Investment Thesis

The punchline is that Cloudflare, Inc. (NYSE:NET) is an expensive stock, currently priced at about 88x its projected non-GAAP operating profits for next year, making it one of the priciest SaaS stocks.

Despite its high valuation, the company’s rapid revenue growth and strong profitability make it an attractive investment.

Overall, I am tepidly bullish about NET.

While I acknowledge its strong potential, I also understand that it needs to execute perfectly for investors to see rewards. However, given Cloudflare’s track record of flawless execution, I am comfortable maintaining a cautiously optimistic stance on this stock.

Rapid Recap

Back in April, I said,

I put a tepid Buy rating on NET stock only for the fact that its growth rates are now reaching $2 billion in annualized revenues and growing this sort of revenue at close to 30% CAGR is a very challenging feat, which reflects the high demand for its products.

Author’s work on NET

While I recognize that NET has underperformed the S&P 500 (SP500) by nearly 12 percentage points since I turned tepidly bullish on this stock, I remain of the opinion that this stock is satisfactory. Here’s why.

Cloudflare’s Near-Term Prospects

Cloudflare provides various Internet services designed to improve the security, performance, and reliability of websites and applications. Their offerings include protection against cyber threats like malware and DDoS attacks, ensuring that websites stay online and perform efficiently even under heavy traffic. They also offer products that help developers build and manage applications on their platform, leveraging their global network infrastructure to deliver fast and reliable service worldwide.

In the near term, Cloudflare is poised for continued growth due to its strong performance in securing significant deals and expanding its customer base. The company’s recent quarter saw a 30% y/y revenue increase and a substantial rise in large customers.

With new leadership focused on enhancing sales and marketing, Cloudflare aims to penetrate deeper into the enterprise market, potentially becoming a key vendor for major companies. The expansion into AI services and the continued rollout of new products also position Cloudflare well for capturing emerging market opportunities.

Despite its strong performance, Cloudflare also faces challenges. For example, while Cloudflare has successfully grown its customer base, maintaining this growth rate and managing the complexity of large deals will require substantial meticulous, detailed execution.

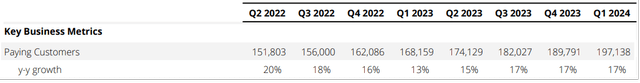

NET Q1 2024

Furthermore, although its customer adoption numbers above are nothing less than astounding, overall customer adoption is trending lower, and it is worth attuning to these figures for any significant deceleration.

Given this balanced background, let’s now discuss its fundamentals.

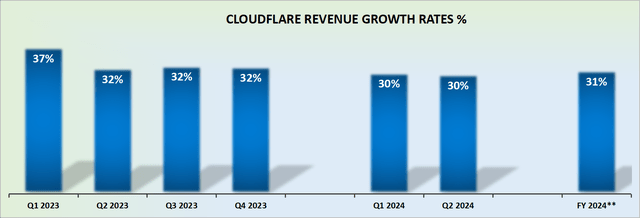

Revenue Growth Rates Point to 31% CAGR This Year

NET revenue growth rates

Cloudflare is symbolic of a growth stock. And that it does well. Case in point, for 2024, its growth rates point to a 31% y/y increase, which puts it among one of only 3 stocks that I know that in 2024, can deliver 30% CAGR, with revenues higher than $1 billion.

The other two are CrowdStrike (CRWD), a company that Cloudflare has partnered with for security, and Samsara (IOT), which helps large organizations manage and improve their physical operations by using technology to make their work more efficient (this is a company that I own and recommend).

Accordingly, given that among the S&P 500 and the tech-heavy Nasdaq, I can only single out 3 names that in 2024 can deliver hyper-growth, meaning higher than 30% growth, at scale, this goes to the essence of how much of a rare breed Cloudflare is.

Given this context, isn’t it natural for this stock to be priced at such a high premium?

NET Stock Valuation — 88x Next Year’s Non-GAAP Operating Income

As an investor, I believe it’s of utmost importance to understand a company’s financial footing. This is quick to perform, but without which, it’s akin to flying blind. Cloudflare has a net cash position of nearly $500 million.

This implies that not only Cloudflare’s financial position is strong, but it has enough cash that it could withstand a troublesome period without having to become overly concerned with its balance sheet.

Moving on, Cloudflare’s guidance implies that it could possibly deliver around $180 million of non-GAAP operating income. This would leave this stock priced at 161x this year’s valuation.

Next, consider two matters. Firstly, we are halfway over 2024, so it makes more sense for us to turn our focus towards estimating 2025.

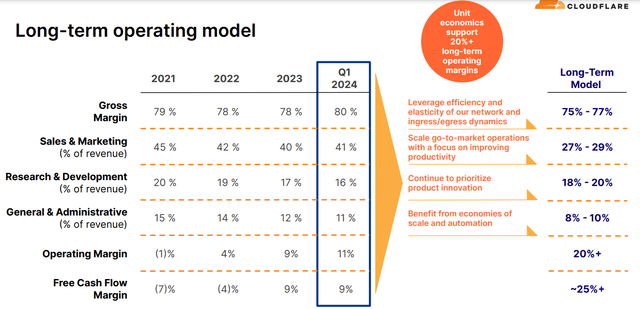

Secondly, consider the following graphic.

NET investor day

Cloudflare contends that it has a path to increase its non-GAAP operating margins to approximately 20% in the near term. Given that this year, its non-GAAP operating margins point to approximately 11%, this implies that it’s possible for Cloudflare’s non-GAAP operating margins to expand by 400 basis points in 2025, perhaps reaching 15%.

Therefore, this could see Cloudflare delivering around $330 million of non-GAAP operating profits in 2025, an 85% y/y increase relative to 2024.

So, yes, the stock inevitably looks expensive at 88x next year’s non-GAAP operating income. So, investors are having to take a leap of faith that everything tallies up nicely.

But for investors with a really long-time holding period, this stock could be worthwhile considering.

The Bottom Line

Despite its high valuation at 88x next year’s non-GAAP operating profits, Cloudflare, Inc.’s robust revenue growth, strong financial position, and potential for substantial margin expansion make it an attractive investment for long-term investors.

The company’s ability to secure significant deals, expand its customer base, and innovate in emerging markets, particularly AI services, positions it well for future success. Investors with a long-term perspective can anticipate fair returns as Cloudflare continues to execute flawlessly and capture market opportunities.

For those willing to wait, investing in Cloudflare could be a net positive.

Read the full article here

Leave a Reply