Thesis

These are pivotal times for Annovis Bio (NYSE:ANVS). Since my last coverage on how the Phase 2 trial in Alzheimer’s disease (AD) had missed its primary endpoint, the company’s CFO has resigned, the company has released eight additional press releases, and its stock has been all over the place.

The only potential catalyst that Annovis still has is the Phase 3 readout for Parkinson’s disease (PD). The topline readout for this trial was announced for June 2024, although the trial had already ended in December of last year.

Annovis has changed the primary endpoints for that study, after having announced unblinding of the study, excluding the part on motor function which I believe to be the most essential. That change has not been communicated to investors, and more importantly, is not in line with what the FDA had requested.

The company had an investor call in which it stated that the Phase 3 trial in PD may not have enrolled enough patients (min. 27).

Seeing how Annovis had initially reported success in this trial, but finally admitted on June 11, 2024 that it did fail its primary endpoint, I have lost trust in the company’s reporting at this point.

The company has almost no cash left. However, it has plans to initiate two Phase 3 trials in Alzheimer’s and Parkinson’s of longer duration, enrolling up to 600 patients or more. Realistically, I believe the only chance the company has left to raise money would be after the data release for Parkinson’s, on high volume. Even then, at the current valuation, Annovis may not be able to pick up the financing it requires to see even one of these trials through.

Company

Annovis is a clinical-stage biotech company that tries to bring Buntanetap/posiphen to market for the treatment of AD and PD. I have covered Annovis initially with a Hold rating, prior to results, and subsequently with a Strong Sell rating after the topline readout for AD.

Annovis had two trials ongoing, a Phase 2/3 trial in AD and a Phase 3 trial in PD. Both were large but rather short trials that the company claimed were symptomatic.

The Phase 3 trial in Parkinson’s disease is the only trial that Annovis is still to report on, and is therefore much anticipated.

The company now has a $64 million market valuation, and the stock’s recent trajectory has been very volatile.

Six-month stock chart (Google)

I will discuss recent developments and my view on that, after a review of the abundance of press releases the company had issued after my previous coverage.

Alzheimer’s updates

Previous reporting on Phase 2/3 trial

Co-primary endpoint: Adas-Cog11

In my previous coverage, I had discussed the company’s April 29, 2024 press release on topline data of its Phase 2/3 trial in AD. That trial was a randomized, double-blind, placebo-controlled trial investigating safety and efficacy in patients with mild to moderate AD, having MMSE scores ranging from 14 to 24. The trial had enrolled 353 patients, and the study duration was 12 weeks. Adas-Cog11 and ADCS-CGIC were its primary endpoints.

The company’s press release touted the efficacy seen in patients with mild AD, announcing: ‘Annovis Bio announces statistically significant Phase 2/3 data in patients with early Alzheimer’s disease’. But the trial was not only in patients with early AD.

A subtitle mentioned: ‘ADAS-Cog 11 (Co-primary Endpoint) Shows a 3.3 Statistically Significant Improvement’, as if moderate patients were not included in that trial. It appears now that these patients had actually not seen an improvement. Placebo patients with mild AD apparently also improved 0.3 points on the Adas-Cog11 rating scale.

The text under the subtitle further revealed that the analysis focused on patients with MMSE 21-24, pTau217/tTau≥4.2%, namely 202 out of 325 patients. In other words: the analysis excluded patients with MMSE 14-20, and excluded 123 patients with pTau217/tTau <4.2%.

However, this was a randomized placebo-controlled trial in patients with mild to moderate AD, and as no subgroups had not been prespecified based on the distinction between mild and moderate AD, the above distinction is post-hoc. Annovis had done the same excluding about one third of patient data based on them not being able to meet the pTau217/tTau threshold. Annovis had not announced that it would do so prior to data readout. In an investor call, Annovis claimed that it had suffered from the enrollment of patients who did not have AD (min. 7.40). Whatever the case, the distinctions are post-hoc, and I believe this is how the FDA will look at them.

There was no reporting on how the following patient groups had performed:

– 123 patients with pTau217/tTau <4.2%;

– patients with MMSE 14-20.

Co-primary endpoint: ADCS-CGIC

Annovis did not report on its co-primary endpoints ADCS-CGIC in the title or header of its press release. Only under the subtitle ‘other study endpoints’ the company reported that no statistically significant difference was observed for this endpoint, and that ADCS-CGIC in all patients ‘barely changed’. No concrete reporting, for any of the above-mentioned non-pre-specified subgroups, was made. In my eyes, that means that the study failed to reach its primary endpoints.

In my eyes, Annovis’ Phase 2/3 trial in Alzheimer’s disease failed to reach its primary and secondary endpoints on cognition and function. I believe this view was confirmed by other Seeking Alpha analysts, who shared their view on Annovis’ reporting, twice with a Strong Sell rating, once with a Hold rating. Yet, Annovis has been particularly slow in recognizing that failure.

Moreover, the FDA has expressly requested Annovis to report both on Adas-Cog11 and on ADCS-CGIC, as results from its annual report:

The FDA requested to include two co-primary endpoints to have an objective primary endpoint (ADAScog, cognition) and a subjective primary endpoint (ADCS-CGIC, activities of daily living). Together, these co-primary endpoints are intended to provide in a more complete picture of the study and treatment results.

I believe it would have been fair to investors to present trial data as such when reporting topline data.

Secondary endpoint: ADCS-ADL

Annovis reported a large placebo effect in ADCS-ADL, showing similar improvements with no statistical difference. That means the trial failed on this endpoint as well.

Secondary endpoint: MMSE

Annovis did not even report on MMSE, although it used MMSE to distinguish between patients with mild AD and moderate AD. I assume the trial failed with regards to this endpoint as well, otherwise Annovis would have surely reported on it.

Shareholders’ letter: outperformance of placebo in moderate AD

Further data

On May 6, 2024, Annovis’ CEO reported, in a shareholders letter, that the team had been saddened by the drastic stock price drop, and emotional investor reactions.

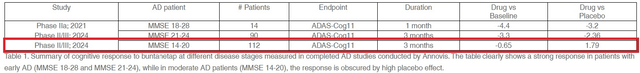

The same shareholders letter contained crucial information that had not been contained in the above-mentioned press release. It included additional data for patients with MMSE scores of 14-20, i.e., moderate AD. That chart showed that these 112 patients, i.e., after having excluded patients with pTau217/tTau <4.2%, had declined -0.65 points on Adas-Cog 11.

Adas-Cog11 reported in shareholders letter (Shareholders letter)

On the Adas-Cog rating scale, less points indicate cognitive improvement. The typical disease progression, which is cognitive decline, is about +1.46 points for every three months.

The chart did not show the placebo response, but instead it showed ‘drug versus placebo’. That means, for efficacy of drug over placebo, one would need to see a negative value. A positive value would indicate placebo outperformed drug. The ‘drug vs baseline’ value was -0.65, and the ‘drug vs placebo’ value was +1.79 for moderate AD. In other words, the placebo patients with moderate AD who had confirmed AD must have on average improved by -2.44 points, massively outperforming patients on Buntanetap and performing totally against the normal course of placebo. The explanation below the chart stated that in moderate AD, the response was obscured by high placebo effect, but that explanation does not make sense to me. The so-called placebo effect, in that case, was more than twice as strong in placebo patients, which does not make sense at all.

Interestingly, also, the ‘drug vs placebo’ value for mild patients is -2.36. Taking into account a ‘drug vs baseline’ value of -3.3, there is a net difference of +0.94 between drug and placebo. However, just some weeks before, Annovis had reported that placebo patients had improved by -0.3 points. I have a hard time reconciling these two values.

Still missing data and intermediate conclusion

Still no data for the 123 patients with a pTau217/tTau <4.2% were reported, and it is also unknown how many patients were enrolled in the respective placebo groups, meaning one cannot deduct exact numbers for how the total patient populations had performed.

One can assume say that, if already a considerable placebo effect had been seen in patients with mild AD, placebo patients with confirmed moderate AD scoring -2.44 points on Adas-Cog, i.e., a massive improvement whereas patients with AD should have progressive disease, is truly a very odd value. At best, I infer that the trial’s results need to be seen as random. Yes, Buntanetap saw efficacy in mild AD, after an exclusion of about one third of the patient population, but the results in moderate AD completely countered that. Logically, no statistical significance would have been detected for the overall trial. But we would come to that confirmation by Annovis only in an investor call a month later.

Investor call regarding safety and efficacy in AD

Comparison with Aricept, Leqembi and donanemab

On June 11, 2024, Annovis announced an upcoming investor call that same day during which safety and efficacy in the above-mentioned trial would be discussed. The focus was on efficacy as reported above, and Annovis’ goal to conduct an 18-month Phase 3 trial in biomarker-positive early AD patients. How Annovis would fund that was left undiscussed.

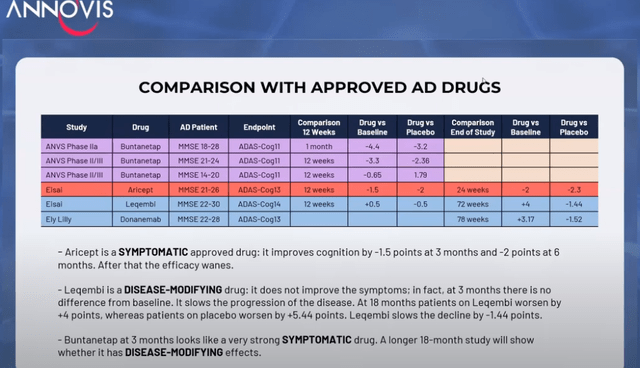

Annovis showed the following chart and explanation and stated that Buntanetap looks liked a ‘really really good’ symptomatic drug (min. 28), stressing that it is a symptomatic drug, and has not yet proven to be a disease-modifying drug.

Comparison chart (Investor call)

As a reminder, symptomatic drugs such as Aricept do not alter the course of the disease. These drugs do not benefit patients in the long term. However, Annovis had in the past always considered that Buntanetap inhibits the translation of neurotoxic proteins, which means it should be disease-modifying, not symptomatic.

Annovis did confirm during the investor call (min. 17), for once: ‘Our drug did not work in (MMSE) 14-20’ adding ‘none of these drugs work in 14-20’. But Aricept, as the most-known approved symptomatic drug, actually does, so I believe that’s an incorrect statement to make. Furthermore, the trials for Biogen’s (BIIB) Leqembi and Eli Lilly’s (LLY) donanemab did not include patients with moderate AD, so we do not know yet whether they work in moderate AD.

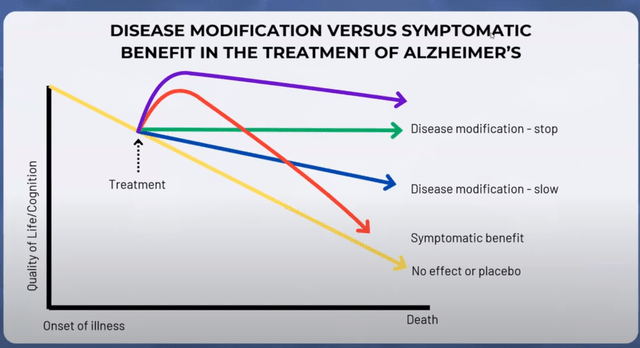

Annovis then showed this chart, considering that the purple line is what Annovis hopes Buntanetap will do after 3 months, knowing it outperforms the other drugs – symptomatic or disease-modifying – at this point.

Graph on disease-modification versus symptomatic (Investor call)

However, I believe that chart is also incorrect as Buntanetap’s efficacy in mild and moderate AD patients together does not outperform that of Aricept.

Further data in all patients: -2.2 point improvement for placebo

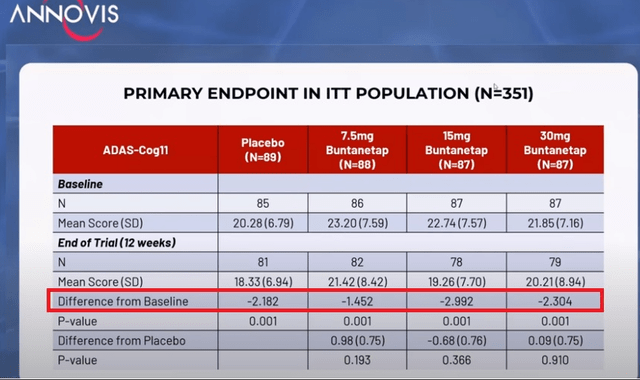

Annovis actually reported its Adas-Cog11 for all patients later in that webinar, showing that overall, placebo improved impressively by -2.2 points, largely outperforming the 7.5mg dose of Buntanetap, and performing similar to the 30 mg dose. Rather inexplicably, the 15 mg dose performed better, which would indicate imperfect correlation between dose response and efficacy.

Adas-Cog11 in total patient population (Investor call)

When requested whether the trial failed its primary endpoint (min. 28), Annovis’ CEO stated expressly during that investor call:

Yes, it did fail the primary endpoint, and it is not a pivotal study […].

I do not understand why the company did not announce that on April 29, 2024, why it had investors figure that out for themselves, and why it needed to take a month and a half and an investor question to get there.

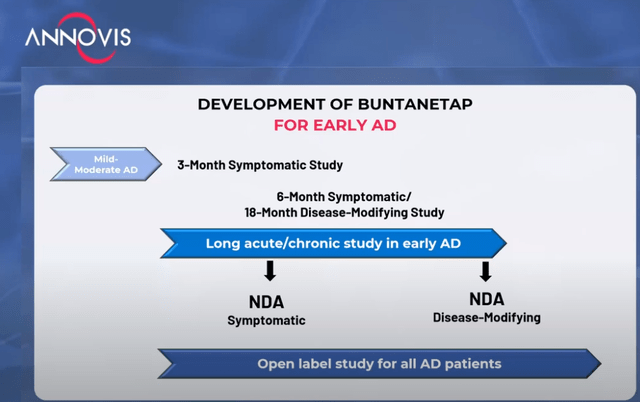

Annovis then laid out its plans for an upcoming study, which in my eyes is actually two studies in one, namely a 6-month/18-month symptomatic/disease-modifying study, with the hope to file two NDAs: one for a symptomatic drug and one for a disease-modifying drug.

Development timeline (Investor call)

My feeling is that this idea, which would entail a data readout midway to a randomized trial in 600 patients or more, stands little chance of being accepted by the FDA, as it would break the blind.

Parkinson’s phase 3 update

Introduction

Annovis has been conducting a six-month Phase 3 trial in patients with Parkinson’s disease, with data initially expected for December 2023. However, on January 24, 2024, Annovis announced the postponement of the Phase 3 data considering ‘data cleaning efforts to ensure the accuracy and reliability of the study results’. The company had assured investors that during this period, the Company remains blinded to the data, and the statistical analysis is yet to be performed. On April 3, 2024, the company was still ‘meticulously cleaning the data’.

However, on May 9, 2024, Annovis announced unblinding of the Phase 3 data, without however reporting the data. It would go another two months without doing so.

The company reported that it had detected an error in the trial data, with up to 50% of plasma samples not showing the presence of Buntanetap instead of the expected 33% for placebo. Annovis then blamed the group which was evaluating the PK for having modified the measurement method, which was corrected once the pharmacokinetic measurements were repeated. The unblinding of data was confirmed on May 13, 2024.

Change of trial endpoints June 2024

After having announced that the Phase 3 trial had been unblinded, Annovis apparently changed the trial’s endpoints and not slightly, without informing investors, and without updating its corporate presentation.

For reference, this is a randomized, double-blind, placebo-controlled Phase 3 trial with a 6-month double-blind duration and 1-2 month follow-up period, in 450 patients with PD receiving either placebo, 10 mg or 20 mg of Buntanetap. This is what Annovis had previously reported, after an interim analysis at 2 months in 30% of patients, showing MDS-UPDRS 2+3 as the two primary endpoints (slide 15).

Interim analysis slide (partial) (Corporate Presentation)

To me, UPDRS-3 on motor function is the most important here. Parkinson’s is essentially characterized by the very uncomfortable and gradually worsening tremor.

If one knows where to look, the Clinical Trials website allows a comparison between actual and historical versions of information on a trial.

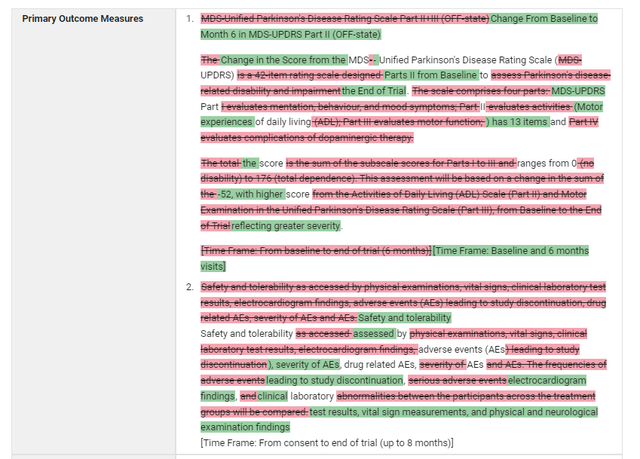

Until June 2, 2024, primary endpoints were indeed MDS-UPDRS Parts II and III, and safety and tolerability. Secondary outcome measures were MDS-UPDRS total score, Global Impression of Change, and CGIS.

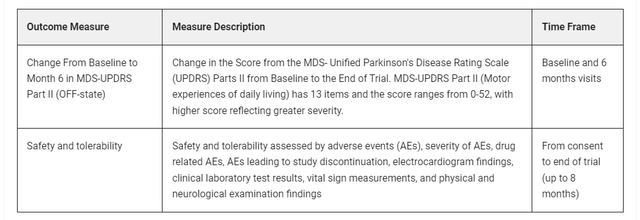

On June 2, 2024, Annovis changed the first primary endpoint from MDS-UPDRS parts II and III to UPDRS Part II. As shown below, the first primary endpoint was ‘MDS-Unified Parkinson’s Disease Rating Scale Part II+III (OFF-state)’ before, but now it is ‘change from baseline to month 6 in MDS-UPDRS Part II (OFF-state). That is essential as PD’s most significant characteristic is motor function.

Modified primary endpoints (Clinical Trials website)

The modifications were pretty drastic and all over the place. For example, this is how the primary endpoints look in comparison to the previous view.

Comparison view (Clinical Trials website)

Annovis basically added two secondary endpoints, and moved its primary endpoint related to efficacy – motor function to a secondary endpoint. I find an endpoint change prior to a data readout, and especially post unblinding, highly disconcerting and even more so, when that is the endpoint on tremor in Parkinson’s.

This is not what the FDA asked, as Annovis had stated in its annual report:

Specifically, The FDA requested two co-primary endpoints to have an objective primary endpoint (MDS-UPDRS Part III, motor function) and a subjective primary endpoint (MDS-UPDRS Part II, activities of daily living). Together, these co-primary endpoints are intended to provide in a more complete picture of the study and treatment results.

Annovis went even further than in AD here. In the case of PD, Annovis still went ahead and changed the endpoint, without informing investors, after data unblinding.

Additionally, the company stated in the June 11, 2024 investor call that good results on UPDRS-2 would be hard to get, and that in order to have statistically significance, the number of enrolled patients may not be sufficient (min. 26.30).

In Parkinson’s, one of the issues is UPDRS-2, and it is hard to get because as far as I know, no company to date has been able to show an improvement in UPDRS-2, so we are really curious to see whether our drug shows something in UPDRS-2, but then realistically maybe in Parkinson’s, we are not using enough patients […]. And once we know what our data is in the Phase 3 that we are going to report in a few weeks, we may decide to also do a 600 month (read: patients (per group)) study so that we have enough patients to see something in UPDRS-2.

On June 25, 2024, after having announced for months that data would be reported in June 2024, the company scheduled a post-market webcast to discuss the Parkinson’s results for July 2, 2024.

CFO departure

Right after topline data readout for AD, an SEC filing for Annovis of May 1, 2024 reported that Annovis’ CFO had resigned, and that Annovis’ CEO would step in to take his place.

Financials

As of March 31, 2024, Annovis had cash and cash equivalents of $3.1 million, which the company believes to be sufficient to fund operations into Q4 2024 combined with $0.8 million cash received from the execution of an ELOC purchase agreement that had been put in place days before topline data readout for AD.

Annovis still has that ELOC financing tool in place, allowing it to sell up to 2,051,428 shares of common stock, adding to a total of 11 million outstanding common stock. 2 million shares would allow about $12 million in cash at the current prices. However, the ELOC cannot be used once the share price drops below $5.

Annovis has a cash burn of about $8-10 million, looking at the latest quarterly reports. Last quarter, the company was able to receive a $6.7 million non-cash gain from change in fair value of liability-classified warrants.

Even with a fully usable ELOC financing, the company would still be in dire need of cash, and most certainly if it wants to fund the additional trials it has in mind.

In my eyes, the company’s trial in AD has failed. If it also fails in Parkinson’s the drug has no value in either indication, meaning the company may over time trade at cash level. At cash level, the company’s share price would be about $0.26.

I do not exclude that Annovis at this time will try to do an additional financing after topline data release for PD.

Risks to sell thesis

The Company has a strong investor base that continues to support the company’s results, and appears to believe the drug works, at least in mild AD. The company may be able to convince the FDA to move forward only for patients with mild AD.

Investors may also consider the Phase 3 results in PD a success. It is unclear what the FDA will think, given the last minute change of primary endpoints.

Annovis’ financing concerns may turn out less worse than I expect them to.

Conclusion

Annovis has now given more insight in its Phase 2/3 trial results in AD, which underscore the trial’s failure to produce meaningful results in my eyes. There is an inexplicably strong placebo response. The trial failed to reach any of its endpoints in the overall population, even excluding about one third of the patient population who had a pTau217/tTau ratio above 4.2%. The trial could only be seen as successful looking at ADAS-Cog 11 alone, in mild AD patients alone, after excluding patients with a pTau217/tTau value above 4.2%. It failed on its second co-primary endpoint, even looking only to that subpopulation. I doubt the FDA will see the trial as a success.

In Parkinson’s, the company has changed the primary endpoints which had been requested by the FDA, after having announced study unblinding. It excluded the endpoint on motor function – tremor as a primary endpoint. And it did not inform investors about that change.

In light of the above, I have lost trust in the upcoming reporting in PD.

The company would like to run large additional Phase 3 trials, both in AD and PD. However, it lacks funding to do so. At this time, the company may even lack funding to run the company until it can file another IND. I assume, therefore, that a financing is imminent, and that it may come at price well below the share price of the day before the financing is announced.

For the above reasons, I reiterate my Strong Sell rating on the stock.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply