Following the easing of lockdown restrictions, travel picked up and that halted the e-commerce growth that we had seen during the pandemic. At the same time, more aircraft belly capacity came online, which further put pressure on dedicated air freighter demand. That obviously hurts providers of dedicated air freighter airplanes or services, and one of those companies is Air Transport Services Group (NASDAQ:ATSG). However, having followed the quarterly calls of aerospace companies, I did notice that demand in the air freight market is stabilizing and that could be a good indication for Air Transport Services Group. In this report, I will be discussing the company’s most recent earnings as well as risks and assess whether the ATSG stock hold rating and price target issued in May are still valid.

Air Transport Services Group Is Stuck With A Fixed Cost Balance And Declining Revenues

ATSG

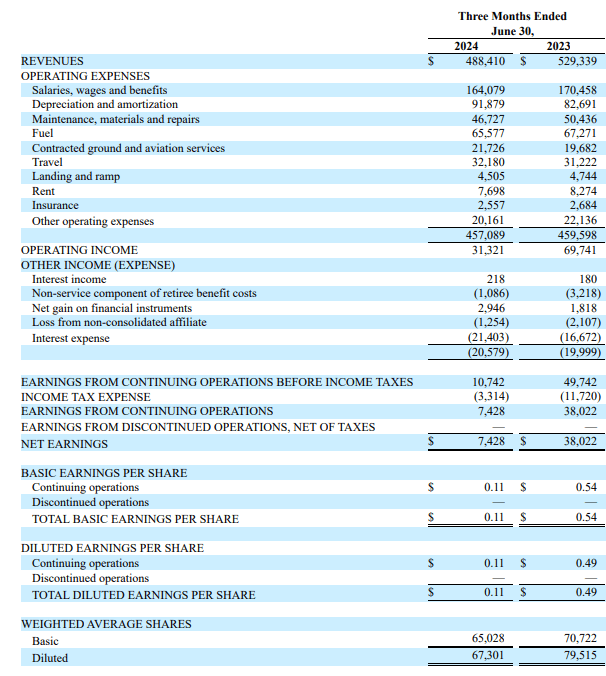

Second quarter revenues fell 7.7% to $488.4 million, missing analyst estimates by $25.3 million. The company reports in two segments, namely CAM, which is the aircraft leasing segment, and ACMI services, which provides flight services for customers. CAM revenues decreased by 6.2% driven by planned redeliveries of Boeing 767-200 freighters and lower income from power-by-the-hour revenues from engines under contract for those freighters. ACMI services saw a revenue decline of 7.7% which was driven by 10% lower block hours flown. So, we see that revenues are falling as demand is soft.

I previously already noted that while the top line is under pressure, taking cost out of the business is tough and the second quarter operating costs also showed that as total costs of $457.1 million indicated a mere 0.5% decline in operating costs. So, the complete reduction in revenues translated through in the bottom line and that resulted in operating income declining from $69.7 million to $31.3 million, marking a 55% decline, and it shows how important it is for ATSG to reduce CapEx when market conditions soften. On an adjusted EBITDA basis, earnings declined $27 million to $130 million. The 17% decline in adjusted EBITDA is slightly better and is driven by the depreciation costs of a bigger fleet being added back. Earnings per share of $0.11 missed estimates by $0.04.

What should be kept in mind is that in June, ATSG started flying some additional Amazon capacity as contracted and that came with some additional costs such as training to fly the airplanes. As the complete fleet enters services by the end of the year, we should also see those “gear-up costs” vanish, but I don’t think it is going to be a big mover on the cost balance.

ATSG Updates Guidance On Lower CapEx Expectations And Opportunities Materializing

ATSG

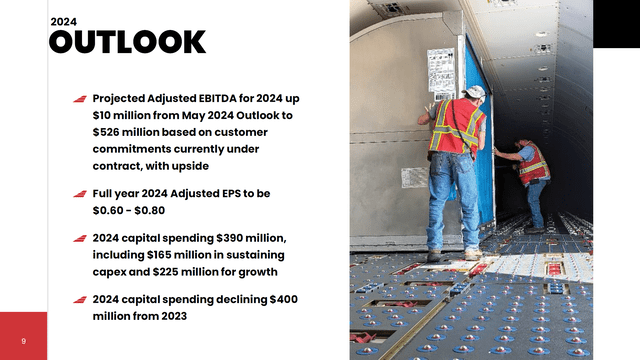

For 2024, the company is now expecting $526 million in adjusted EBITDA reflecting additional lease contracts signed, and that lift was part of $30 million in opportunities that the company sees. The EPS guidance has been lifted by $0.05 at the lower side and capex estimates have come down by $20 million to $390 million. The changes are not impressive, but they help the company through a tougher time while simultaneously also positioning for growth eventually.

ATSG To Fly Airplanes For Amazon

While the earnings beat might be a positive, I think the bigger reason for ATSG stock to trade higher is the fact that the company entered into a new agreement with Amazon (AMZN) to start flying 10 additional freighters. Operations will start in June this year and run for five years, while the existing contract has been extended by three years to March 2029 with Amazon being given an additional 2.9 million shares to purchase ATSG shares.

What Are The Risks And Opportunities For Air Transport Services Group?

The risk for ATSG is rather evident, and that is a further cooldown of demand for air freight. The air freight market is very sensitive to global economic conditions, so demand and subsequently the stock prices of companies with exposure to air freight are also sensitive to changes in the demand environment. Furthermore, when demand is subdued, we see that the company has few levers in terms of operating costs to optimize the business and relies on selling airplanes and reducing capex.

However, I do believe that Air Transport Services Group is positioned well to capitalize on long-term growth trends for e-commerce. The flights the company will execute for Amazon are a clear example of that.

Air Transport Services Group: Upgrading The Stock To Buy

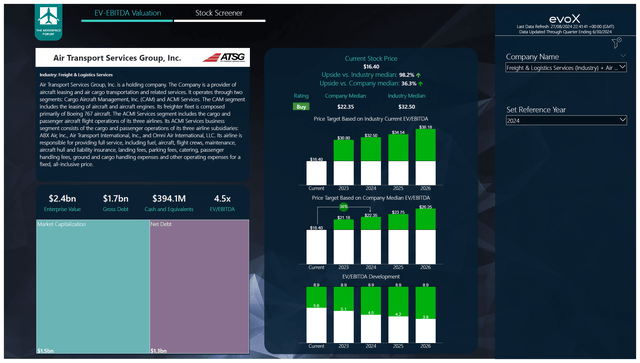

The Aerospace Forum

To determine multi-year price targets the Aerospace Forum has developed a stock screener which uses a combination of analyst consensus on EBITDA, capex and free cash flow along with the most recent balance sheet data, cash flow statements and my assumptions on debt repayment, share repurchases and dividends. Each quarter, we revisit those assumptions and update accordingly, and if need be, we supplement our own estimates if key items such as for example acquisitions are not reflected in estimates yet. The estimates are not bases on any guidance provided by the companies we cover, but by a strong combination of consensus and my own estimates.

For ATSG, the demand environment has not improved tremendously, but we’re seeing the company identify and capitalize on some opportunities in the market, and between 2024 and 2026, EBITDA is now projected to be 3% higher compared to the last projections. There remains a significant debt of around $1.6 billion, but I don’t think that the company will see major issues in refinancing the debt as the airplanes in its fleet carry a $2.8 billion book value. With that in mind, as well as the lower capex, sales opportunities for airplanes and the incremental improvements on the 2024 earnings, I rate the stock a buy and lift my price target from $18.19 to $22.35 providing 36% upside.

Conclusion: Environment Remains Complex For Air Transport Services Group

The operational environment remains complex for Air Transport Services Group. Second quarter results once again put on display an inability to decrease operating costs while revenues are coming down, so there seems to be little space to reduce costs on lower revenues. However, the contract extension and expansion with Amazon is a big deal that, I believe, will help the company increase predictability and stability in revenues. I also believe that the worst on the air freight market is behind us. The operational environment will not become easy instantly for air freight service providers, but we’re seeing signs of stabilization, and that’s likely to lead to renewed interest in leasing freighters and air freight capacity to participate in the global trade and e-commerce trends.

Our analytical model uses an array of input variables to provide a valuation and multi-year stock price target cadence based on an EV/EBITDA valuation against the company’s median EV/EBITDA multiple and the peer group multiple. Apart from a multi-year price target based on these multiples, we also score each stock with a rating system.

Read the full article here

Leave a Reply