Amid worries of a slowing U.S. economy this year, the stock market remains afloat near all-time highs: But many companies, including and especially e-commerce stocks, are reporting poor results and seeing their share prices get whacked in return.

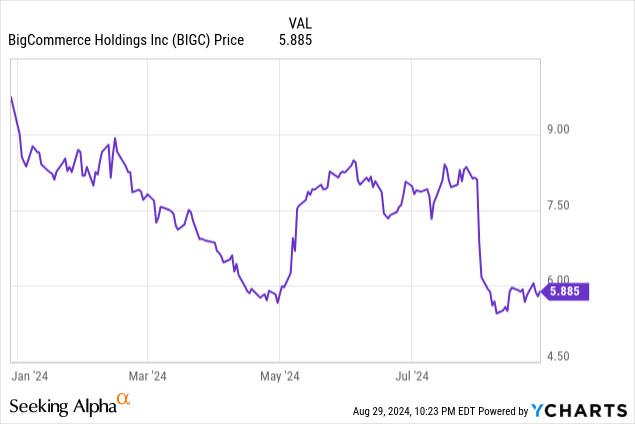

BigCommerce (NASDAQ:BIGC) is among the notable losers. The e-commerce software platform, a rival of the much larger Canadian-based Shopify (SHOP), has shed ~30% of its market value this year, with losses picking up steam after the company’s latest Q2 earnings print.

I last wrote a note on BigCommerce in June when the stock was trading closer to $8 per share, downgrading the company to a sell rating. Since then, growth rates have trended worse while BigCommerce’s guidance implies forward-looking growth dropping down to nearly nothing. As a result, I’m reiterating my sell rating on this company.

As a smaller and lesser-known vendor, BigCommerce has a large chunk of its revenue connected to small business customers. Two-thirds of its ARR is in enterprise clients, while the remaining one-third are customers using its simpler “Essentials” plan – and this portion of the customer segment is declining. Meanwhile, the enterprise segment is also slowing down. From the perspective of an enterprise buyer, it makes much less sense to invest in a mission-critical e-commerce tool like BigCommerce, whose future is uncertain, rather than a proven commodity like Shopify. In my view, BigCommerce’s poor growth trends are set to worsen.

Here are all of the core reasons to remain bearish on BigCommerce:

-

Growth has continued to decelerate without any signs of a rebound. With the exception of the most recent quarter, BigCommerce has seen revenue growth decelerate every quarter since the start of 2022. Yes, poor macro trends are partially to blame here, but it can also be argued that BigCommerce’s non-transactional revenue and subscription ARR should have held up stronger.

-

Pricing actions haven’t played out well. The company’s boost to its small-business pricing has now resulted in declining ARR in that segment.

-

Compares poorly versus Shopify – The big name in e-commerce platforms is Shopify, which is still managing to grow revenue north of 20% y/y despite being at a much larger scale than BigCommerce. This indicates a severe loss of market share, and given that e-commerce brands will want to align themselves to the best platforms that will facilitate online sales growth, this will cause a vicious cycle that will likely crush BigCommerce.

-

Maybe focusing on the wrong client segment – BigCommerce has for years tried to move upmarket into the enterprise space to boost its expansion opportunities and protect itself from the natural churn of smaller businesses. With much more prominent competitors like Shopify taking share among the bigger names, it’s likely that BigCommerce is targeting the wrong segment when it should be trying to grab share in the lower middle market space.

-

Heavy debt – BigCommerce has more debt than cash, which is rare for smaller software companies. Even though BigCommerce is making progress toward adjusted EBITDA breakeven, this debt load will be difficult for BigCommerce to overcome in a high interest rate environment.

Continue to steer clear here: there’s more room on the downside for BigCommerce.

Q2 Download

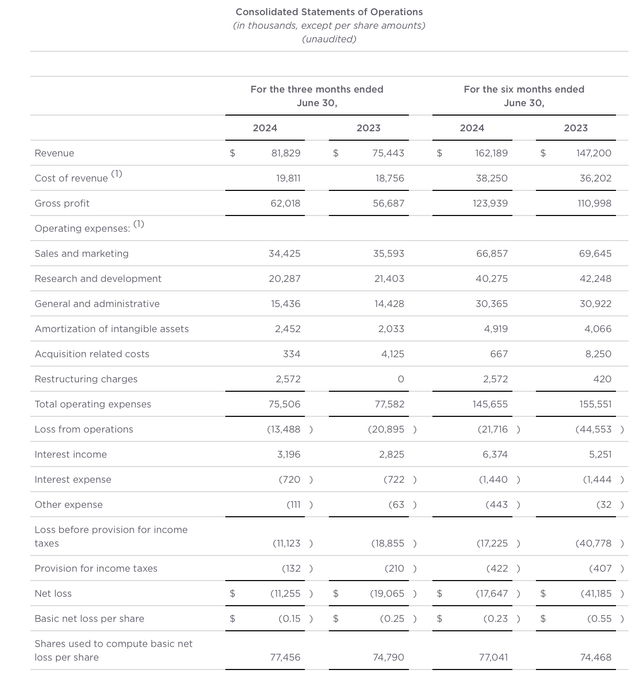

Let’s now go through BigCommerce’s latest quarterly results in greater detail. The Q2 earnings summary is shown below:

BigCommerce Q2 results (BigCommerce Q2 earnings release)

BigCommerce’s revenue grew only 8% y/y to $81.8 million, barely beating Wall Street’s expectations of $81.1 million but decelerating sharply versus Q1’s 12% y/y growth pace.

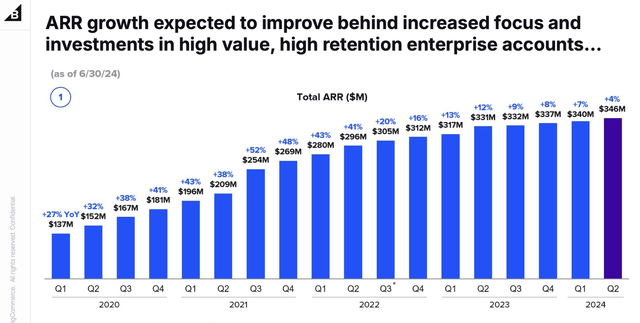

Making matters worse, BigCommerce’s ARR – its most closely watched metric and an important health indicator for a subscription software company – also slowed down to 4% y/y growth, from 7% growth in the prior quarter.

BigCommerce ARR trends (BigCommerce Q2 earnings release)

By segment, the company notes that while enterprise ARR grew 7% y/y to $254 million, in the remainder of the stack, small business ARR declined -3% y/y. The company blamed this on lapping price increases last year: which suggests that a good chunk of these accounts have churned since then.

The good news is that BigCommerce isn’t sitting stagnant while its growth slows. It has hired a new President to lead go-to-market operations, and one of the most significant changes that the company is making is to broaden its reseller ecosystem in the hope of potentially winning more deals. Per CEO Brent Bellm’s remarks on the Q2 earnings call:

I’d now like to provide an update to the go-to-market changes and improvements we’re making under the leadership of our new President, Travis Hess. Under Travis, we have unified end-to-end ownership of the customer, including acquisition, satisfaction, and growth. As a result, we’re improving operational processes and metrics to drive customer retention, success, and expansion. We’re seeing encouraging results in multi-product sales, inclusive of our core e-commerce platform, Feedonomics, Makeswift, and the products and services of our partner ecosystem. Gross and net retention rates are pacing well against our internal plans. We’re excited by gains already achieved in go-to-market efficiency and cohesion, and we expect continued improvements in the quarters ahead.

In terms of customer acquisition, we’re improving the targeting and efficiency of marketing spend by refining our ideal customer profile definitions. Leveraging Travis’s background from Accenture, we’re expanding our network of global systems integrator partnerships, building on existing relationships such as WPP and EPAM. We have stabilized our small business segment and are improving our ability to help small businesses grow into our enterprise offering. We are streamlining our revenue operations capabilities to drive go-to-market effectiveness and transparency on spend ROI. We are more tightly integrating BigCommerce, Feedonomics, and Makeswift teams to improve cross-sell results.”

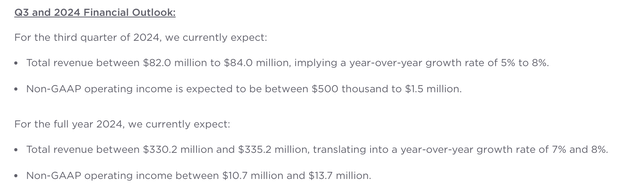

Unfortunately, the company is pointing to near-term results getting worse before they get better. For the third quarter, BigCommerce’s guidance points to revenue growth of 5-8% y/y, decelerating up to three points versus this quarter’s results:

BigCommerce outlook (BigCommerce Q2 earnings release)

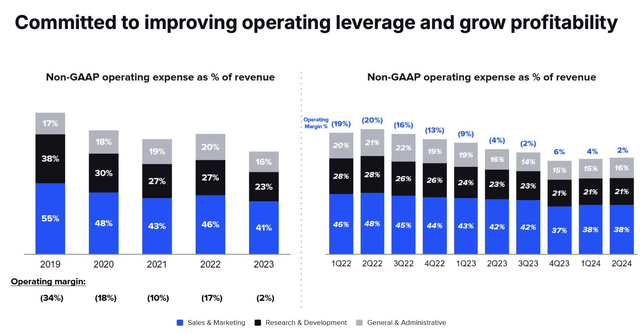

We also lament the fact that profitability isn’t improving much. Pro forma operating margins in Q2 were 2%, which improved six points y/y but were down 2 points sequentially relative to Q1.

BigCommerce operating margins (BigCommerce Q2 earnings release)

With much slower top-line growth and considerable go-to-market investments in place, the company’s opportunity to expand its margin profile will be limited going forward.

Valuation and Key Takeaways

The one and only allure to BigCommerce is its cheap valuation. At current share prices below $6, BigCommerce trades at a market cap of $457.2 million. After we net off the $275.9 million of cash and $340.5 million of debt on BigCommerce’s latest balance sheet, the company’s resulting enterprise value is $521.8 million.

This puts BigCommerce at a valuation of 1.6x EV/FY24 revenue. Low single-digit multiples of revenue are certainly difficult to find in today’s market, but considering BigCommerce is barely growing as well as the fact that it’s overshadowed by a much more prominent competitor in Shopify, I’d consider this stock a value trap.

Continue to avoid this name and invest elsewhere.

Read the full article here

Leave a Reply