As the largest supplier of structural building products in the United States, we think Builders FirstSource (NYSE:BLDR) is well-positioned to continue taking share in the fragmented Building Products industry, should benefit from long-term structural growth tailwinds in housing construction.

In our view, the company’s ability to grow inorganically, via both large acquisitions and strategic tuck-ins, underscores management’s strong track record of capital allocation as well as the company’s ability to grow through the cycle.

We also believe that management’s compensation structure aligns closely with shareholder interests, with long-term incentives driven by ROIC and relative shareholder returns vs. a peer group. Moreover, management has shown an ability to consistently capitalize on opportunities to take out cost and improve efficiency.

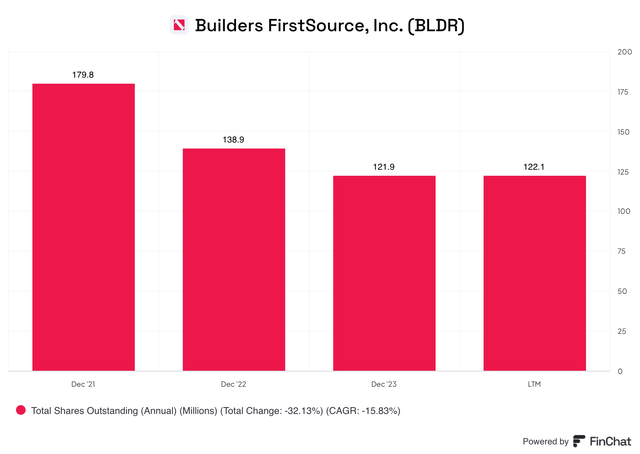

In addition to leveraging its strong balance sheet to execute accretive acquisitions, the company has also used excess cash to fund share repurchases – reducing BLDR’s share count by more than 30% since 2021, as shown in the chart below:

BLDR Total Shares Outstanding (FinChat.io)

With only about 4% market share across its core markets, we think BLDR has substantial runway for both organic and inorganic growth.

As such, we are initiating coverage on BLDR with a Buy rating.

Company Overview

BLDR is a leading supplier and manufacturer of building materials, serving both professionals and consumers across the US.

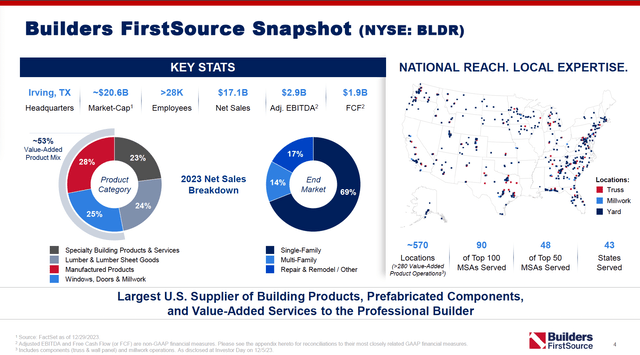

The company operates approximately 570 locations across 43 states, offering a vertically integrated solution that includes everything from manufacturing to installation.

BLDR’s product portfolio includes materials for roofs, stairs, doors, and windows, including lumber and millwork.

The below slide from the company’s June 2024 Corporate Presentation provides a nice snapshot of the business:

BLDR Snapshot (Builders FirstSource – June 2024 Corporate Presentation)

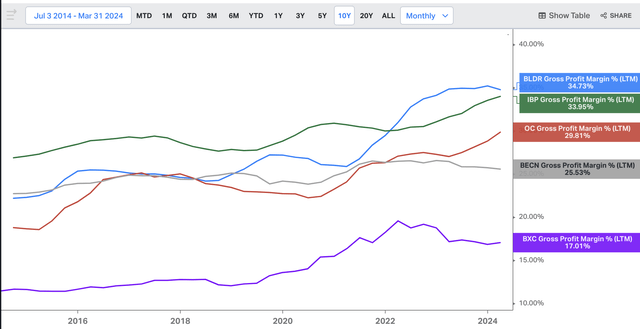

BLDR’s value-added products and services, which include manufactured components and installation services, account for more than 50% of the company’s net sales and support its industry-leading gross margins of around 35%.

While there aren’t many perfect public comps for BLDR (most of their direct competitors are private, like ABC Supply Co. and 84 Lumber), the below compares BLDR’s gross margins to a few publicly traded comps over the last 10 years (through the end of 1Q24):

BLDR Gross Margins vs. Peers (Koyfin)

BLDR has also grown significantly through acquisitions, notably including the purchase of ProBuild in 2015 as well as the company’s merger with BMC in 2021. In our view, these transformational mergers and acquisitions have significantly expanded BLDR’s geographic reach and enhanced its value-added product offerings.

In addition to the larger transformational deals, BLDR has consistently pursued tuck-in acquisitions to expand its geographic reach and enhance its product offerings. Many of these smaller deals have allowed BLDR to enter new markets, increase its market share in existing areas, and add complementary products and services. For example, BLDR’s acquisition of WTS Paradigm in August 2021 bolstered the company’s capabilities in housing design software and services, further integrating BLDR into the homebuilding process.

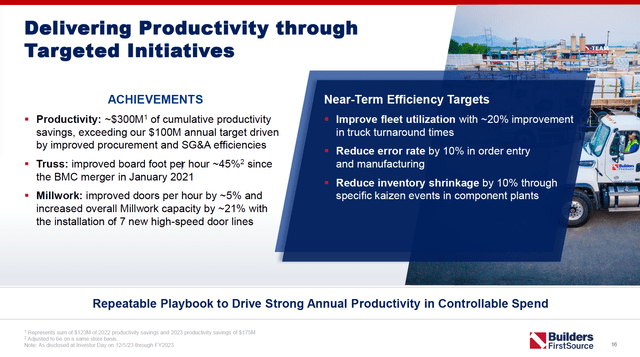

BLDR’s acquisition strategy has both driven growth and improved operational efficiency. The company has leveraged its increased scale to reduce costs, with initiatives including truss plant automation, price optimization, warehouse automation, and delivery optimization.

The slide below outlines BLDR’s productivity achievements in 2022 and 2023, as well as the company’s near-term efficiency targets, which we think underscores management’s ability to both successfully extract synergies from acquisitions while constantly looking for areas to reduce or take out unnecessary costs.

BLDR’s Productivity Gains & Near-Term Efficiency Targets (Builders FirstSource – June 2024 Corporate Presentation)

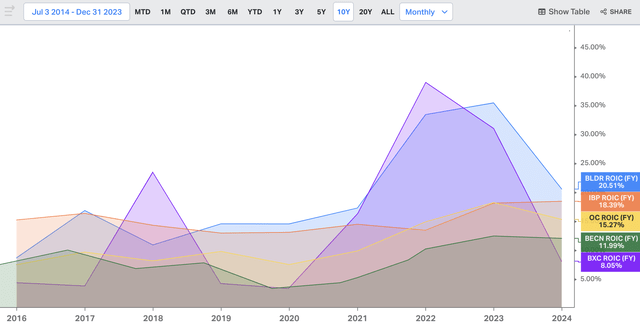

The company has consistently maintained a high ROIC, and currently has one of the best ROIC’s in the industry, relative to its publicly traded comp set.

BLDR’s ROIC vs. Peers (Koyfin)

In our view, the company’s disciplined approach to integrating acquisitions and extracting synergies has been a major factor in BLDR’s ability to maintain industry-leading margins and returns on invested capital.

Financials

In Q1 2024, BLDR reported net sales of $3.9bn, a slight increase of 0.2% year-over-year. While commodity price deflation of 1.7% and weakness in multifamily and repair and remodel segments impacted results, this was offset by 1.9% growth from acquisitions and strength in single-family starts.

Gross profit for the quarter was $1.3bn, with a gross margin of 33.4%, down slightly from 35.3% in Q1 2023. According to management, the margin decrease was primarily due to a shift in product mix towards lower-margin early-stage home building products and normalization in the multifamily segment.

Adjusted EBITDA for Q1 2024 was $541 million, representing a 14.4% decrease year-over-year.

We recognize that this certainly wasn’t the company’s best quarter, but we’re encouraged by BLDR’s ability to maintain solid profitability, with a mid-teens EBITDA margin, even in what’s proven to be a very challenging environment.

Importantly, the company’s balance sheet remains solid, with a net debt to adjusted EBITDA ratio of 1.1x as of Q1 2024. We think the company’s conservative leverage profile should provide the flexibility necessary to fund future acquisitions and share repurchases.

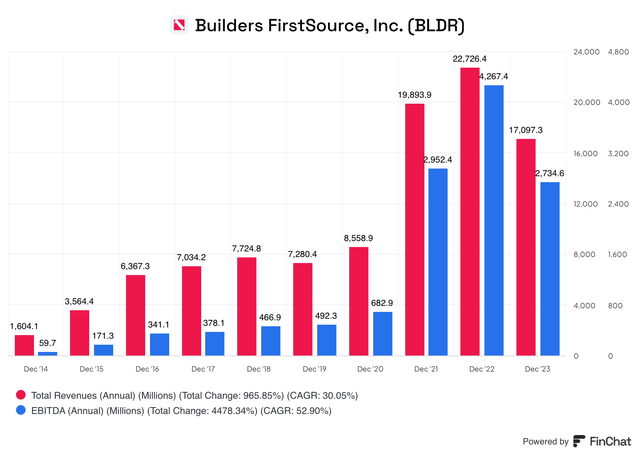

While it’s important to follow quarterly earnings, we are much more focused on the long-term picture.

Even after a challenging 2023, BLDR still boasts laudable 10-year revenue and EBITDA CAGRs of ~30% and 53%, respectively, as shown in the chart below.

BLDR’s 10-Year Revenue & EBITDA Growth (FinChat.io)

And for those wondering, the CAGR figures reference above are nearly identical to the period from 2014-2020, which excludes BLDR’s merger with BMC.

We think the company’s long-term track record of growth, profitability, and capital allocation depict a business that can grow through the cycle and weather downturns, emerging on stronger footing.

As such, we aren’t spooked by the company’s disappointing Q1 results.

Valuation

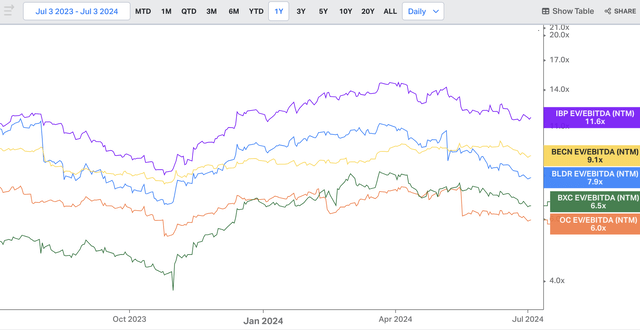

BLDR currently trades at around 7.9x NTM EV/EBITDA, which is near the middle of the pack relative to its publicly traded peers. Given BLDR’s superior fundamentals, we think the company probably deserves to trade at a premium to some of these peers.

BLDR NTM EV/EBITDA vs. Peers (Koyfin)

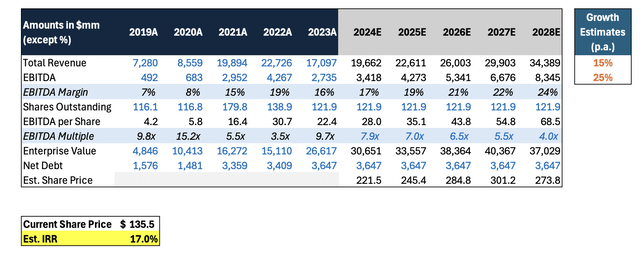

Prior to the company’s merger with BMC, BLDR was compounding revenues and EBITDA at a clip of around 30% and 50%, respectively.

Even if we assume the company grows at half that rate for the next 5 years, and because of that lower growth profile it trades an EV/EBITDA multiple of about -1 standard deviation from its 5-year mean (which would be approximately 4x), it’s hard for us not to get excited about BLDR’s current valuation. Even in a Draconian environment where these assumptions prove true, we still think BLDR currently trades at a highly attractive 17% 5-year IRR.

Our analysis is summarized in the table below:

BLDR Fwd 5-Year IRR Projection (FinChat.io; FV Capital Analysis)

Risks

Despite what we view as an attractive setup for long-term investors, our investment thesis for BLDR could be negatively impacted by a number of key risks.

First, BLDR’s performance is sensitive to interest rates and economic cycles, and if mortgage rates remain historically high for a prolonged period, this could offset our view on long-term tailwinds for housing demand and lead to an extended period of muted construction activity.

BLDR is also experiencing notable weakness in its multifamily segment, which management expects to continue throughout the year. And although the company has reduced its commodity exposure, lumber still accounts for ~25% of sales, leaving BLDR susceptible to commodity price volatility.

Additionally, BLDR’s growth strategy relies heavily on successful integration of acquisitions and execution of its shift towards higher-margin, value-added products. Missteps by management in these areas or in capital allocation decisions would likely negatively impact future growth and profitability.

Key Takeaways

Despite recent short-term headwinds, we think BLDR presents a compelling long-term investment opportunity at current levels.

As the leading building products’ distributor in a fragmented market, we think BLDR is well-positioned to capitalize on the long-term structural growth in housing construction.

The company’s proven track record of successful inorganic growth, its focus on high margin value-added products, and consistent operational improvements underscore management’s ability to drive growth and profitability.

In our view, BLDR’s conservative balance sheet, strong and consistent profitability and growth, and its attractive valuation relative to both its publicly traded peers and to its long-term growth potential, justify our Buy rating on the stock.

Read the full article here

Leave a Reply