Investment Thesis

Even though investing in the S&P 500 ETF (NYSEARCA:SPY) (NYSEARCA:SPY) offers several benefits for investors, its Dividend Yield [TTM] of 1.21% and 5-Year Weighted Average Dividend Growth Rate [CAGR] of 5.76% provides limited potential for dividend income and dividend growth.

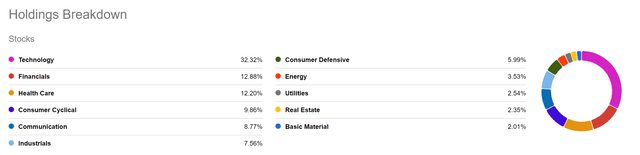

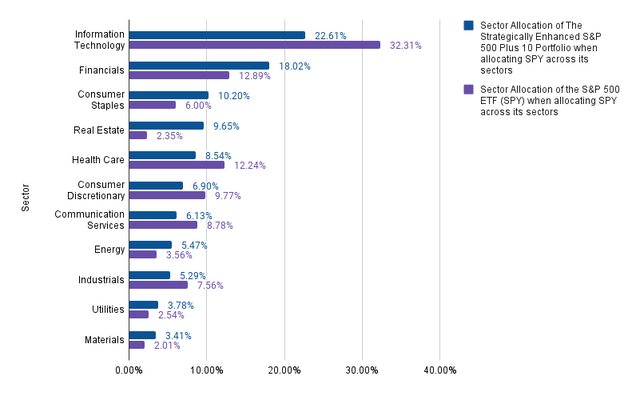

Additionally, the S&P 500 ETF (SPY) is heavily invested in the Information Technology Sector, representing 32.32%. This indicates an elevated sector-specific concentration risk for investors that solely invest in SPY.

In contrast, other sectors such as the Materials Sector (2.01% of SPY), the Real Estate Sector (2.35%), the Utilities Sector (2.54%), and the Energy Sector (3.53%) represent a relatively low proportion.

Have you ever considered strategically enhancing your S&P 500 ETF core position with individual dividend paying companies from underrepresented sectors to achieve an increased dividend income and reduced overall risk level?

The main objective of today’s article is to show you how to allocate 10 carefully selected dividend paying companies to enhance your S&P 500 ETF core position, aiming to reach enhanced dividend income, a broader portfolio diversification, reduced company-specific and sector-specific concentration risk, and an additional geographical diversification when compared to only investing in the S&P 500 ETF (SPY).

Within this article, I will refer to three different portfolios:

- S&P 500 ETF (SPY): A hypothetical portfolio that only consists of SPY.

- The Strategically Enhanced S&P 500 Plus 10 Portfolio: A hypothetical portfolio which holds SPY as a core position in addition to 10 dividend paying companies for broader diversification, and an increased ability to produce dividend income.

- The Dividend Income Accelerator Portfolio: An actual portfolio that involves real money, which I am constructing and documenting on Seeking Alpha. The portfolio balances dividend income and dividend growth, and allows investors to invest with a reduced level of risk, in addition to offering an extensive diversification across sectors and industries.

Overview of the S&P 500 ETF (SPY)

Holdings Breakdown

With a proportion of 32.32%, the Technology Sector is by far the largest sector within the S&P 500 ETF (SPY). The second and third largest sectors are the Financials Sector (with 12.68%), and the Health Care Sector (with 12.20%).

The high proportion of the Technology Sector represents an elevated sector-specific concentration risk for investors who only invest in the S&P 500.

Source: Seeking Alpha

By incorporating companies from sectors which are underrepresented within SPY, we aim to reduce this sector-specific concentration risk within The Strategically Enhanced S&P 500 Plus 10 Portfolio when compared to only investing in SPY.

The sectors which are underrepresented within the S&P 500 are the Basic Materials Sector (2.01%), the Real Estate Sector (2.35%), the Utilities Sector (2.54%), the Energy Sector (3.53%), and the Consumer Defensive Sector (5.99%).

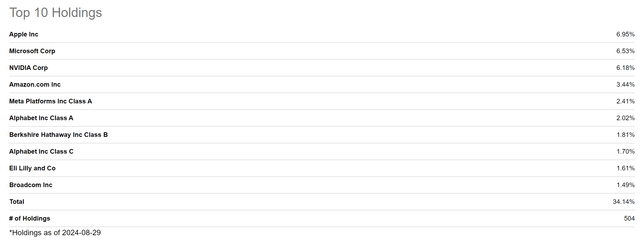

Top 10 Holdings

With a proportion of 6.95%, Apple (NASDAQ:AAPL) is the largest position of SPY, followed by Microsoft (NASDAQ:MSFT) (6.53%), and NVIDIA (NASDAQ:NVDA) (6.18%).

Source: Seeking Alpha

The relatively high percentage of the three largest positions represents an increased company-specific concentration risk for investors. By adding additional companies to The Strategically Enhanced S&P 500 Plus 10 Portfolio, we are aiming to further reduce its company-specific concentration risk.

I have selected the following 10 dividend paying companies in addition to the S&P 500 ETF (SPY) for The Strategically Enhanced S&P 500 Plus 10 Portfolio:

- The Toronto-Dominion Bank (NYSE:TD, TSX:TD:CA)

- Altria (NYSE:MO)

- Rio Tinto Group (NYSE:RIO)

- NextEra Energy (NYSE:NEE)

- HSBC (NYSE:HSBC)

- Nestlé (OTCPK:NSRGY)

- Realty Income (NYSE:O)

- NNN REIT (NYSE:NNN)

- Ares Capital (NASDAQ:ARCC)

- Canadian Natural Resources (NYSE:CNQ)(TSX:CNQ:CA)

I have chosen Realty Income and NNN REIT not only to increase the proportion of the Real Estate Sector when compared to only investing in SPY, but also because both effectively combine dividend income and dividend growth, enhancing the portfolio’s ability to generate dividend income.

I have allocated 4% to each Realty Income and NNN REIT, ensuring that they are overweighted due to their lower risk level and the fact I consider both to be currently undervalued.

Through this strategic allocation approach, we have raised the proportion of the Real Estate Sector from 2.35% (when investing solely in the S&P 500 ETF (SPY)) to 9.65% within The Strategically Enhanced S&P 500 Plus 10 Portfolio. This will naturally reduce the proportion of the Information Technology Sector, thus lowering the sector-specific concentration risk.

I have not allocated more than 4% to any single position to ensure that Apple and Microsoft still account for the largest proportion of the portfolio, ensuring an optimized risk-reward profile.

The Toronto-Dominion Bank and Canadian Natural Resources have been selected for the portfolio since they effectively blend dividend income and dividend growth, and to further ensure geographical diversification.

Ares Capital and HSBC have been selected given their ability to produce dividend income, underscored by their Dividend Yields [TTM] of 9.18% and 6.86%, respectively. This allows us to raise the portfolio’s Weighted Average Dividend Yield.

Nestlé has been selected as it will enhance the portfolio’s geographical diversification, in addition to its ability to reduce portfolio volatility (underlined by a 60M Beta Factor of 0.56). Additionally, the company will contribute to increasing the proportion of the defensive Consumer Staples Sector.

Altria has been incorporated due to its ability to produce dividend income (evidenced by its Dividend Yield [TTM] of 7.29%) and to further enhance the proportion of the Consumer Staples Sector. This allows us to further reduce the proportion of the Information Technology Sector compared to only investing in the S&P 500 ETF (SPY).

NextEra Energy has been included due to its capacity to contribute to the portfolio’s dividend growth potential (underlined by its 5-Year Dividend Growth Rate [CAGR] of 10.62%), and to raise the proportion of the Energy Sector (which has a proportion of only 3.53% within the S&P 500 ETF (SPY)).

Rio Tinto has been chosen to contribute to raising the Weighted Average Dividend Yield of this portfolio (evidenced by its Dividend Yield [TTM] of 6.88%) and to further increase the proportion of the Materials Sector (which holds only 2.01% of SPY).

Due to the company’s elevated risk level, I have only allocated 2% to Rio Tinto. This is because I do not consider its dividend to be entirely safe. Such an approach helps us to lower the risk level, ensuring that a dividend reduction would have a limited impact on the portfolio’s investment outcomes.

Overview of the Composition of The Strategically Enhanced S&P 500 Plus 10 Portfolio

|

Symbol |

Name |

Sector |

Industry |

Country |

Market Cap in $B |

Dividend Yield [TTM] |

Dividend Growth 5 Yr [CAGR] |

Allocation |

|

SPY |

S&P 500 ETF (SPY) |

ETF |

ETF |

United States |

1.21% |

4.76% |

70.00% |

|

|

TD |

The Toronto-Dominion Bank |

Financials |

Diversified Banks |

Canada |

104.8 |

4.94% |

6.88% |

3.00% |

|

MO |

Altria |

Consumer Staples |

Tobacco |

United States |

91.7 |

7.29% |

4.14% |

3.00% |

|

RIO |

Rio Tinto Group |

Materials |

Diversified Metals and Mining |

United Kingdom |

106.8 |

6.88% |

5.62% |

2.00% |

|

NEE |

NextEra Energy |

Utilities |

Electric Utilities |

United States |

165.4 |

2.50% |

10.62% |

2.00% |

|

HSBC |

HSBC |

Financials |

Diversified Banks |

United Kingdom |

1239.2 |

6.86% |

3.65% |

3.00% |

|

NSRGY |

Nestlé |

Consumer Staples |

Packaged Foods and Meats |

Switzerland |

282.0 |

3.07% |

6.23% |

3.00% |

|

O |

Realty Income |

Real Estate |

Retail REITs |

United States |

54.1 |

4.98% |

3.55% |

4.00% |

|

NNN |

NNN REIT |

Real Estate |

Retail REITs |

United States |

8.6 |

4.84% |

2.46% |

4.00% |

|

ARCC |

Ares Capital |

Financials |

Asset Management and Custody Banks |

United States |

13.3 |

9.18% |

3.97% |

3.00% |

|

CNQ |

Canadian Natural Resources |

Energy |

Oil and Gas Exploration and Production |

Canada |

76.9 |

4.06% |

22.38% |

3.00% |

|

2.49% |

5.42% |

100.00% |

Source: The Author, data from Seeking Alpha

Risk Analysis of The Strategically Enhanced S&P 500 Plus 10 Portfolio

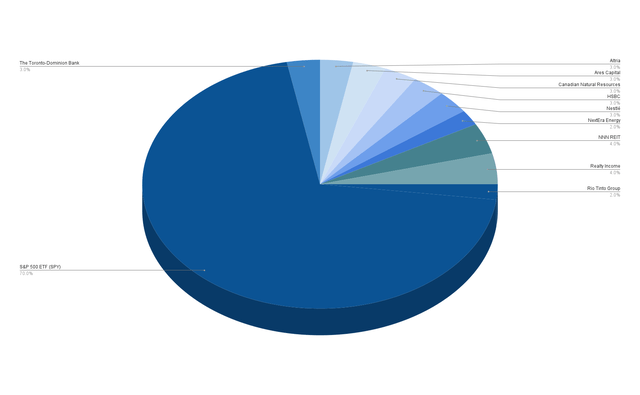

Risk Analysis of the Portfolio Allocation per Company/ETF

Through the inclusion of 10 individual companies next to the S&P 500 ETF (SPY) position, SPY accounts for 70% of The Strategically Enhanced S&P 500 Plus 10 Portfolio.

Realty Income and NNN REIT are the largest individual positions, each representing 4% of the overall portfolio.

NextEra Energy and Rio Tinto account for 2% of the portfolio each. All other companies represent 3% of the overall portfolio each.

Source: The Author

By allocating less than 5% to an individual position, we ensure a reduced company-specific concentration risk, and a reduced overall risk level for our portfolio.

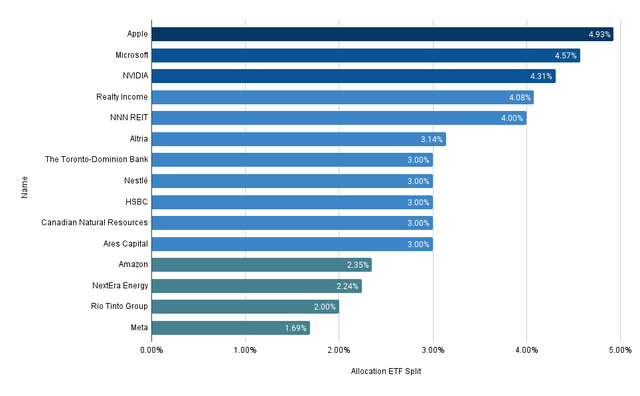

Risk Analysis of the Portfolio’s Company-Specific Concentration Risk When Distributing SPY Across its Sectors

The chart below illustrates the company specific concentration risk of The Strategically Enhanced S&P 500 Plus 10 Portfolio when allocating SPY across the companies it is invested in. The chart shows all companies that represent more than 1.5% of the overall portfolio.

Source: The Author, data from Morningstar and Seeking Alpha

Due to the inclusion of the 10 individual companies, we have slightly lowered the proportion the three S&P 500 ETF (SPY) top holdings Apple, Microsoft and NVIDIA hold on the overall portfolio, thus reducing the company-specific concentration risk.

The proportion of the Apple position has decreased from 6.95% (in the S&P 500 ETF (SPY)) to 4.93%, while the share of the Microsoft position has gone down from 6.53% to 4.57%, and the NVIDIA position has lowered from 6.18% to 4.31%.

Due to the careful selection process of the selected 10 dividend paying companies, we have ensured that none of the previously mentioned companies represents more than 5% of the overall portfolio, even when distributing SPY across the companies it is invested in. This further indicates a reduced company-specific concentration risk for the portfolio.

Maintaining Apple (with 4.93%) and Microsoft (4.57%) as the two largest positions of this portfolio is appropriate from my perspective, given the companies’ reduced risk level, their financial robustness, and their strong competitive advantages (including their broad product portfolios), evidencing their attractive risk-reward profile.

Risk Analysis of the Portfolio’s Sector-Specific Concentration Risk When Distributing SPY Across its Sectors

Due to a careful selection process, we have significantly lowered the proportion this portfolio holds on the Information Technology Sector when compared to solely investing in the S&P 500 ETF (SPY).

The Information Technology Sector represents 32.31% of SPY. By incorporating companies from sectors that are underrepresented within SPY, we decrease this proportion to 22.61% within the Strategically Enhanced S&P 500 Plus 10 Portfolio. Doing so ensures a reduced sector-specific concentration risk within this portfolio compared to SPY.

While the Materials Sector only accounts for 2.01% of SPY, it makes up 3.41% of The Strategically Enhanced S&P 500 Plus 10 Portfolio. The proportion of the Utilities Sector has been raised from 2.54% to 3.78% and the share of the Energy Sector has increased from 3.56% to 5.47%.

Through the inclusion of companies such as Realty Income and NNN REIT, we have significantly increased the proportion of the Real Estate Sector (from 2.35% to 9.65%), further enhancing portfolio diversification.

In addition to that, it is worth highlighting that we have further reduced the risk level due to the inclusion of companies from the Consumer Staples Sector (such as Altria and Nestlé), increasing the proportion of the defensive Consumer Staples Sector from 6.00% to 10.20%.

Source: The Author, data from Morningstar and Seeking Alpha

Risk Analysis: The 10 Individual Positions of The Strategically Enhanced S&P 500 Plus 10 Portfolio

The 60M Beta Factors of The 10 Individual Positions

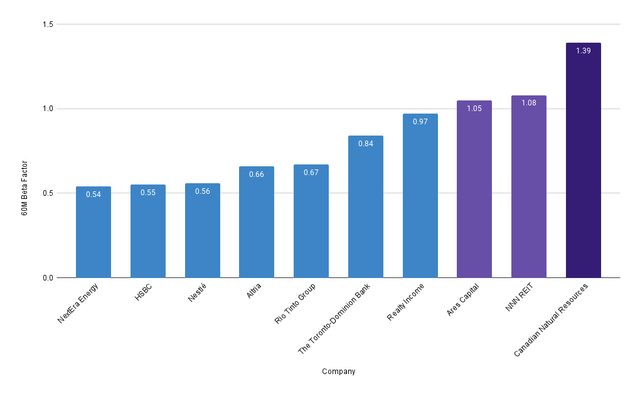

I have predominantly added companies with low 60M Beta Factors to this portfolio. Doing so helps us to further reduce the volatility of The Strategically Enhanced S&P 500 Plus 10 Portfolio compared to solely investing in SPY.

Seven from the 10 individually selected companies have a 60M Beta Factor below 1, indicating that they can effectively contribute to reducing portfolio volatility.

NextEra Energy (60M Beta Factor of 0.54), HSBC (0.55), Nestlé (0.56), Altria (0.66), and Rio Tinto Group (0.67) are the companies that most contribute to the reduction of the portfolio’s volatility.

Source: The Author, data from Seeking Alpha

The Dividend Yield [TTM] of The 10 Individual Positions

When selecting the individual positions for this portfolio, I particularly focused on companies that can contribute to the generation of dividend income, increasing the dividend payments you would receive when compared to investing in an S&P 500 ETF alone.

It is worth highlighting that Ares Capital (with a Dividend Yield [TTM] of 9.18%), Altria (7.29%), Rio Tinto Group (6.88%), and HSBC (6.86%) contribute most to the income generation of this portfolio.

Source: The Author, data from Seeking Alpha![Dividend Yield [TTM]](https://ibudgettingsmart.com/wp-content/uploads/2024/09/55029283-17254425239074514.png)

The 5-Year Dividend Growth Rate [CAGR] of The 10 Individual Positions

Due to the careful selection process of the 10 additional companies for this portfolio, I have further ensured its dividend growth potential, helping you to annually increase your dividend income to a significant degree.

It is worth mentioning that Canadian Natural Resources (with a 5-Year Dividend Growth Rate [CAGR] of 22.38%) and NextEra Energy (10.62%) contribute in particular to the dividend growth potential of this portfolio.

Source: The Author, data from Seeking Alpha![5-Year Dividend Growth Rate [CAGR]](https://ibudgettingsmart.com/wp-content/uploads/2024/09/55029283-17254355158557217.png)

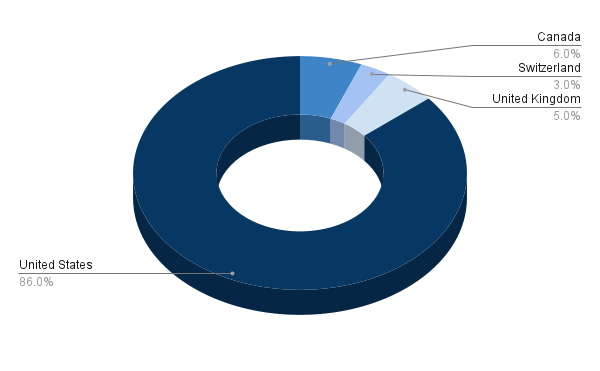

The Geographical Diversification of The Strategically Enhanced S&P 500 Plus 10 Portfolio

When compared to investing solely in the S&P 500 ETF (SPY), we have further diversified The Strategically Enhanced S&P 500 Plus 10 Portfolio geographically, including companies from Canada (Canadian Natural Resources and The Toronto-Dominion Bank with 3% each), United Kingdom (Rio Tinto Group with 2% and HSBC with 3%), and Switzerland (Nestlé with 3%).

With 86%, companies from the U.S. still represent by far the largest proportion when compared to the overall portfolio, ensuring our strong focus on the U.S., which offers us the world’s most attractive companies in terms of risk and reward.

Source: The Author

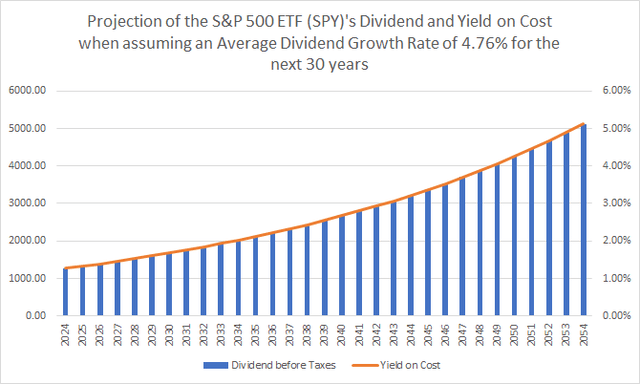

Projection of the Dividend and Yield on Cost of the S&P 500 ETF (SPY)

The S&P 500 ETF (SPY) offers investors a Dividend Yield [TTM] of 1.21%, along with a 5-Year Dividend Growth Rate [CAGR] of 4.76%.

The graphic below illustrates a projection of SPY’s dividend before taxes and Yield on Cost when assuming that you would invest the total amount of $100,000 and assuming an Average Dividend Growth Rate of 4.76% for the following 30 years (based on its 5-Year Dividend Growth Rate [CAGR]).

You could potentially reach a Yield on Cost of 2.02% in 2034, 3.22% in 2044, and 5.12% in 2054. These numbers show that solely investing in an S&P 500 ETF might not be the best option for investors aiming to generate dividend income.

Source: The Author

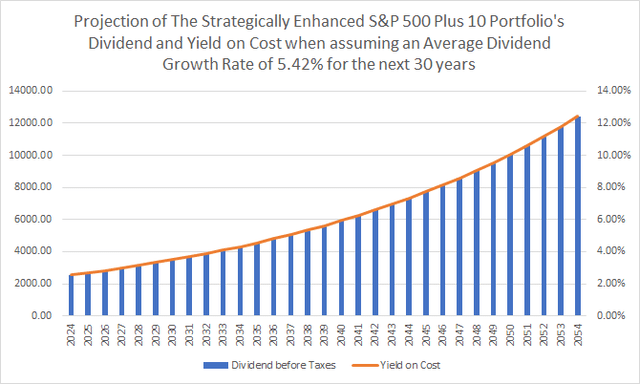

Projection of the Dividend and Yield on Cost of The Strategically Enhanced S&P 500 Plus 10 Portfolio

The Strategically Enhanced S&P 500 Plus 10 Portfolio offers investors a Weighted Average Dividend Yield [TTM] of 2.49%, and a 5-Year Weighted Average Dividend Growth Rate [CAGR] of 5.42%.

The chart below shows a projection of the portfolio’s dividend before taxes and Yield on Cost when assuming that you would invest the amount of $100,000 and assuming an Average Dividend Growth Rate of 5.42% per year for the following 30 years.

You could potentially reach a Yield on Cost of 4.32% in 2034, 7.33% in 2044 and 12.42% in 2054.

Source: The Author

Even though this mix of dividend income and dividend growth is superior to what you could potentially reach with an investment in the S&P 500 ETF (SPY), the numbers are still far from effectively mixing dividend income and dividend growth.

The Dividend Income Accelerator Portfolio, which blends dividend income and dividend growth while providing investors with a reduced risk level, offers a significantly superior mix of dividend income and dividend growth potential.

Therefore, investors who are interested in an even more dividend-focused oriented investment approach might follow a similar investment approach to The Dividend Income Accelerator Portfolio.

The Dividend Income Accelerator Portfolio

The Dividend Income Accelerator Portfolio’s objective is the generation of income via dividend payments, and to annually raise this sum. In addition to that, its goal is to attain an appealing Total Return when investing with a reduced risk level over the long term.

The Dividend Income Accelerator Portfolio’s reduced risk level will be reached due to the portfolio’s broad diversification over sectors and industries and the inclusion of companies with a low Beta Factor.

Below you can find the characteristics of The Dividend Income Accelerator Portfolio:

- Attractive Weighted Average Dividend Yield [TTM]

- Attractive Weighted Average Dividend Growth Rate [CAGR] 5 Year

- Relatively low Volatility

- Relatively low Risk-Level

- Attractive expected reward in the form of the expected compound annual rate of return

- Diversification over asset classes

- Diversification over sectors

- Diversification over industries

- Diversification over countries

- Buy-and-Hold suitability

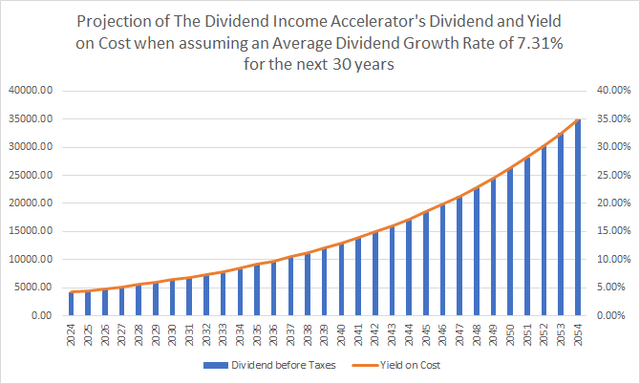

Projection of The Dividend and Yield on Cost of The Dividend Income Accelerator Portfolio

Given its current composition, The Dividend Income Accelerator Portfolio presently offers investors a Dividend Yield [FWD] of 4.20%, in addition to a 5-Year Weighted Average Dividend Growth Rate [CAGR] of 7.31%.

The chart below illustrates a projection of the portfolio’s dividend before taxes and Yield on Cost when assuming that you would invest the amount of $100,000 and assuming an Average Dividend Growth Rate of 7.31%, which is based on its 5-Year Weighted Average Dividend Growth Rate [CAGR].

You could potentially reach a Yield on Cost of 8.50% in 2034, 17.22% in 2044 and 34.87% in 2054.

Source: The Author

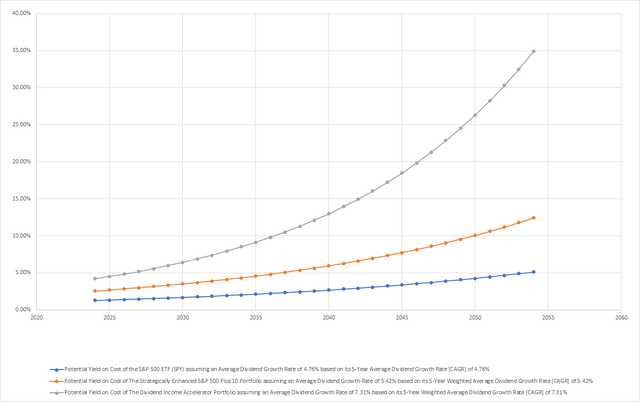

The Comparison between the S&P 500 ETF (SPY), the Strategically Enhanced S&P 500 Plus 10 Portfolio and The Dividend Income Accelerator Portfolio

The below graphic illustrates a comparison between the Yield on Cost you could potentially reach when investing in the S&P 500 ETF (SPY), The Strategically Enhanced S&P 500 Plus 10 Portfolio, and The Dividend Income Accelerator Portfolio.

For each of the portfolios I have assumed an Averaged Dividend Growth Rate for the following 30 years which is based on the respective portfolio’s 5-Year Weighted Average Dividend Growth Rate [CAGR].

The graphic illustrates that The Dividend Income Accelerator Portfolio provides investors with a potentially superior mix of dividend income and dividend growth, offering a potentially significantly higher Yield on Cost when compared to the S&P 500 ETF (SPY) and The Strategically Enhanced S&P 500 Plus 10 Portfolio.

Source: The Author

While you could potentially reach a Yield on Cost of 5.12% in 2054 when investing in the S&P 500 ETF (SPY) (assuming an Average Dividend Growth Rate for the following 30 years that is based on its 5-Year Dividend Growth Rate [CAGR]), the potential Yield on Cost when following The Strategically Enhanced S&P 500 Plus 10 Portfolio stands at 12.42% for 2054, and the potential Yield on Cost when following the investment approach of The Dividend Income Accelerator Portfolio stands at 34.87% for 2054.

Overview of the Three Investment Approaches

|

S&P 500 ETF (SPY) |

Strategically Enhanced S&P 500 Plus 10 Portfolio |

The Dividend Income Accelerator Portfolio |

|

|

Description of the investment approach |

Investing in the S&P 500 ETF alone (a hypothetical portfolio). |

Strategically enhancing the S&P 500 ETF with 10 divided paying companies (a hypothetical portfolio). |

Balancing dividend income and dividend growth while investing with a reduced risk level (an actual portfolio that involves real money). |

|

Benefits for investors |

No need for the individual selection of companies. Focusing on the achievement of an attractive Total Return. |

Superior dividend income compared to investing in the S&P 500 ETF (SPY) alone. Reduced company- and sector-specific concentration risk compared to investing in the S&P 500 alone, through the inclusion of 10 dividend paying companies from sectors that are underrepresented within the S&P 500. |

Superior mix of dividend income and dividend growth. Investing with a reduced risk level through broad diversification across sector and industries. Portfolio inclusion of companies with particularly attractive risk-reward profiles. Risk-reward optimized dividend portfolio. |

|

Investment approach ideal for |

Investors who aim to achieve an attractive Total Return without prioritizing dividend payments and who do not want to select companies individually. |

Investors who aim to increase their annual dividend payments. Investors who would like to reduce the level of risk compared to solely investing in the S&P 500 through an even broader sector diversification and geographical diversification. |

Any investor looking to generate a significant amount of extra income and aiming to raise this amount significantly year over year. Investors of all age groups seeking to follow a long-term investment approach. Investors looking to generate a significant amount of dividend income for retirement. |

|

Portfolio’s Weighted Average Dividend Yield [FWD] |

1.27% |

2.55% |

4.20% |

|

Portfolio’s 5-Year Weighted Average Dividend Growth Rate [CAGR] |

4.76% |

5.42% |

7.31% |

|

Potential Yield on Cost in 2034 |

2.02% |

4.32% |

8.50% |

|

Potential Yield on Cost in 2044 |

3.22% |

7.33% |

17.22% |

|

Potential Yield on Cost in 2054 |

5.12% |

12.42% |

34.87% |

Source: The Author

Conclusion

Investing in the S&P 500 ETF (SPY) offers investors several benefits, but it also has limitations, especially for those aiming to generate a significant amount of dividend income.

With a Dividend Yield [TTM] of 1.21%, the S&P 500 ETF’s (SPY) capacity to produce dividend income is limited. Additionally, the proportion of the Information Technology Sector (which represents 32.31% of the S&P 500) is disproportionally high, leading to an elevated sector-specific concentration risk for investors that only invest in SPY.

Other sectors, such as the Real Estate Sector (accounting for 2.35%), are significantly underrepresented within the S&P 500.

To address these weaknesses, I have selected 10 individual companies for inclusion into The Strategically Enhanced S&P 500 Plus 10 Portfolio, reducing sector-specific concentration risk, and enhancing the portfolio’s ability to produce dividend income. The Weighted Average Dividend Yield [TTM] of the Strategically Enhanced S&P 500 Plus 10 Portfolio stands at 2.49%, which is superior to the 1.21% of the S&P 500.

The proportion of the Information Technology Sector has decreased from 32.31% to 22.59% within The Strategically Enhanced S&P 500 Plus 10 Portfolio, offering investors a reduced sector-specific concentration risk when compared to investing in the S&P 500 alone.

You could additionally reduce the volatility of this portfolio, by incorporating U.S. government bonds, allowing you to strategically position the portfolio for a stock market decline.

It is worth highlighting that currently about 10% of The Dividend Income Accelerator Portfolio is invested in SCHO (NYSEARCA:SCHO), an ETF that invests in short-term treasury securities. You could follow a similar allocation strategy, taking into consideration your individual investment goals and risk tolerance.

However, it should be highlighted that for more dividend income-oriented investors, The Strategically Enhanced S&P 500 Plus 10 Portfolio still offers limitations, due to its still not particularly attractive Weighted Average Dividend Yield [TTM] of 2.55% and limited 5-Year Weighted Average Dividend Growth Rate [CAGR] of 5.42%.

For investors aiming to reach a superior mix of dividend income and dividend growth, The Dividend Income Accelerator Portfolio might be the more accurate investment approach, effectively integrating dividend income and dividend growth, while providing investors with a reduced risk level through a broad diversification. The portfolio offers investors a Weighted Average Dividend Yield [FWD] of 4.20% in addition to a 5-Year Weighted Average Dividend Growth Rate [CAGR] of 7.31%.

Which of these three investment approaches is the most accurate for you depends on your individual investment goals and risk-tolerance.

Investors aiming to achieve an attractive Total Return without prioritizing dividend payments and who do not want to select companies individually, might find an approach that focuses on an S&P 500 ETF to be an adequate choice.

For those investors who would like to enhance their S&P 500 ETF (SPY) core positions with dividend paying companies for an increased dividend generation, The Strategically Enhanced S&P 500 Plus 10 Portfolio might be attractive.

For investors seeking a superior mix of dividend income and dividend growth while investing with a reduced risk-level and striving for an attractive Total Return over the long-term, following the investment approach of The Dividend Income Accelerator Portfolio might be ideal.

Author’s note: It would be great to hear which investment approach you believe is most appropriate for you. Which dividend paying companies would you select to strategically complement the S&P 500 ETF core position? Feel free to share any thoughts in the comments below!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply