By Jennifer Nash

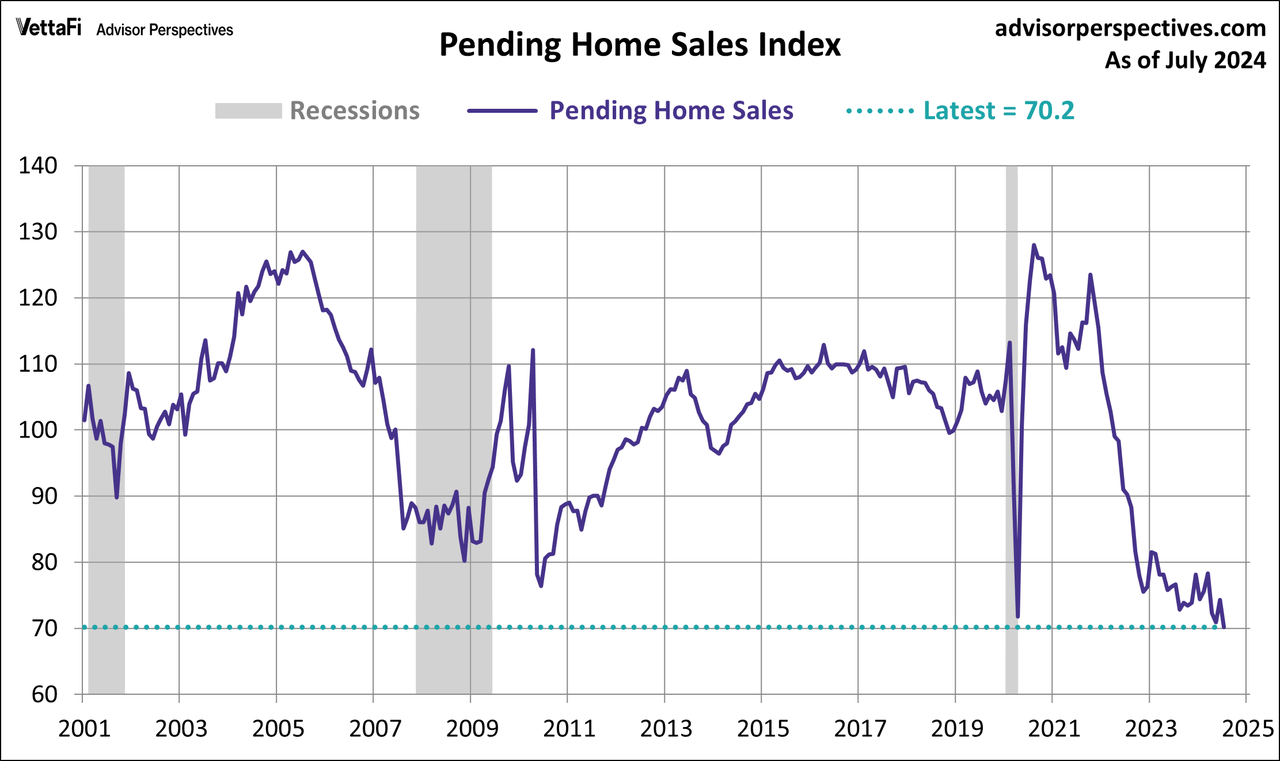

The National Association of Realtors (NAR) unexpectedly fell 5.5% in July to 70.2, its lowest level in history. Pending home sales were expected to inch up 0.2% from the previous month. The index is down 8.5% from one year ago.

“A sales recovery did not occur in midsummer,” said NAR Chief Economist Lawrence Yun. “The positive impact of job growth and higher inventory could not overcome affordability challenges and some degree of wait-and-see related to the upcoming U.S. presidential election.”

“In terms of home sales and prices, the New England region has performed relatively better than other regions in recent months,” added Yun. “Current lower, falling mortgage rates will no doubt bring buyers into market.”

Read more

Pending Home Sales Background

The pending home sales index (PHSI) was created by the National Association of Relators to track home sales where the contract is signed, but the transaction has not yet closed. An index of 100 is equal to the level of contract activity in 2001. The PHSI is a leading economic indicator of future existing home sales.

The chart below gives us a snapshot of the index since 2001, the first year data was analyzed.

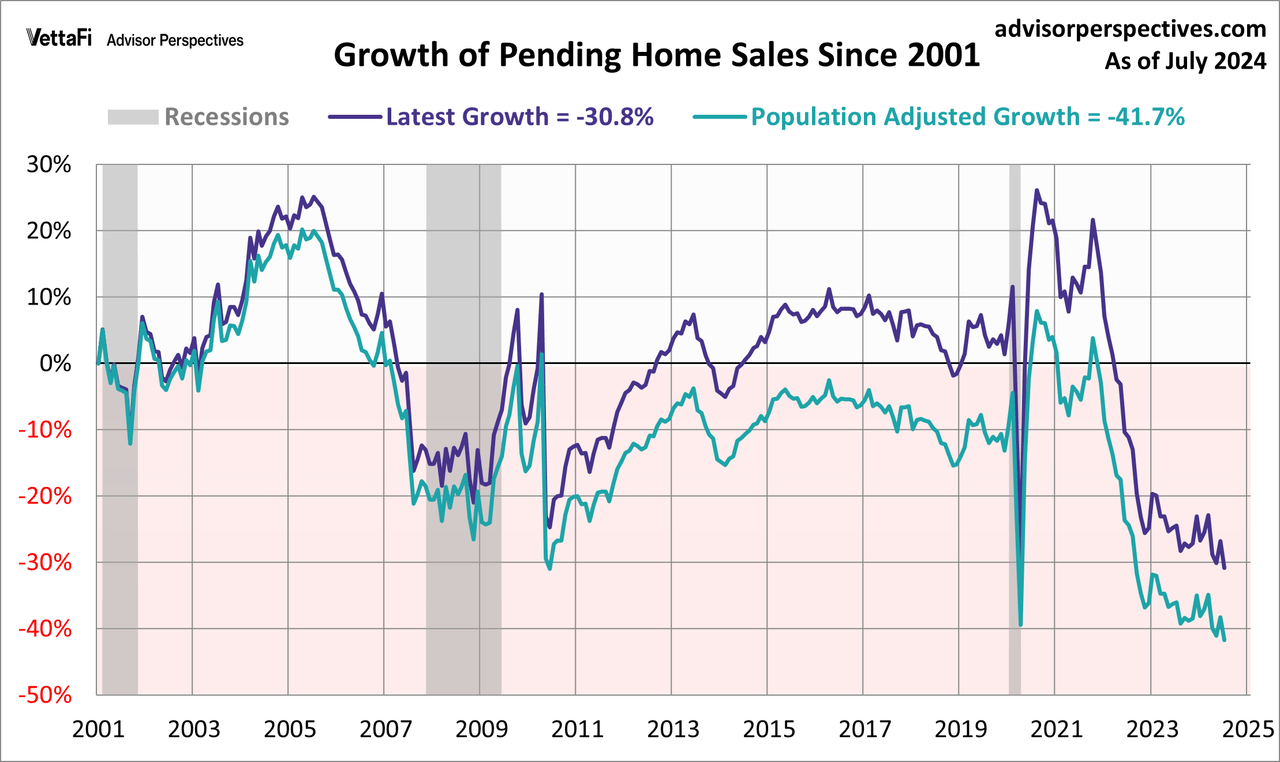

Over this time frame, the US population has grown by 18.7%. For a better look at the underlying trend, here is an overlay with the nominal index and the population-adjusted variant. The focus is pending home sales growth since 2001.

The above chart shows the percent off turn-of-the-century values. The index for the most recent month is currently 45% below its all-time high from August 2020. The population-adjusted index is 52% off its high from April 2005.

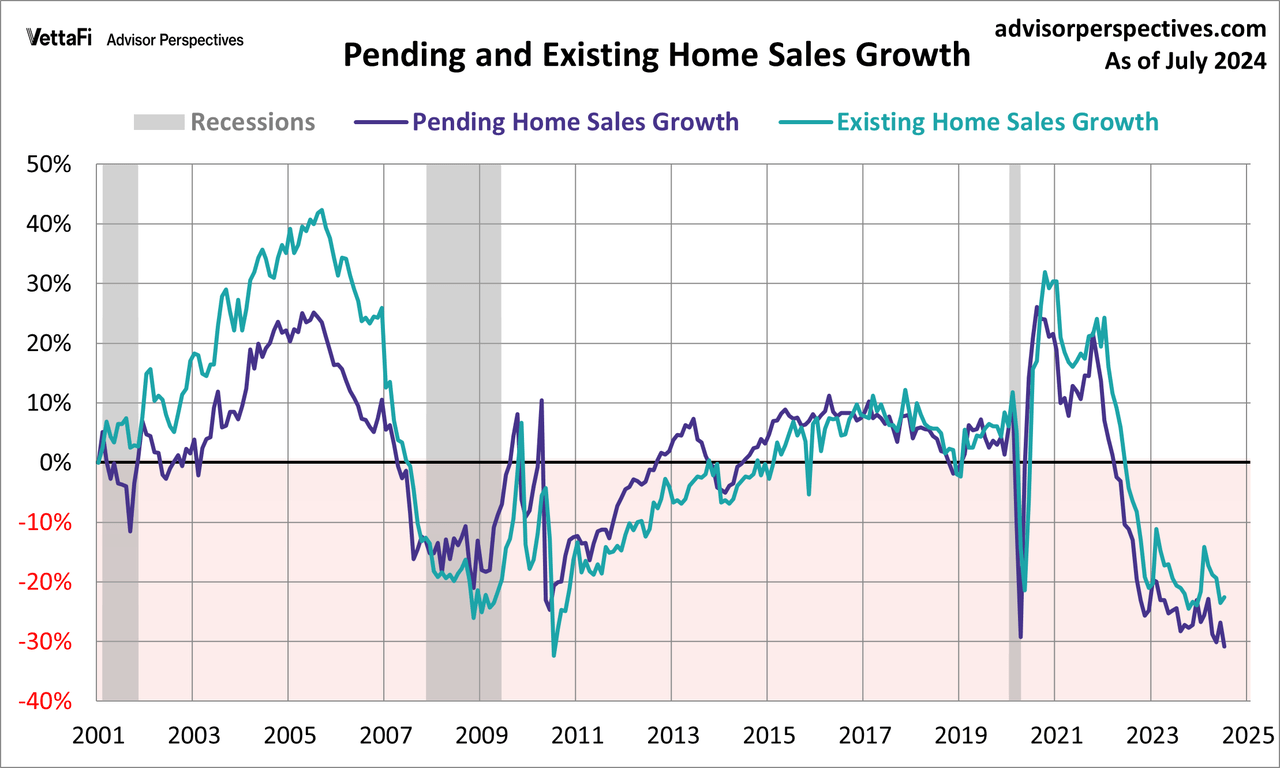

Pending Home Sales vs. Existing Home Sales

Pending home sales measures the change in number of homes under contract to be sold but still awaiting the closing transaction. Whereas existing home sales measure the number of home sales by mortgage closings. The NAR explained that “because a home goes under contract a month or two before it is sold, the Pending Home Sales Index generally leads Existing-Home Sales by a month or two.” The pending home sales index is considered a more relevant and accurate measure of the real estate market.

Here is a growth overlay of the two series. The general correlation, as expected, is close. And a close look at the numbers supports the NAR’s assessment that their pending sales series is a leading index.

ETFs associated with residential real-estate include: iShares Residential and Multisector Real Estate ETF (REZ).

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here

Leave a Reply