Introduction

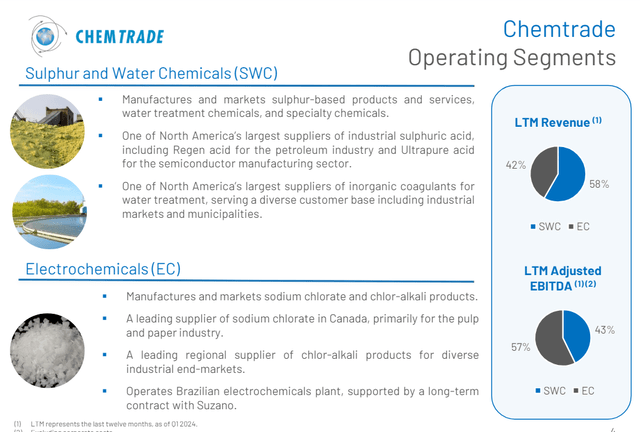

I have a substantial long position in a convertible debenture issued by Chemtrade Logistics (OTC:CGIFF) ( TSX:CHE.UN:CA), a company focusing on two specific divisions: Sulfur and water chemicals and electrochemicals. I don’t mind being a creditor of a strong company, but I definitely plan to follow up on my investments at least once per quarter to make sure I have nothing to worry about.

Chemtrade Investor Relations

This article is an update to previous articles, so to get a better understanding of the company’s business model and past performance, I’d like to refer you to the older articles on Chemtrade. This recent presentation (published in May) also will be very helpful to get a better understanding of Chemtrade’s business.

The sustaining free cash flow remained strong in Q1

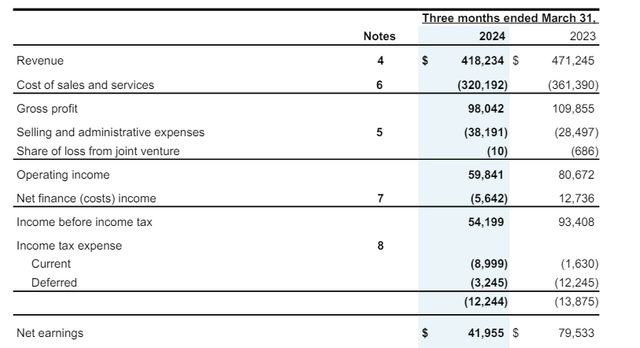

While the income statement is not as important as the sustaining free cash flow result, it obviously does provide a good look behind the scenes to ensure the company’s performance remains strong.

As you can see below, the total revenue of Chemtrade was C$418M in the first quarter of the year, which is a decrease of in excess of 10% compared to the revenue in Q1 of last year. Fortunately, Chemtrade was also able to reduce its COGS, resulting in a gross profit of C$98M but I was slightly disappointed when I saw the SG&A expenses increased by almost C$10M on a YoY basis.

Chemtrade Investor Relations

As the income statement above shows, SG&A expenses increased to C$38.2M and this definitely put pressure on the bottom line result. The pre-tax income decreased to C$54.2M resulting in a net profit of C$42M. Not bad in the greater scheme of things, but definitely much worse than the almost C$80M in net profit in Q1 2023. That being said, the company was able to record a non-recurring finance income in Q1 2023 and this had a rather sizeable impact on the pre-tax and net income. That being said, the Q1 EPS of C$0.36 per share is still quite decent compared to the current share price of Chemtrade, which is currently trading below C$10/share.

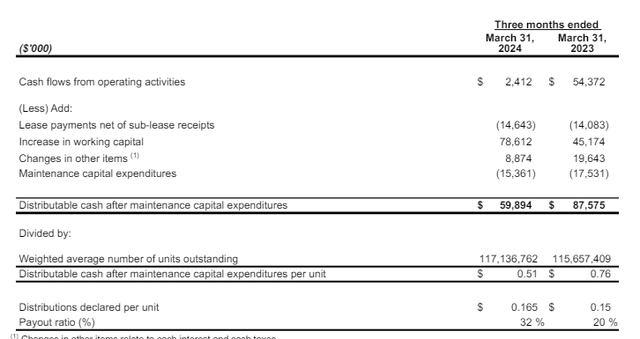

In Chemtrade’s case, not the reported EPS but the distributable cash flow is what really matters. And as you can see below, the company generated almost C$60M in distributable cash flow and this represents C$0.51 per unit.

Chemtrade Investor Relations

Chemtrade currently pays a monthly distribution of C$0.055 per share which means that based on the Q1 result, the payout ratio was just 32%. While that was indeed higher than the payout ratio of just 20% in Q1 2023, let’s not forget Chemtrade’s financial performance is now normalizing after a few years of tailwinds.

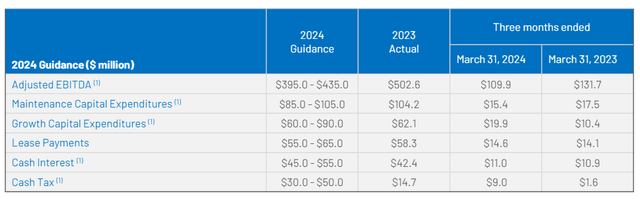

Looking at the full-year guidance, Chemtrade expects to generate C$415M in adjusted EBITDA (I am using the midpoint of the guidance shown below) and after deducting C$50M in interest payments, C$60M in lease payments and C$40M in cash taxes, Chemtrade will generate C$265M in cash flow.

Chemtrade Investor Relations

We see total capex will be C$195M which at the very least means Chemtrade will generate C$70M in free cash flow, but as you can see above, there’s up to C$90M earmarked for growth. Using the high end of the maintenance capex (C$105M), the underlying distributable cash flow would be C$160M, or C$1.37 per share.

And that makes the current share price of just over C$9 still attractive.

I’m still overweight the debentures

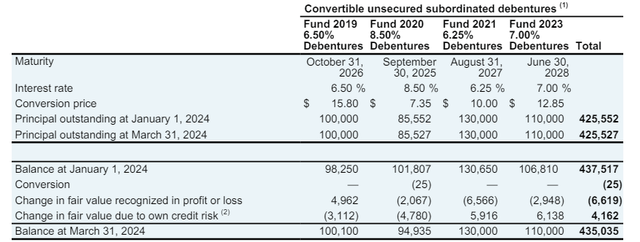

I have a pretty substantial long position in the Series H convertible debentures issued by Chemtrade. Those debentures mature on June 30, 2028, (so in four years from now) and have a 7% coupon. This series of debentures is currently trading around par. As you can see below, the conversion price is C$12.85 per share which means the share price would have to increase by approximately 40% before the debentures are “in the money” and converting it into stock makes more sense.

Chemtrade Investor Relations

For now, I’m considering the convertible debentures to be “straight” debentures: Considering the conversion price is substantially higher than the current share price, I will just assume the debentures won’t be converted. This means I’m receiving a 7% yield on this debt security (there’s no withholding tax on interest payments made by Canadian companies).

I’m quite confident Chemtrade will have no issue to continue to cover its interest payments: In the first quarter of this year, the company booked a C$10.5M total interest expense, including C$7.3M on the four different issues of convertible debentures. That’s about C$42M in total interest expenses on an annualized basis, which should be very well covered by the anticipated C$265M in operating cash flow.

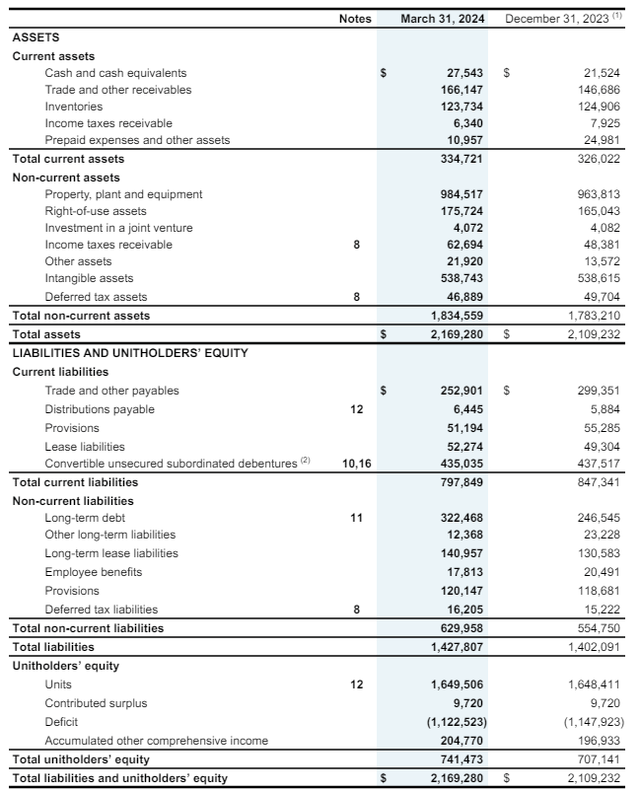

Secondly, the balance sheet also looks pretty decent from a creditor’s perspective. As you can see below, Chemtrade has C$27.5M in cash and a net debt of C$730M. This represents just over two times the adjusted EBITDA (also adjusted for lease payments) which isn’t too big of a deal, while the total amount of equity on the balance sheet is approximately C$741M.

Chemtrade Investor Relations

And in case there’s any need, Chemtrade could simply just suspend or lower the distributions on the common equity to save cash, but I don’t expect that will be necessary.

Investment thesis

I have a long position in the Series H convertible debentures issued by Chemtrade. I think the 7% yield is a fair compensation given the very strong EBITDA, reported free cash flow result and distributable cash flow result of Chemtrade. According to the analyst consensus, Chemtrade’s EBITDA will remain relatively flat in the next few years which obviously is a good situation for the debenture holders as the cash flows will remain strong.

The common units are currently yielding 7.2% which still is an attractive compensation considering the distributable cash flow will likely come in around C$1.37 per share, resulting in a payout ratio of just around 50%. I may consider adding the common units to my portfolio as well, despite the recent share price increase since my previous article.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply