Listen below or on the go on Apple Podcasts and Spotify

David Zinsner and Michelle Johnston Holthaus will replace Pat Gelsinger. (0:15) Morgan Stanley adjust ratings on cybersecurity stocks. (3:22) OpenAI looks at ads. (4:06)

This is an abridged transcript of the podcast.

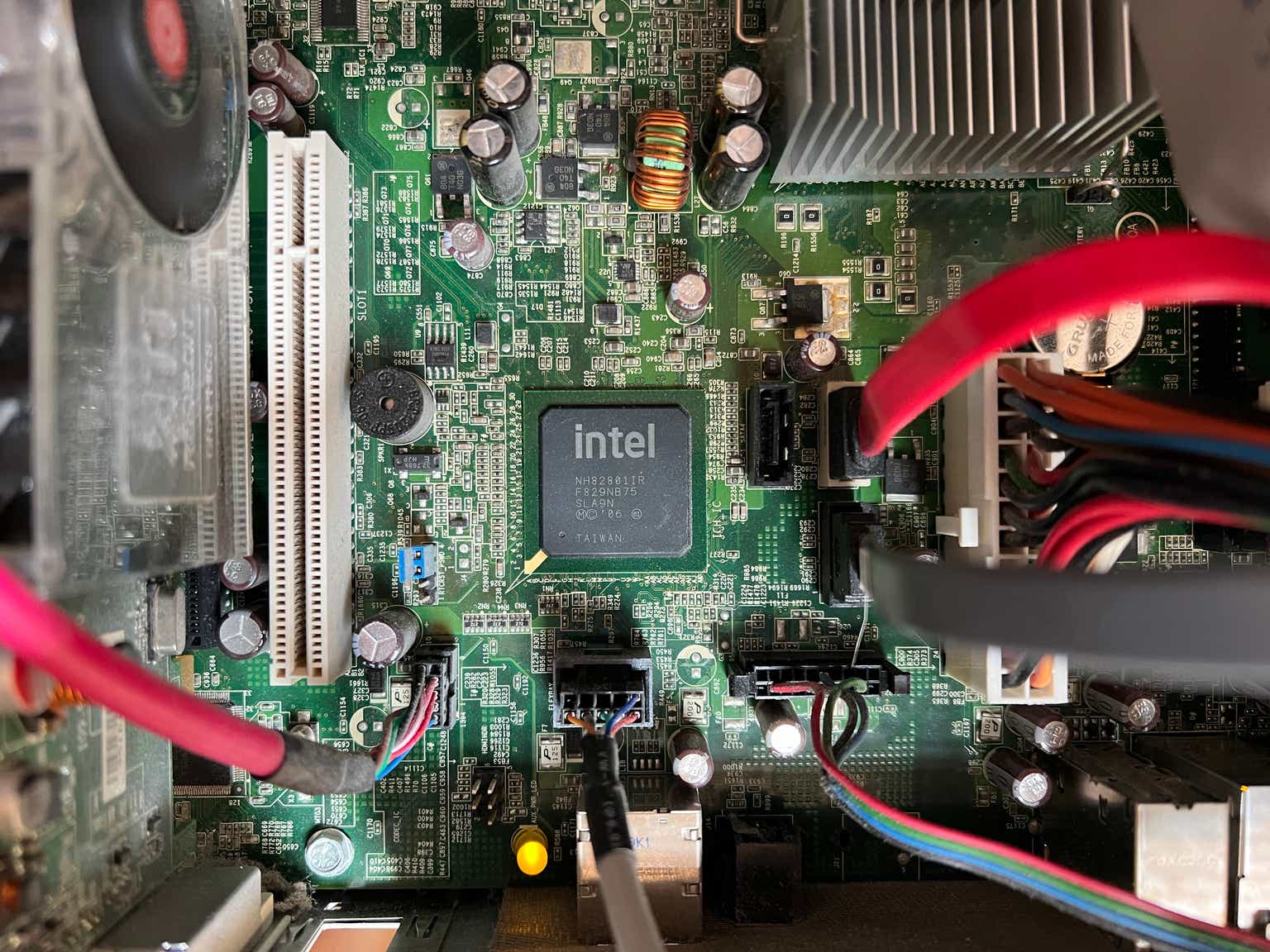

Our top story so far. This morning, Intel (NASDAQ:INTC) made the surprising announcement that CEO Pat Gelsinger is retiring and will be replaced by co-CEOs David Zinsner and Michelle Johnston Holthaus.

Gelsinger is also stepping down from the company’s board of directors. Both departures are effective December 1.

Holthaus has been appointed to the newly created position of CEO of Intel Products, while Frank Yeary was named interim executive chair.

Yeary said: “While we have made significant progress in regaining manufacturing competitiveness and building the capabilities to be a world-class foundry, we know that we have much more work to do at the company and are committed to restoring investor confidence.”

In August, the company said that it was cutting staff by 15% and spending by $10 billion as it works to streamline its operations. Intel shares, which rose slightly after the announcement, are down 50% year to date.

In today’s trading, stocks are mixed with the Nasdaq (COMP.IND) outperforming, up nearly 1%.

Goldman’s trading desk says sentiment “really is varied depending on where you look but it would appear we’ve seen selling in prime and most sentiment indicators look quite restrained.”

“The US market is expensive … very much so, but that in it of itself does not preclude further gains as we head into the end of the year.”

“This week will really be all about jobs and … the market will be hoping they are not too firm (GS +235k, consensus +200k) just enough to keep Fed from having an excuse to skip December.”

If you want great coverage going into that big Fed meeting, be sure to check out our Cyber Monday deal. That’s 20% off all Seeking Alpha products. Our team covers financial news round the clock, and with our Listen to Article feature you can take your research on the go. Check out SeekingAlpha.com.

On the economic front, the ISM Manufacturing index improved to 48.4 in November from 46.5 in October, topping the 47.6 consensus.

The manufacturing sector contracted for the eighth straight month, while the overall U.S. economy expanded for the 55th month.

Pantheon Macro economist Oliver Allen notes the new orders index jumped to 50.4, an eight-month high, which “suggests that the drop in corporate bond yields in recent quarters and a slight improvement in external demand are starting to support U.S. manufacturers.”

But the “slight improvements from a low level still suggest that the manufacturing sector is far from out of the woods just yet.”

Among active stocks today, Marvell Technology (MRVL), which reports earnings later this week, rose as the firm expanded its strategic collaboration with Amazon Web Services. Marvell expanded the collaboration for electronic design automation in the cloud to deliver its silicon solutions.

Citi downgraded Nu Holdings (NU), which operates NuBank in Brazil and Mexico, to Sell from Neutral as it faces a tougher road for growth after rapid expansion.

Analyst Gustavo Schroden said it will take longer than expected for alternative revenue sources, such as payroll loans in Brazil, Mexico, and Colombia, to offset the slowdown in credit cards and personal loans in Brazil.

And Morgan Stanley made several ratings changes to cybersecurity, upgrading Okta (OKTA) and Cloudflare (NET) and downgrading SentinelOne (S) and Tenable (TENB).

Okta was raised to Overweight from Equal Weight. Analysts said they see the demand environment “stabilizing,” the headwinds from competition appear to be easing, and new products are taking hold. They boosted Cloudflare to Overweight from Equal Weight, saying there is a path to “sustainable” 25% to 30% revenue growth over the next few years.

SentinelOne was cut to Equal Weight from Overweight on “slower expected demand” for the core endpoint security market in 2025, along with a challenging competitive and pricing environment. Tenable was also cut to Equal Weight from Overweight on pricing pressures in the vulnerability management market.

In other news of note, Microsoft-backed (MSFT) OpenAI is discussing plans to introduce advertising to its range of products, as the ChatGPT maker seeks new revenue sources.

The Financial Times says the group has been hiring ad talent from big tech rivals such as Meta (META) and Google (GOOGL).

In a statement, OpenAI CFO Sarah Friar said, “Our current business is experiencing rapid growth and we see significant opportunities within our existing business model. While we’re open to exploring other revenue streams in the future, we have no active plans to pursue advertising.”

And in the Wall Street Research Corner, Fitch/BMI expects commodity prices to be under pressure in 2025, driven by abundant supply and U.S. dollar strength.

In energy, prices continue to see downside pressures as soft demand and resilient supplies outweigh the premium of geopolitical risk.

BMI lowered its 2025 Brent forecast to an average of $76 a barrel, a 5% decline from 2024’s annual average of $80. But the front-month Henry Hub gas benchmark is expected to gain 42% in 2025, rising to $3.40 per million BTUs.

“The developing La Niña conditions are expected to fuel a colder than normal Northern Hemisphere winter, which should support natural gas prices both in the U.S. and abroad,” BMI said.

Analysts expect significant volatility in metals on the back of anticipated U.S. dollar strength and Trump-led trade policy shifts, with sentiment highly sensitive towards a long-awaited Mainland Chinese demand turnaround. Gold is expected to average $2,500 per ounce.

Agricultural commodities are expected to ease but remain historically elevated.

Read the full article here

Leave a Reply