Introduction

United Community Banks, Inc. (NYSE:UCB) is a regional bank that has a strong presence in the American southeast. Like many in the industry, the bank has faced headwinds associated with higher interest rates and deposit competition. Back in June 2023, I profiled the bank’s preferred shares as a high yielding option for income investors. Upon revisiting the bank’s financial situation, I do not see anything to alarm investors to sell, but the current pricing of the preferred shares has me reluctant to reaffirm a buy rating.

UCB Financial Results

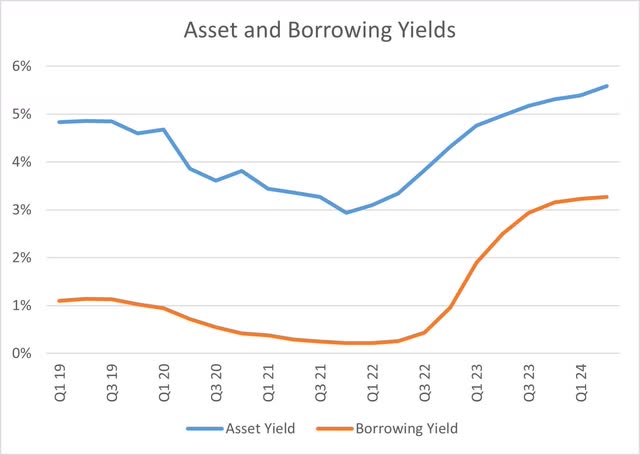

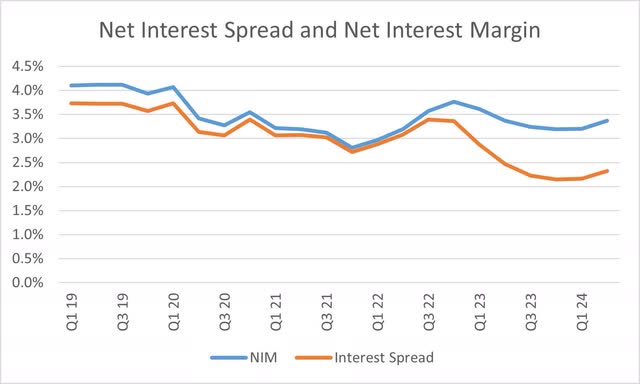

When the Federal Reserve began raising interest rates to fight inflation, United Community Banks saw quick changes to its business. Asset yields rose from 3% in late 2021 to nearly 5% just a year later. In the second quarter, asset yields continued to rise to above 5.5%. Consequently, borrowing yields rose from 0.3% to over 3% from 2022 to the second quarter of 2024. The faster rise in borrowing rates has compressed the bank’s net interest spread, but good management of the balance sheet has allowed the bank to maintain a net interest margin around the same levels it did during the pandemic.

Company Financials Company Financials

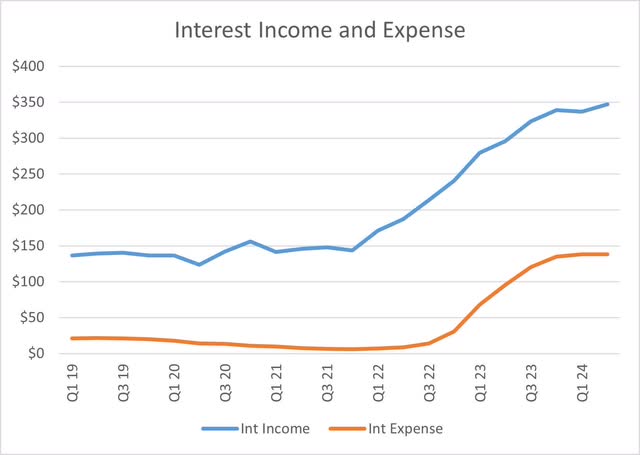

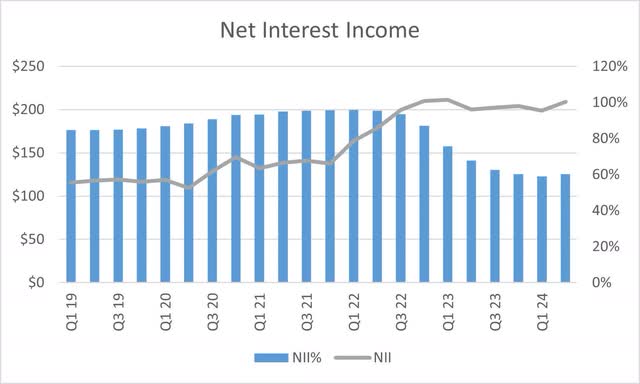

When it comes to earnings, the bank had a somewhat surprising second quarter where interest income rose, and interest expenses remained stable. These changes allowed net interest income (interest income less interest expense) to rise. Interestingly, the bank’s net interest income is well above pre-pandemic or pandemic levels, and almost at its 2022 highs, which is better than many of the other banks I’ve examined.

Company Financials Company Financials

An Examination of Loans and Deposits

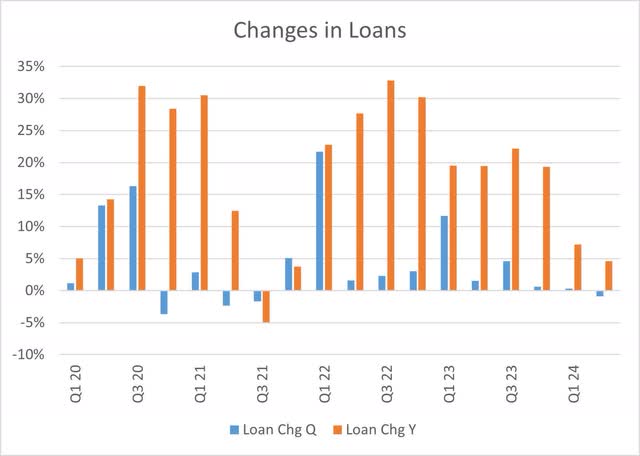

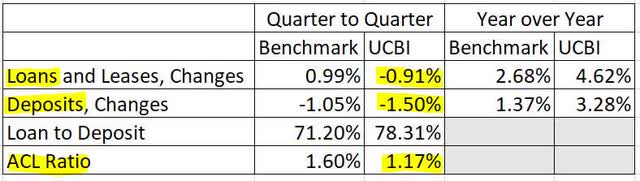

During the onset of the pandemic and following PPP forgiveness, United Community Banks saw robust growth in lending. Later, the bank experienced more loan growth fueled by the 2022 merger with Reliant Bancorp and the 2023 merger with Progress Financial. Just as the industry has slowed lending, so has United Community Banks as lending shrank during the second quarter for the first time since PPP forgiveness in 2021.

Company Financials

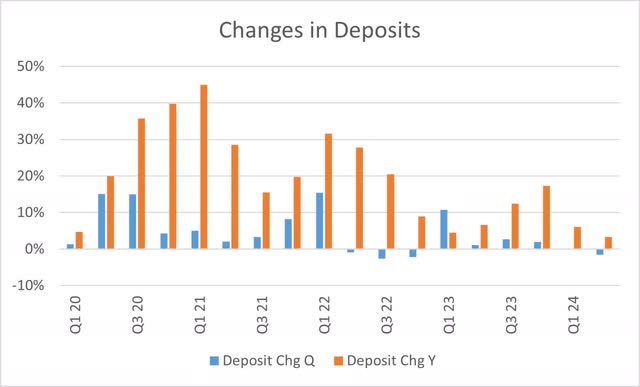

With respect to deposit growth, the trend is very similar to the bank’s loans. Mergers in 2022 and 2023 helped fuel deposit growth, but the recent slowdown in banking has led to a reduction in deposits. Deposits shrank by 1.5% in the second quarter and on a year-over-year basis, deposit growth is at its lowest level of this business cycle.

Company Financials

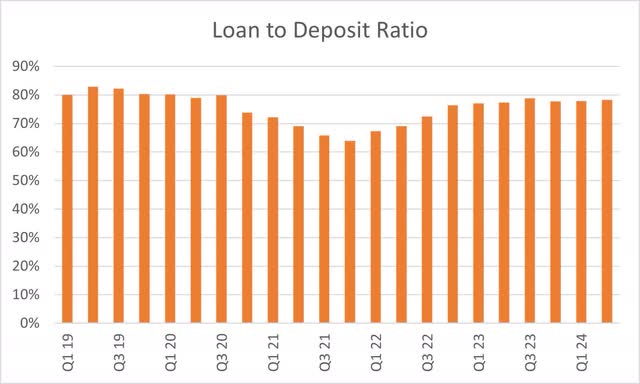

Deposit loss can force a bank to seek financing from external debt sources to fund loan demand. This source of financing is often more expensive than deposits and negatively impacts the bank’s earnings. A good indicator to show a bank’s dependence on external debt is the loan-to-deposit ratio. While the loan-to-deposit ratio has risen since PPP forgiveness, it remains under their pre-pandemic levels, which were over 80%. At 78%, United Community Bank’s loan-to-deposit is within a reasonable level relative to its peers and therefore the bank should be able to ride out a temporary drop in deposits.

Company Financials Federal Reserve and Company Financials

Risks to United Community Banks

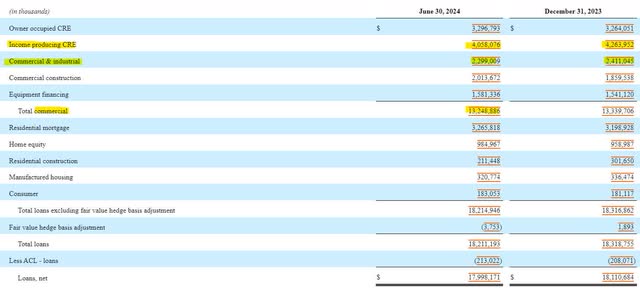

There are risks to United Community Banks that investors should be aware of and monitor with each quarter’s financial reports. The bank’s exposure to non-owner occupied commercial real estate (classified in the financials as income-producing CRE) is concerning. At $4 billion, non-owner occupied CRE is the largest component of the bank’s $18 billion portfolio, followed by owner-occupied CRE, and residential mortgages. Non-owner occupied CRE has recently come under scrutiny as investors of these assets are simply walking away from them due to poor performance and thereby handing ownership over to their banks.

SEC 10-Q

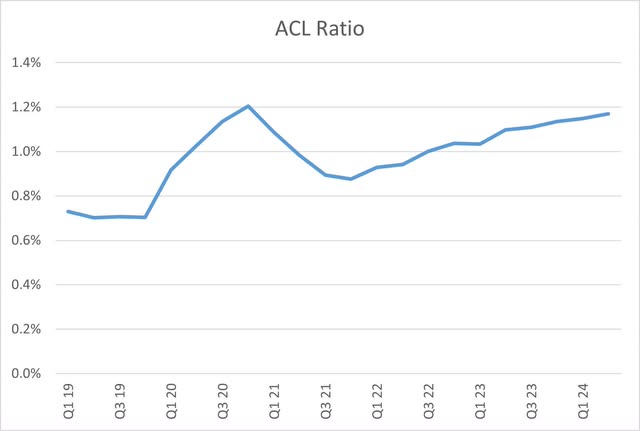

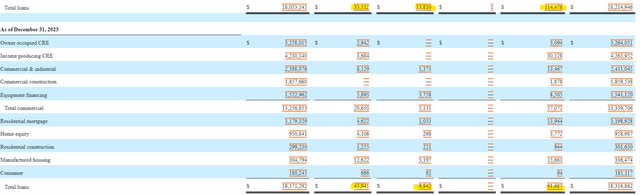

The bank has classified just under $300 million, or approximately 7% of the non-owner occupied CRE segment as either a special mention or substandard. The bank has begun to accumulate a loan loss reserve to handle an eventual rise in defaults, but even at 1.2% of gross loans, the allowance is still behind its peers. Delinquent loans have fortunately ticked down slightly since the end of the year, but non-accrual loans have risen from $92 to $114 million in the last six months.

SEC 10-Q Company Financials SEC 10-Q

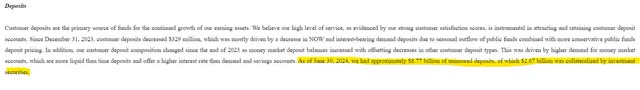

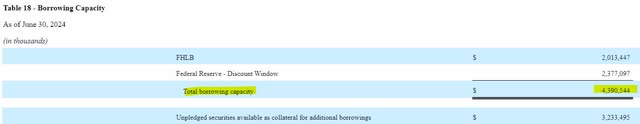

A second risk to be keenly aware of is uninsured deposits. Uninsured deposits have become a key data point since the failure of Silicon Valley Bank. United Community Bank currently has just under $8.8 billion in uninsured deposits with $2.67 billion collateralized by investment securities and a borrowing capacity of $4.4 billion. While there may be an implied backstop in place with respect to uninsured deposits, United Community Banks would be in a vulnerable position if those depositors became fearful of their safety.

SEC 10-Q SEC 10-Q

Conclusion

Despite the risk regarding uninsured deposits, I don’t consider there to be enough risk to sell my United Community Banks’ preferred shares. But, at a 7.2% dividend yield, I don’t believe the pricing/income yield is comparable to other banks I’ve covered; therefore, I am downgrading the shares to a hold. For investors looking for comparable securities at higher yields, they should look at WaFd, Bank of Hawaii, or Triumph Financial. Even the debt securities being offered by some banks like NewtekOne and Dime Community Bancshares are producing higher income than United Community’s preferred shares and are in a more senior position in the capital stack. Despite the valuation not being attractive, investors should be on the lookout for dips, which could create buying opportunities.

Read the full article here

Leave a Reply