has guided FY24 results in the following ranges:

We expect the following, 50 to 54 net new CAVA restaurant openings. CAVA’s same restaurant sales growth of 4.5% to 6.5%. CAVA restaurant level profit margin between 23.7% and 24.3%. Preopening cost between $12 million and $13 million, and adjusted EBITDA including the burden of preopening costs, between $100 million and $105 million.

CAVA’s same restaurant sales growth of 4.5% to 6.5%, implies a mid to high single-digit same restaurant sales for the remainder of the year. Additionally, same restaurant sales guidance includes the current same restaurant sales strength we are seeing, the expected mix impact of the steak rollout, as well as the potential traffic headwind as we anniversary, the IPO buzz in the summer of 2023.

In short, any metrics that don’t meet or exceed these metrics, when extrapolated out, will likely cause scrutiny from analysis and sell orders from investors.

For us, we’re looking at 5%+ SSS growth, 13-14+ new restaurant openings, and restaurant level profit margins of at least 24%. These would be impressive results to us, even inclusive of the cyclicality mentioned by management on the call.

On the call, analysts were also particularly interested in a few key items, including the roll out of new steak menu items, new unit suburban performance, and ongoing labor costs.

For each of these, we don’t see a reason that company projections would have changed substantially between the last call and the upcoming one.

As in, nothing happening, publicly, over the last few months would have impacted any of these key data to the negative, as far as we can tell.

On the steak front, many reviewers have sung the praises of the new menu item, and on the inflation front, the CPI has come down in recent months which should reduce labor cost pressures going forward.

Finally, from our perspective, CAVA’s 90-10 split towards developing new units in suburban areas makes a TON of sense, and we think that strong results from this cohort should continue the ‘strong growth’ narrative and continue pushing the stock higher.

All together, we think that shares are well positioned to move up on the report. If shares do sell off, then unless the reason is due to some structural issue with the company, we’d see that as a strong opportunity to pick up more stock for the long term.

Risks

The key risk here is the premium valuation.

Some other analysts have argued that CAVA’s mid-single-digit same store sales growth shouldn’t demand such a premium multiple, but we’re more focused on the expanding margins and premium brand going forward, which is what we think the market will be looking for as well.

In our view, the valuation can be supported as long as CAVA can continue executing its growth plan, building up new stores and expanding revenue and profitability per store.

As a ‘show me’ story, if the company falters, even a little bit, the stock might take an outsized hit.

Finally, there’s a latent risk that ROI on new units could decrease incrementally over time as CAVA runs out of cheap real estate to retrofit (picked up from the Zoes Kitchen acquisition). Critics argue that expanding more will be much more expensive, but we don’t think that this should eat into margins too substantially looking ahead.

Summary

Long story short, there are some risks going into Q2 earnings, especially given how generously priced the stock is.

However, we’re mostly confident that management can meet or beat expectations as a result of how the business (and the macro) has progressed over the last quarter.

If the stock does end up getting hit, then unless it’s due to some new structural risk within the company, we’d see the dip as an opportunity to keep loading up on this best-in-class company.

Good luck out there!

Read the full article here

Leave a Reply