My thesis

Energy midstream appears to be an interesting domain to invest in as there are several large players paying generous dividends. With its $85 billion market cap Enbridge (NYSE:ENB) is by far the largest North American midstream company. The stock offers an attractive 6.81% forward dividend yield, meaning that it certainly deserves a closer look.

Enbridge’s positioning in North American Midstream is unique due to its extensive footprint and massive infrastructure. I think that the dividend yield is safe and has the potential to demonstrate growth, but the current share price is above ENB’s intrinsic value. It means that there is likely no potential upside from the current share price level. Therefore, I think that the high dividend yield and overvaluation offset each other, making Enbridge a Hold.

ENB stock analysis

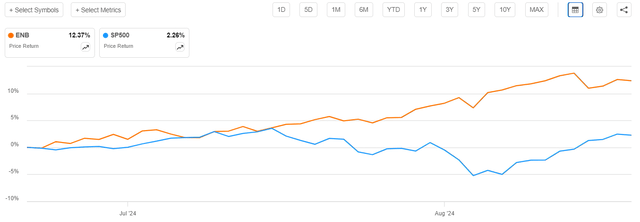

Enbridge’s share price dynamic over the last two months looks strong with a 12.4% rally compared to a modest 2.3% delivered by the S&P 500 index. The stock grew with rare pullbacks, demonstrating strong momentum.

Seeking Alpha

Strong demand for the stock over the last two months was explained by a pullback in growth stocks due to high expectations around the Q2 earnings season and elevated recession fears. ENB offers a 6.81% dividend yield, which is certainly attractive even in the context of the current Fed’s tight monetary policy. Moreover, there are numerous reasons to believe that Enbridge’s dividend yield is sustainable.

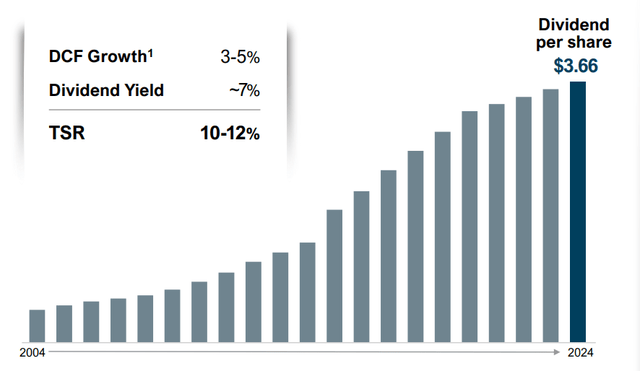

Enbridge’s dividend payouts history is stellar. The company has been consistently increasing payouts over the last two decades. ENB’s dividend yield has been strong even during the Great Recession and the COVID-19 pandemic. Having such a resilience in terms of dividend payouts speaks volumes about the company’s commitment to generate value for shareholders.

Enbridge’s Q2 2024 slides

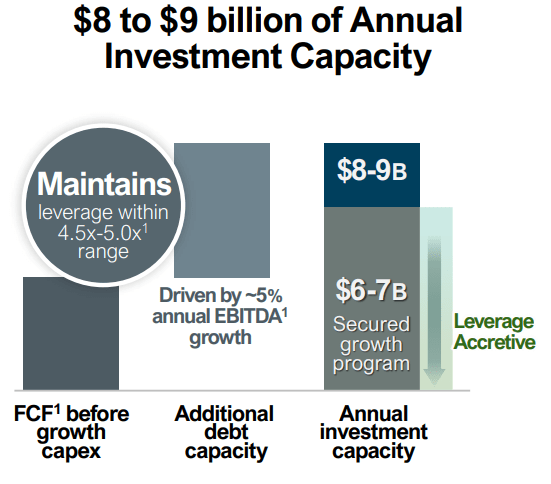

In its latest presentation for investors, the management emphasized its commitment to preserve prudent capital allocation. The management plans to keep leverage levels within the predictable range to maintain the company’s financial flexibility. An expected 5% annual EBITDA growth will also help in ensuring dividend safety.

Enbridge’s Q2 2024 slides

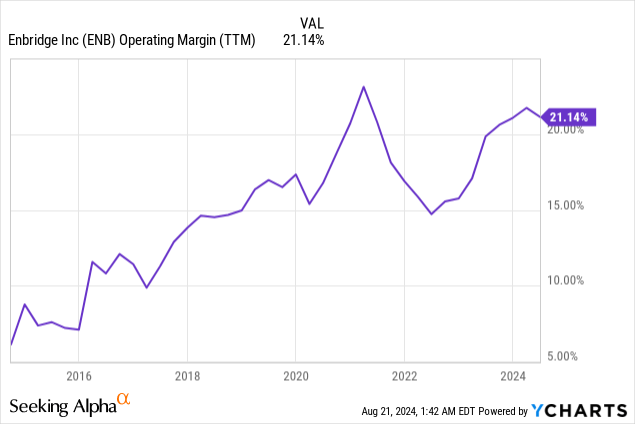

Trends demonstrated by the company’s profitability profile also add optimism in terms of dividend safety. The operating margin is robust and is close to the last decade’s high. There is a strong upward trend in the metric since the early 2022 dip. Since the management expects to deliver a 5% EBITDA CAGR over the next several years, I think that this improvement will be driven by exercising operating leverage.

Apart from the company’s specific strengths, it is also important to acknowledge that external trends are also quite positive for Enbridge as the leading North American midstream company. Both U.S. and Canada produced record volumes of oil and gas in 2023. The Russian economy is isolated as a result of war in Ukraine, and geopolitical situation is complex in an oil-rich Middle East region. These developments suggest that North America is likely to continue breaking oil and gas production levels to ensure the energy security of the developed world. More production will mean more oil and gas transportation and processing volumes, which will benefit midstream companies.

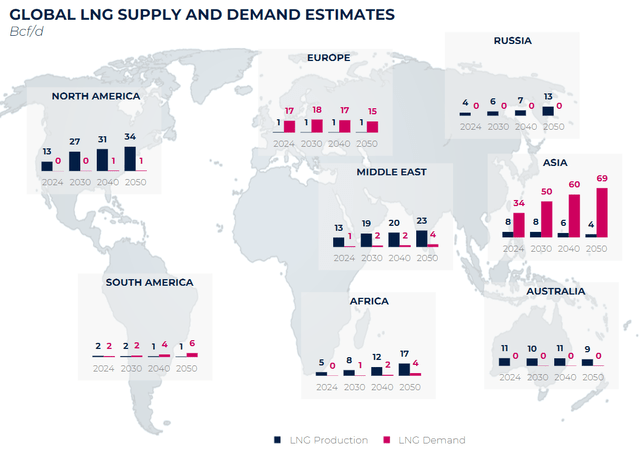

Enbridge also has exposure to the thriving liquified natural gas (‘LNG’) industry, as it serves 15% of LNG export capacity on the Gulf Coast. This is crucial because the U.S. gas producers appear to be betting big on expanding their LNG export potential. EQT Corporation (EQT) is the largest natural gas producer in the U.S. This company forecasts the global LNG market to double by the end of 2030s. The below map suggests that vast amounts of LNG imports will be required in Europe and Asia. As the world’s largest producer of natural gas, the U.S. is positioned well to become the leading LNG exporter to these destinations. This is another positive secular factor for Enbridge, due to its solid footprint in midstream operations for LNG.

EQT Corporation

Geopolitical catalysts are not the only ones to benefit North American midstream. The spike in demand for data centers is a strong secular tailwind for the whole energy industry. According to Goldman Sachs, AI is poised to drive a 160% increase in data center power demand.

Intrinsic value calculation

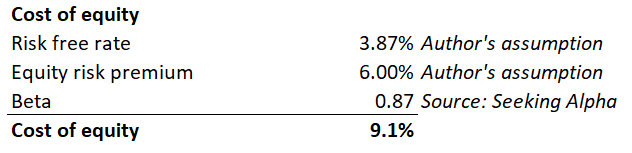

The dividend discount model (DDM) approach requires us to use the cost of equity as a discount rate. In the working below, I outline how I arrived at a 9.1% discount rate for ENB, including comments regarding sources of the input data.

DT Invest

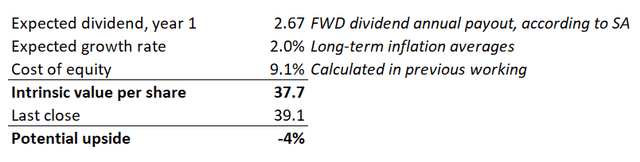

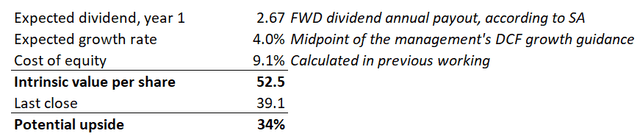

A 9.1% discount rate to be incorporated into my second working with the DDM formula below. Other variables include the forward annual dividend payout and the expected constant growth rate for the company’s dividend. Sources for these variables are also described below.

DT Invest

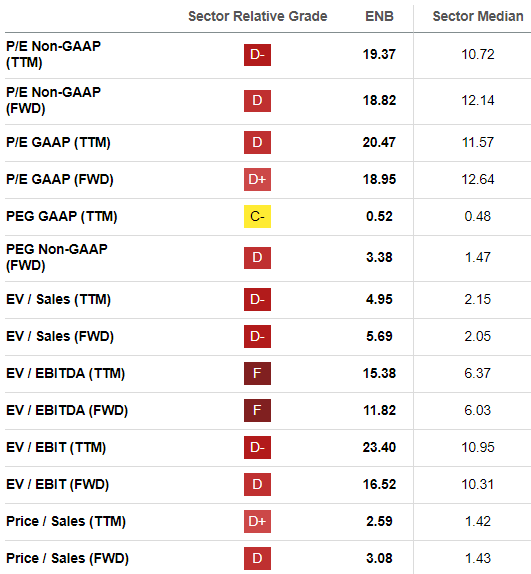

According to the DDM analysis, intrinsic value of the stock is $37.7. Therefore, there is a 4% potential downside, and I find ENB’s valuation as not very attractive. Looking at Enbridge’s valuation ratios also points to overvaluation as most of the ratios look substantially higher compared to the industry.

Seeking Alpha

Two different approaches pointing to overvaluation is a warning sign, meaning that ENB is likely not a good buy at the current share price. The downside potential offsets the compelling dividend yield. I would better consider buying ENB if the stock price dips below $35, which is approximately the midpoint of the share price’s last 52-week range.

What can go wrong with my thesis?

In one of my previous articles, I mentioned that the sentiment around growth stocks is cooling, which we saw from the Q2 earnings season as none of the tech giants’ stock rallied despite solid quarterly performance. As a large cap established business paying a high dividend yield, Enbridge’s stock might be in high demand in case investors switch from growth stocks to value. ENB reached around $47 per share during the 2022 selloff in growth stocks, meaning there is still potential to grow in case of the rotation of capital like we saw two years ago.

DT Invest

Enbridge is well-known for its rich dividend history, and any dividend hike beyond the market’s growth expectations might be a solid positive catalyst for the stock price. Moreover, the management forecasts the distributable cash flow growth to be within the 3-5% range by 2026. The DDM approach is sensitive to changes in the dividend CAGR, and when I implement a 4% dividend growth rate, ENB’s intrinsic value soars to $52.5.

Summary

I am adding Enbridge’s stock to my watchlist as the company is fundamentally strong and offers a robust 6.8% dividend yield. I do not like the valuation and will initiate a position only if the stock dips below $35. At the current $39 share price, ENB is a Hold.

Read the full article here

Leave a Reply