Introduction

We wrote an article on iShares U.S. Healthcare ETF (NYSEARCA:IYH) back in October 2023. At that time, we noted that the fund will likely continue to rangebound and underperform to the S&P 500 index. However, the current macroeconomic environment is very different than last year. Will IYH’s underperformance continue, or will this situation be reversed? We will analyze IYH and provide our update and recommendation.

ETF Overview

IYH invests in a portfolio of large-cap U.S. healthcare stocks. The fund has an expense ratio of 0.4%. This is not cheap relative to other healthcare funds. For example, Health Care Select Sector SPDR ETF (XLV) only charges an expense ratio of 0.09% annually. The fund may have underperformed against the S&P 500 index in the past, but has a good chance to outperform the index in the next few years. Its valuation may be towards the high end of the valuation range in the past 20 years. However, given the strong earnings growth potential of stocks in IYH’s portfolio, we think investors may want to consider owning this fund in the long run.

Fund Analysis

IYH trailed the broader market in the past year

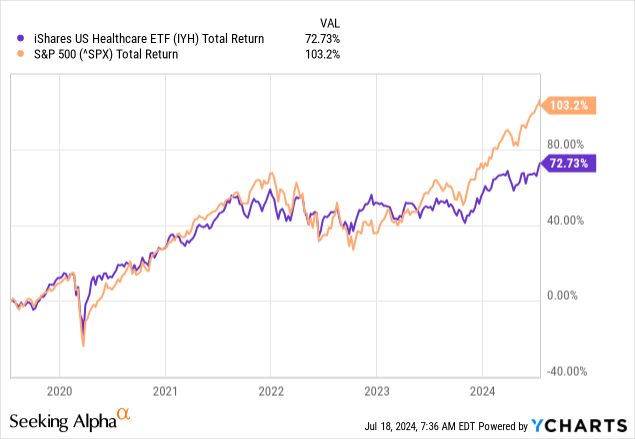

Let us first review how IYH performed in the past. As can be seen from the chart below, IYH’s total return was about 72.7% in the past 5 years. This rate was quite good, but still trailed the total return of 103.2% of the broader market, namely the S&P 500 index. As can be seen from the chart below, IYH has pretty much performed inline to the S&P 500 index between 2019 and 2023. However, IYH began to trail the S&P 500 index in mid-2023 and the gap has widened in the past 1 year.

YCharts

Earnings should top most other sectors in 2024 and 2025

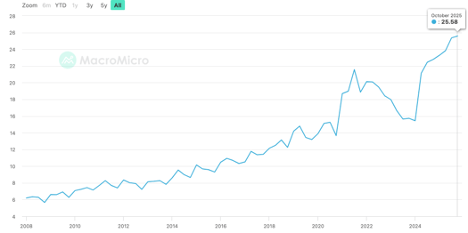

Fortunately, this underperformance may soon be reversed. As the chart below shows, earnings for healthcare stocks in the S&P 500 index is expected to rebound strongly in 2024 according to consensus estimate, and this momentum should carry forward to 2025 and beyond.

MacroMicro

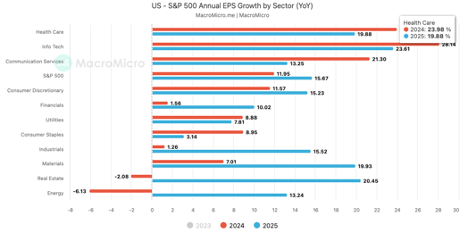

This strong rebound in healthcare stocks’ earnings is reflected in its strong consensus earnings growth rate in 2024 and 2025. As can be seen from the chart below, consensus earnings growth rate for healthcare stocks in the S&P 500 index are expected to be 24.0% and 19.9% in 2024 and 2025 respectively. These strong growth rates are better than most other sectors in the S&P 500 index. The sector’s growth rates are only expected to trail the information technology sector. The growth is expected to be driven by profit margin improvement as wage inflation has dropped considerably, and the introduction of new diabetes and GLP-1 weight loss drugs.

MacroMicro

Growth expected to be better than the S&P 500 index

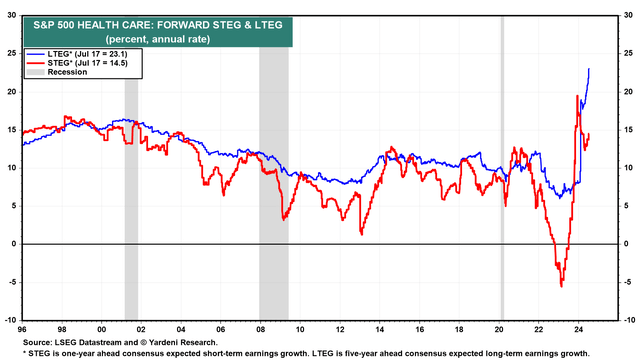

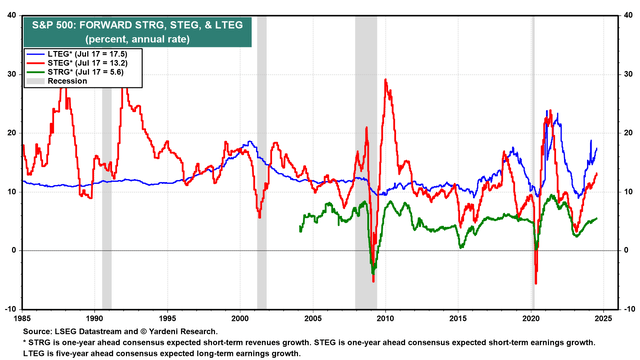

Thanks to healthy and consistent demand for healthcare services and products (e.g. ageing population, new drug introduction, and the use of technology, etc.), earnings growth are expected to be very strong beyond 2025. As can be seen from the chart below, the sector’s 5-year ahead consensus long-term earnings growth (LTEG) rate is expected to be 23.1%. This growth expectation is much higher than the previous peak growth rate of about 16% reached in 2021.

Yardeni Research

Healthcare sector’s LTEG rate of 23.1% is also higher than the expected LTEG rate of 17.5% of the S&P 500 index. Therefore, we are very optimistic about healthcare’s future outlook, and think this sector has a good chance to outperform the broader market.

Yardeni Research

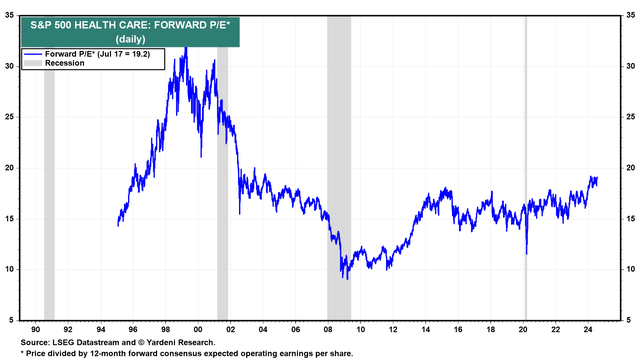

Valuation a bit high but nowhere near the dot-com bubble

Finally, we will take a look at IYH’s valuation. As can be seen from the chart below, the forward P/E ratio of healthcare stocks in the S&P 500 index is about 19.2x. In the past 20 years, this sector has typically traded at a forward P/E ratio between 10x and 20x. Therefore, IYH’s valuation may be expensive, but it is still nowhere near the forward P/E ratio of above 30x during the dot-com bubble.

Yardeni Research

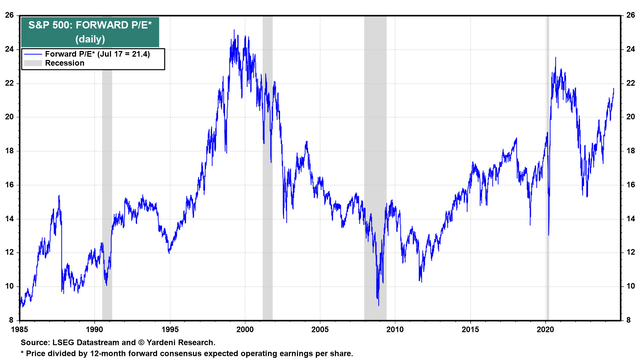

In contrast, the S&P 500 index currently trades at a forward P/E ratio of 21.4x. As can be seen from the chart below, the index’s valuation is quite expensive and is much closer to the peak valuation of about 25x reached during the dot-com bubble than the healthcare sector.

Yardeni Research

Investor Takeaway

IYH may be trading at a higher valuation relative to its valuation range in the past 2 decades. However, we are not particularly concerned, as stocks in its portfolio have very strong earnings growth potential in the next 5 years. Therefore, we think investors should consider owning this fund in the long run.

Additional Disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.

Read the full article here

Leave a Reply