August was a rollercoaster for investors. Markets started the month blindsided by a large move downward that included a one-day over 1,000-point loss in the Dow. The ‘fear index‘ or S&P VIX Index (VIX) briefly rose over 60 for the first time in more than four years early in August, as shown in the chart below. At its nadir, the market rout took the NASDAQ into correction territory for a nanosecond with just north of a 10% loss. The S&P 500 was off just over seven percent, and the Dow fell over five percent.

Seeking Alpha

However, calm and complacency quickly returned to the market as the probability that the Federal Reserve would start cutting interest rates at its September FOMC meeting became a near ‘lock‘. By the end of the month, the Dow was at an all-time high. The S&P 500 ended up having a 2.3% gain for August and even the NASDAQ ended the month barely in the black (up .7%). Here is how all 11 sectors of the S&P fared for the month.

#1: Consumer Staples +5.78%, and The Consumer Staples Select Sector SPDR® Fund ETF (XLP) +5.99%.

#2: Real Estate +5.64%, and The Real Estate Select Sector SPDR® Fund ETF (XLRE) +5.73%.

#3: Health Care +4.99%, and The Health Care Select Sector SPDR® Fund ETF (XLV) +5.06%.

#4: Financials +4.36%, and The Financial Select Sector SPDR® Fund ETF (XLF) +4.57%.

#5: Utilities +4.29%, and The Utilities Select Sector SPDR® Fund ETF (XLU) +4.81%.

#6: Industrials +2.67%, and The Industrial Select Sector SPDR® Fund ETF (XLI) +2.82%.

#7: Materials +2.22%, and The Materials Select Sector SPDR® Fund ETF (XLB) +2.32%.

#8: Communication Services +1.23%, and The Communication Services Select Sector SPDR® ETF Fund (XLC) +1.78%.

#9: Information Technology +1.16%, and The Technology Select Sector SPDR® Fund ETF (XLK) +0.70%.

#10: Consumer Discretionary -1.08%, and The Consumer Discretionary Select Sector SPDR® Fund ETF (XLY) -0.20%.

#11: Energy -2.32%, and The Energy Select Sector SPDR® Fund ETF (XLE) -2.07%.

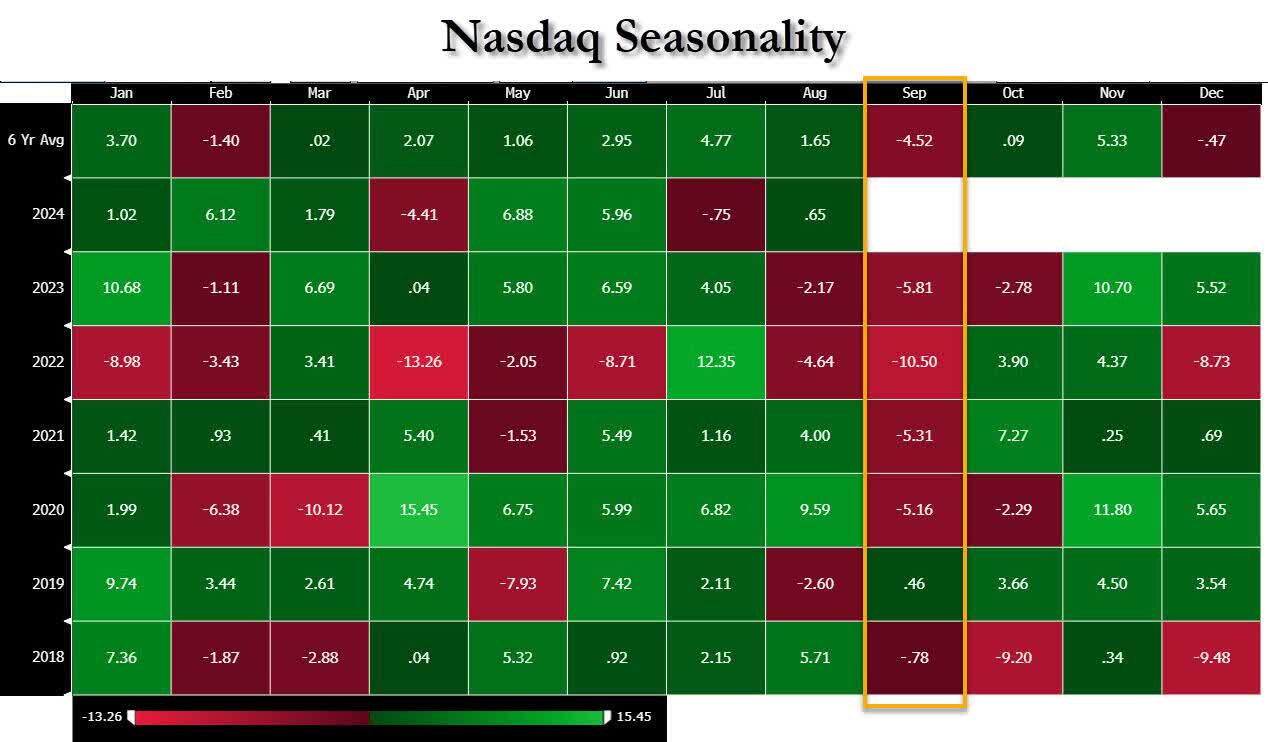

I put out my five market predictions for September, the weakest month historically for equities, last week. However, before we close the books in August, here are four parting thoughts on the month.

Job Picture Is Darkening:

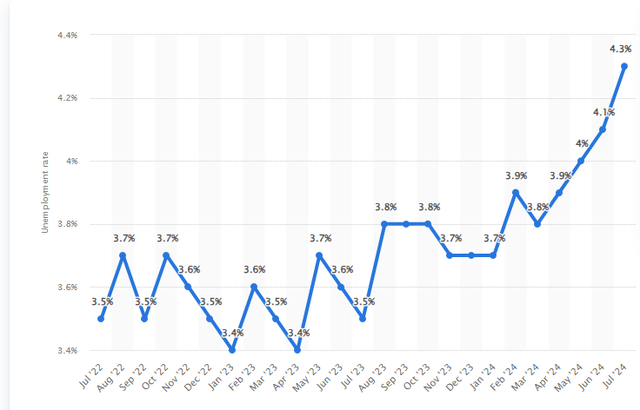

Investors knew the jobs market was slowing coming into August. Job openings had hit a three-year low in June, which didn’t take into account the significant rise of ‘ghost jobs‘ in recent years. The unemployment had slowly ticked up from 3.5% last summer to 4.1% in the June BLS jobs report.

U.S. Monthly Unemployment Rate (Statista)

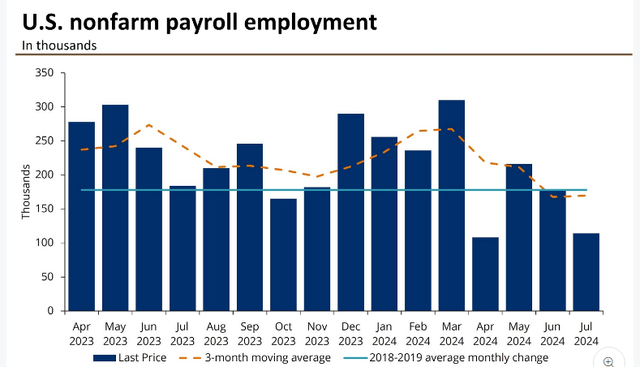

However, the jobs market looks like it may have significantly deteriorated more than investors had expected, given some key readings in August. On the second day of the month, the July BLS jobs report hit the wires just before the markets opened. It was dismal, showing only 114,000 positions created in July, 60,000 below the consensus. The previous two months’ job numbers were also revised down.

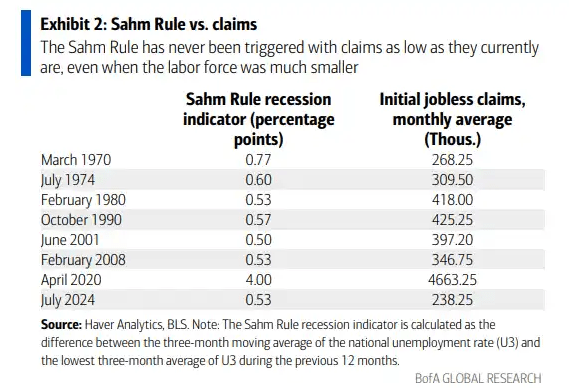

Bank of America Global Research

And importantly, the unemployment rate ticked up sharply to 4.3%. This violated the Sahm Rule, something that can be used to predict upcoming recessions. This was of one of the factors for the deep sell-off in the markets early in August.

Bloomberg

Then on August 21st, the BLS announced that its previous estimate of jobs created between March 2023 and March 2024 would be revised down by a whopping 818,000 positions or 31% off its previous projection. Given increasing worries about the jobs market, the August BLS jobs report is going to be a critical data point when it comes out just before the bell on Friday, September 6th. Investors don’t want a blowout number that could cause any sort of uncertainty about the Federal Reserve cutting rates at their September FOMC meeting. Nor is another weak report that could move the central bank to enact a 50bps cut from the current 25bps rate reduction modeled. This would smack of desperation and could set off some panic in the markets. Investors want a jobs number that meets or slightly exceeds the consensus.

Investors Remain Complacent:

As mentioned in the opening paragraph, there was a huge spike up in volatility and fear at the beginning of August. The VIX briefly breached the 60 level for the first time since the Covid pandemic shut down the country. However, fear quickly dissipated and the VIX ended August at just the 15 level.

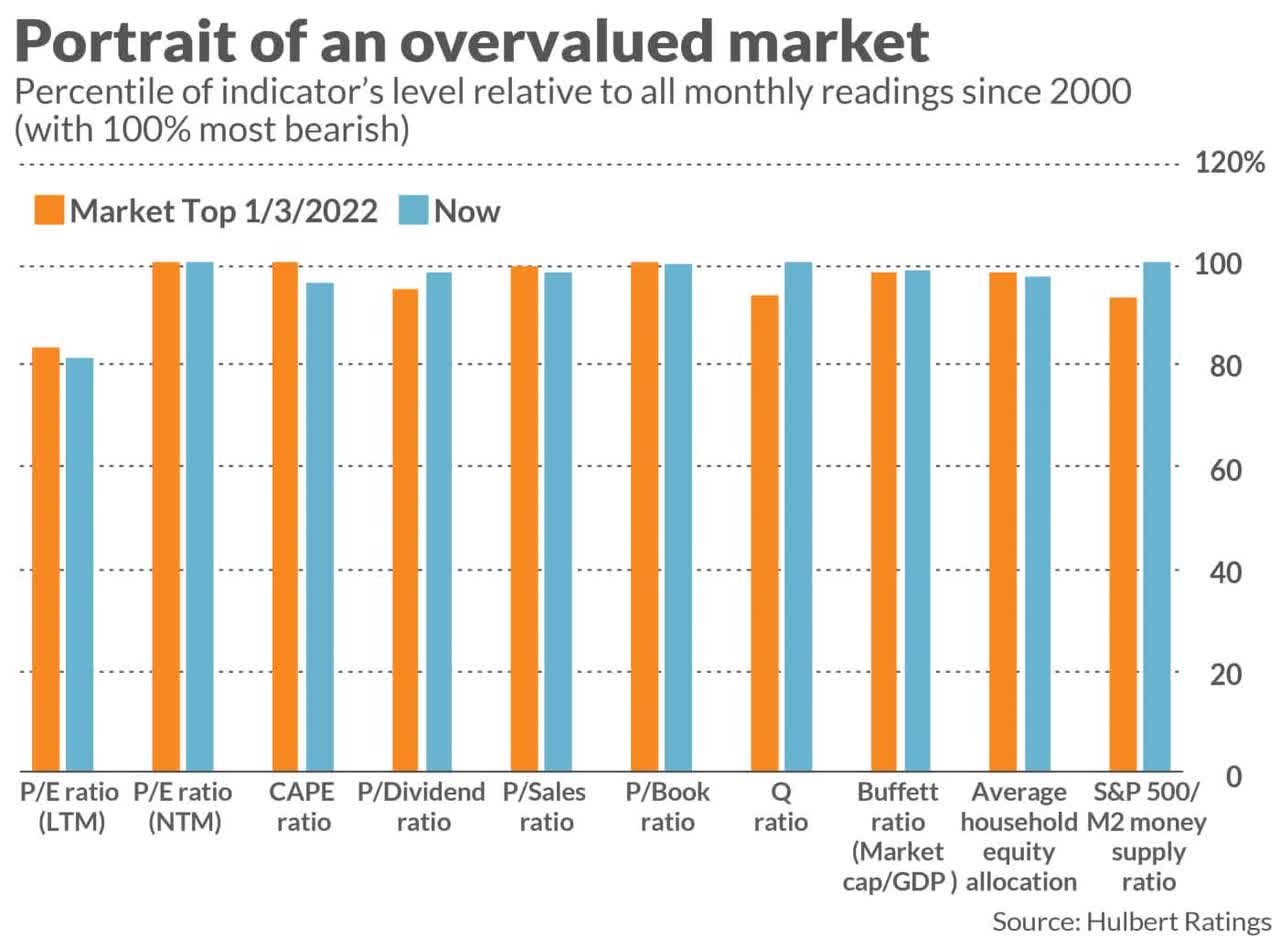

Hulbert Ratings/MarketWatch

However, by many measures, the valuation of the market is as high or higher than at the beginning of 2022. This was just before the NASDAQ lost a third of its value during that year and the S&P fell just over 18%, including dividends. Even when the Federal Reserve starts cutting the Fed Funds rate, note that it will still be much higher than it was throughout 2022.

AI Story Is Losing Some Luster:

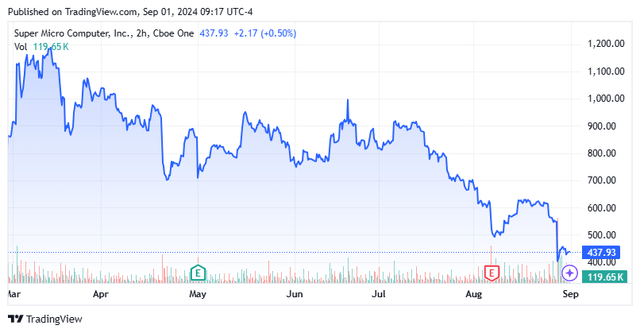

The AI revolution has been a key driver of the market rally throughout 2024. However, two of the key horsemen behind the paradigm shift pushing the markets higher got dinged in August.

Seeking Alpha

First, the luster continued to come off Super Micro Computer, Inc. (SMCI). The stock has shown some weakness for several months, but really plunged in August. The stock’s demise was helped along by a new short report by Hindenburg Research and the company announcing there would be a delay in filing its 10-K report last week.

Seeking Alpha

As a sign of how bubbly the AI rally had gotten, last Wednesday the stock of AI juggernaut NVIDIA Corporation (NVDA) dropped over six percent on the day despite better-than-expected Q2 results, upwardly revised guidance and a new $50 billion stock buyback. In addition, it is a good bet that NVDA’s margins have peaked.

The question for investors in September is whether this is just a blip on the road for the AI rally, or the start of a period of consolidation or further decline. If the latter, where will new market leadership come from?

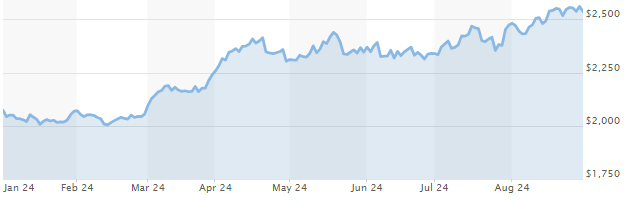

Gold Is Still Shining:

Gold price per ounce (MarketWatch)

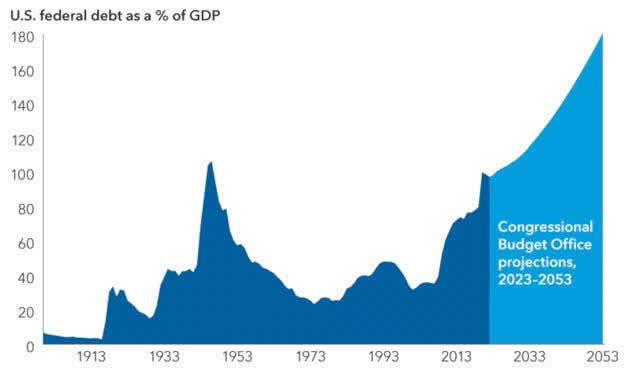

Gold continued to move up in August as it has all year. It ended the month at around $2,535 an ounce, not too far from its highs hit earlier in the month. It is hard not to see the appeal of the yellow metal right now. The federal government continues to spend like drunken sailors even as the U.S. debt-to-GDP ratio is at its highest level in the country’s history. The fiscal deficit will once again come in north of 6% of annual GDP, and during an economic expansion. With two months to go, the fiscal deficit for the government’s 2024 fiscal year stands at $1.52 billion. The dollar has also lost more than 20% of its buying power since 2021 thanks to inflation.

CBO/Capital Economics

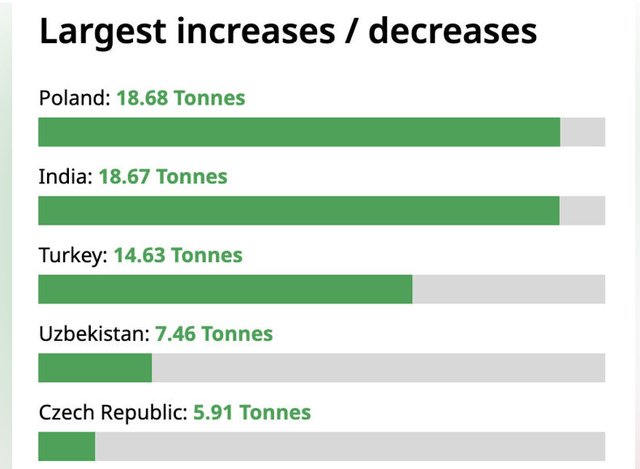

Even some central banks are upping their purchases of gold. Here are the reserve banks of countries who made the biggest purchases of gold in the second quarter of this year.

Jerusalem Post

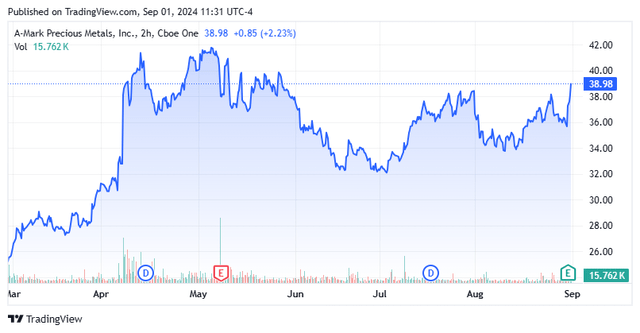

I have built up decent-sized positions in two gold-related stocks via covered call orders in recent months. They are gold miner Newmont Corporation (NEM) and A-Mark Precious Metals, Inc. (AMRK). NEM rose 12% in August and AMRK was up nine percent in trading on Friday after posting preliminary quarterly results just after the bell on Thursday. The stock is now up 20% since I gave this name a ‘thumbs up’ in April, not including dividends.

Seeking Alpha

And those are some thoughts around the month of August as trading commences in September. One final note as we start a new trading month, the last few Septembers have not been kind to investors, especially to those in the NASDAQ, as can be seen below.

ZeroHedge

Read the full article here

Leave a Reply