Above: By any measure, the low price of Macau dominant Las Vegas Sands Corp. (NYSE:LVS) stock in the world’s biggest gaming market remains one of the unfathomable puzzles. Why the market passes on its bargain price despite positive analyst ratings over years is a mystery.

Price at writing: $41

google

Above: LVS could be a growth laggard hangover since last year and, in fact, the last five years at 3% return to investors.

Holders over 5 years have seen a poor average 3% return. This reflects, we believe, an emotional tug that slows interest in good times and speeds volume selling when either earnings, concern about debt and China instability enter the calculation. Mr. Market has seemed negative on LVS too long.

Worse case intrinsic value: $45 and 9% undervalued. Alpha Spread puts the best case at $68. Over 35% undervalued.

I believe that, though it is a “best guess” call, that there are many factors related to family control that do not enter the calculation per se.

There are few good stocks with more accumulated BUY recommendations that have remained deal pooled in a trading range far below fair value. Part of this is the overall tone of the market, unquestionably. But to many analysts following the shares, it remains a puzzle. The stock is down (24%) since January. Its recent results showed EPS grew from $0.46 to $0.55 in Q2. While this is not a blockbuster gain, it does show a directional upside for the company, recognizing a trending recovery from the COVID-19 damage.

Q2 results were impacted by low hold and renovation disruption at The Londoner that will end at near Q4 or 1Q25.

Overall, consider this: LVS has by far the largest room capacity in Macau (12,000), its command of the mass market is sure, its premium mass and mass play is strong at all its properties. Marina Bay Sands in Singapore has broken operating records relative to pre-COVID-19.

google

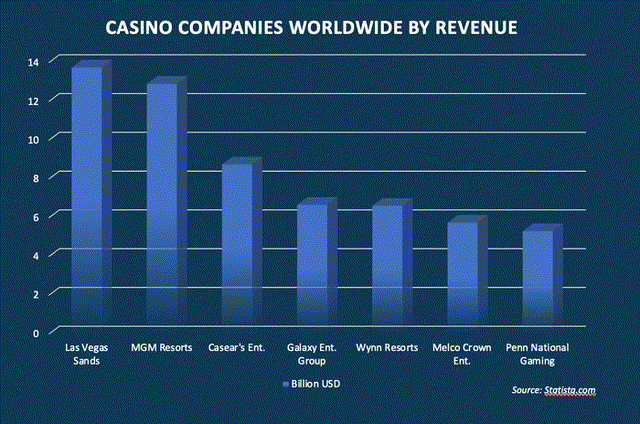

Above: LVS’ top spot is a product of its dominant position in Macau with 12,000 rooms, plus the vitality of its MBA Singapore MBS casino.

LVS finances: Worry about debt load may be excessive. LVS has $13.7b in debt, with only $1b maturing in the next two quarters. The company has $5.11b cash on hand at writing. LVS recently issued a refi of notes rated as investment grade. Debt to EBITDA is 3X, Forward P/E ratio 16Xm extremely indicative of a BUY opportunity now, PEG ratio low by comparison to peers. Revenue consensus for 2024: $11,8b and could well reach $12b.

Consensus: Fair value estimate $48.79, a bit more than alpha spread

LVS archives

Above: The Venetian, one of LVS’s premiere properties building mass revenue.

In prior articles by myself and many other analysts, we have pondered the many reasons we thought responsible for the inability of LVS shares to move closer to fair value. They included wariness over Beijing’s constant threats and political saber-rattling that could result in confiscation. There is a belief that selling off their Vegas assets was too early, and was a turnoff for the market.

And no real movement by management to advance its progress on expanding to another Asian market. Thailand is moving at a snail’s pace–but there are other opportunities. Although LVS has acquired a lease deal on a Long Island, NY site, they are one of many possible bidders on a downstate casino license. The favorites are MGM and Genting Berhad (OTCPK:GEBHY). Both have long operating experience and good vibes with the political powers in NY. LVS has leased a vacant arena on Long Island as a potential temp casino if they get the nod. The plan: Build a mega resort that will dazzle an already saturated market.

I have dealt with this majority Miriam Adelson issue in a prior article for SA, but as one of many bigger reasons we believed the stock was not moving anywhere near fair value. My further research into the assumption has brought forth more conviction. I now believe LVS’s capital structure and board are committed to the existing state of affairs. And from that emanates a negative aura for the stock.

The Hilton hieroglyph unearthed that led to what could be a key part of a viable solution as to why LVS shares simply don’t move higher

The Will of Conrad Hilton triggered a legal action based on Barron’s demand for the majority shares held by a charity. After a final ruling in his favor, Hilton shares went on a run.

For context, a story that hit my mind last week was buried in memory. I went back to my archived notes and did an archeological dig, as it were, unearthing a very possible reason for positive analyst ratings falling on deaf ears every time the stock nears fifty. It has to do with Hilton history.

Back in the eighties, a very close industry friend, Mr. Dennis Gomes, (d.2012) who ran many Vegas properties had a guest at a dinner we had panned during a Vegas business trip. It was Barron Hilton, who had become close with Dennis. An affable man, rightly proud to discuss his Vegas properties, mighty earnings, turned to talk about his dad, Conrad Hilton (D:1979). The topic: Conrad Hilton’s shocking Will.

Briefly, Conrad left all his money, including his 27.4% of Hilton shares, for “charity.” Barron, as his eldest son, then 58 in 1981, was left $750,000 market value of Hilton shares and not a penny more. The entire family was otherwise cut out without a penny. He left the entire estate for “charity” which later fell into the possession of the Sisters of Mercy Foundation. Barron offered them $165m (roughly $3.7b in today’s money according to several inflation calculators) to buy the stock. They refused, as the stock was on a run.

Hilton kept fighting. The issue had long become whether the fair value of the stock under the Sisters was being inhibited by its status. Investors who may well have bought the stock, raising its value for all, were staying away as long as the Sisters controlled so large a block of the outstanding shares.

Over the original two years of the Sisters’ ownership, the assets were up $10m from a $160m base. Not likely to sell for sure.

Then, after an interim win by the Sisters, an appeals court eventually ruled in favor of Barron. Once freed from the charitable straight jacket, Hilton shares in 1988 went from $71 to $106. It was really getting out of a straitjacket. After the same, the foundation did well too. (Today, the Conrad Hilton Foundation has $18b in assets to distribute to its recipients).

So, recalling that revelation by Barron from a set of notes I had made, I found a key parallel to the LVS story. Though the circumstances are entirely different, the core principle here is whether a large public company, with its majority held by a single family, imprisons a stock below its fair value over time.

That is an insight I drew, right or wrong, that seems to me is a more central reason for LVS shares stuck in the mud than investors don’t consider than central to its trading problems.

LVS: Sheldon, Dr. Miriam and the foundation sitting on an LVS majority

As I have noted above, there are far too many differences between the Hilton legacy case and LVS’s current situation to suggest a perfect analogy. But we only cite this: Does the refusal of heiress Dr. Adelson and the Board of LVS, or the lack of will to take the equity stake dramatically down, reduce the value of the stock? And does the continued majority holding of the family reflect itself in the suppressed valuation of LVS this long?

Some three years ago, I was at the industry G2E show in Vegas, where I met an old colleague from my Taj Mahal days who was a long-time close associate of Sheldon Adelson. He told me.

“Sheldon had big ideas, but reducing his equity was not one of them. Years later when after he had hit a four bagger in Asia, he asked Sheldon “Why don’t you take some equity off the table? You earned it. It doesn’t help the stock and you can free the money for many possibilities.”

Sheldon replied that he was convinced eventually that he would get more by waiting, that he wanted to continue feeding his and Miriam’s charities here and in Israel. He had received offers occasionally but turned them down. After his death, my friend had a similar discussion with Miriam. She liked things the way they were: Her son-in-law as COO, her board effective in her eyes, stock repurchases and dividends a policy pledge to holders, all made sense to her. My friend pointed out why selling down her equity was more likely to lose rather than gain value, despite the generous dividend and repurchase programs, she remained committed to Sheldon’s legacy.

Why dramatically reduced Miriam and Adelson family foundation LVS positions sold in tranches to public holders could be considered a positive viewpoint in valuing the stock nearer to fair value.

Initial expectations: Supply and demand realities

Miriam is the largest single holder with 32%, Adelson Family Foundation is next with 18% and Vanguard 3%. That is 53% clearly staving off any possibility of a mega offer for many reasons. Examining the history of such equity sales by founder families, we see a pattern. It is the expected initial downside trading on purely a supply and demand reality. With the increase of 53% or less of stock now thrown on the open market, for example, the stock will take a supply and demand hit. However, after an initial hit, we note that the newly freed stocks reach a trade that begins to entice Mr. Market. Over time, it reaches pre-sale levels and then rapidly begins to move up. What we see is closer affinity to peers in the sector that invites better head-to-head comparisons. And conviction by investors that analysts might be right.

The fact of no more family control of LVS figures in how analysts will build comparatives in metrics, which will show LVS in a strong light.

The Mavericks buy: A three pointer or a flagrant foul

Sometimes, majority holders can make deals which border on the bizarre. This can bug holders. Last November, Miriam sold $2b of her LVS shares to raise the cash to purchase majority ownership of the Dallas Mavericks NBA team, valued at around $3b. Eyebrows were raised all over the place among investors scratching their heads.

Was Dr. Adelson so big of an NBA fan that because she had the money and presumably was using her cash per se, she gave into a whim? What was going on? Nobody really knows yet. The most plausible rationale I could find came from a Texas journalist I know. He guesses the move is the subtle beginning of an ongoing PR/lobbying effort. It is designed to establish a strong PR footprint for the people of Texas to get acquainted with LVS as it revs up its lobbying for a Texas casino deal. This is on the property owned by Adelson nearby the arena. Texas at present seems miles away from casinos, according to my journalist friend.

Over time: With a massive increase in public shares to respond to LVS results, positive or negative, there is bound to be a distinctly livelier trading picture of LVS in comparison to sector peers than what appears now.

Daily volume will undoubtedly run much higher, options trading will spurt, and two key elements will develop. One, a house cleaning of the board, now over heavy with elderly members disinclined to change, and the management team refreshed with new faces. The top LVS people today already have their money long stacked in solid investments, ready to be reached on retirements.

And a rapidly pivoting set of corporate priorities that find more investors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply