While my main coverage area is aerospace and defense, my work also includes passenger airlines and from there it is actually not a major step to also freight and logistics services. Over the past few months, I have added more names to my freight and logistics coverage and with this report, I am adding a new name to that list: Svitzer Group (OTC:SVZRF).

Since this is a new name in my coverage and a new publicly traded company, I will be providing a brief overview of the company’s activities before discussing the most recent results and provide a price target for Svitzer Group stock.

What Does Svitzer Group Do?

Svitzer Group

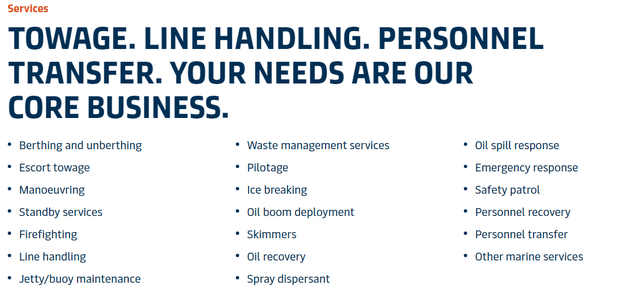

Svitzer Group provides a wide range of services. However, the company is best known for its harbor towage and terminal towage services, which also are the company’s business areas used for reporting. The company is active in 141 ports in Europe, including Rotterdam, which is one of the biggest ports in the world. Svitzer Group is also active in 40 terminals and has a total of 456 vessels.

The company has been spun off from Maersk earlier this year, so while Svitzer Group is a new public company, it is not a new company. In fact, the company has been founded in 1833. The recent demerger just uncoupled the towage services from Maersk.

Svitzer Group

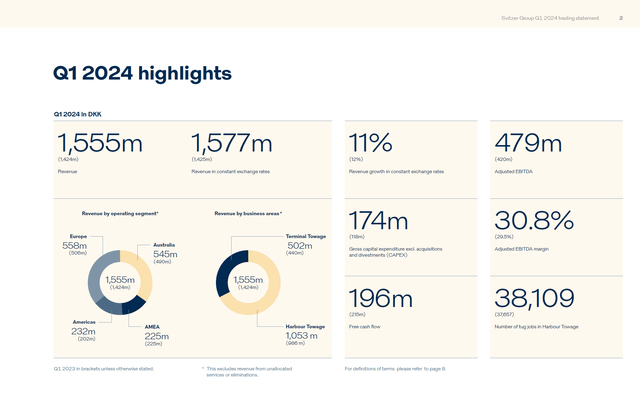

The first quarter earnings do not provide a whole lot of detail or discussion. Many European companies provide a rather limited quarterly report, with more details provided at the H1 and Full Year reports. However, we do see that revenues grew 11% with a DKK 67 million increase in harbor towage revenues as tariffs increased, and new ports were added to the portfolio. Terminal towage revenues increased by DKK 62 million, driven by the timing of towage contracts. So, the revenue growth was strong, but it should be noted that it was a function of contracts taking effect last year and the company is now seeing the positive effect of that. While inflationary costs remain a watch item, we saw that these were positively offset by tariff changes and escalators. Adjusted EBITDA grew from DKK 420 million to DKK 479 million as revenues grew and margins expanded from 29.5% to 30.8%.

Svitzer Group Guidance Shows Tapering Growth For The Remainder Of 2024

Svitzer Group

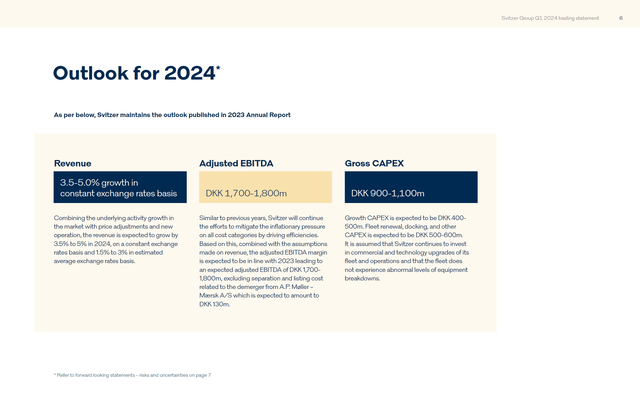

The outlook for 2024 shows that Svitzer Group is expecting 3.5 to 5% growth in revenues. So, the strong growth seen in Q1 will not persist and that is driven by the timing of contract awards last year, which makes the comp more challenging in the balance of the year. Adjusted EBITDA is expected to be DKK 1.7 billion to DKK 1.8 billion, which would indicate 3.5% growth at the mid-point. So, the full-year earnings do not point at exceptionally strong growth prospects for the full year and that is something that should be kept in mind: The strong first quarter is unlikely to be a valid indicator for the remainder of the year. However, we should also mention that Svitzer Group increased the guidance on the 19th of June aiming at 6 to 7.5 percent growth in revenues and the EBITDA guidance has been raised by DKK 75 million. So, that is looking better, but still points at a deceleration from Q1 growth rates.

What Is Svitzer Group Stock Worth After The Spin-Off From Maersk?

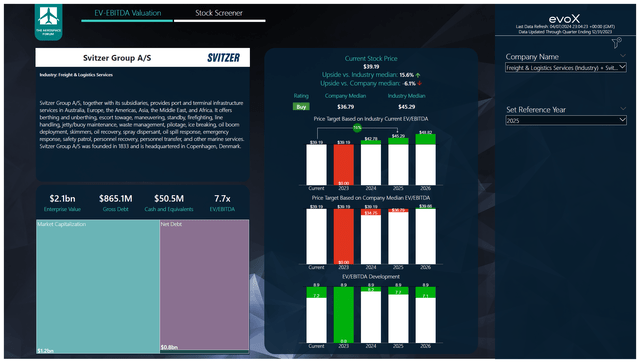

Valuing Svitzer Group is difficult. There are two reasons for that. Our model usually works using a set of metrics that looks at past performance against the metric and those metrics are not present for Svitzer Group or the timescale on which those metrics are available is not necessarily representative of what can be expected over the longer term. Furthermore, the latest quarterly results do not include detailed balance sheet data, so we have to base everything on the information provided in the prospectus. It’s far from ideal, even more so given the fact that Svitzer Group stock is so new that our data provider hasn’t even included the ticker yet. So, a lot of data is loaded in manually.

The Aerospace Forum

For the time being I have a buy rating on Svitzer Group A/S with a $45.29 price target, which represents 16% upside. There is no Wall Street consensus on file for Svitzer Group but for the listing in Copenhagen, it seems that the consensus is 13% upside from current levels. So, I do feel comfortable with my current rating and upside targeted.

Conclusion: Svitzer Group Is An Interesting Investment

I believe that Svitzer Group provides an interesting investment case. The company is not shielded against macro pressures for the simple reason that global economic slowdowns mean less freight, less freight means less ships and less ships means less towing services required. However, the company plays a key role in safe docking for marine vessels, and it can pass through inflationary costs to its customers. So, in that regard, it is somewhat better protected than pure logistics plays.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply