Airport stocks are part of my coverage areas as I consider them to be more stable investment opportunities compared to airlines to capitalize on growing demand for air travel. My airport coverage portfolio includes airports in North America, Europe and Asia. With this report I am adding the first airport in Oceania in the form of Auckland Airport. Since this is my first time covering Auckland International Airport Limited (OTCPK:AUKNY), I will be discussing some details about the company, the most recent earnings, provide a risk assessment and a stock price target and rating.

Auckland Airport: The Gateway To New Zealand

If you want to go to New Zealand, it is most likely that you will pass Auckland Airport. Pre-pandemic, the company processed 21.1 million passengers and $15 billion NZD worth of goods. The airport is the hub of Air New Zealand, which has a fleet of 110 airplanes ranging from regional aircraft to wide body airplanes for long-haul flights. Furthermore, the company is an operational base for low-cost carrier Jetstar. In FY2024, the company processed 18.5 million passengers indicating that passenger numbers had recovered to 88% of pre-pandemic levels.

The company, like other airports, derives its revenues from aeronautical revenues as well as non-aeronautical revenues, which includes parking and retail. The company also has a 24.99% stake in Queenstown Airport, which is a smaller airport in New Zealand. The company also holds a 50% stake in the Novotel Airport Hotel and the Pullman Airport Hotel in Auckland.

Auckland Airport Sees Strong Growth In Sales And Earnings

Auckland Airport

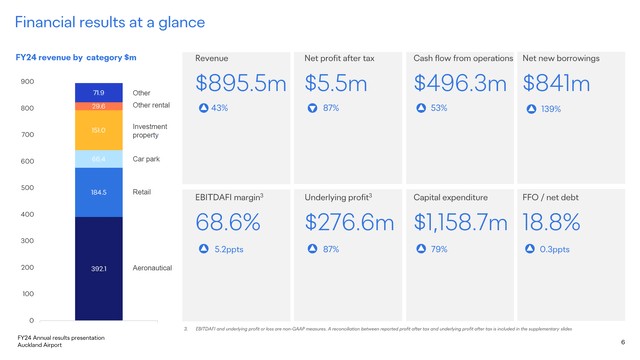

Sales grew 43% to $895.5 million NZD driven by 74% growth in airfield income, am 82% surge in passenger service charges, a 41% increase in retail income and a 15% increase in car park income. This increase was supported by higher service charges and a 10% year-on-year increase in aircraft movements and 17% growth in passenger numbers. Expenses increased by 23% to $281.5 million NZD driven by the increased passenger traffic and aircraft movements as well as continued investments in services and the aeronautical and commercial retail side of the business.

Adjusted EBITDA grew 55% to $614 million NZD marking a 5.2 pts increase in margins to 68.6% while adjusted net income rose 87% to $276.6 million NZD. So, Auckland Airport had a strong year with adjusted profit growth exceeding revenue growth and revenue growth exceeding the growth in passenger numbers and aircraft movements.

What Are The Risks And Opportunities For Auckland Airport?

The opportunities for Auckland Airport pretty much boils down to the continued demand for air travel and the long-term growth trends. The company is still not fully recovered from the pandemic and that provides a growth opportunity. In FY25, the company expects to process 19.1 million passengers or around 90% recovery compared to the pre-pandemic baseline. The risks for airport operators are macroeconomic softening which could reduce demand in the business as well as leisure segments while adverse weather provides risks as it could reduce the number of aircraft movements and passengers and even could result in damage to airport infrastructure as happened in Auckland during the floods of 2023.

Auckland Airport Stock Lacks Upside

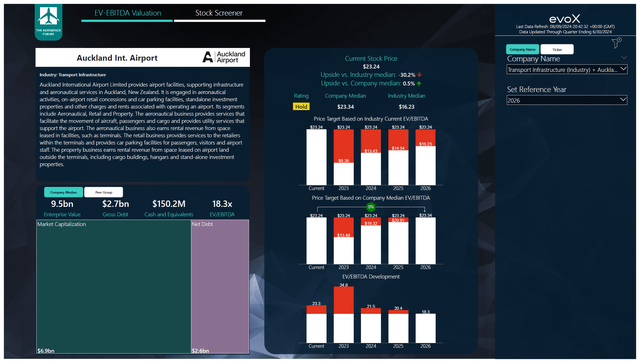

The Aerospace Forum

To determine multi-year price targets The Aerospace Forum has developed a stock screener which uses a combination of analyst consensus on EBITDA, cash flows and the most recent balance sheet data. Each quarter, we revisit those assumptions and the stock price targets accordingly. In a separate blog I have detailed our analysis methodology.

While I do like Auckland Airport and the EBITDA is set to grow at a rate of 28% between 2023 and 2026, the free cash flow is negative, driven by continued investments in the airport which will require the company to add debt for the foreseeable future. At the current prices, the stock is valued fairly with FY26 earnings in mind and given that the company already is in its 2025 financial year that is not an unreasonable valuation as I believe stocks should be able to trade one year ahead of earnings, but it leaves no upside. As a result, I mark the stock a hold.

Conclusion: Auckland Airport Is Interesting But Not Suitable For Investment

I do like Auckland Airport as it serves as the gateway to New Zealand and the company has some growth ahead to fully recover to pre-pandemic passenger and airplane movement levels. However, the company will have significant CapEx in the years ahead which it cannot service with its free cash flow and that will result in the debt balances increasing. With the current valuation metrics, I don’t see a compelling investment case for Auckland Airport.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply